Nastasic/E+ via Getty Images

“A third of population tend to corrupt. The rest have no money.” – Ljupka Cvetanova

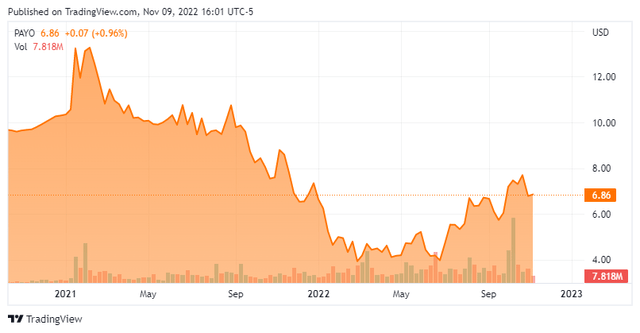

Today, we shine the spotlight on Payoneer Global Inc. (NASDAQ:PAYO) for the first time. The company just announced third quarter numbers this week and is seeing impressive sales growth, particularly from Latin America. An analysis follows below.

Company Overview:

May Company Presentation

Payoneer Global Inc. is based in New York City. The company operates a payment and commerce-enabling platform that facilitates marketplaces, platforms, and online merchants. Small businesses use Payoneer’s capabilities to manage their funds in the currency they want and need, and then ultimately move their money where it needs to go. Payoneer also serves a range of different industries including freelance, remote work, e-commerce, and social content creators. The company does business in 190 countries and territories. The stock currently trades near seven bucks a share and has an approximate market capitalization of just under $2.4 billion.

May Company Presentation

Second Quarter Results:

Wednesday, Payoneer Global posted third quarter numbers. The company had a GAAP loss of eight cents a share, even as revenues rose nearly 30% on a year-over-year basis to $158.9 million. Revenues were also up seven percent sequentially from the second quarter. The rise in revenue was credited primarily to continued customer acquisition, growth of high-value services, and accelerating interest income.

Transaction costs in the quarter were $28 million, which represents 17.6% of revenue. This is an improvement from 20.1% in the third quarter of last year and 17.7% versus the second quarter of this year. Management stated that these transaction costs grew at a lower rate than revenue due to ‘improved commercial terms, internal platform optimizations, and cost structure benefits from increased transaction volumes.’ The volume of transactions increased 11% year-over-year and 3% sequentially to $16.1 billion during the quarter.

May Company Presentation

The company got more than solid growth from emerging markets which include Latin America, Southeast Asia, South Asia, Middle East, and North Africa. Emerging markets delivered 39% sales growth from the same period a year ago, which included a 50% rise from Latin America. In addition, adjusted EBITDA doubled from 3Q2022. Looking at wear-to-date figures, Payoneer’s revenue is up 33% and adjusted EBITDA is up over 150%.

Leadership stated they now expect full FY2022 revenue of between $605 million-$615 million and adjusted EBITDA to be between $40 million-$43 million. This is a slight bump from previous guidance. The midpoint of this latest guidance represents a 29% increase to revenue and 47% increase to adjusted EBITDA on a year-over-year basis.

Analyst Commentary & Balance Sheet:

Since third quarter results came out yesterday, Needham maintained their Buy rating and $10 price target. Citigroup also reissued its Buy rating and bumped up its price target a buck a share to $10 as well.

Just over seven percent of the outstanding float in PAYO is currently held short. Several insiders have been frequent sellers since August of this year, disposing of approximately $3.5 million worth of shares in aggregate. The company ended the second quarter of this year with $508 million worth of cash and marketable securities against some $15 million of long-term debt. Cash balances increased by $15 million during the quarter.

Verdict:

The current analyst consensus has Payoneer Global Inc. right at breakeven both this year and next as sales rise better than 25% in FY2022 to nearly $600 million and better than 20% in FY2023. It should be noted the company should get a significant boost from the interest on the funds it holds due to the continued spike up in interest rates across the globe. Customer funds on Payoneer’s platform were just above $5 billion at the end of the third quarter. The company earned $15 million worth of interest income off these funds during the quarter. In way of comparison, interest income was $1 million in 3Q2021. Leadership expects interest income to increase to $20 million in the fourth quarter of this year.

May Company Presentation

The company is delivering more than solid revenue and adjusted EBITDA growth in what has been a challenging year globally. Payoneer also has a rock-solid balance sheet. If I was more confident in the direction of the global economy in 2023, I would probably take a decent size stake in PAYO at these levels. However, given my pessimistic view for the year ahead, I am only going to take a small ‘watch item’ holding in this name and plan to revisit this concern in the second half of 2023 to see how the company is progressing.

“The height of a man’s wall or fence is usually a reflection of the depth or shallowness of his neighbours’ pockets.” – Mokokoma Mokhonoana

Be the first to comment