martin-dm

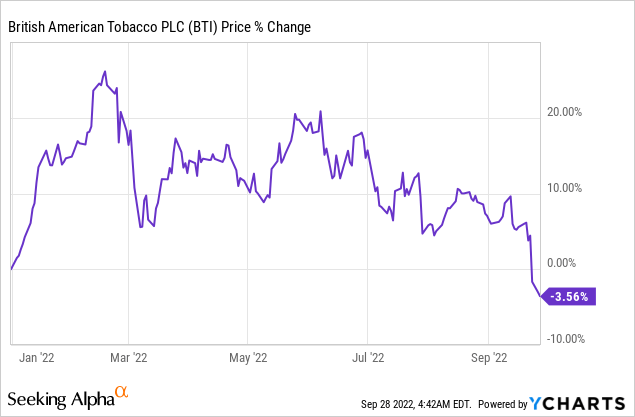

Shares of British American Tobacco p.l.c. (NYSE:BTI) have skidded dramatically lately as the market is seeing yet another down-leg. I believe that the drawdown creates an opportunity to buy British American Tobacco for the long term, as the company continues to make progress growing its alternative tobacco product categories and the dividend yield has become too cheap to ignore. While cigarette companies face significant commercial and regulatory risks, I believe that British American Tobacco has such a low valuation now that the risk profile is skewed upwards anyways!

Market sell-off creates another opportunity

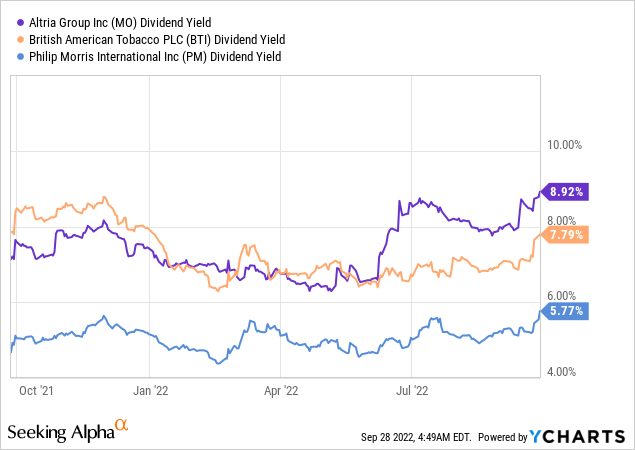

If you are looking for a stable 7.8% dividend yield, this may be the opportunity you have been waiting for. On Friday, shares of British American Tobacco dropped to their lowest price in 2022 due to growing concerns over the condition of the U.S. economy. While shares may trend even lower in the short term, especially if inflation numbers were to get even worse, I believe the current drop already makes the cigarette firm competitive as a yield play.

Since the February 2022 top, shares of BTI have lost about 24% of their value.

Growth in alternative product categories

Companies like British American Tobacco or Altria (MO) have emerged as strong income plays in recent years, since they offer investors high yields but also promise some dividend growth. Although the tobacco sector faces numerous challenges such as restrictions on advertising, the potential banning of certain tobacco products (such as e-cigarettes or menthol cigarettes), and a long-term decline in the market of smokers, there are reasons to buy a company like British American Tobacco if the price is low enough.

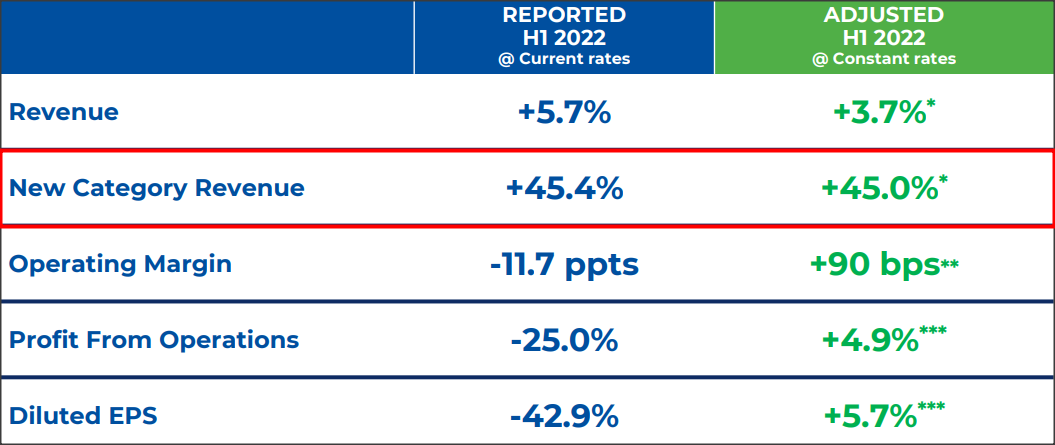

For British American Tobacco, the reason to buy the stock is that the cigarette firm is aggressively growing its non-traditional tobacco categories such as vaping and heated tobacco products. Oral nicotine pouches, which British American Tobacco markets under the Velo brand, are also seeing strong customer adoption and volume growth. British American Tobacco’s revenue growth in new product categories was twelve times faster — on an adjusted level — in the first six months of FY 2022 than British American Tobacco’s total revenue growth.

British American Tobacco

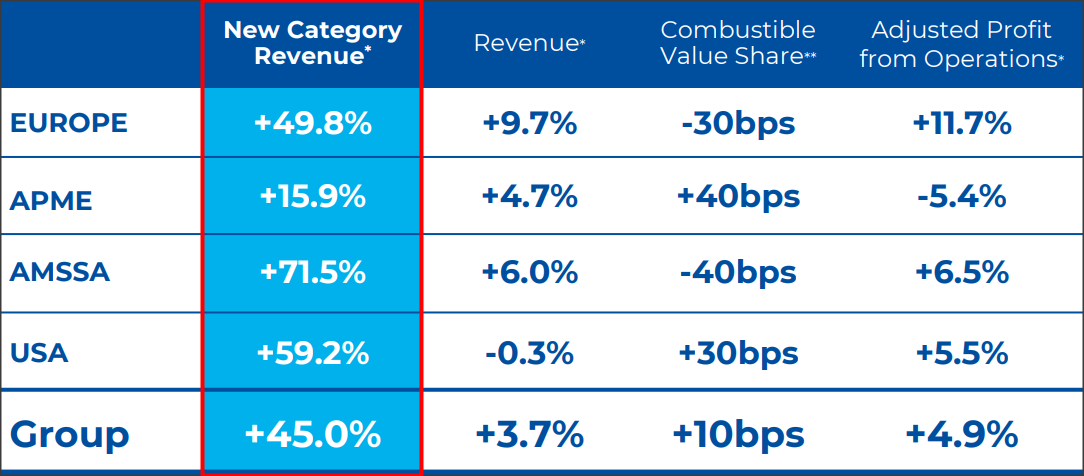

Momentum in new product categories is not limited to Europe and the U.S. Consumers shifting to non-combustible tobacco products is a world-wide phenomenon, and products like vape, pouches and heated tobacco are out-performing for British American Tobacco in every geographic region.

British American Tobacco

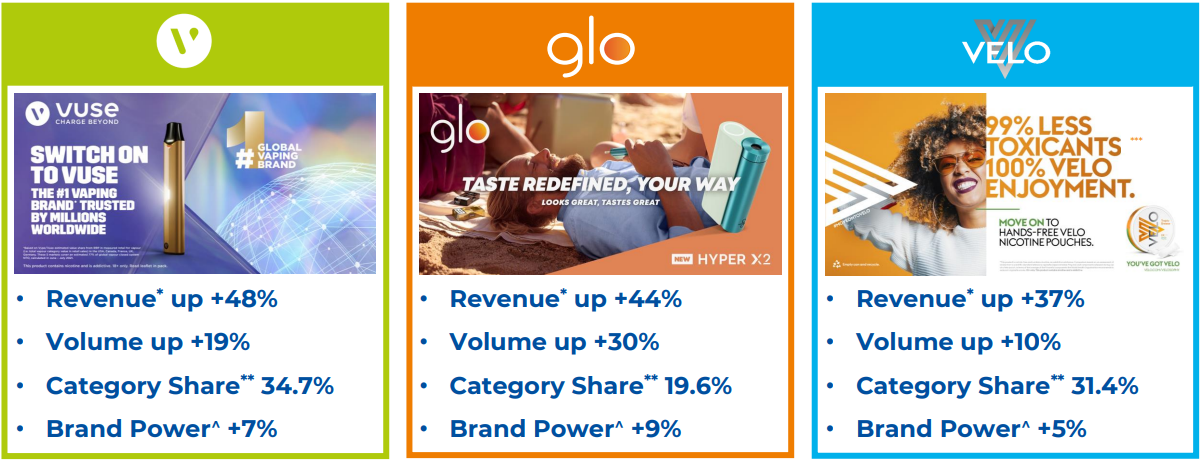

In the new categories that British American Tobacco is heavily promoting, the vape brand Vuse continues to have the biggest momentum. Vuse revenues soared 48% year-over-year in the first six months of FY 2022, driven chiefly by volume gains. British American Tobacco’s heated tobacco products, marketed under the brand glo, have seen revenue growth of 44% year-over-year, while Velo’s nicotine pouches increased revenues by 37%. All brands have seen double-digit revenue growth.

British American Tobacco

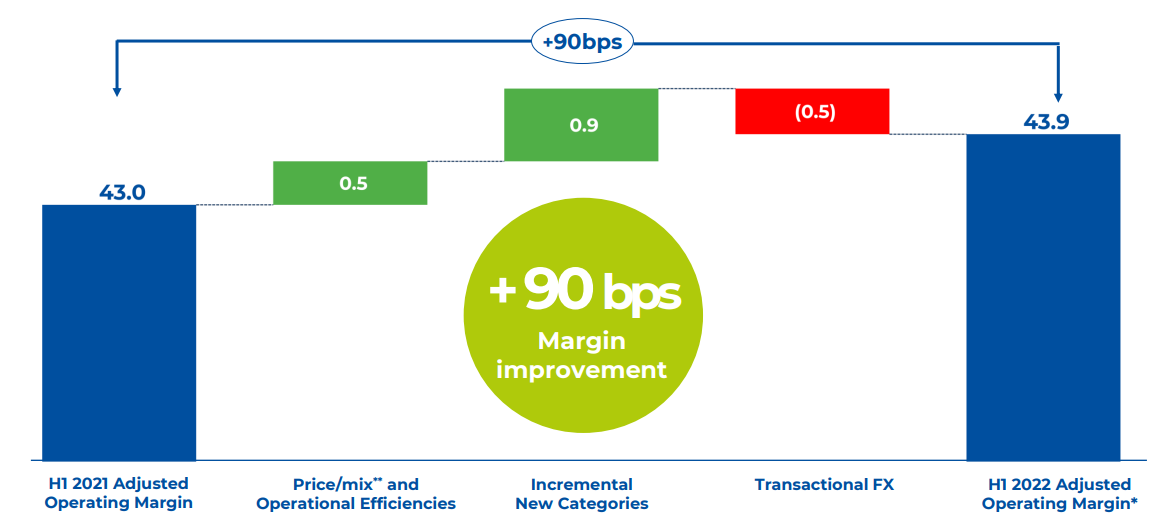

New products drive margin expansion

British American Tobacco’s investments in alternative product categories are key to margin expansion. In the first half of FY 2022, products like Vuse, glo and Velo have driven a 0.9 PP increase in the company’s adjusted gross margin.

British American Tobacco: Q2’22 Operating Margin

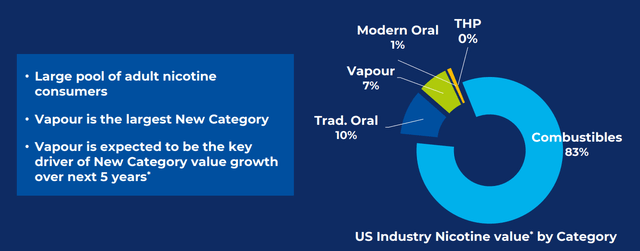

Vape opportunity and revenue target

British American Tobacco has a strong opportunity to grow penetration of the U.S. market with its vape products that are selling under the Vuse brand and which are competing with JUUL Labs’ products. The U.S. is a large market where combustibles (cigarettes/cigarillos) have an 83% market share, whereas vape products only account for a 7% market share.

British American Tobacco: Vape Market Opportunity

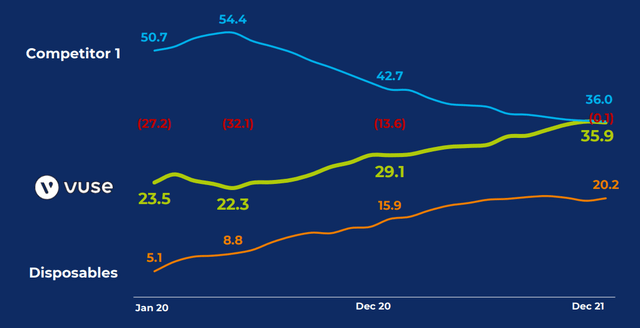

British American Tobacco’s Vuse brand is very promising not only because of the low penetration rate in the U.S. market but also because it achieved profitability in the first half of FY 2021. The tobacco company expects to grow its new categories to £5.0B in revenues by FY 2025, and I believe that the Vuse brand will play a crucial role to meet this top line target. In FY 2021, British American Tobacco achieved £2.1B in alternative product revenue, which means the revenue target implies 25% annual revenue growth. The popularity of the Vuse brand — and related market share gains — are why I believe BTI could easily achieve this goal.

British American Tobacco: Vuse Market Share

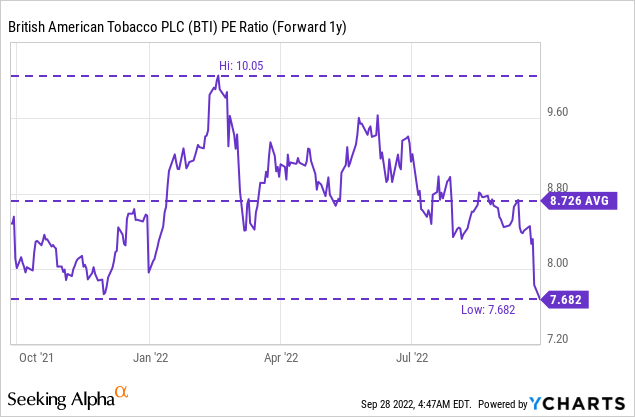

Valuation of British American Tobacco

BTI has a cheap valuation and this is largely because of the steep drop in pricing that shares have seen recently. Currently, BTI is trading at a P/E ratio of 7.7 X based off of EPS expectations of $4.70 in FY 2023. Shares are also trading below the 1-year average EPS ratio of 8.7 X.

Due to the drop in pricing, shares of BTI are currently trading at a 7.8% dividend yield, which exceeds the yield of Philip Morris International (PM).

Risks with British American Tobacco

I already have listed some of the risks that affect British American Tobacco, including advertising restrictions, the potential ban of vape products, and higher taxes that make the purchase of tobacco and non-traditional tobacco products more expensive. Inflation is also a risk factor for tobacco companies in general because it financially stresses consumers and may lead to fewer cigarette trips and reduced spending on tobacco products. What would change my mind about British American Tobacco is if the company saw a material slowdown in its non-traditional tobacco business or if vape products would be completely banned in the U.S.

Final thoughts

The market is wrong in pricing British American Tobacco at a P/E ratio of 7.7x, since the business has not weakened in recent weeks. A low valuation based off of P/E, strong growth in alternative product categories, and ambitious revenue targets indicate that the market has become too bearish on the cigarette company. I believe the most recent drop in pricing is mostly unjustified given British American Tobacco’s strong execution in the alternative product category and the potential of the Vuse brand. For those reasons, I believe investors may want to buy the drop since shares have a very attractive risk profile!

Be the first to comment