jetcityimage/iStock Editorial via Getty Images

It’s important to try and view any stock through fresh eyes. Unfortunately, in the case of Tesla (NASDAQ:TSLA), fresh eyes are close to impossible.

It seems almost certain that no stock in history has had more words written about it. It seems likely that no stock in history has had such large, entrenched camps on both side of the trade. Tesla bulls believe the company literally can transform life not only on Earth but on other planets as well:

Twitter

Tesla bears, meanwhile, see a company that is overvalued and further away from innovations like autonomous driving than bulls believe.

Personally, I’ve been in the middle. I’ve shorted TSLA twice and successfully both times, most recently covering just near the absolute bottom in 2019. (That’s not much of a brag: TSLA trades at ~15x the entry point on that short. It might have been a good trade, but quite obviously not the best one available.) Like many fundamentally-minded investors, I’ve questioned, at least from afar, the valuation assigned to the company (which incredibly cleared $1 trillion at the highs).

That said, I’ve hardly been an ardent or long-time bear. In late April, I expressed my admiration for the business Tesla has built. In 2019, I criticized some of the claims of irregularities made by TSLAQ bears.

But what makes a TSLA short intriguing here is that the short case doesn’t have to be based on the long-running TSLAQ arguments. Simply considering the profile of this stock in this market — in other words, when considering TSLA as just another stock — an investor can build a rather strong short case.

The Cyclical Argument

Of late, there’s more and more evidence that that the macro environment is starting to deteriorate.

The details of the macro debate don’t need to be rehashed, but there is at least a clear risk of a recession. We don’t know how Tesla will fare in that scenario — the company has never been through a recession, save for the brief 2020 dip — but the history of the sector suggests macro weakness will hit the stock. In 2008-09, Ford (F) lost 75% of its value, General Motors (GM) went bankrupt, Toyota Motors (TM) dropped 60%-plus, and Volkswagen (OTCPK:VWAGY) fell ~70% from its peak (excluding the famous short squeeze/corner in that stock).

Unit sales from that period admittedly don’t look quite as bad. Global unit sales went from 66 million in 2007 to 57 million in 2009. But ex-China (more on this in a moment), global unit sales dropped 22%. In the U.S., market figures from the Ford 10-K (see p. 6) show even greater weakness at the high end of the market.

To be sure, TSLA is probably not the best bet out there on a recession. Three weeks ago, we recommended a short on boating stocks in part due to cyclical worries; other sectors (homebuilders, for example) too might face a greater economic hit than would Tesla.

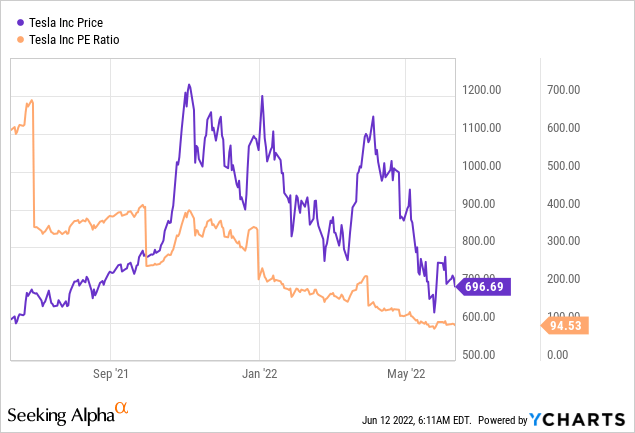

But those sectors are baking in at least some cyclical weakness already: for instance, homebuilders D.R. Horton (DHI) and Lennar (LEN) trade at 5-6x trailing GAAP earnings. Tesla trades at 94x. The market still is pricing in some kind of linear growth here.

From a long-term perspective, that perhaps makes some sense. EV adoption is going to grow from 2021’s 9%. Even if global unit sales decline for all automobiles, the EV market still can grow thanks to higher penetration.

That said, both bulls and the Street seem to be forecasting Tesla’s growth as if the EV industry will grow going forward as it has looking backward. Increase penetration by three points (the 2020-2021 rate) and drop global auto unit sales 10% and the EV industry grows about 20%. Analyst consensus forecasts 36% revenue growth for Tesla next year.

That’s not a target that gets hit if a global recession lands — or even if inflation moves buyers down the value chain, away from the more profitable versions of the Model 3. TSLA is not the most cyclical stock out there, but it clearly is a cyclical stock, and unlike the group it’s trading at almost 100x trailing earnings.

The Competition Problem

The cycle also presents a potential “double whammy” for Tesla. The company will face significant macro pressure for the first time — while also facing the greatest degree of competition it’s ever faced.

To be sure, the potential for competition, notably from Ford, Toyota, and Volkswagen, has been a pillar of the bear case for some time, and it simply hasn’t played out yet. Tesla still owns over 70% of the U.S. electric vehicle market (the U.S. accounted for ~45% of trailing twelve-month sales). The bearish argument that Tesla can’t make quality cars simply hasn’t been reflected in sales numbers despite semi-viral claims of “whompy wheels” and Autopilot errors.

But new competition is on the way, with Lucid Motors (LCID) winning the Motor Trend Car of the Year and Ford in particular going all-out in EVs. Musk’s recent political turn probably doesn’t move the needle (I’m skeptical that his Tweets get that far outside of that platform and/or people paying close attention to the stock) but it’s possible that some EV buyers (a usually more left-leaning constituency) may look to other manufacturers.

The combination of slowing industry growth and new competition leads, almost certainly, to significant pricing pressure — and potential margin contraction. Bear in mind that Tesla has been surprisingly profitable of late. Automotive gross margins have steadily expanded from 26.5% in Q1 2021 to 32.9% a year later. That expansion has been a big reason why operating margins more than tripled over the same stretch to a whopping 19.2% in the most recent quarter.

Consensus estimates do forecast some modest margin compression next year. But there’s a scenario in which margins contract materially in a hurry. Input costs continue to rise. Lithium costs have become so elevated that Musk has floated the idea of Tesla itself becoming a miner. Those costs offset the potential for continued battery cost reductions (summarized in “Wright’s Law,” at least as detailed by ARK Invest).

Meanwhile, in a recessionary environment both new entrants (Lucid, Fisker (FSR), etc.) and legacy ICE (internal combustion engine) will have to compete largely on pricing. We believe Tesla faces the possibility of deflationary sticker prices and an inflationary cost environment.

That’s just in the U.S., of course. In China (almost a quarter of sales), Tesla doesn’t have quite the same dominance. Tesla’s TTM revenue in the country is about $15 billion; NIO (NIO) and Li Auto (LI) combine for over $10 billion in sales over the same period, but that’s just a fraction of the existing EV competition.

Tesla has been successful in China in the past but there is no guarantee of continued success. Especially when Chinese authorities are so keen (unsurprisingly) to support domestic manufacturers. How much growth in China is priced in? Moreover, China has its own economic worries, is still dealing with the novel coronavirus pandemic (which shut down Tesla’s Shanghai plant), and is subject to the same inflationary pressures as the rest of the world. Europe has greater macro risk and more intense competition.

There is a world in which Tesla’s unit sales have peaked for good. To be clear, that scenario seems particularly unlikely. Still, competition is intense worldwide, and it’s important to remember that one key benefit of EVs is precisely the fact that they last longer (owing to fewer parts). A market with higher EV penetration ostensibly is a market with less overall demand for new vehicles.

But what does seem more likely is a world in which Tesla’s profit margins have peaked. There is no better environment for pricing power than an environment with a solid macroeconomic backdrop (including stimulus payments worldwide!) and still-nascent competition. We believe both of those aspects are about to change, potentially dramatically. Again, at nearly 100x trailing earnings, that’s not priced in.

The Stock Market Problem

To be fair, this broad case for shorting TSLA stock, one based on valuation, competition, and margins, has never worked for any real length of time. Part of this is because Tesla has outperformed expectations. Musk is not exactly known for making conservative projections, but even he predicted the Model 3 would generate ‘only’ $20 billion in revenue at a 25% gross margin. Bears scoffed at the margin figure, but Tesla’s Model 3 gross profit dollars total more than double what Musk himself projected.

But part of what has kept TSLA stock afloat has been the market itself. Tesla shareholders have faith in Musk and have faith in the company, We believe shareholders continue to assign value to parts of the business that don’t, you know, actually exist yet. (So do Wall Street analysts.)

That faith is being tested right now in a big way. It’s not hard to find multiple anecdotes of individual investors with potentially irresponsible exposure to the stock. (To be fair, for many of those investors the exposure is only irresponsible now because their net worth consists so largely of unrealized gains in the stock.) Again anecdotally, many retail Tesla shareholders have large chunks of their portfolio in other EV names, crypto, or even meme stocks — essentially all of which have crashed already.

For sure, shorting Tesla based on an expensive PE ratio in the past has been a recipe for disaster. But the market environment now is completely different. TSLA has a retail investor base that owns almost 40% of the company at a time of sharp inflation and a steep market pullback (one that likely is even steeper for the average TSLA stockholder’s portfolio). Add real macro fear and dwindling liquidity to that mix and there’s the chance of a real stampede to the exits.

Put another way: it’s been retail investor demand that (to my eye, anyway) has allowed TSLA to float well above fundamental fair value for some time. That demand for the stock has a real chance of drying up, to the point that there’s a scenario in which TSLA drops below its long-term fundamental fair value.

Indeed, Tesla’s stock split announcement on Friday did little to move the stock (+1.7% after-hours), showing that the old retail-friendly tricks perhaps don’t work the way they used to. The exit of Larry Ellison from the Tesla board last week portends a potentially large slug of stock coming to market as well. Meanwhile, at the same time demand for the stock slows, the demand for Tesla products risks doing the same. (There of course is some overlap between customers and shareholders as well.)

Outside of retail, part of the momentum behind TSLA has been the belief that the company will find new sources of profit beyond the Model 3. But the Cybertruck has been delayed again; the energy business has posted negative gross profit over the past four quarters; the Optimus robot “may” (Musk’s word) have a prototype available by the end of September, when Tesla holds a postponed AI Day.

Those opportunities are exciting, and enticing, in a bull market. It’s why we had a SPAC bubble. However, we don’t believe there is a SPAC bubble anymore. When growth slows, and stocks plunge, analysts and investors don’t assign tens of billions in value to opportunities that may happen at some indeterminate point in the future. They get focused on the present.

Not All Of The Above

The jackpot short case for TSLA is that investor attention returns narrowly to the present at the same time the present looks far more challenging. And the argument for that jackpot short rests in part on the fact that the pillars are interconnected. Disappointing macro performance hits the industry, and thus Tesla’s revenue and margins. Weaker industry performance creates more desperate competitors, which adds to margin pressure. The macro environment leads to weakness elsewhere in the market, further undercutting confidence among Tesla’s shareholder base. Even the lower stock price itself raises Tesla’s cost of capital, reversing the “virtuous circle” which has helped the company’s growth to this point.

But for the short to simply succeed, not all of these things necessarily have to play out all at once. Tesla can keep its market share position — only for disappointing market growth to lead in turn to below-expectations revenue. Financial performance can come in relatively in line — but the multiple assigned to the stock can continue to shrink.

It’s a fool’s errand in this environment, with this stock, to assign a specific price target. But there’s clear room for material downside even in a reasonable scenario.

It seems crazy to say about a stock that is down 44% that something close to perfection is priced in. But this is a car manufacturer (and for now, yes, only a car manufacturer) trading at almost 100x earnings. TSLA stock still is up more than 700% since the beginning of 2020. TSLA may be at $700 instead of $1200, but both prices require years of relatively linear growth going forward. There are an awful lot of things that can go wrong along the way.

Again, shorting Tesla on this basis has not worked in the past. But there are clear signs that this time is different. Rates are going up and speculative assets are coming down. This is not clearly seen than in the recent performance of crypto.

How The Shorts Lose (Again)

To be sure, shorting TSLA at any point is not without risk, as history shows. It’s likely no stock has caused more short-seller losses. That history alone might push some investors away from the stock — but it’s far from the only reason for caution.

One is that for all the debate over the stock, Tesla is an impressive business. The company has delivered just over 1 million vehicles over the past four quarters. In a market filled with meme stocks, and junky de-SPACs, there’s a “surely there’s an easier short elsewhere?” retort to the case here.

But, again, the opportunity set in cyclicals is somewhat limited. Many of the gravity-defying names in the market already have crashed significantly. Individual investors probably can find better shorts for their tastes/profiles, but TSLA still looks like a strong opportunity. An exceptionally liquid options market helps as well.

Another is that EVs in general may see a tailwind for higher gas prices. $5 gas could accelerate EV adoption, thus ameliorating the pressures caused by inflation and competition.

Yet $5 gas probably doesn’t stick around if the economy indeed turns south. Even if it does, high gas prices are not fixing the cyclical demand problem that is likely to face the auto industry. Higher EV penetration in a declining overall industry still results in modest absolute growth at best. TSLA stock, even off the highs, is not priced for modest absolute growth.

There’s the “too late” argument as well. TSLA already is 44% off November highs; it’s down 39% just since April 4. But as we detailed in our short case on Carvana (CVNA) in April, there are still profits to be made even well off the highs. The broad point still holds, even if TSLA admittedly is not CVNA.

What it might be, however, is Cisco Systems (CSCO). At the March 2000 peak, Cisco was the second-most valuable company in the world. On U.S. exchanges, Tesla topped out at number four. In 2000, CSCO ended the year more than 50% below its peak; by the end of 2001 it was down more than 75% from those levels.

It’s worth remembering that Cisco indeed is a great company. It doesn’t quite seem that way given performance of late, admittedly. But Cisco’s market cap still is in the top 50 worldwide. Trailing twelve-month revenue is over $50 billion. Tesla’s long-term top-line potential no doubt is greater (Cisco’s revenue has only risen ~4.7% annualized since FY00), but the lesson here holds: even a solid business that is overvalued can sell off big in a market downturn.

The largest, broadest risk is that such a downturn doesn’t arrive and that recessionary fears are overblown. In other words, this market is not a lighter version (and for now it still looks like a lighter version) of 2H 2000 or 2H 2008, but more like Q4 2018. The roaring optimism of 2020-2021 returns, and TSLA bounces back into four-digit territory (four-digit pre-split, to be clear).

This, of course, is a risk to any short at the moment; so is a brief bear market rally. This year, TSLA managed to gain 60%-plus in a matter of weeks (late February to early April) and 21% in three sessions (May 25-27, amid hopes that Musk could exit the Twitter (TWTR) deal). A TSLA short is likely going to see some volatility.

Final Thoughts

To sum up, we believe this is going to be a volatile market for a while. For TSLA to bounce from here and hold it, the stock is going to need the macro environment to cooperate; the market environment to cooperate; and investor sentiment toward growth stocks to cooperate. If all three of those outcomes occur, the long portion of an investor’s portfolio should do rather well. TSLA soared during a bull market; it almost certainly is going to need another one to see a sustained rebound from these lows.

That new bull market looks increasingly unlikely, at least any time soon. Investors across the market are falling out of love with high growth, high P/E stocks with sky high expectations. They are coming around to the fact that valuations matter, which is why TSLA has fallen more than 40% already. The bet here is that more investors will come to that realization — and TSLA will fall further as a result. As mentioned prior, we believe there is considerable downside ahead.

Be the first to comment