blackred

By Joe Duarte

Stocks should have crashed on Friday after a blowout headline employment report, but they didn’t.

That’s because hedge funds and other investing “pros” missed the recent bottom in stocks. Now they seem to be playing catchup.

Fear of the Fed

After Friday’s big payroll number, stocks sank as the buzz was that the Federal Reserve will raise interest rates by 75 basis points at its September meeting. And they well might.

Yet, stocks recovered from their lowest levels. Moreover, until something changes stocks remain in an uptrend amidst a bullishly rising wall of worry and unusual reports of heavy retail buying combined with hedge fund paralysis and aggressive corporate insider selling.

Interestingly, bond yields remain in a downtrend, which means that for now, the buzz about the Fed raising rates by 75 basis points is just talk. Of course, amidst all this uncertainty it is certainly possible that the recent rally in stocks could fizzle.

But, what if it doesn’t? And if it doesn’t, are we then seeing a significant change in the investing world? I believe we may be seeing just that.

The Playing Field Has Been Evened

Historically, retail investors are described by Wall Street “smart money” types as bag holders as individual investors have been crushed over and over again by hedge funds and big money selling at the top of bull markets.

So once again, Wall Street is crowing about retail buyers being set up to fail, as they themselves miss a huge rally fueled by retail buyers. Normally, I would be in agreement. Except, we’re not at a market top. We seem to be at a market bottom. But retail investors seem to be acting, not as bag holders, but as the smart money by buying low and perhaps selling high, while the pros were literally caught short, being forced to cover their short positions and actually juicing stock prices higher.

It’s clear that something happened on the way to business as usual for the stock market: the Internet and the rise of services like Stockcharts.com, MoneyShow, and Joe Duarte in the Money Options.com, where conscientious analysts provide useful information and instruction to the masses seem to have leveled the playing field for individual investors.

In addition, with the rapid transit of information these days, it doesn’t take long for any investor who is plugged into his broker’s trading rig/news feed and a myriad of websites, many of them free with ads, to have fairly fast access to actionable information. The bottom line is that while insiders are living in the past where they once had the advantage, the “little guy” now has nearly equal access to actionable information as well as credible support and can act accordingly much more efficiently.

Of course, there is nothing that equals being next to the algos as they front run everyone’s trades. But, since Wall Street’s antics are no longer a secret, individual investors are getting a shot at better returns, at least for a while—until the machines adjust. The answer may well lie in the fact that complex systems emerge to new levels as enough of the agents in the system find a successful exit point from the old status quo. And if that’s true, then we’re dealing with a whole new ball game as more people are thinking for themselves when it comes to the stock market.

Point of Emergence: Reddit, Retail, and MELA

Remember the Reddit Mobs? How about the hedge funds that had to close their doors because their short positions were destroyed by retail investors who thought the underlying companies targeted by short sellers were actually viable?

Well, it looks as if a lot of the so-called “newbies” and Robin Hooders, are back.

One of the amazing developments of the Covid pandemic was that many people who were forced to stay home learned to how to trade and invest, thanks in part to those famous “stimmy” checks. The result has been, despite the lack of mainstream acknowledgment, an increase in focus on the stock market, not as an abstract to be dealt with by professionals, but as a hands-on tool to be used to pay the bills and to build long-term wealth.

I often write about the MELA system, where the Markets, the Economy, people’s life decisions, and the artificial intelligence algorithms meet. The net result is that the stock market, which fuels IRAs, 401(k) plans, trading accounts, and crypto has become the primary mover of economic activity. In other words, as more people leave their jobs, or adjust to some sort of hybrid employment status, they depend more and more on the stock market for spending money.

Yeah, the US is now more of a trader nation than ever before.

So, when I read about insider selling, and retail buying at what looks to be a tradeable bottom, as prices explode to the upside, I have to wonder if insiders are now the dumb money while the Reddit mob and retail investors who depend more and more on the stock market for a living aren’t the new smart money.

Of course, this could all be a fleeting moment of temporary reality. But it sure is interesting to watch.

Bonds Remain in Bullish Posture

The Federal Reserve says they are not turning dovish. In fact, the Fed is getting more vocal about raising interest rates. And after Friday’s employment report, until something changes, such as a surprisingly better than expected CPI, we may get a 75-basis point rate increase soon. But the bond market is saying that the Fed should lower interest rates.

Last week’s worst day, 8/2/22 delivered aggressive selling as several Fed speakers plainly stated that they were not turning dovish, that there had not been a pivot toward lower rates, and that even higher interest rates were coming.

The bots bought the story for a day. But by 8/3/22 when more data came out suggesting the economy is slowing, stocks rallied as bond yields once again sank.

The net result was another short squeeze of hedge funds, which according to many reports are frustrated and don’t know what to do. Go figure. They spend millions on Algo trading programs and analysts and they don’t know what to do.

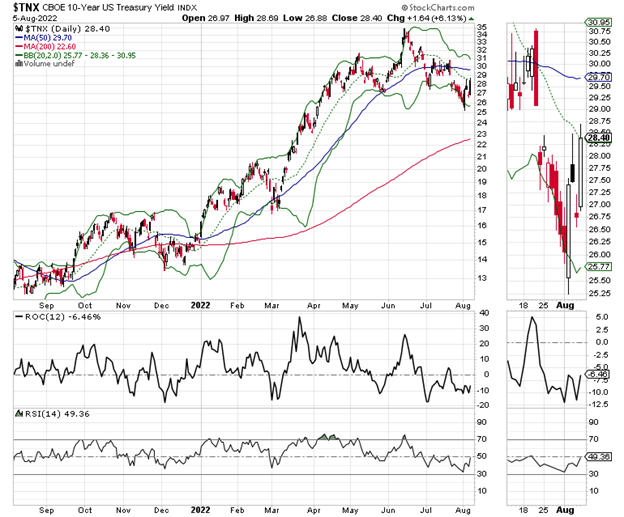

On 8/3/22, the US Ten-Year Note Yield (TNX) moved higher on the news that the Fed would keep raising rates, but within 24 hours the downtrend was back. The same thing happened, to a lesser degree after the employment report. Net-Net, bond yields remain in a bullish downtrend pattern of lower highs and lower lows.

And on 8/5/22, even after the employment report, bond yields ended well off of their highs and below the critical resistance area near 2.97%. This suggests that not everyone is buying into the notion that the Fed will raise rates by 75 basis points.

Moreover, this type of sober trading in bonds suggests that many expect the Fed’s aggressiveness to lead to a more severe slowing of the economy and an eventual new bout of QE, which is why stocks are well off of their recent bottom.

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” –Complexity Labs

Market Breadth Remains Bullish. Liquidity Tests Support.

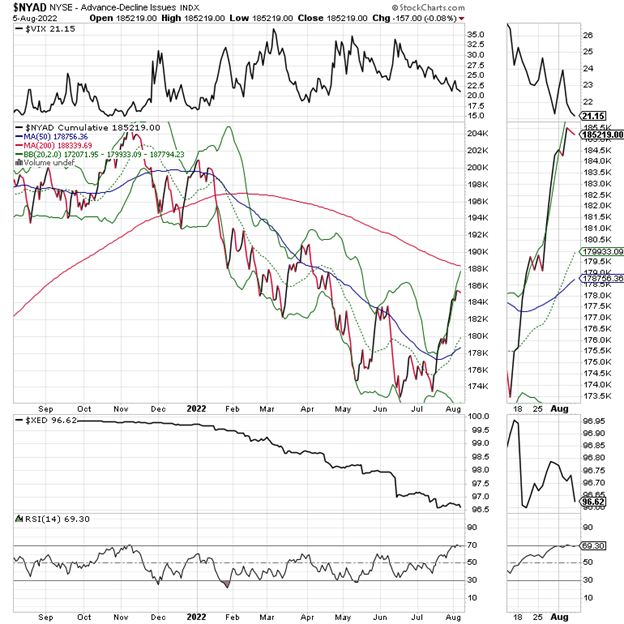

Despite the possibility that the Federal Reserve could raise interest rates by 75 basis points in September, stocks remained in an intermediate-term uptrend as measured by the most accurate indicator of the market’s trend. The NYAD Advance-Decline line (NYAD) moved decidedly higher for most of last week, remaining above its 50-day moving average. Thus, Friday’s nearly even breadth in the face of volatile trading is quite bullish. Moreover, the possibility of consolidation, not a reversal is rising as the RSI for NYAD is above 70.

On the other hand, the CBOE Volatility Index (VIX) has again broken to a new low as the bears continue to bail out of their put option positions.

If there is something to be concerned with, it’s the market’s liquidity as XED, the Eurodollar Index is testing its recent lows. A break below 96 could lead to increased market volatility due to fading liquidity.

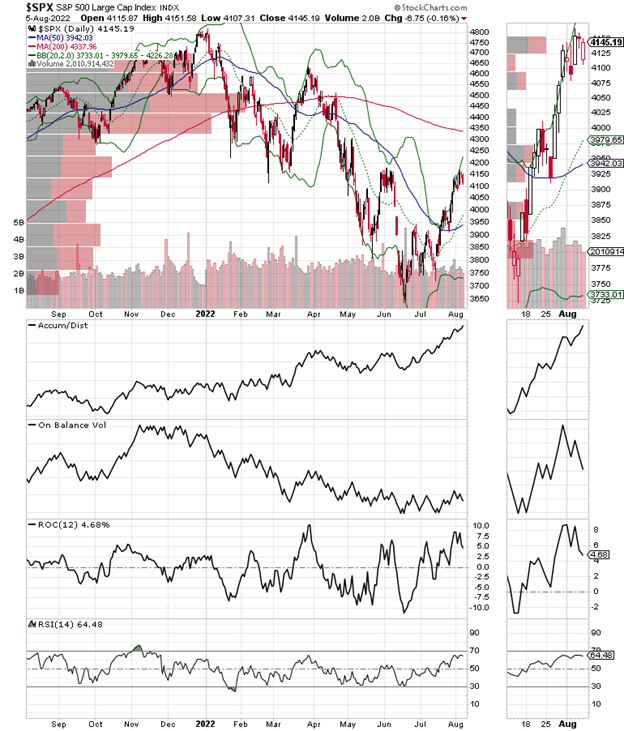

The S&P 500 (SPX) remained above the 4000-4100 support band with 4200-4300 being the next big resistance level. Accumulation Distribution (ADI) is still rising which means short covering is ongoing. A turn-up in On Balance Volume (OBV) which was evident last week rolled over, however, a sign that buyers are still a bit skittish.

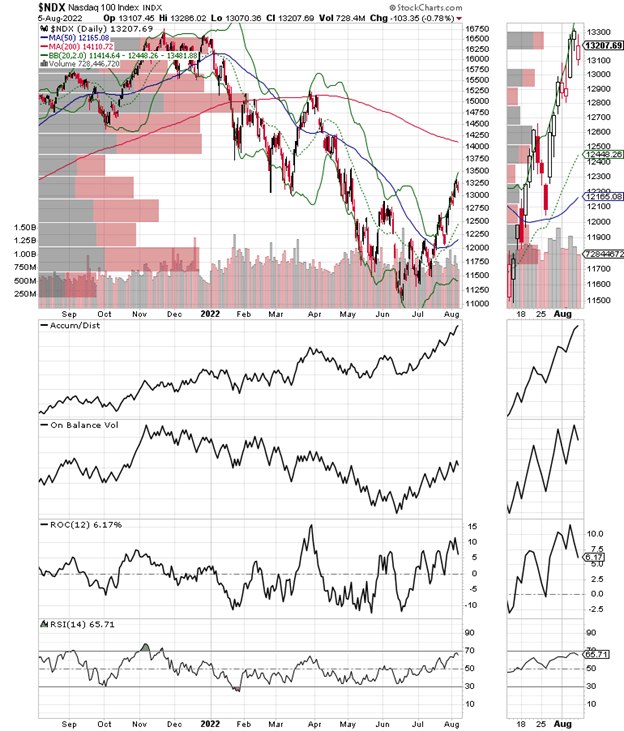

The Nasdaq 100 Index (NDX) also remained above its 50-day moving average with 12500 now becoming stronger support. A clear break above 13000 did not materialize. If and when it does, it would likely take NDX close to 14000. Accumulation Distribution (ADI) is suggesting short sellers are still stampeding out and On Balance Volume (OBV) is strengthening as buyers come in.

Originally published on MoneyShow.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment