Crystal Bolin Photography/iStock via Getty Images

Co-produced with Treading Softly

I’m often on the opposite side of the equation from my peers.

They were focused on being cool, I was focused on my future.

They were career-building, I was wooing my wife and getting married at a young age.

They were selling out of a falling market in fear, I was buying income-producing stocks hand over fist.

The longer I am invested in the market, the more my style has become well-known. It’s also become a target for nay-sayers and disagreement. I accept that and I feel it is highlighting the impact and benefits it has. No one else on Seeking Alpha can boast of being the team leader of the largest and most subscribed-to Service. Why is that? Because I am. Yet another way I am on the opposite side of the equation from my peers. I’m the biggest, while they are not.

I am subscribed to many other marketplaces and services. I love to get alternative perspectives outside of just my own and my team’s. Seeing what others think and weigh as important helps ensure I am not overlooking something or missing an important data point. I’m proud of the hard work of Seeking Alpha’s editors, moderators, and employees who have created such a wonderful place where we all can come together and disagree civilly. It’s rare in our highly polarized world to have such a place, we need to cherish and protect it.

That being said, I am used to being on the opposite side of the equation. While many are selling out of the market, ditching perfectly good dividend-paying securities, and sadly participating in a “buy high, sell low” mentality, all in the name of “preserving capital.” I am recycling my income, which comes in the form of regularly deposited dividends and causing my future income to grow by leaps and bounds.

It is time we changed a major focus from preserving capital to preserving and growing our income. It might just change whether and when you can retire successfully. That’s a discussion for another article, let’s dive into today’s excellent opportunities.

Pick #1: NLY – Yield 21%

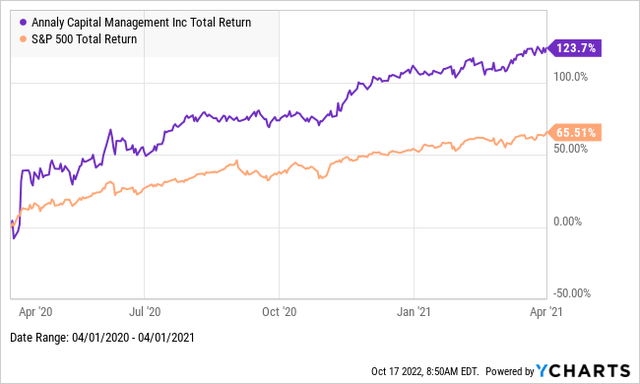

Annaly Capital Management, Inc. (NLY) is now trading at a price similar to where it was on April 1st, 2020. Back then, there was much wailing and gnashing of teeth. NLY was a “terrible pick,” it would “never recover,” it would take “years of dividends” to get back to even, total return is horrible for the past X years, etc. The same things we see anytime a dividend stock is down in price. If you are feeling this way about NLY today, and I know many are, let me ask you this question: On April 1st, 2020, was it a good day to buy or sell NLY?

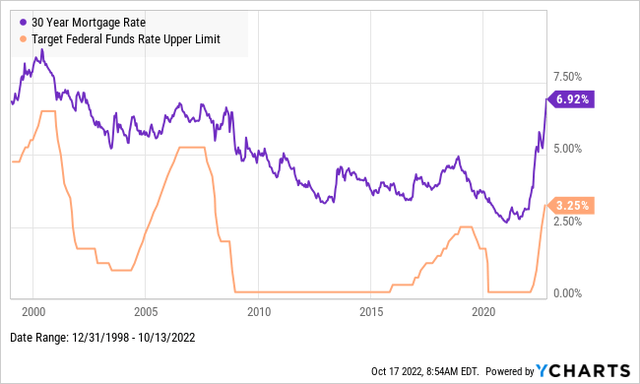

Well, over the next year, NLY recovered in price and paid a few boatloads of dividends to boot. The point is that there is no reason to panic over price changes. Prices go up, they go down, and they bounce around. When we bought NLY back in 2019, our outlook was that we would hold it for at least 5 years. We didn’t expect that NLY’s share price would only go up in a straight line for 5 years – that isn’t how any stock works. During that period, we could expect to see the price move up and down. It’s been a bit more volatile than we might have predicted, and the culprit is easy to identify: mortgages hit 20-year highs. The last time mortgages reached over 7%, the Federal Funds rate was over 6%.

What does this mean for NLY? The vast majority of NLY’s assets are mortgage-backed securities. If mortgage rates are higher, that means that the price of older mortgages is lower. After all, today MBS has coupons of 6%. If you can buy a 6% coupon MBS close to $100 par, would you pay $100 for a 3% coupon? Of course, you wouldn’t. You would require a discount in order to consider buying a 3% coupon. Therefore, as higher-yielding investment options become available, the price of lower-coupon MBS comes down.

Yet from a cash flow perspective, that 3% coupon MBS is still paying the same $3 interest per $100 in principal. Book value goes down, cash flow is no different for NLY, they collect the same interest as last quarter. Just like your portfolio. Your stock prices are lower, but your dividend income is the same or higher if you’ve seen some raises and special dividends declared, the change in share price did not impact your dividend income.

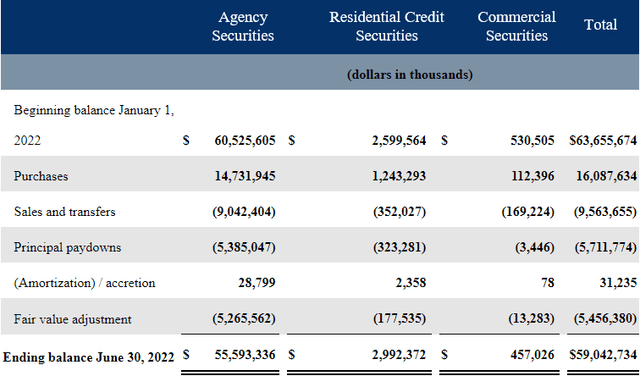

Going one step further, NLY receives principal payments every quarter. In the first half, NLY received nearly $5.4 billion in principal pay downs. These are part voluntary prepayments and partly required, mortgages are “amortizing” loans which means every payment includes principal and interest. NLY will receive a portion of the principal repaid every month. This principal is then reinvested into new MBS. (Source: NLY Q2, 10-Q)

With new MBS now paying a much higher coupon, this reinvested principal will earn a higher yield. A 3% MBS might be valued at $87, but the principal will always be repaid at $100 par and then reinvested closer to a 6% yield. NLY will be nearly doubling its yield on every dollar they are able to reinvest.

The bottom line, their book value might be down, but their income will climb thanks to this tailwind. When you are investing in fixed income, higher yields reduce the value of all lower-yielding investments you hold, but when you reinvest the principal, higher yields mean you will have a higher return on new investments. NLY has been systematically deleveraging and waiting for a buying opportunity. After COVID, NLY was wary of reinvesting into so many unknowns and the Fed quickly crowded the market, blindly bidding up MBS prices to unreasonable levels. Today, NLY can reinvest at cheap prices, and the economy is facing more mundane risks like recession and inflation which we have seen before.

The last time NLY was this cheap, it was a clear buy, this time it isn’t any different.

Pick #2: RNP – Yield 13.6%*

At HDO, we often say, “the market is down, but our income is up”. It could be our tagline for the year. Well, we can say it again. Cohen & Steers REIT & Preferred Income Fund (RNP) is the latest example that share price and income sometimes have very little to do with each other. RNP is trading near 52-week lows, yet the income you receive from it is higher. RNP just announced its largest special dividend since 2007 at $1.0714/share, ex-dividend on December 7th. That is in addition to the $0.136 monthly dividend we are collecting every month. *The current yield of 13.6% includes the special dividend, after which we expect the yield to return to an 8-9% range.

Typically, we expect the announcement of a hefty special dividend to boost the price. For RNP, it hasn’t, it is still trading below its NAV!

RNP invests in real estate investment trusts (“REITs”) and preferred shares. Two sectors that we are very bullish on. The market has turned bearish on REITs, presumably because REITs tend to use a fair amount of leverage so rising interest rates add to one of their largest expenses. However, REITs generally use fixed-rate loans for the bulk of their debt. Only a portion of their debt will mature in a given year and need to be refinanced at higher rates. In time, interest expenses will rise, but it isn’t like the cost goes up overnight.

On the revenue side, REITs are benefiting from inflation, and they are benefiting from it right now. Commercial rents are rising, and that is directly increasing the revenue for REITs.

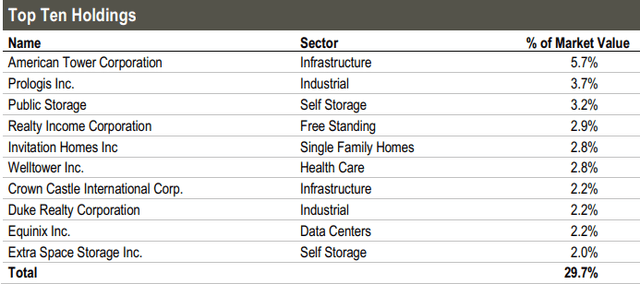

RNP’s top 10 holdings are a “who’s who” of blue chip REITs. (Source: Factsheet).

Without exception, these are REITs with strong balance sheets, fantastic histories, and high-quality management. These are REITs that we can count on to navigate any economic conditions.

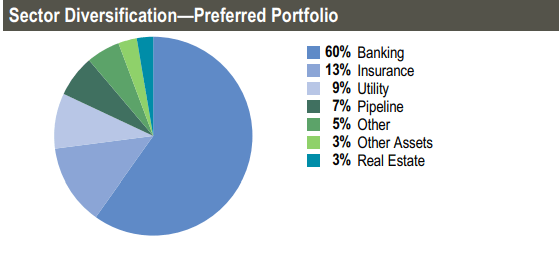

RNP balances this out with exposure to preferred equity, emphasizing banks, insurance companies, and utilities.

Factsheet

These are sectors that we can expect to continue to service their preferred shares even through a recession.

Maybe the market hasn’t noticed the huge special dividend, the discount to NAV, or the high yield on the monthly dividend. The market didn’t notice, but we did, and we’re happy to add a bit more.

Shutterstock

Conclusion

So which side of the equation have you found yourself on recently? The seller or the buyer?

I’ve long been used to being in the minority. The contrarian viewpoint is a well-worn path for me. This path has allowed me and countless others to use the market as a tool for generating large sums of recurring income.

The market doesn’t dominate my life. I am not emotionally tied to every rise and fall. I know some are, I feel bad for them when the market drops, and fear and panic arrive at their door like an unexpected and unwanted visit from a long-lost relative.

Instead, I enjoy the rise and fall like I enjoy watching the waves crash onto the shoreline. I grab a chair, and a hot cup of coffee, and take time to enjoy the simplicity of the ocean that meets the shoreline.

I get income. It comes in recurringly and I reinvest my income to get more and more. Watching it build and build over time. The market is my tool to achieve this. My life is filled with hobbies and interests which grow me as a person and bring enjoyment to my life.

If the market is causing you to panic and sell, I’m probably buying up your selling. If the market is causing you to panic and sell, perhaps it’s time to change how you invest so you, too, can enjoy a cup of coffee from the shoreline along with me.

That sounds like a wonderful morning. That’s the freedom of income investing.

Be the first to comment