swissmediavision/E+ via Getty Images

Co-produced with PendragonY.

Investors are constantly bombarded with articles that tout must-own investments. Retirees even more so. So why is another article pushing some investments as must-owns for retirees?

Retirees, like all investors, have goals and circumstances that make generally suitable investments more or less important for them. So how does a retiree sort through all of the good investments to find those that are best suited to their goals, circumstances, and risk tolerance?

The Income Method

The first thing to know about The Income Method is that it doesn’t depend on regular sales of shares to produce cash. The goal is to develop a portfolio that produces sufficient income to meet our cash needs and still has enough cash to buy additional shares. Once achieved, this creates a portfolio that is capable of continuing indefinitely. Instead of selling shares, your portfolio is constantly growing, buying more shares and receiving the dividends that come with them – every year, producing more income than the year before.

Using an Income Strategy, the HDO model portfolio targets an average yield of around 8%-10%, providing plenty of excess to reinvest 25% or more. These new shares help grow the income from the portfolio, which helps to offset the impact of inflation.

The Income Method focuses on immediate income, but you can’t just blindly buy everything high yield and expect it to end well. Dividends can be cut and some investments don’t pan out. We must be prepared for any economic conditions because, over the course of our lives, we will see bear markets, recessions, and “black swans.”

Create a diversified stream of dividends and interest

We recommend investing in a diverse group of income-producing assets. We recommend selecting approximately 42 different positions in a variety of sectors so that no single problem will have a significant impact across many positions (We call this the Rule of 42). That will have each position be around 2% of your portfolio value which can protect your income stream from serious disruption. This is not a maximum number, but each additional position will be less significant in reducing risk.

There is always a risk that your income is disrupted, so by limiting the size of each position, you mitigate the impact when something bad happens. When you were working, you had the risk of being fired, being laid off, or being forced to take off time for an injury. Back then, you had one income source, so it was a huge impact when something happened. When you are retired, you can have dozens of income sources!

Do your due diligence

Dividends and even interest payments from companies are not guaranteed. Let me repeat that, even though there are strong incentives for companies to continue to pay dividends and interest, those payments are not guaranteed.

When you are managing your own portfolio, you must do your “due diligence” and buy companies that will be able to meet their debt obligations and will be able to support their dividends.

Part of doing that is having a basic understanding of how a company or fund gets the cash it uses to make such payments. Due diligence can be time-consuming but is even more important once you retire. If you are still working, you can replace losses with extra earnings from your job. But once you are retired, the options to get cash to replace losses are far fewer. There are many places you can go to get the tools you need to help you do your diligence more quickly and effectively. I’m a bit biased, but right here on Seeking Alpha, including HDO, are some of the best places to start!

Reinvest at least 25% for income growth

You want your income to last forever, and you want to protect yourself from inflation. You should always be saving and investing, and having a high enough yield from your portfolio to be able to buy new shares gives you more control than just relying on your investments to increase their dividends. Using at least 25% for reinvestment will ensure that you are always buying more shares and will help ensure that your income keeps growing. Even using preferred shares and baby bonds, by buying more, you can grow your income.

Allowing this excess also means that if dividends are cut in your portfolio, you will still have enough for your personal budget.

Actively manage your portfolio to grow your income even more

Reinvesting is not the only way to grow your income. The reality is that stock prices move a lot. Companies might be high-yielding one year but low-yielding next year as their price climbs. Taking time to realize gains in companies that have become popular, and reinvesting in higher-yielding options, can greatly increase your income.

We look at every trade with an eye on how it impacts our income. Actively buying or selling opportunities as they arise will help grow your income.

Enjoy your retirement!

Once you set up your income stream and the dividends start coming in, you can step away from the day-to-day frenzy of the market if you wish. Stock market prices can change dramatically every time a Fed official opens their mouth, some billionaire (not just Elon either) sends a tweet, or some economic metric differs from “expectations.” If you enjoy the drama, you can follow it, but you no longer have to do so. The only news you need to worry about is the news that impacts your income. Most of the drama won’t. That will give you more time to do things you actually enjoy.

So now that we have established some parameters for what we require for our portfolios, let’s look at two investments that will make a great foundation for a retiree’s portfolio using the Income Method.

Pick 1: Athene Preferred Shares, Yield 6.3%

Athene Holding Ltd. 6.325% DEP SHS RE 1/1000 NON CUM PF SR C (ATH.PC)

ATH-C is a reset-rate preferred stock. This means that if the stock is not redeemed on its call date, 9/30/2025, the yield will change to 5.97% plus the yield on the 5-year Treasury note. Thereafter, the rate will be re-calculated and reset every five years (unless it is called on that 5-year anniversary). Currently, the 5-year note yield is 3.9%.

Although nobody knows what the 5-year note will be in 2025, if the rate is as it is today, the yield on the stock will go from its current 6.375% to 9.87%. And if the 5-year note continues to rise, the reset rate can move even higher with the 5-year note at subsequent reset dates. This is a preferred stock with significant inflation protection.

In the scenario where interest rates are very low three years from now, as long as the 5-year note yield is above 1% in 2025, the yield on ATH-C will still reset higher on its call date. If the 5-year is close to 0%, then preferred prices will likely be very high again, and even 5.97% wouldn’t look too bad. So even in a low-rate environment, it will provide an excellent yield.

ATH-C is a top-quality preferred with little credit risk. Athene Holding Ltd. (ATH), merged into Apollo Global Management, Inc. (APO), has an “A-“ credit rating from S&P, which puts its preferred stock at a BBB rating. Only a small percentage of corporate preferred stocks are themselves investment grade. Further enhancing the quality of the dividend, ATH-C pays a qualified dividend, so the entire amount qualifies for the lower tax rate on qualified dividends for those who want to hold in a taxable account.

Athene Holding Ltd. is a Bermuda-based insurance company specializing in retirement services and reinsurance. As an insurance company with an A- rating (well into investment grade), it has a reasonably safe income stream that should make its BBB-rated preferred shares quite safe. At a 6.3% yield, it is at the bottom of our acceptable yield range, but given its high credit rating and dividend track record, it is a good value at par ($25). Right now, it is trading just a few cents above that ($25.27), but setting a limit order around $25 should get the shares in short order. The next ex-dividend date is Dec. 14th.

Pick #2: JPS Income Fund, Yield 7.4%

Nuveen Preferred & Income Securities Fund (JPS).

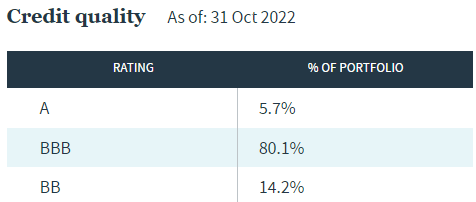

JPS is a CEF (Closed-End Fund) that aims to invest at least 80% of its managed assets in preferred and other income-producing securities, including hybrid securities such as contingent capital securities. Notably, ~85% of JPS portfolio securities maintain investment-grade ratings, indicating the higher quality of its overall composition.

JPS Fund Page

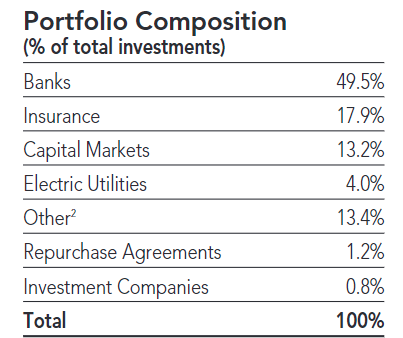

About 67% of the fund is comprised of securities issued by banks and insurance companies. Global and national regulatory bodies closely watch these entities’ health and lending potential to prevent a 2008-type event.

JPS Annual Report

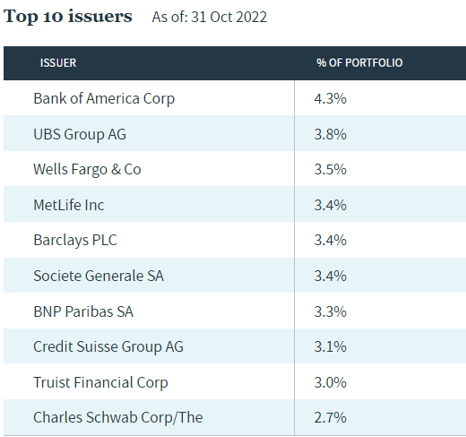

The JPS portfolio holds 248 securities using just under 40% leverage. The fund’s top 10 positions are preferred securities of leading global banking names and represent ~40% of the total portfolio.

Nuveen

Today, the fund trades at an attractive 9% discount to NAV, making it a bargain for income investors and retirees. The fund’s current $0.0435/share monthly distribution translates to a 7.4% annualized yield.

It is noteworthy that JPS has paid $16.8311 in distributions since its inception in 2002. In recent years, preferred shares have struggled with low yields as low-interest rates caused preferred equity prices to be bid up, putting downward pressure on cash flow.

While investors are trained to see higher prices as a “good” thing, it is more complicated for fixed-income investments. For fixed-income investors, higher prices result in lower cash flow and lower future returns. Rising interest rates are “bad” for prices, but they are great for future returns when investing in fixed income. For many years, dividends and interest from fixed-income investments have declined due to high prices and lower yields.

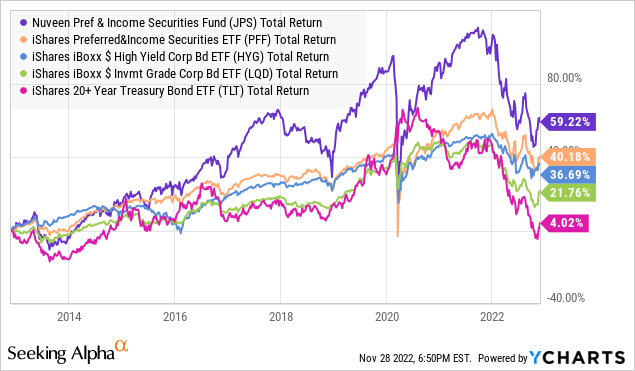

Despite this difficult environment, JPS has outperformed the preferred exchange-traded fund (“ETF”) iShares Preferred and Income Securities ETF (PFF), as well as ETFs covering other debt classes like high-yield bonds, investment-grade bonds, and treasuries.

As we look forward, yields are getting higher. Money invested today receives higher dividends from preferred shares and higher interest from debt. As JPS reinvests the principal, it will be reinvested at higher yields. At this point, the cost of leverage is feeling most of the impact of rising rates, while the yields of preferreds have yet to see the full impact of those increases. As time goes on, this means that JPS should begin to see its income increase.

JPS, with its portfolio built with quality preferreds from the financial services sector, has outperformed its indexes through a tough period for fixed-income. With fixed-income much more attractively priced today, the outlook for future returns is brighter.

Conclusion

The Income Method provides immediate income for retirees. Preferred stocks and funds that invest in them can provide a stable base for a retiree’s portfolio using the Income Method for immediate income.

With the Federal Reserve raising short-term interest rates, the prices of preferred shares have been hard hit. However, lower oil prices and reduced inflation may soon allow for a pause in interest rate increases. This should stabilize the prices of preferred shares, making now a good time to start buying shares. Using DCA (Dollar Cost Averaging) to make repeated small purchases in good investments like JPS and ATH-C will ensure that you get below the average market price whether prices increase or decrease from here.

Be the first to comment