CIPhotos/iStock via Getty Images

There should be an honored place in history for statesmen whose ideas turned out to be right.”― Walter Isaacson

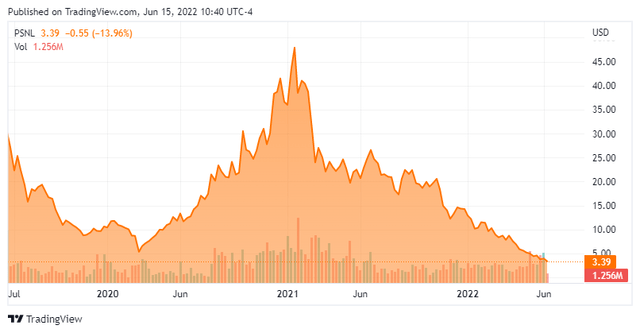

Today, we put Personalis, Inc. (NASDAQ:PSNL) in the spotlight here at the Biotech Forum for the first time. The stock of this small cancer genomics concern have cratered over the past year. The company is posting some large losses, but the stock’s market cap is currently significantly below the net cash on its balance sheet. Oversold or a value trap? An analysis follows below.

Company Overview

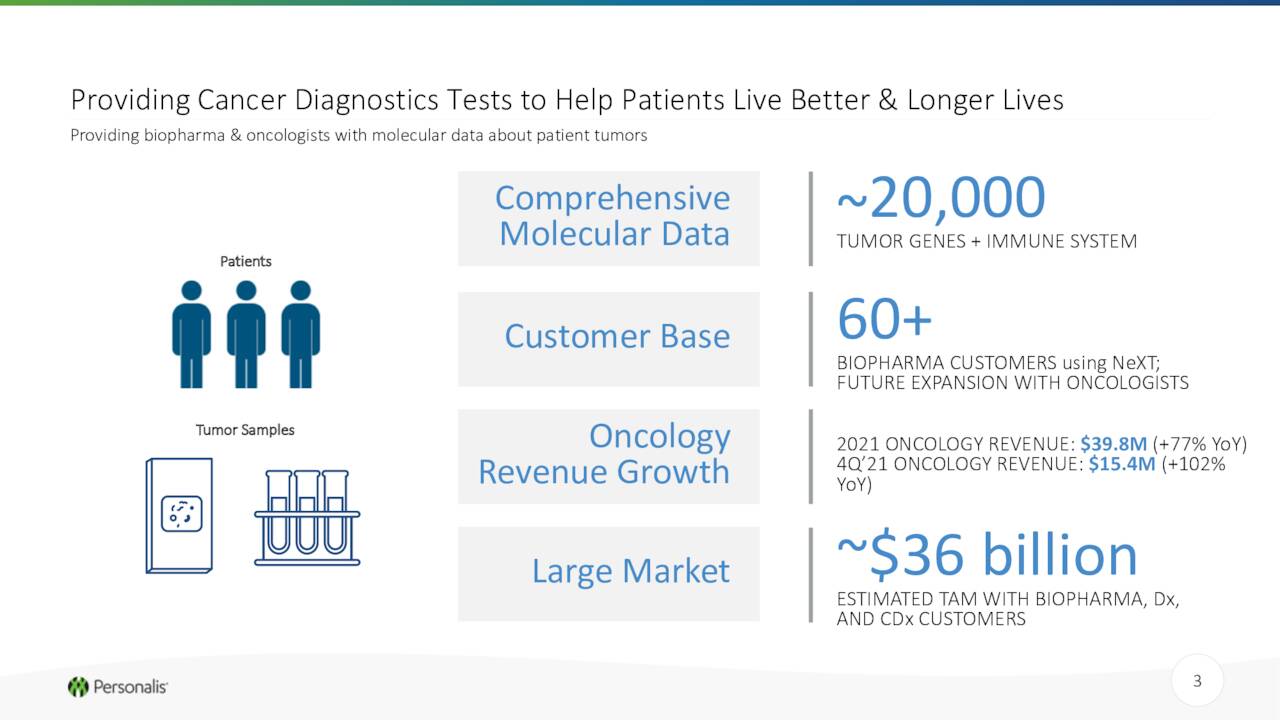

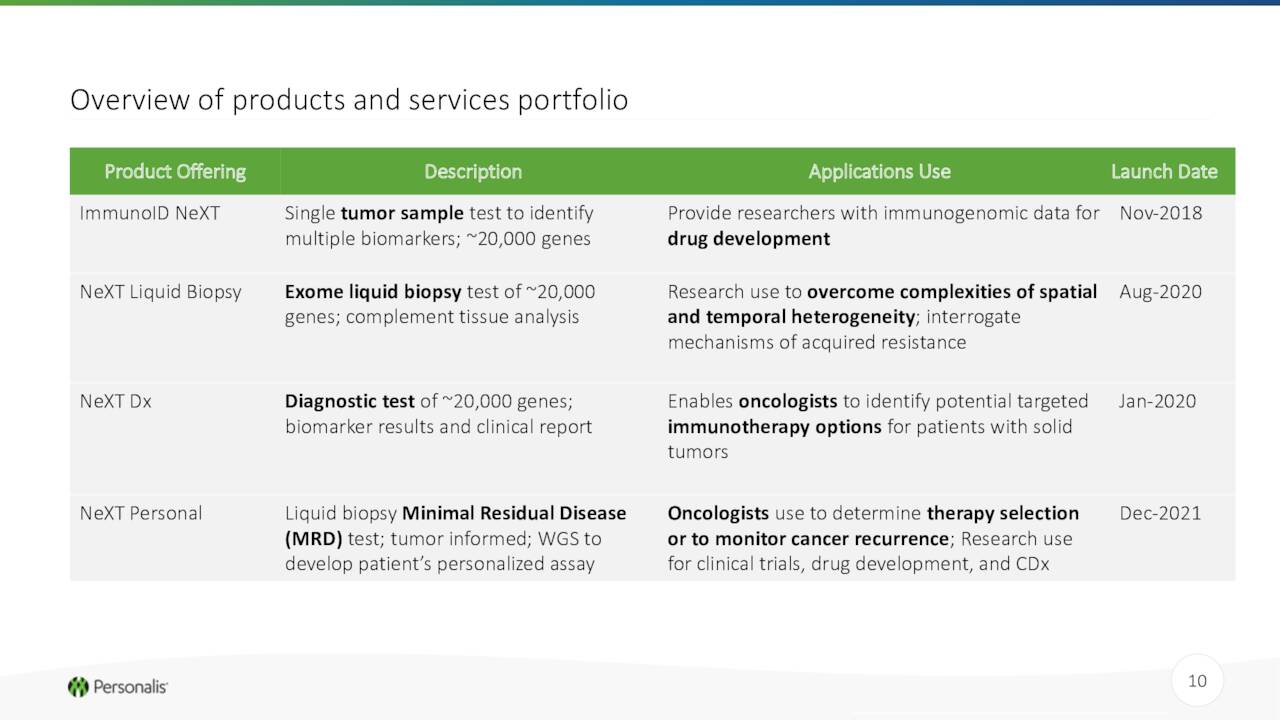

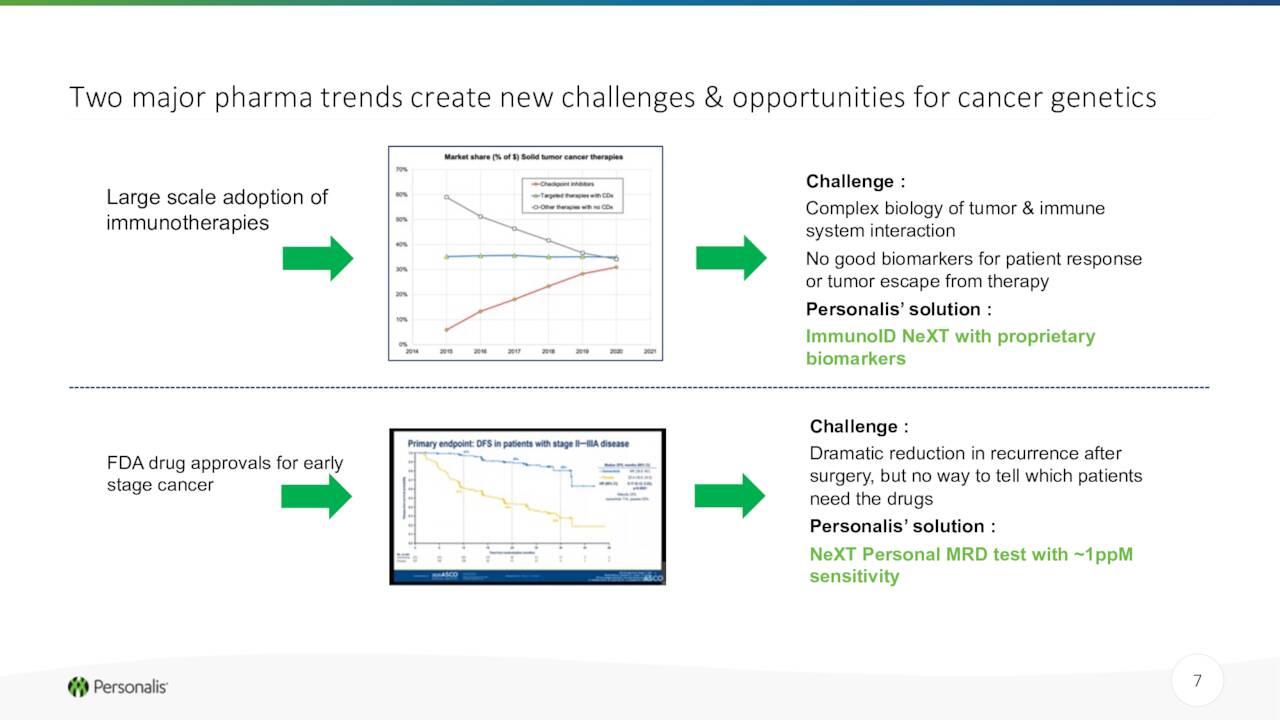

Personalis is headquartered just outside of San Francisco. The company is focused on enabling the next generation of precision cancer therapies and diagnostics. Its Personalis NeXT Platform® is designed to adapt to the complex and evolving understanding of cancer, providing its biopharmaceutical customers and clinicians with information on all of the approximately 20,000 human genes, together with the immune system, from a single sample. The company was founded by executives from industry heavyweight Illumina (ILMN). The stock currently trades just under $3.50 a share and sports an approximate market capitalization of $180 million.

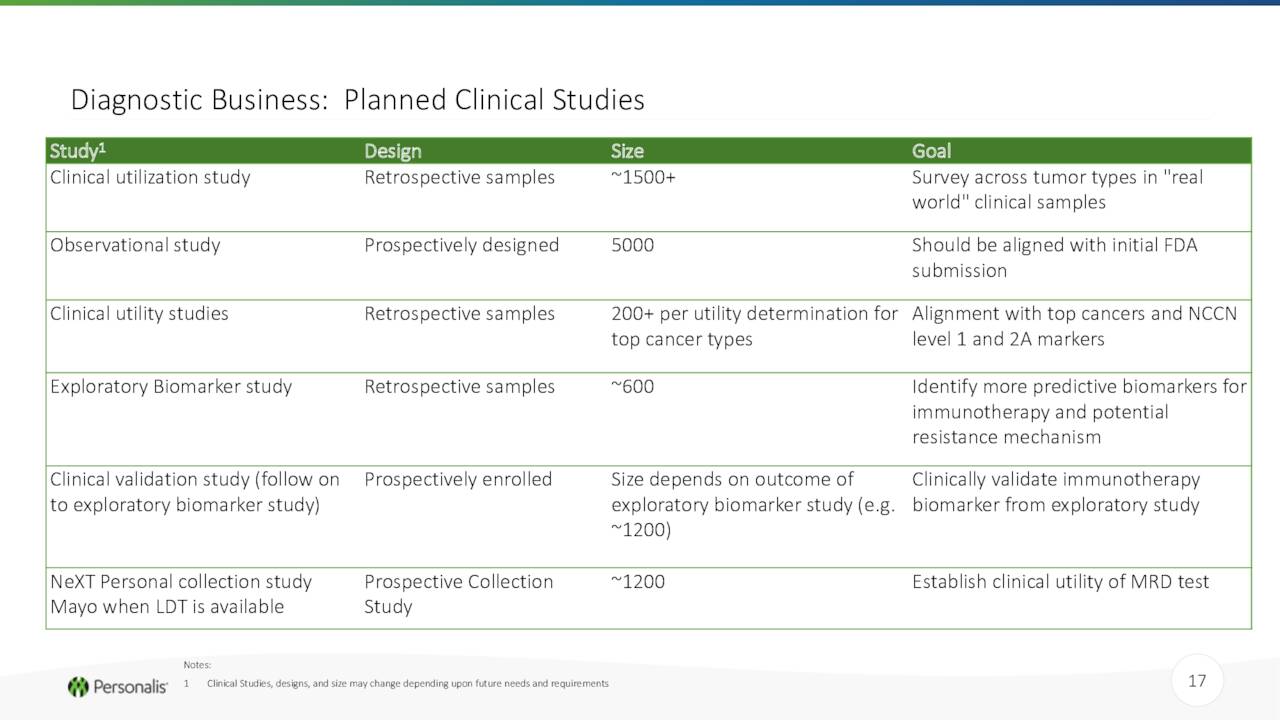

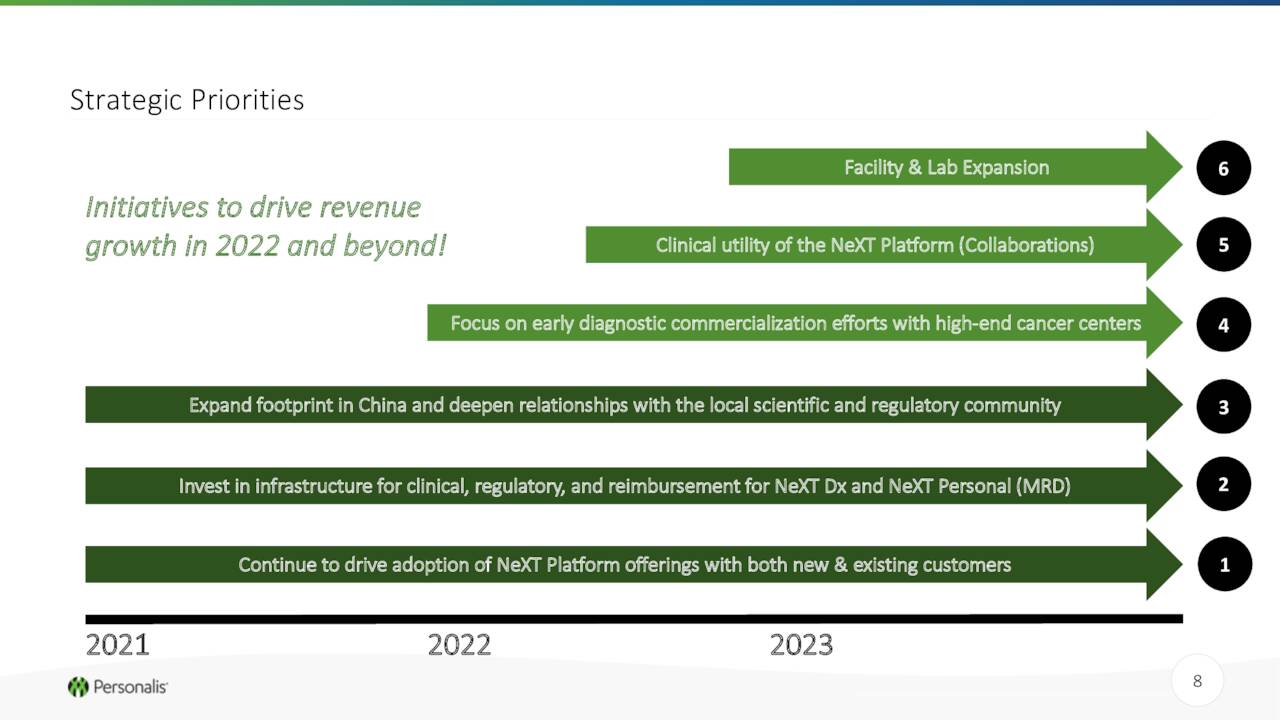

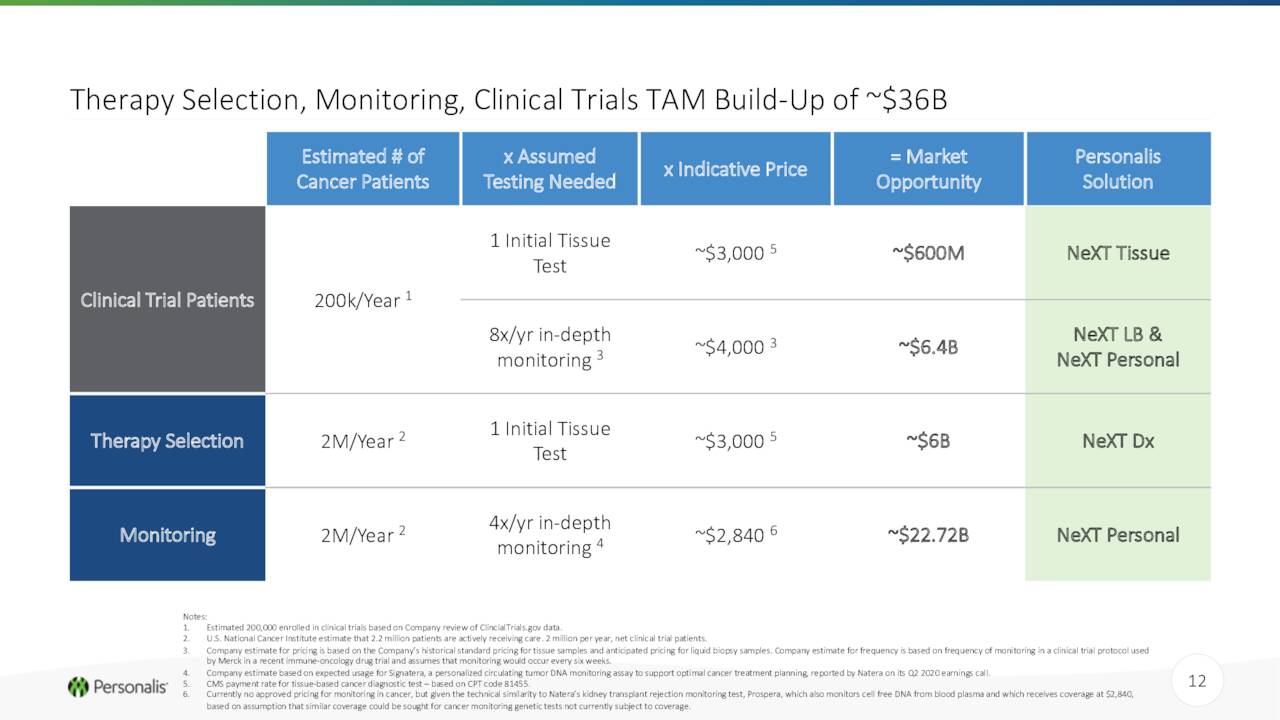

April Company Presentation

The company has several approved tests on the market. Personalis has garnered a large portion of its revenues since coming public via a contract with the U.S. Department of Veterans Affairs Million Veteran Program (VA MVP). That revenue stream is shrinking and being de-emphasized as the company focuses on growing its oncology testing business via its NeXT platform.

April Company Presentation

First Quarter Results

On May 4th, the company posted its first quarter results. Personalis posted a GAAP net loss of 63 cents a share, slight below expectations. Revenues fell some 27% on a year-over-year basis to just over $15 million, a tad over the analyst consensus.

VA MVP revenue for the quarter came in at $3.5 million. This was expected but was 73% lower than 1Q2021., compared with $13.2 million for the same period of the prior year. Management did state that unfulfilled orders from this contract were $4.1 million at the end of the first quarter and they expect the unfulfilled orders to convert to revenue during the second quarter.

April Company Presentation

The company’s oncology focus is resulting in good growth, albeit off a fairly low base. Biopharma and all other customers accounted for revenue of $11.7 million in the first quarter, up more than 50% from the same period of a year ago. This was driven by the continued adoption of the company’s NeXT Platform, which accounted for nearly two-thirds of this revenue during the quarter.

For the full year, management expects $62 million to $67 million in overall revenue. Of which, oncology revenue from biopharma and other customers to be in the range of $55 million to $60 million.

April Company Presentation

Leadership also mentioned its business continues to be impacted by the lingering impacts of the pandemic. One of the key long term growth drivers for the company is partnering with oncology firms during trials. In fact, half of Personalis’ biopharma work is now for these prospective clinical trial projects. Covid-19 continues to delay and reduce patient enrollment in these studies. The company’s effort to expand its footprint in China has also suffered due to the lockdowns in Shanghai where its lab is as well.

Analyst Commentary & Balance Sheet

Since first quarter numbers were posted, Morgan Stanley ($13 price target) and Needham have reiterated Hold ratings on the stock. Both BTIG ($15 price target) and H.C. Wainwright ($30 price target) have reissued Buy ratings. Citigroup did the same but lowered its price target to $14 from $18 a share previously.

Approximately five percent of the outstanding shares are currently sold short. A beneficial owner added just over $3 million to their holdings in early March. Since then, four insiders have made very small sales. The company ended the fourth quarter with just over $265 million of cash and marketable securities on its balance sheet after posting a net loss of $28.2 million during the quarter. The company has negligible long term debt, but has access to credit facilities if needed. The company used just over $20 million of cash during the first quarter. Leadership projects it will burn through approximately $140 million for all of FY2022. This includes a one-time investment of approximately $45 million for the construction and fit-up of a new company facility, which is one of the company’s key initiatives.

April Company Presentation

Verdict

The current analyst consensus has the company losing $2.50 a share in FY2022 as revenues fall some 25% to some $64 million. Revenues should stabilize near FY2020’s levels of $85 million according to analysts in FY2023, even as losses are projected to come in around this fiscal year’s levels.

April Company Presentation

There is no doubt that Personalis is aiming at some very large potential markets. 2022 is going to be a transition year as the company’s VA MVP business continues to ebb and as its builds up its oncology business while building out capacity at a new facility. Growth will return in FY2023 and beyond, and the company appears to have enough cash to bridge that transition.

The market has been absolutely brutal to profitless small cap concerns in 2022, knocking many including Personalis to significantly under their net cash value. This puts no value on the company underlying assets and Personalis could easily be a strategic ‘bolt on‘ acquisition for a larger player at current trading levels. However, that is probably the only way the shares have a sharp rebound until investing sentiment improves in the market.

We all have problems. Or rather, everyone has at least one thing that they regard as a problem.”― Mokokoma Mokhonoana

Be the first to comment