vaaseenaa/iStock via Getty Images

The Simply Good Foods (NASDAQ:SMPL), a nutritional snacks company with the Atkins and Quest brands under its banner, saw a surprisingly strong set of quarterly sales numbers. In particular, US retail takeaway came in well above expectations, more than offsetting any weakness internationally. Gross margins missed consensus amid higher startup and freight costs, but the robust sell-through and inventory levels were a positive heading into a weaker consumer backdrop ahead. Overall, profitability outpaced expectations, which was much better than many had expected coming into the results.

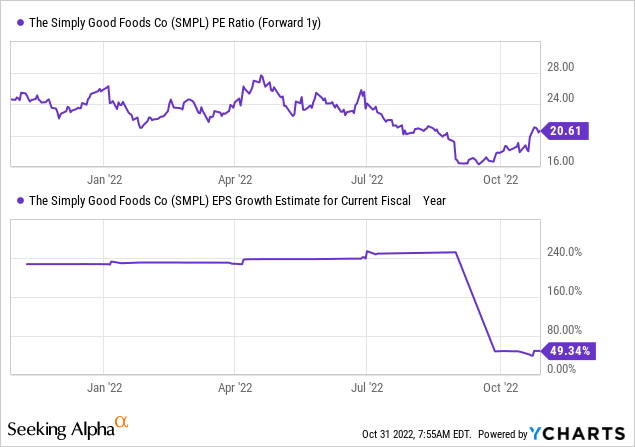

Coupled with guidance for another strong sales quarter and margin resilience (helped by SMPL’s pricing power), the earnings growth outlook appears as strong as ever, in my view. Over the long run, continued innovation around product types, flavors, and sizes will help, along with adjacent monetization opportunities, presenting upside to the earnings growth runway as well. At ~21x fwd P/E for a company primed to see its EPS double through FY25, the current valuation seems very reasonable.

A Surprisingly Resilient Sales Update

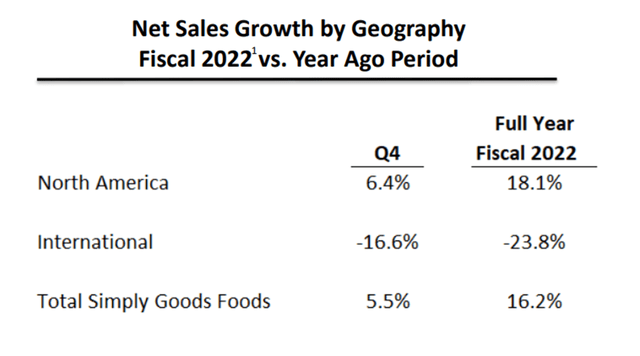

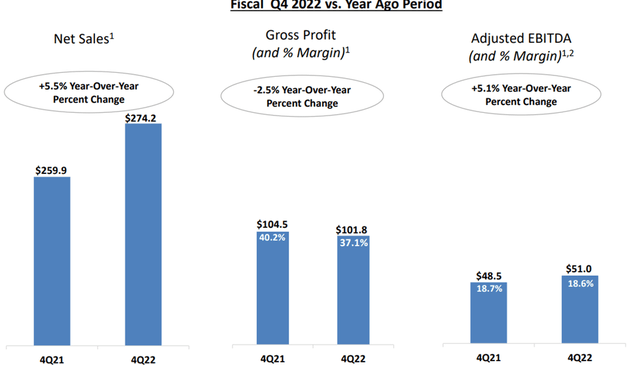

SMPL’s sales growth for the quarter came in ahead of expectations at +5.5%, driven primarily by a +9.5% growth in pricing, which offset a ~4% volume decline. By region, North America was the key outperformer, with sales up +6.4% on a better retail takeaway result than management expectations. Core sales were flat YoY, though, as International sales underwhelmed at -16.6% in Q4. By brand, Atkins and Quest were the standouts, reflecting the ongoing convenience, function, and protein demand tailwinds, all of which have helped growth outpace the broader category.

Looking at unmeasured sales, for instance, the +24% growth for Quest drove a strong +12% overall retail takeaway. Channel-wise, the strength across club and e-commerce was impressive as well, highlighting SMPL’s diverse reach.

Simply Good Foods

All in all, the Q4 result means growth for the full fiscal year stands at +16%, easily beating the initial guidance range of +8-10%. This came as a positive surprise – recall that only last quarter, the commentary was rather pessimistic on elevated retail inventory levels and elasticity concerns. The rebound in retail takeaway levels this quarter should alleviate any over-shipment worries, though elasticity levels remain a risk for future volumes, particularly with SMPL having already taken additional pricing. On the other hand, its key brands (Atkins and Quest) will see near-term tailwinds from favorable August shelf resets at Walmart (WMT), so expect the Q4 sales rebound to sustain into the next quarter as well.

Navigating the Margin Pressures

In contrast with the revenue strength, SMPL saw its gross margins miss consensus expectations amid elevated freight and startup expenses. That said, inventory levels were a bright spot, reversing the prior quarter’s concerns about high retail inventory and elasticity. Better-than-expected retail takeaway at +12% (led by Quest) also went a long way toward addressing these concerns, along with incremental tailwinds from August shelf resets across both key brands. EBITDA of $51m was ahead of expectations as well, while management-defined EPS of $0.36 (i.e., excluding D&A and stock-based compensation) also outperformed on the back of a lower tax rate.

Simply Good Foods

To its credit, SMPL has deployed most of its capital over the last year to reduce net leverage, which now stands at 1.4x (down from 1.7x prior). Having bought back ~$80m in stock, management has also expressed an interest in allocating more to buybacks, though given the rising rate backdrop, further debt paydown should be prioritized, in my view.

Guidance Update Signals a Better-Than-Expected Outlook

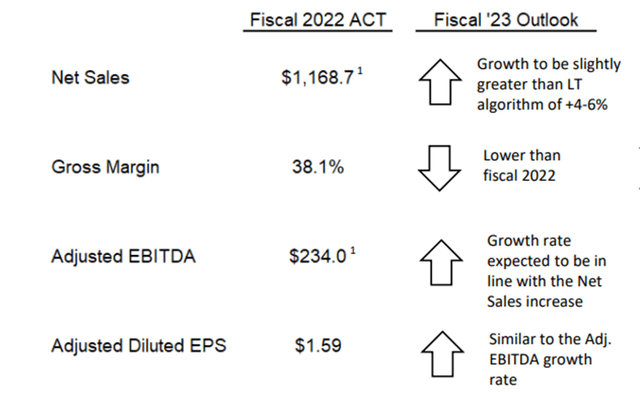

Despite the uncertainty heading into FY23, SMPL’s sales guidance calls for growth to run just ahead of its long-term +4-6% target algorithm – even after incorporating a ~1% headwind from exiting the Quest pizza license. One key driver of this improved outlook is the favorable impact from the pending Walmart shelf space reset, which bodes well for a similar outcome at other major retailers such as Target (TGT) and Kroger (KR) as well.

While the Atkins brand will likely remain a drag, the innovation pipeline at Quest is promising – upcoming product launches such as new mini-bars and chocolate-enrobed bars could help to reverse the fading innovation gains in recent months. The caveat to the FY23 sales guidance, however, is that it embeds potential macro and consumer uncertainty. So, expect revisions (upward or downward) down the line as visibility improves in the coming quarters.

Simply Good Foods

In contrast to the revenue guide, SMPL sees margin pressure continuing into FY23. Gross margins, for instance, are guided to see a YoY contraction, although most of the decline is focused in Q1, where the YoY comparison is tougher. On the other hand, adj EBITDA growth is guided to be in line with net sales growth at slightly above the +4-6% target on better expense control.

Elevated input costs are also assumed to extend into the next fiscal year, which could prove conservative given freight costs are already declining. Should costs diverge favorably, management will have additional room to reinvest for mid to long-term growth or accelerate the deleveraging. The latter will be particularly bullish for the FY23 EPS growth trajectory, which currently incorporates interest expense headwinds.

The Growth Runway Remains Intact

On balance, SMPL’s Q4 2022 report was as good as it could get, given the macro uncertainty. Sales numbers were boosted by an above-par US retail takeaway result, particularly within unmeasured channels, while margins were helped by robust sell-through. The updated FY23 outlook was similarly resilient, as the buying activity within the health foods category continues to outperform. With the overall buy rate also below historical pre-COVID levels and the runway for product innovation, as well as adjacent monetization opportunities still intact, there remains ample room for incremental upside to the guide.

In the meantime, innovation progress for its Quest brand will be worth watching out for, alongside input and supply chain cost pressures. Additionally, SPAC sponsor Conyers Park’s recent distribution of ~13m of SMPL shares could also be an overhang, particularly with the lock-up terms (if any) currently undisclosed. Nevertheless, the stock is reasonably priced at ~25x P/E (vs. expectations for EPS to approximately double through FY25), leaving ample room for upside ahead.

Be the first to comment