gguy44/iStock via Getty Images

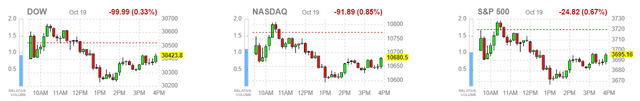

Despite blowout earnings reports from Netflix and United Airlines before the open, as well as several other top and bottom line beats from companies across a broad array of sectors, the major market averages struggled yesterday in the face of higher interest rates. The 10-year Treasury yield rose to a new high of 4.14%, while the 2-year yield hit 4.55%. Earnings are giving investors good reason to be optimistic, but interest rates need to stabilize before the broad market can start to recover on a sustained basis. Things may change for the better on November 8 if history has anything to say about it.

Finviz

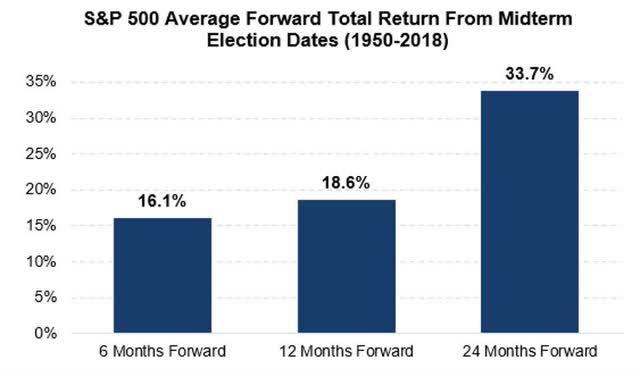

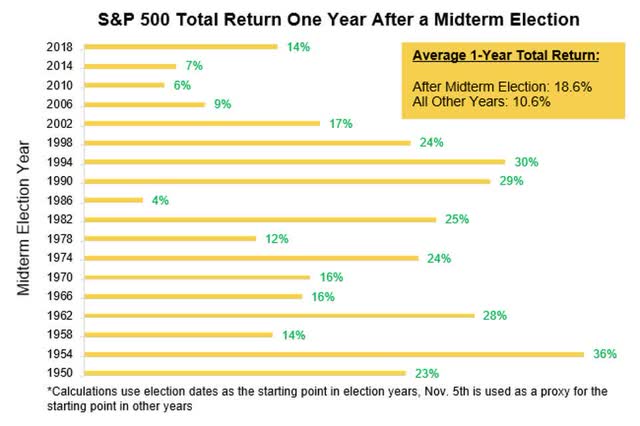

I have been discussing the importance of the midterm elections to the stock market for weeks now, but it is finally starting to catch on with the main stream. I think it will be a critical factor in improving sentiment, as investors don’t want to miss out on the outsized gains that have historically followed the elections dating back to 1950. This is probably the reason why one of the biggest bears on Wall Street is hedging his bets with a bullish short-term modification to his otherwise gloomy market outlook.

Forbes

Morgan Stanley’s Mike Wilson pivoted this week to say that the S&P 500 could rally 16% from last Friday’s close to 4,150 in what he would call a technical recovery after the index held its 200-week moving average. He then sees a resumption of the decline to levels as low as 3,000-3,200. It is an odd coincidence that the S&P 500 has rallied an average of 16% during the six months that follow the midterms. Of course, a lot could change between now and a 16% rally in the S&P 500, which opens the door for bears to become less bearish, if not bullish.

As for this historical precedent, it is not just the outsized gains that followed the midterms over the past 70 years that is impressive, but the fact that gains have been produced 100% of the time. It is rare to see such a certain statistic in financial markets.

Forbes

Will this time be different? I seriously doubt it, as the timing lends itself perfectly to my outlook for a peak Fed funds rate before year end. Early indications of such would be a decline in 2-year Treasury yields that foreshadows a pivot in policy by the Fed from extremely hawkish to a more neutral stance. We are certainly not there yet with 2-year yields hitting fresh highs yesterday, but the S&P 500 is holding well above its 52-week low as yields climb, which is encouraging. Regardless, this historical precedent is a monster tailwind for the stock market over the next six, 12 and 24 months that should not be ignored.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment