onurdongel

Thesis

The RealReal (NASDAQ:REAL) is a stock that has been terrible for investors for years, and we believe that the company will continue to perform poorly. The company’s recent financial performance has failed to impress investors, and the company’s balance sheet is deteriorating rapidly. With rising recession risks to further derail the company’s fortunes, we believe that The RealReal should be avoided by investors.

Company Overview

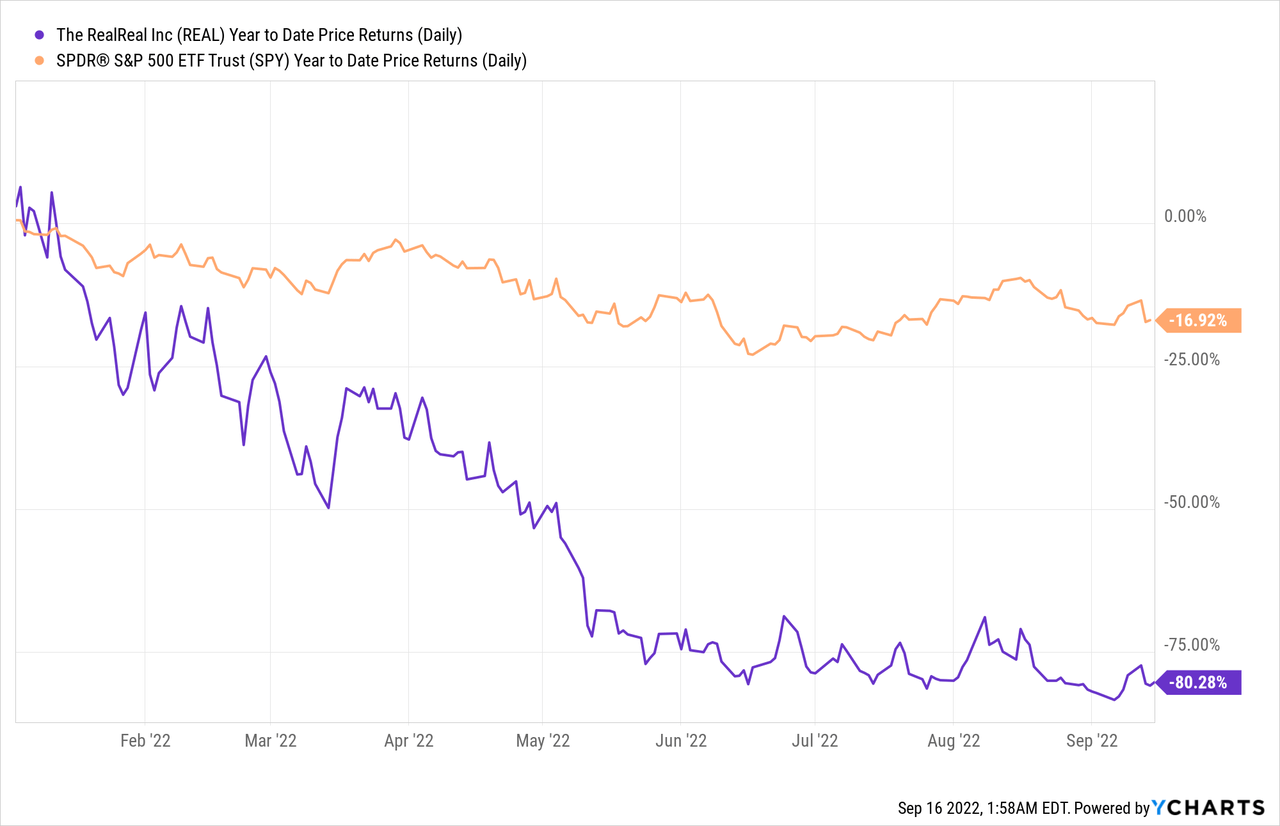

The RealReal, Inc. is an online and brick-and-mortar marketplace for authenticated luxury consignment. The company sells consigned clothing, fine jewelry, watches, fine art and home decor through both online and retail channels. The RealReal’s stock price performance year-to-date has been abysmal, declining -80.28% since the beginning of the year. In the same time frame, S&P 500 has declined -16.92%. The company’s market capitalization now stands at $218.78 million, which is far below its valuation of $1.7 billion in its IPO in 2019.

Mountain of Risks

Poor Financial Performance and Liquidity Risks

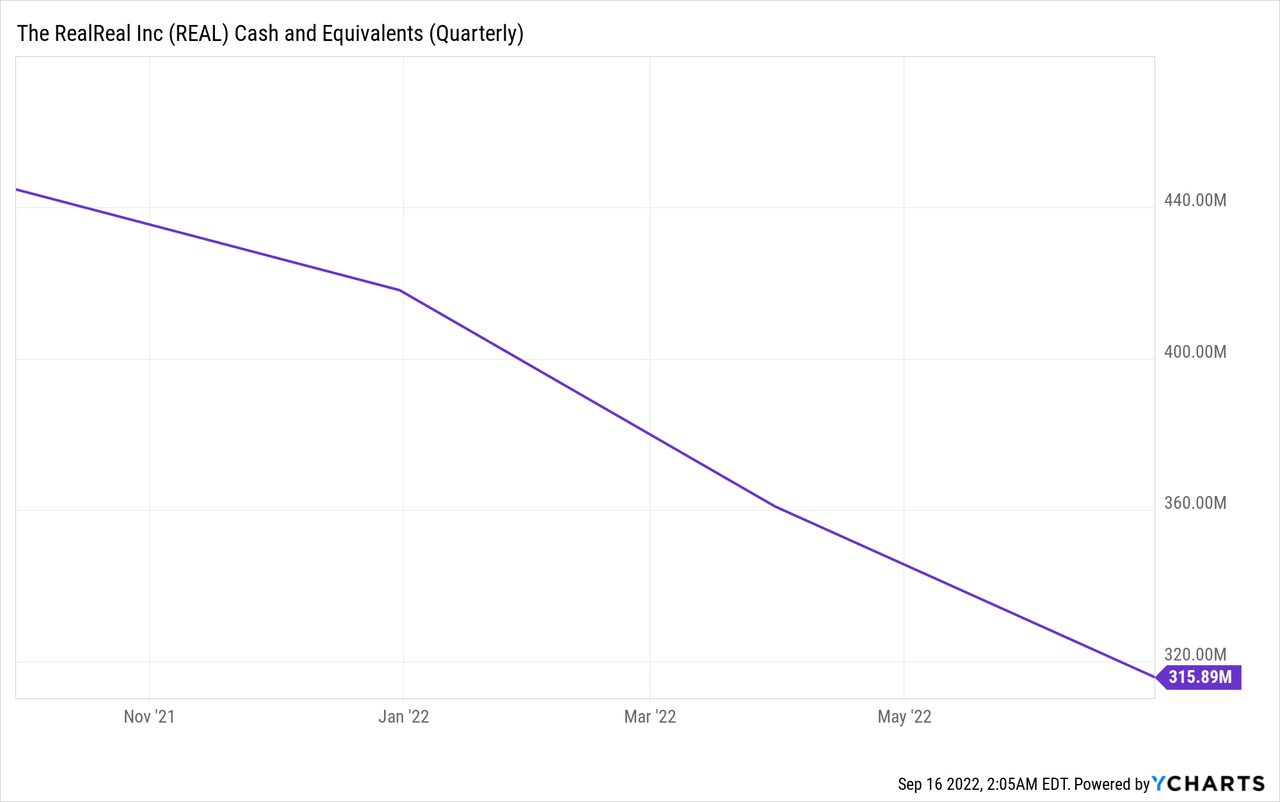

In the most recent earnings announcement for Q2 2022, management remained upbeat on its performance, highlighting the company’s YoY quarterly revenue growth along with a reduced adjusted EBITDA loss. However, we viewed this quarterly announcement as highly negative, primarily due to the rapidly deteriorating balance sheet and the lowering of guidance. First and foremost, the company reported a cash on hand of $316 million in Q2, which is a substantial decline from $361 million in Q1 of this year. In just three months, the company has spent nearly ~13% of its cash balance, and we believe this level of cash burn is dangerous for the company’s prospects. As one can see below, the cash burn has accelerated since last year with no signs of slowing down. Furthermore, the company’s debt position is concerning, given that it has ~$600 million in total debt at the end of the quarter. The debt position is roughly 3x the market capitalization and net debt is roughly 1.5x the market capitalization. In combination with the sequential EBITDA loss, we are worried about the company’s deteriorating balance sheet and liquidity position.

Slowdown in Luxury Market

The RealReal is exposed to the demand for luxury products as the company’s platform predominantly sells consigned luxury goods. We believe that as inflation persists and rates rise, consumption will likely slow and impact the luxury consigned market more acutely than some of the other businesses related to consumer discretionary goods. Already, we are seeing a slowdown in the demand for luxury homes as rates rise and economic uncertainties persist. Furthermore, if 2008/2009 recession is any example, the luxury market then took a direct hit from the recession as even wealthy consumers shied away from prolific spending. We believe that the company’s prospects are highly endangered from a major economic downturn, and inflationary pressures will continue to shutter people’s overall spending on consumer discretionary goods – especially luxury goods that The RealReal’s business model relies on.

Competitive Risks

The RealReal is not the only player in the luxury resale space, with large fashion-oriented players like Farfetch (FTCH), Grailed, Poshmark (POSH) as well as larger e-commerce players like eBay (EBAY), Etsy (ETSY), and even Amazon (AMZN) as one of the potential competitors. We believe that such wide array of players in the space will make it hard for The RealReal to finding meaningful organic growth opportunities and will likely continue to face margin pressures as consumers will have a wide array of options to choose from in the luxury resale space.

Thoughts on Valuation

As The RealReal is an unprofitable company with negative free cash flow, we are relying on simple valuation multiple metrics to determine how the company is priced compared to its peers. Compared to the sector, The RealReal is valued well under the sector median by some metrics, such as Price to Sales. However, we believe that the company should be undervalued compared to peers given its risky capital position and the declining market fundamentals. With a net debt position nearly more than its market capitalization, we believe that the company is an extremely risky proposition to be bullish on and therefore the current valuation is at the very least justified.

Upside Risks

One upside risk that we see for this company is a potential “short squeeze” as the short interest ratio is near ~13%. When short interest ratio nears 10%, the likelihood of a “short squeeze” is high. Such risk should be kept in mind from being too bearish on the stock or initiating short duration options trades as the stock price may rally well beyond its fundamentals as a result of short positions being covered. Another upside risk could be from potential rumors or news of acquisitions and mergers, as there may eventually be some consolidation in the space.

Conclusion

The RealReal is a company that should be avoided by investors due to its poor financial performance and declining fundamentals. The company has failed to impress shareholders since the IPO, and we believe that the company will continue to struggle to turnaround investor sentiment and bring any meaningful shareholder value growth in the immediate future.

Be the first to comment