imaginima/iStock via Getty Images

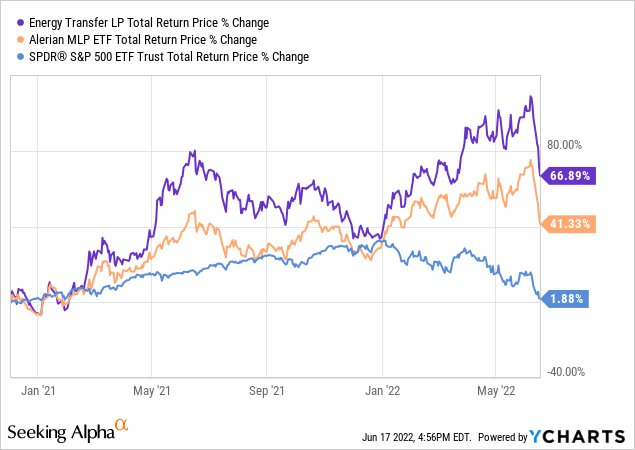

Energy Transfer (NYSE:ET) is one of our highest conviction holdings in our real money Core Portfolio at High Yield Investor and has done very well for us since we first added it back in December 2020:

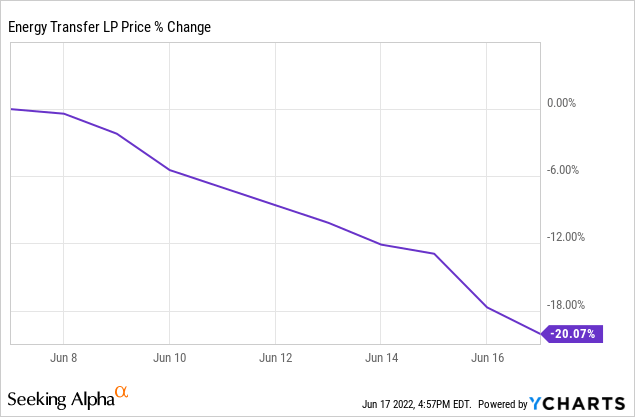

However, in recent days the unit price has taken an absolute beating, losing a fifth of its market value in just 10 days:

While it’s certainly not fun to watch unit price gains evaporate so rapidly, we remain extremely bullish on ET and actually took advantage of the dip to buy more units today for the following reasons:

#1. Unit Price Is Far More Volatile Than Business Fundamentals

ET’s business model – while certainly exposed to energy prices and macroeconomic fundamentals – typically produces cash flows at a far steadier pace than then its unit price volatility indicates. As a result, when the energy sector is booming, ET’s cash flows typically see an uptick, but not nearly to the same degree that oil producers see and when energy prices decline sharply, ET’s cash flows typically remain quite steady. As a result, its distribution payout is generally very predictable and easily coverable with distributable cash flow.

Its unit price soared higher with energy prices, and now – given that energy prices have pulled back in recent days – the unit price is crashing to earth. However, in its most recent investor presentation, ET illustrated that it expects its 2022 adjusted EBITDA to be 90% fee-based, with only 10% of it being commodity price sensitive. As a result, even if energy prices experience further declines moving forward, it is unlikely that its 2022 EBITDA will be impacted by double digits.

For a recent illustration, during the COVID-19 outbreak and Russia-Saudi Arabia energy price war in 2020 which caused energy prices to experience an historic crash, ET still generated very strong cash flow as EBITDA only declined by 6.1% and was still 10.7% higher than it was in 2018. It also rebounded quickly in 2021 with EBITDA soaring by 23.9%, though some of this was due to a one-time benefit from winter storm Uri. Still, 2022 EBITDA numbers are expected to be far higher than even 2019’s, so ET has proven to be both a stable cash flow generator in the worst of macro conditions and a steady grower over time as well.

While short-term unit price gains are always nice, as long-term value investors, we only care about the business fundamentals. It’s only when the unit price meets or exceeds our fair value estimate that we typically decide to take up Mr. Market on his generosity and sell our units, so we’re happy to hold ET indefinitely with little concern about the unit price while we collect rich and growing distributions.

#2. Business Fundamentals Have Arguably Never Been Better

Not only are we not too concerned about the short-term gyrations in the unit price or even in the price of energy, but ET’s business fundamentals have arguably never been better.

Oil prices remain well above $100 as we speak, ET is scoring export contract after contract, and soaring gas prices in the United States mean that there will be significant political pressure on the Biden administration to not meddle further with the Dakota Access Pipeline.

Even better, ET has made significant progress toward deleveraging its balance sheet, reducing debt by ~$6.6 billion over the past five quarters and maintaining paying down debt as its top priority. In fact, on a recent earnings call, ET said that it doesn’t plan to refinance its upcoming debt maturities unless it is opportunistic to do so. Instead, it plans to pay them down, reflecting how strong its cash flow is.

On top of that, ET has numerous projects coming online in the near future which should further help its cash flow profile, combining with declining interest expense and inflation-linked escalators on its pipeline contracts to increase distributable cash flow per unit.

All of this combines with its hefty $2.41 in expected distributable cash flow per unit for 2022 that makes its goal of restoring the distribution to its pre-COVID-19 $1.22 annualized level very achievable. As a result, investors have 52.5% in distribution growth to look forward to in the coming quarters as on its latest earnings call, management stated:

On April 26, we were pleased to announce a quarterly cash distribution of $0.20 per common unit or $0.80 on an annualized basis, which represents a more than 30% increase over the first quarter of 2021. As a reminder, future increases to the distribution level will be evaluated quarterly with the ultimate goal of returning distributions to the previous level of $30.5 per quarter or $1.22 on an annual basis, while balancing our leverage target, growth opportunities and unit buybacks.

#3. The Units Are Compellingly Cheap

With robust business fundamentals, a rapidly strengthening investment grade balance sheet, and a very stable cash flow profile that should be fairly defensive in the face of a recession, ET’s unit price looks extremely cheap here. At a $9.83 unit price at the moment, ET’s current distribution yield is 8.1% and would be 12.4% at their target of $1.22. Meanwhile, the distributable cash flow yield is a whopping ~25% right now. Given the expectations of further growth for the business and the increasingly solid balance sheet, this is an extremely compelling bargain.

It looks even cheaper when compared to peers and its own history. In addition to being one of the very cheapest investment grade midstream businesses on a P/DCF and EV/EBITDA basis, it trades at a mere 7.73x EV/EBITDA multiple right now, well below its five-year average of 9.23x.

Investor Takeaway

The ET unit price is plunging at the moment as investors are worried about demand destruction during a potential recession. While this is a very possible scenario, the reality is that ET only saw its EBITDA decline by 6.1% in the worst possible macro environment in 2020. Furthermore, its balance sheet is in far better shape today and the price of energy is very high right now. Inflation also is providing a tailwind for cash flow thanks to inflation linked escalators on ET’s pipeline contracts.

As a result, we’re very bullish on ET and are happy to take Mr. Market up on his recent discounted offering of ET units. We’re excited about the 12.4% yield on cost that we expect to be reaping within a few years and believe ET will help our Core Portfolio continue its run of massive outperformance over the long term.

Be the first to comment