ivan68

“There is only one kind of shock worse than the totally unexpected: the expected for which one has refused to prepare.” – Mary Renault

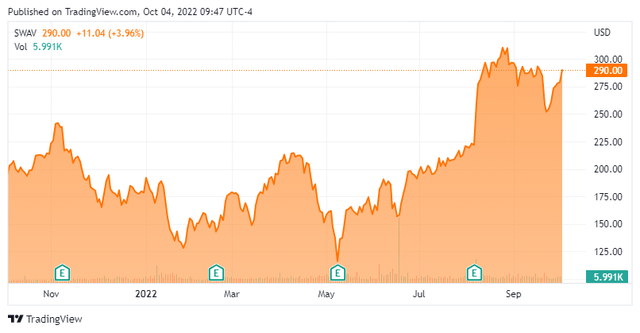

Today, we put ShockWave Medical, Inc. (NASDAQ:SWAV) in the spotlight for the first time. This medical device maker is experiencing rapid growth and the stock has held up quite well during the large market downturn in the back half of the third quarter. However, the stock also trades at some extreme valuations. Are the shares destined to fizzle in the months ahead? An analysis follows below.

Company Overview:

ShockWave Medical, Inc. is a medical device concern based in Santa Clara, CA. The company is focused on developing and commercializing intravascular lithotripsy technology for the treatment of calcified plaque in patients with peripheral vascular, coronary vascular, and heart valve diseases. The stock currently sells for right around $290 a share and sports an approximate market capitalization of $10 billion.

August Company Presentation

The company’s flagship product is its Intravascular Lithotripsy System or IVL. This device utilizes high-energy sound waves delivered through a catheter guide-wire that breaks up hard calcium.

August Company Presentation

This increases blood flow and decreases the chances of heart attack.

August Company Presentation

The system provides the benefits of efficacy, ease of use, and fewer patient complications compared to competing devices.

August Company Presentation

Management’s focus is to continue to grow market share for its devices within their approved procedures and also to continue to add new indications.

August Company Presentation August Company Presentation

SWAV’s Second Quarter Results:

The company reported second quarter numbers on August 8th. They were outstanding. ShockWave had a GAAP profit of 68 cents a share, compared to a penny a share loss in the same period a year. Revenues increased by just over 120% on a year-over-year basis to nearly $121 million, more than $20 million above consensus estimates as well. In addition, the company boosted full year revenue guidance to a range of $465 million to $475 million from $435 million to $455 million previously.

August Company Presentation

Analyst Commentary & Balance Sheet:

Since second quarter numbers posted, four analyst firms including Wells Fargo and Canaccord Genuity have reissued Buy ratings on the stock. Price targets proffered range from $230 to $338 a share. Meanwhile, Morgan Stanley ($255 price target) maintained its Hold rating on the stock and one month ago Oppenheimer downgraded the shares to an Underperform with a $165 price target. Oppenheimer’s analyst citing both valuation and noted ShockWave’s ‘IP moat has been completely dismantled by rival Cardiovascular Systems‘

Insiders are taking advantage in the recent rally of the shares. Numerous insiders sold nearly $20 million worth of shares in aggregate in the third quarter of this year. There were frequent but somewhat smaller sellers of shares in the previous two quarters of the year as well. Approximately five percent of the outstanding float is currently held short. The company ended the second quarter of this year with approximately $225 million of cash and marketable securities on its balance sheet against negligible long-term debt.

Verdict:

The current analyst firm consensus has sales doubling this fiscal year to $475 million while the company posts a profit just north of $2.50 a share. Growth is projected to slow to just 30% in FY2023 while earnings increase to $3.50 a share.

August Company Presentation

The company is clearly hitting on all cylinders right now and targeting a substantial market opportunity. However, the shares also seem to be priced for perfection at over 110 times this year’s expected profits and more than 20 times forward revenues. In addition, sales growth is slated to slow significantly in FY2023. Part of the gains in September were due to vague takeover speculation. Insiders also seemed to pick up the pace of selling their shares in the third quarter.

Let’s add in rising interest rates that tend to hurt growth stocks more than value stocks and the fact the stock is now above every analyst firm’s price target except for one (Piper Sandler, $338 price target). If I shorted stocks, this is one name that would on my list. I considered doing so by buying puts in the options markets, but the option premiums against this equity are massive. This also tells me the chances of ShockWave giving up a good portion of its recent gains through yearend in a deteriorating economy seem very high. Therefore, the shares are an Avoid or a candidate for investors that engage in short selling in my opinion.

“Veterans scream in their dreams, reliving nightmares so that we can sleep peacefully” – Kamil Ali

Be the first to comment