Nuthawut Somsuk/iStock via Getty Images

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” – John Maynard Keynes

Given the general demand coming from very loyal and esteemed followers for us to put an end to our much longer than average hibernation from our market ramblings we decided to commit yet again to the exercise.

When it comes to choosing our title analogy, given the “Kodiak” bear market mauling we witnessed, it seems to us appropriate to use the Myopic Loss Aversion Theory. Myopic loss aversion is the idea that the more we evaluate our portfolios, the higher our chance of seeing a loss and, thus, the more susceptible we are to loss aversion.

This theory is explained in an article entitled “myopic loss aversion: a behavioral answer to the equity premium puzzle?” from The behavioral science and policy association:

“One behavioral theory by Shlomo Benartzi and Richard Thaler attributes the equity premium puzzle to what’s known as myopic loss aversion (MLA) – the idea that loss-averse investors (as all investors are) take too short-term a view of their investments, leading them to react overly negatively to short-term losses. Since investors are especially worried about losses, they need to know that equities have high return potential to justify investing in them – hence the equity premium.”

In a previous post of ours entitled “Some like it hot” in February 2021 we carefully warned about rising inflation and its consequences on stimulating “pitchfork risks”. As such we were not very surprised by the collapse of Sri Lanka’s economy, riots in Ecuador and global unrests materializing in many parts of the world.

Rest assured given the ongoing European Energy Crisis and tragedy in Ukraine, it is not the beginning of the end, but, just the end of the beginning we think. In continuation to the aforementioned post of ours, we decided to keep below our title the famous quote from John Maynard Keynes.

When it comes to the Ukrainian tragedy we expect a “Carthaginian peace” deal between Russia and Ukraine. It refers to any brutal peace treaty demanding total subjugation of the defeated side. This is what Russia we think, will ask from Ukraine yet there are some risks of serious escalation with a potential blockade of Kaliningrad.

In this return conversation, we would like to look at the materialization of “pitchfork risks” coming from food inflation because as illustrated in our conversation “The Decoy Effect”, “deglobalization goes hand in hand with inflation we wrote back in 2018. For us the real pain in the markets has been in Fixed Income given everyone has been focusing on equities given that “size of market” does indeed matter.

Deglobalization goes hand in hand with inflation

Back in July 2018, in our conversation entitled “The Decoy Effect” we posited the following:

“If inflation creeps up, then companies will suffer margin compression and will be forced to raise prices, which will lead to wage increases to compensate that higher price level. We have pointed in the past that trade wars could lead to a stagflationary scenario playing out, meaning lower growth and higher inflation.” – Macronomics July 2018

As well we foresaw what has been unfolding calling in advance the stagflationary outcome at the time of this specific article:

To repeat ourselves, rising energy prices could be the match that lights the bear market. Continued inflationary pressure coming from energy prices will eventually lead to financial markets “repricing” accordingly. We are already seeing blood in some selected EM with rising inflation in double digits (Turkey for example). It is probably understandable why the Trump administration is reaching out to OPEC for them to slowdown the steady rise in oil prices with elections coming later this year. While escalation in the trade war would no doubt affect Developed Markets and Europe in particular, Emerging Markets which have been more recently on the receiving end of tighter liquidity and rising US dollar would as well be seriously impacted by a stagflationary income.” – Macronomics July 2018

Given looming midterm elections for the battered Biden administration, no wonder they are as well, in similar fashion reaching out to OPEC in general and Saudi Arabia in particular. Unfortunately for the Biden administration, lack of CAPEX in the oil and gas sector in the last 10 years thanks to the ESG cult and Saint Greta are leading to some drastic measures such as firing up coal plants in Europe to offset the dwindling deliveries of Russian gas to a much more energy-import exposed Europe, and the fact that unless the Biden administration reviews rapidly its stance towards fossil fuel, it will be a growing issue in the US as well.

We won’t rant again on the stupidity of European elites in general and Germany in particular, deciding to favor gas over nuclear energy and also attempting to dominate even more the European energy market by becoming the biggest gas distributor of gas in Europe via Nordstream 2 while lobbying hard against French nuclear industry and its ailing giant EDF.

We do understand acutely the European geopolitical game. We would just add to our dear readers that for any government there are two long term strategies you should never mess with, one is building an independent energy strategy, the other being insuring food security. On both counts the European Union and European Commission failed miserably. History will not be kind with their epic failure.

Having a long-term strategy for energy is an “adult game” and should not be tampered with by “teenagers’ dreams”. Regardless of what some green activists tell you, nuclear is clean energy hence the huge success of French nuclear strategy in the 70s following the oil crisis unfolding. We would also add that President Macron stopping the Astrid nuclear program in the summer of 2019 was a grave mistake in our opinion but enough ramblings.

While the Trump administration decided that tariffs was the way to go against China, the only outcome, which was even more acutely increased due to the COVID pandemic was to accelerate even more “deglobalization”.

Countries have come to terms with the need on re-onshoring some of their production but, given labor costs differences which was the “raison d’être” of the GATT agreements and China being approved onto the WTO, the current state of affairs can only be attributed to these decisions which were highly criticized at the time by maverick investor Sir James Goldsmith as we pointed out in our conversation “The Pigou effect”:

On the fallacy of Balance accounting as per Sir James Goldsmith:

“The idea that accounts must balance, and that inflows must ultimately match outflows, is an accountant’s idea. But there is a fundamental misunderstanding here. If you make a loss, perhaps because you own a business that is trading unprofitably or because you have made a bad investment, you will not get rid of the loss by borrowing the amount needed to pay for it. You will have avoided or postponed a personal liquidity crisis, but you will still be poorer by the amount of the loss. You will also have to pay interest on the loan. Alternatively, you might sell your house and rent somewhere else to live. You will have used the proceeds of the sale to pay your debts, but you will remain poorer by the value of the house. And in future, you will have to pay rent. When the Asian countries, as mentioned by the European Commission, invest their ‘excess cash’ abroad, normally they do so by buying into businesses or by lending money. The latter normally takes the form either of buying government debt or of deposits, say in sterling or dollars, in the banking system. Now consider the position of the nations which, unlike the Asian countries, import more than they export and which, as a result, have a deficit as opposed to an excess of cash. To finance their deficit, businesses or other assets are sold and debt is issued. This puts them in exactly the same position as an individual who sells his house or borrows money to cover his debts. Such a haemorrhage can last only a limited time before ending in bankruptcy.” – Sir Jimmy Goldsmith

And this is something to take into account. So far the trade was exchanging promissory notes (USTs, European government bonds) against cheap commodities and the ability for rich foreigners to “protect” their assets under more favorable property law regimes and buying “real estate”. Now this game is up and so is “globalization”. The break down in trade flows vs money flows will have tectonic repercussions particularly if one takes into account demographic headwinds for the likes of Japan and Europe which will be discussed below in our final bullet point relating to Angus Maddison’s work.

Though we were probably in 2018, the consequences of COVID related supply chain disruption, very high US fiscal stimulus and with the tragedy in Ukraine unfolding are all leading to higher inflation and an acceleration of “deglobalization”. As such we read with interest AXIOS article by Neil Irwin from March 24th entitled “The future of the world economy is deglobalization”:

“Flashback: For years now, companies with complex multinational supply chains have grappled with unexpected costs. First there were the Trump tariffs, applied to different lists of products and import sources with little warning.

The pandemic, with its lockdowns and extreme travel restrictions, were even more disruptive, as the continued shortages at car dealers and on U.S. store shelves confirm.

Now, the price of oil and agricultural commodities has soared, and with Russia cut off from the world economy, there is the prospect of sustained shortages of crucial industrial materials including nickel, palladium and neon.

This is forcing businesses to shift from an emphasis on “just-in-time” to “just-in-case,” as Atlanta Fed president Raphael Bostic said in a speech this week. That is, they are increasingly willing to sacrifice efficiency for reliability.

Leading investors are coming to the same view. BlackRock chief Larry Fink writes in a new letter to shareholders that the Ukraine war “has put an end to the globalization” experienced in recent decades.

Howard Marks, of Oaktree Capital, writes in a new investor letter that this era of globalization has been a boon for global GDP, but that the swing away from it may “improve importers’ security,” and “increase the competitiveness of onshore producers and the number of domestic manufacturing jobs.”

The bottom line: The global economy of the 2020s is looking quite different from the world of the previous three decades — in ways that we’re only starting to understand but could have profound implications for macroeconomic policy.”

Not only “deglobalization” will have profound macroeconomic policy implications but, from an asset allocation perspective, this will create tremendous opportunities and shifts.

If indeed, “savings” stays more “local” then indeed, the whole “recycling” of flows of money from the East to the West is going to “shift”. From the same article:

“Just as globalization was deflationary, its unwinding will be inflationary,” Mark Carney

This is why for those who have been following us for many years understood why we changed our stance from being “deflationistas” to inflationistas”. Back in October 2017 in our conversation “Who’s Afraid of the Big Bad Wolf?” we asked ourselves if indeed the game was turning and if we should switch camp from the “deflationista” towards the “inflationista” camp:

“Given China’s most recent uptick in its PPI to 6.9%, we are indeed wondering if this is not a sign that we should change allegiance slightly towards the “inflationista” camp and start fearing somewhat the possibility of the return of the Big Bad Wolf aka inflation. We will be monitoring closely this latest China “inflation impulse”. China’s rising costs via exports could boosts inflation expectations in the US. These higher inflation expectations in the US would mean a steeper yield curve with a rise in long-duration yields overall and it would lead to higher rates volatility down the line. A bear market needs a wolf and this wolf would materialize in a return of inflation we think.” – source Macronomics, October 2017

Also, as all eyes are looking at the significant surge in oil prices in recent months as per our March 2016 conversation “Unobtainium“:

“A very interesting 2015 paper by the Bank of Israel (Sussman, N and O Zohar 2015, “Oil prices, inflation expectations, and monetary policy”, Bank of Israel DP092015.) indicates that since the Great Financial Crisis (GFC) of 2008, a 10% change in oil prices moves 5Y5Y expected inflation by nearly 0.1% in the US and 0.05% in the Euro area. Therefore, given the recent significant surge in oil prices, we do not think it is such a surprise to see a rise in inflation expectations in that context.” – source Macronomics, March 2016

There you have, the impact of the surge in inflation expectations is different between the US and the Euro area, but in conjunction of rising oil prices, the fall of the Euro currency is making matters worse for European countries where the weight of energy imports is more important hence the tremendous pressure on the ECB to somewhat normalize its monetary policy.

“Pitchfork risks” are rising for the sorcerer’s apprentices, aka central bankers.

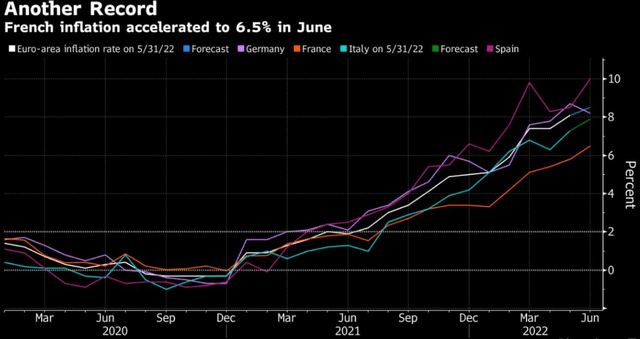

With inflation running very hot in Europe as seen in the latest inflation print for Spain (10.2% for June, a new record) and in France coming at 6.5% in June, the ECB is clearly under huge pressure:

Bloomberg

Graph source Bloomberg – Twitter

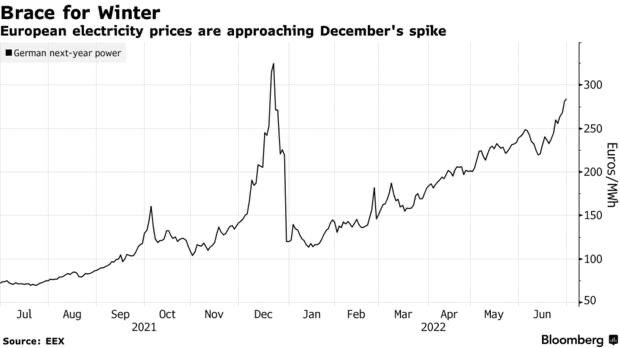

Given rising pitchfork risks are already present in troubled Emerging Markets (Sri Lanka, Ecuador), you can rest assured that European countries will not be spared by the trouble brewing and Yellow Jackets (Gilets Jaunes in French) might indeed return in the fall with a vengeance when one looks at the ongoing surge in electricity prices:

Bloomberg

Graph source Bloomberg – Twitter

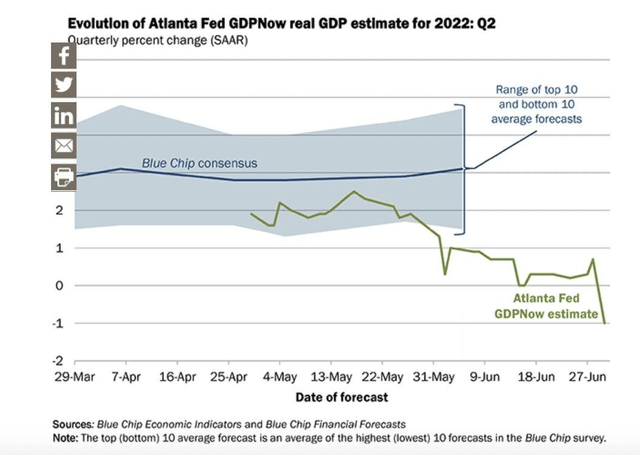

As well, the Atlanta Fed’s latest GDPNow reading has turned solidly negative:

Atlanta Fed

Graph source Atlanta Fed – Twitter

European countries are facing a serious new shock as a result of a reduction in natural gas supplies from Russia, which will further increase inflation in the region and push the eurozone’s largest economy, Germany, into recession, Deutsche Bank experts say. The prognosis, to say the least is not good.

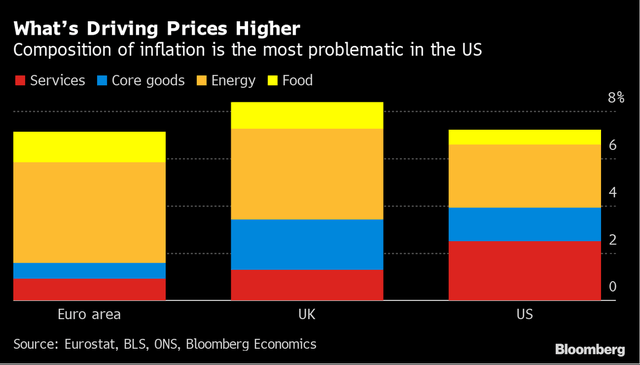

At the same time you can expect the Fed to continue to hike, putting even more pressure on the ECB in that context:

“U.S. has a more problematic & stickier inflation problem than other nations, since more of the price pressure stems from services rather than physical goods. That’s why the Fed will likely go further in hiking rates into restrictive area than other central banks” – Lisa Abramowicz – Bloomberg

Bloomberg

Graph Source Bloomberg

This stagflationary outcome which we saw coming will no doubt create in the fall additional social tensions and unrest in many parts of the world.

So no wonder our “Generous Gamblers” aka central bankers are starting to feel the heat following years of tampering with the interest levels and ultimately the price of money.

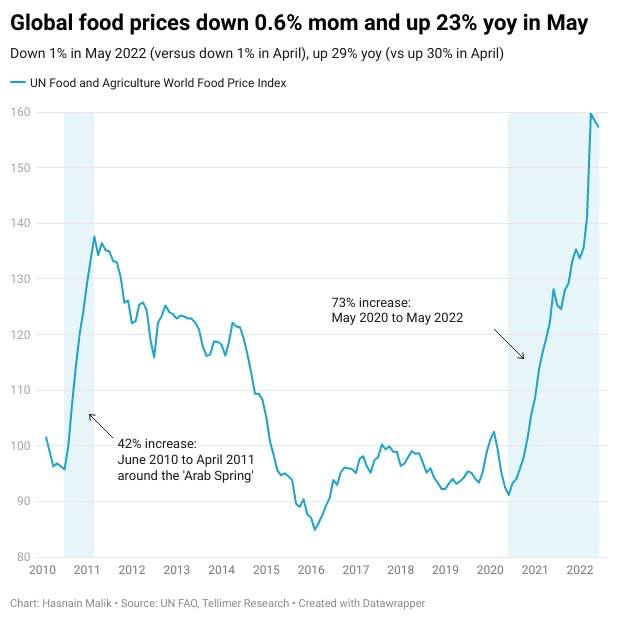

FAO

Graph source FAO

As a reminder food accounts for around 15% of the U.S. consumer price index (CPI) basket, but 50% of the Philippines’ CPI basket.

Their jedi tricks never really worked on us to confide with you and we never bought the “transitory” part of the inflation story they have been trying to sell us. June Eurozone inflation was a record 8.6%, above the consensus expectation of 8.5%; Italy’s came in at 8.5%, beating the consensus expectation of 7.9%. Inflation is a global issue. Pakistan’s inflation accelerated in June to over 21%, more pitchfork risks rising we think. On top of that the surge in the US dollar and real rates aka what we have called Mack The Knife, has a propensity to inflict serious damages to Emerging Markets.

This is what we previously posited in relation to Emerging Markets and Mack The Knife (US Dollar + rising real yields). When it comes to the acceleration of flows out of Emerging Markets and growing pressure on their respective currencies, it is, we think a clear illustration of our “macro theory” of reverse osmosis playing as we have argued in our conversation “Osmotic pressure” back in August 2013:

“The effect of ZIRP has led to a “lower concentration of interest rates levels” in developed markets (negative interest rates). In an attempt to achieve higher yields, hot money rushed into Emerging Markets causing “swelling of returns” as the yield famine led investors seeking higher return, benefiting to that effect the nice high carry trade involved thanks to low bond volatility.” – Macronomics, 24th of August 2013

As a reminder, in our part 2 conversation “Availability heuristic” from September 2015, the liabilities structure of industrial countries is mainly made up of debt (they are “short debt”), in particular in Japan, the US and the UK. In contrast, the international balance sheet structure of emerging markets is typically composed of equity liabilities (“short equity”), which is the counterpart of strong FDI inflows that contributed to improve emerging markets’ external profile in the last decade. With a rising US dollar, what has been playing out is a reverse of these imbalances hence our “macro reverse osmosis”. This is the theory we put forward in terms of basic biology simple analogy at the time of our past musing:

“In a normal “macro” osmosis process, the investors naturally move from an area of low solvency concentration (High Default Perceived Potential), through capital flows, to an area of high solvency concentration (Low Default Perceived Potential). The movement of the investor is driven to reduce the pressure from negative interest rates on returns by pouring capital on high yielding assets courtesy of low rates volatility and putting on significant carry trades, generating osmotic pressure and “positive asset correlations” in the process. Applying an external pressure to reverse the natural flow of capital with US rates moving back into positive real interest rates territory, thus, is reverse “macro” osmosis we think. Positive US real rates therefore lead to a hypertonic surrounding in our “macro” reverse osmosis process, therefore preventing Emerging Markets in stemming capital outflows at the moment.” – Macronomics, August 2013.

What we are seeing in true “biological” fashion is indeed tendency for capital outflows to flow out of an Emerging Market country in order to balance the concentration not of solutes, but in terms of “real interest rates” (US vs rest of the world). Animal cells lack rigid cell walls. When they are exposed to hypertonic environments, water rushes out of the cell, and the cell shrinks. The resulting cells are dehydrated and lose most or all physiological functions while in the shriveled state. If cells are returned to isotonic or hypotonic environments, water reenters the cell and normal functioning may be restored. Cells without cell walls (capital controls) can burst when in a hypertonic condition. Too few solutes (US dollars) and the environment will become the hypertonic solution. There goes our reverse osmosis global macro analogy for you.

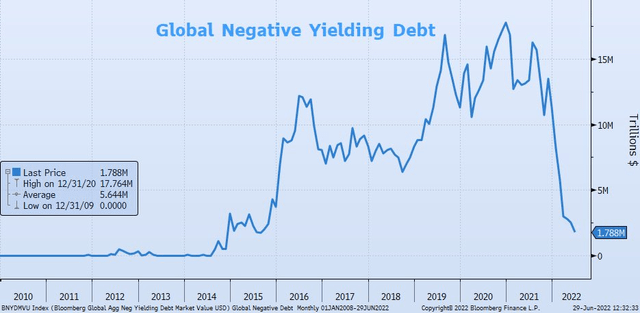

Given that Bondzilla aka the NIRP monster has shrinked at a very rapid pace, no wonder we are seeing the impact of US dollar liabilities in exposed Emerging Markets countries coming to fore:

Bloomberg

Graph source Bloomberg

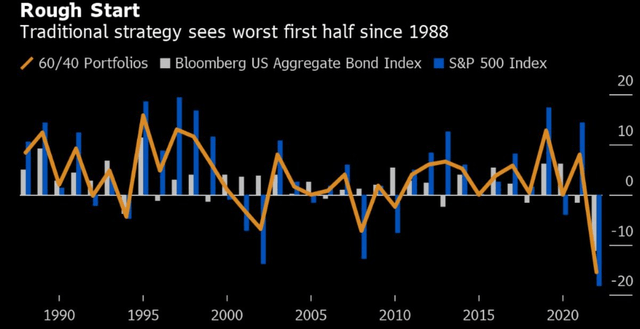

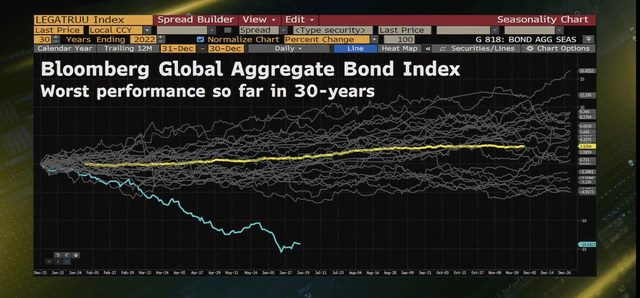

2022 saw the death of Bondzilla the NIRP monster in epic fashion. As well the famous 60/40 portfolios got whacked spectacularly and so did risk parity strategies in the first part of the year:

Bloomberg

Graph source Bloomberg – Twitter

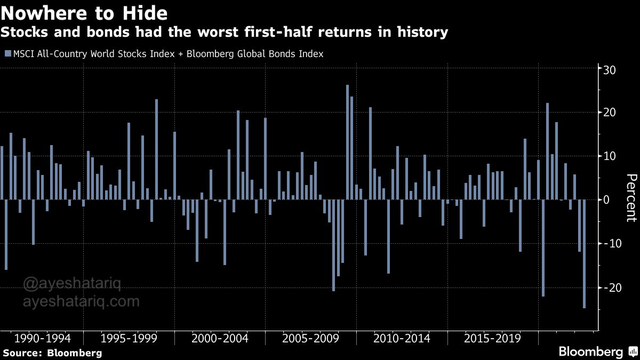

As well, stocks and bonds were under terrible pressure during the whole first part of the year. In fact, the worst on record because thanks to our “Generous Gamblers” both in credit where credit risk and duration were at record high level, zero interest rates favored buybacks on a grand scale:

Bloomberg

Graph source Bloomberg

This leads us to our next bullet point relating to “convexity”.

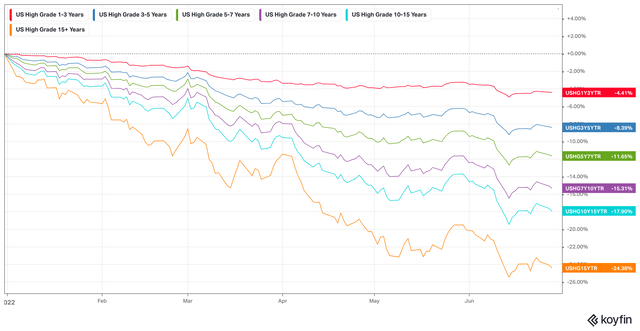

Convexity bites and 2022 has been extremely painful

The return of convexity in 2022 for Investment Grade bond investors (LQD) facing rising yields has been acutely painful as indicated in the below chart from EddTraderMx on his twitter feed:

Bloomberg

Graph Source Bloomberg

This is what we had to say in our conversation “Some like it hot” in February 2018:

“With Global stocks having the longest run of gains since 2003 and with Treasury yields hitting their post-pandemic highs, while Gold is facing somewhat a return of Gibson Paradox, there is no margin for error in US Investment Grade credit land.” – Macronomics, February 2018

2022 has indeed been very painful in the first part of the year as shown in the below KOYFIN charts displaying all maturity buckets for US Investment Grade:

KOYFIN

Graph source KOYFIN – Macronomics

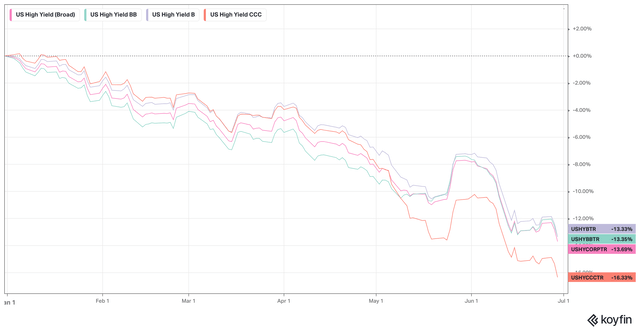

As well our call in February 2021 for US High Yield CCCs to outperform in 2021 thanks to their exposure to the Energy sector.

But, in 2022, we are starting to see things breaking up thanks to the Fed hiking tilt. No longer rising oil prices is providing support to US High Yield CCCs rating bucket:

KOYFIN

Graph source KOYFIN – Macronomics

The severity of the rise in yields is much worse than the 2013 taper tantrum, especially if you go further out the curve, so all in all this has been negative for Gold (Gibson Paradox), US Investment Grade and US Treasuries (TLT, ZROZ).

As well this is what we indicated in our February 2021 conversation:

“No doubt to us that there is a material return of inflation with rising oil prices in conjunction with rising food prices, this could lead to rising “instability” in Emerging Markets à la QE2. We could potentially see an Arab Spring 2.0. There is already some trouble brewing and standoff in Turkey between the government and university students.” – Macronomics, February 2021

As we pointed out as well in 2014, in our conversation “The Molotov Cocktail”, past history has shown, what matters is the velocity of the increase in the oil prices, given that a price appreciation greater than 100% to the “Real Price of Oil” has been a leading indicator for every US recession over the past 40 years.

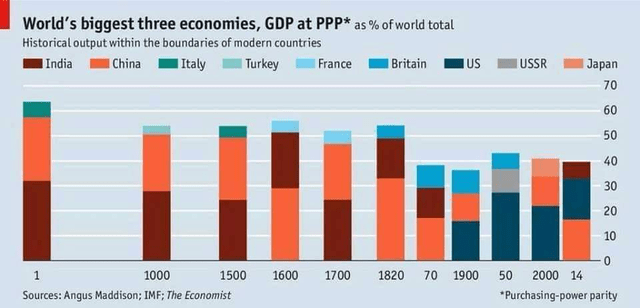

World shifting East: An Angus Maddison moment in the making?

According to British economist Angus Maddison, China had been leading the world economy for over 1000 years since the Tang Dynasty in 713. For 1,700 of the last 2,000 years, India was the biggest economy in the world. China is now slowly regaining the top slot. Given the evolution of the BRICS with other countries willing to join, we are seeing rising new alliances in the process.

THE ECONOMIST

Graph source The Economist – Twitter

Published in 2001 but still relevant today, The Economy – A Millennial Perspective, written by Angus Maddison, provides a comprehensive view of the growth and levels of world population since the year 1000.

According to Angus Maddison’s projection for 2030 (page 340 in his book), you can expect the following:

- Western Europe share of GDP will drop to 13% in 2030 from 19.2% in 2003.

- Asia (including Japan) shares of World GDP will power ahead from 40.5% in 2003 to 53.3% in 2030.

In 1820 Asia’s share was 59.4% with a low point of 18.6% in 1950. Asia will therefore become the largest driving force in world trade. After all Asia accounted for more than half of world output for 18 of the last 20 centuries. You can know understand why the United States is urgently pivoting towards Asia and trying to counter mighty China. In fact China is already leading in many ways such as when we read this article by David Goldman entitled “China’s top computing talent supports military while top US graduates spurn defense industry”:

“Much has been written about China’s numerical advantage in science and engineering. China awarded 1.38 million engineering bachelor’s degrees in 2020. The comparable American number is 197,000 (144,000 in engineering and 54,000 in computer science), or just one-seventh of China’s total.

This is a daunting disparity. But our story has to do with quality rather than quantity, with the creative handful of top graduates who are most likely to innovate.” – source Asia Times

China is simply winning, plain and simple. For more on the subject we recommend books written by Dambisa Moyo on the subject (Winner Take All).

For sure it has been a long time since we posted our musings. We are now going back on track.

As well we are still present but less so on Seeking Alpha. Going forward we will publish more frequently on our dedicated “Substack” page with less frequent free articles, but leaning more towards a subscription basis.

Be the first to comment