drnadig

Marathon Oil Corporation (NYSE:MRO) is the largest individual position in my portfolio and I have written several times about the stock before. In a nutshell, my investment thesis has been:

- Good quality and long-lived inventory, despite presence in shale basins that may be overall in decline now;

- Cheap valuation, as of late around 25% – 30% free cash flow (or FCF) yield; and

- Strong commitment to returning capital to the shareholders, currently most via buybacks.

Naturally, the Inflation Reduction Act (formally, H.R. 5376), now passed by the U.S. Senate, which among other changes introduces a 1% non-deductible tax on stock buybacks, is of potential concern. The new tax may push oil companies to prioritize dividends, which may not be a bad outcome, but perhaps some companies would also decide to reinvest more in capex.

Upon reviewing the bill closer though, I walked away with the opposite conclusion. Since the excise tax would apply only on repurchases after December 31, 2022, I think the legislation may have the unintended consequence of many companies front-loading buybacks in the remainder of 2022 to avoid paying the tax in 2023.

Quick recap of Q2

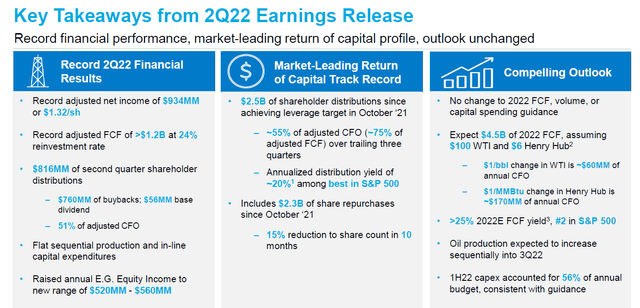

Marathon’s Q2 results didn’t leave out many things to ask for:

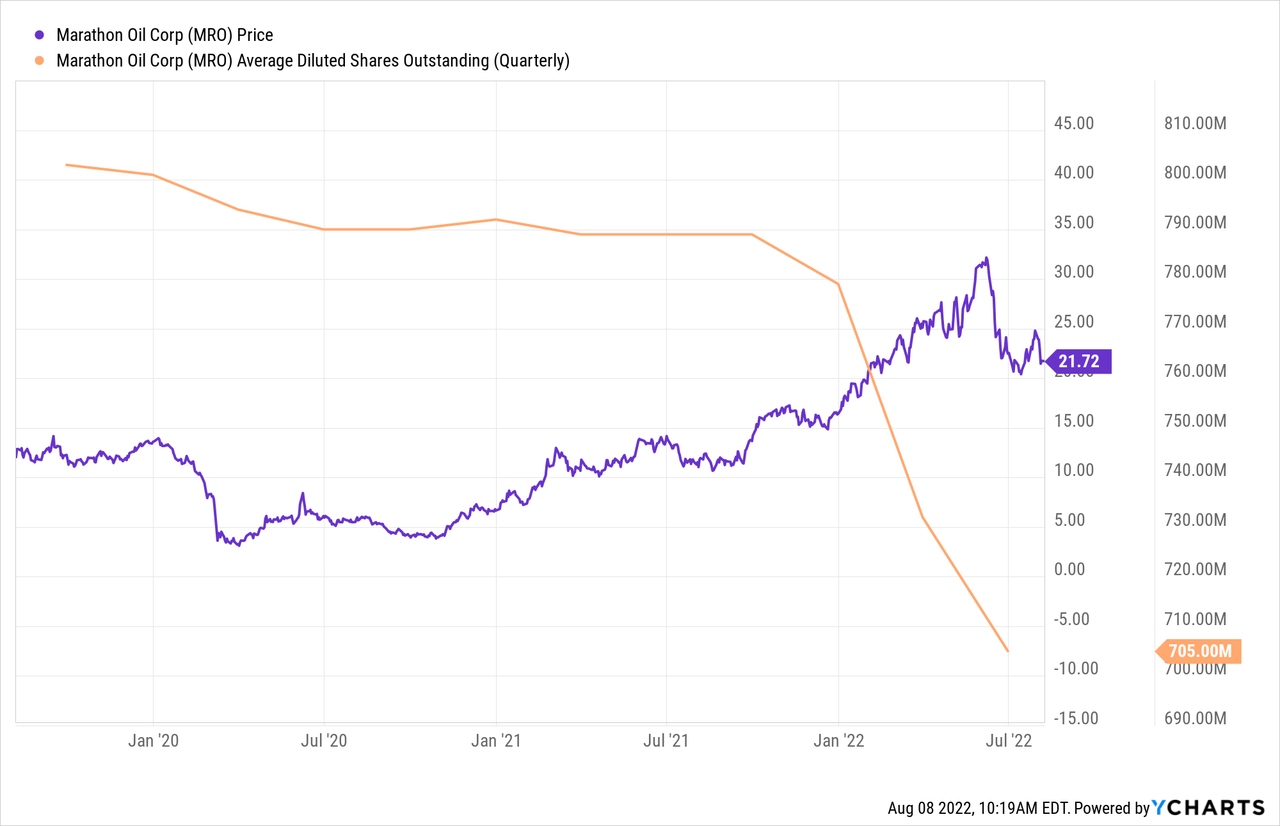

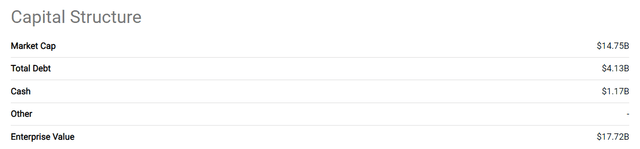

Annualized free cash flow (“FCF”) even at $90 average WTI price (CL1:COM) would be close to $4 billion. This is close to 30% yield on the market cap:

The company has also been “walking the walk” when it comes to returning the generated cash to its shareholders. From the earnings call:

Neal Dingmann

Great details. And then my second is just on capital allocation. Specifically, you’ve all been pretty clear about suggesting that the shareholder return will continue to be predominantly buybacks given the intrinsic value. I’m just wondering how do you think about the relative comparisons, I guess, in today’s market, even given where oil and given where your share price is, when you think about the comparative comparison between buybacks and dividends?

Dane Whitehead

Yes, Neal, it’s Dane. I’ll just take a quick cut at that. I mean I think we’ve been pretty strong in our view that returning capital to shareholders through the share buybacks structurally changes the company drives per share growth and is synergistic with our ability then to increase our base dividend over time without increasing our cash — total cash distributions on the dividend. And so we like that, especially in light of the fact that the free cash flow yield that our stock is generating right now is in the 25%. It’s even got closer to 30% recently. So it’s just an unquestionable value to do that. And so it’s been very easy for us to allocate capital that way. We still do think the base dividend is a very important part of the return equation. We have raised the base dividends through the first quarter of this year, 5 consecutive quarters, total of 167% over that period of time. We paused this quarter I will say, though, that with the consistent and large share repurchase activity that we’re doing, we’ll definitely be in a position likely this year to reassess that because we’re just absorbing so much of that outstanding stock. So I think they’re synergistic there. We like them both. And the variable dividend idea is something we — it’s a tool in the toolkit. But given what I have said about how compelling share repurchases are to us right now, it’s going to just be on the back bench.

The share count has decreased by more than 10% now:

So an excise tax on the company’s primary means of returning capital may drive some changes in strategy.

The Excise Tax

At this point, the excise tax is a done deal. The bill will return to the House for reconciliation of the versions passed by the House and Senate, but I think further changes are unlikely. Moreover, the 1% amount, though not so high, could be increased in the future as it already establishes a precedent.

However, the tax also won’t apply on stock repurchases prior to December 31, 2022. For me, this is a key point as it may have unintended consequences. When legislation is enacted that announces future tax changes, the affected taxpayers and their advisors usually rush ahead with “no regrets” initiatives, meaning that they seek to accelerate the affected taxable events prior to the cutoff date. Perhaps executing more buybacks during calendar 2022 is one option on the table for Marathon. Alternatively, management may take a deeper look at the variable dividend which was discussed during the earnings call.

Conclusion

Marathon Oil remains a compelling investment despite the stock repurchase excise tax introduced by the Inflation Reduction Act. I don’t think the tax would ultimately affect management’s commitment to returning capital. One possibility for the company is to accelerate some of its buybacks from 2023 into late 2022 to take advantage of the cutoff date. Alternatively, we may see a switch to a variable dividend formula, which may prove even more bullish for some investors.

Be the first to comment