Marina113/iStock Editorial via Getty Images

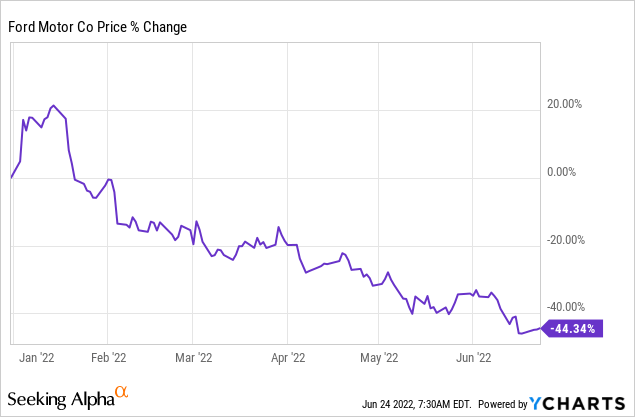

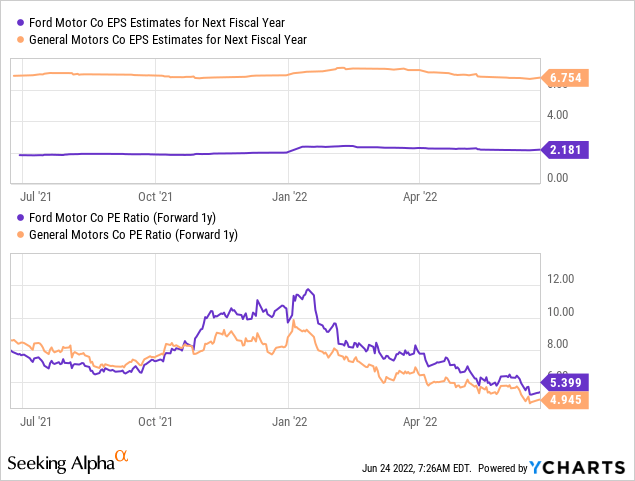

The market is misjudging Ford Motor Company (NYSE:F)’s prospects in the electric vehicle market. Shares of Ford have now declined 55% from their 1-year high, leaving many investors wondering if Ford is still worth buying. Since Ford’s electric vehicle sales are surging and the car brand trades at a P/E ratio of only 5.4x, I believe the automaker is a very attractive investment going forward. Additionally, the decline in Ford’s share price has resulted in a 3.5% dividend yield.

Ford’s electric vehicle sales are through the roof

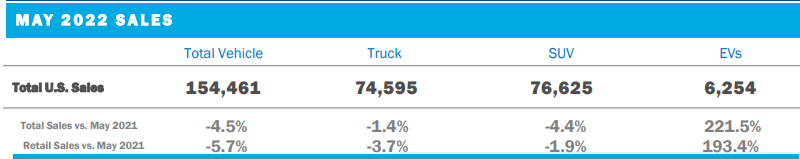

Ford is executing well against its electric vehicle growth targets. The car brand sold 6,254 electric vehicles in May, showing 221.5% growth compared to the year-earlier period. According to Ford, sales in Ford’s electric vehicle category grew four times faster than the U.S. electric vehicle industry in May. Sales performance was chiefly driven by strong demand for the Mustang Mach-E sport utility vehicle, which achieved a new monthly sales record in May with 5,179 models sold. Year over year, Mustang Mach-E sales increased a massive 166.3%. Electric vehicles had a 4% sales share in May, but as Ford ramps up production of its various EV models (F-150 Lightning, Maverick, E-Transit and Mach-E), investors can look forward to a significant increase in both total sales as well as a growing EV sales share. I believe Ford could achieve a 15% EV share (as part of total unit sales) by the end of FY 2023.

Ford

Ford is going to see a massive ramp in electric vehicle production in the next two years

Ford is investing billions of dollars into its electrification plans, which are set to result in a massive expansion of Ford’s EV manufacturing capacity going forward. Ford is looking to grow F-150 Lightning production capacity to 150 thousand units annually by FY 2023. Ford has guided for a total production capacity of 600 thousand EVs by the end of next year. By FY 2026, Ford is expected to produce 2M electric vehicles annually.

Safety recall weighing on Ford’s short-term prospects

In June, Ford had to announce the recall of 3.3M vehicles in the United States and Canada because of a damaged or missing shift cable, meaning the vehicle may not shift into the gear chosen by the driver. Ford also instructed its dealers to stop selling the Mach-E SUV and also recalled about 49 thousand Mach-E models for a safety defect that could result in the vehicle losing power. The recall announcements may have contributed to Ford stock’s latest down leg and will likely result in Ford reporting a significantly lower number of Mach-E SUV sales in June.

Ford’s biggest selling points right now: yield and P/E ratio

Ford pays a $0.10 per-share dividend every three months, or a $0.40 per-share dividend annually. At current prices, this means investors can get a 3.5% dividend yield that is relatively safe. On top of that, Ford’s prospects in the electric vehicle industry are likely to be highly underpriced right now, considering that Ford has a P/E ratio of only 5.4 X. Other legacy car brands are also cheap, indicating that the market may not only be wrong regarding Ford but regarding the entire industry’s potential for growth.

Risks with Ford

Ford is committed to ramping up its electric vehicle production, but supply chain dislocations could become a serious problem for the car brand this year while higher raw material costs also potentially pose a challenge. Ford has said that it expects $4B of commodity headwinds this year. If inflation gets worse, there is a risk that Ford will have to refresh its free cash flow and margin guidance for FY 2022. So far, Ford sees $5.5-6.5B in free cash flow in FY 2022. Higher raw material costs would affect Ford’s margins and guidance and could be used as a justification for another down leg.

Final thoughts

The market is wrong about Ford. It prices the car brand’s prospects at a 5.4 X P/E ratio, although Ford’s EV sales, especially Mustang Mach-E sales, are surging and the company is growing faster than the industry as a whole.

Shares of Ford are down 55% since reaching a high of $25.87 in January, but this drop creates a buying opportunity for investors that believe in Ford’s longer-term electric vehicle transformation and growing strength of its EV lineup. Unfortunately, safety recalls and uncertainty about higher raw material costs have weighed on Ford’s valuation lately. Safety recalls are only a short-term issue, and the car brand is executing very well against its long-term electric vehicle production goals.

Be the first to comment