Mario Tama

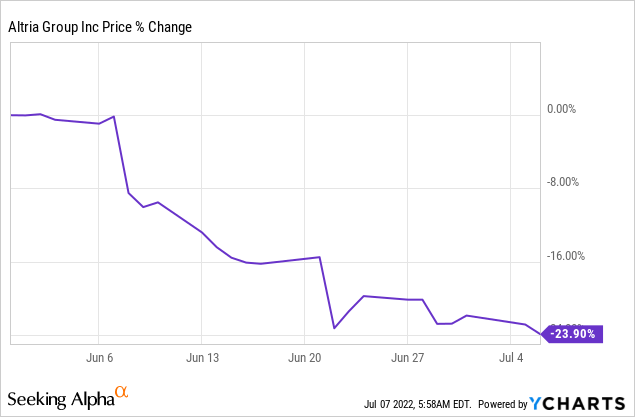

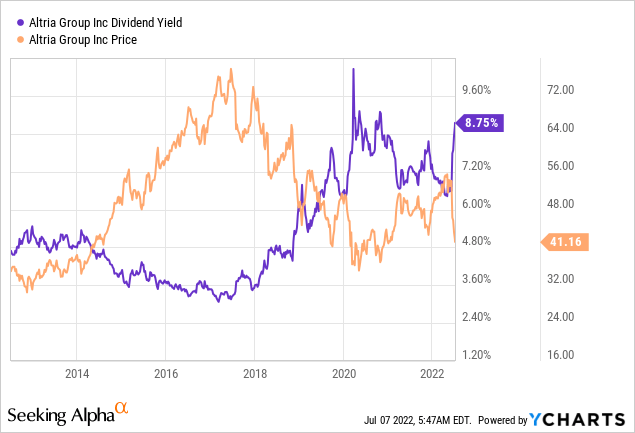

In June, the U.S. Food and Drug Administration (FDA) issued a ban on e-cigarettes sold by Juul Labs, which is partially owned by Altria Group, Inc. (NYSE:MO). Because of expectations of additional declines in the value of Juul Labs, shares of Altria went through a 24% decrease in pricing since the end of May. The firm’s yield has soared to 8.8% and is extremely attractive right now. Investors don’t want to miss out on this opportunity and take advantage of this exaggerated decline in pricing!

The FDA banned Juul Labs from selling its e-cigarettes in the U.S.

The U.S. Food And Drug Administration banned Juul Labs from selling and distributing its Juul device and four types of JUULpods in June, thereby creating valuation pressure on Altria, which has a 35% ownership interest in Juul Labs.

The FDA’s ban on the sale of e-cigarettes has weighed on Altria’s shares ever since, especially because the cigarette company has repeatedly written down the value of its investment in Juul Labs, stoking fears that another round of valuation adjustments awaits Altria.

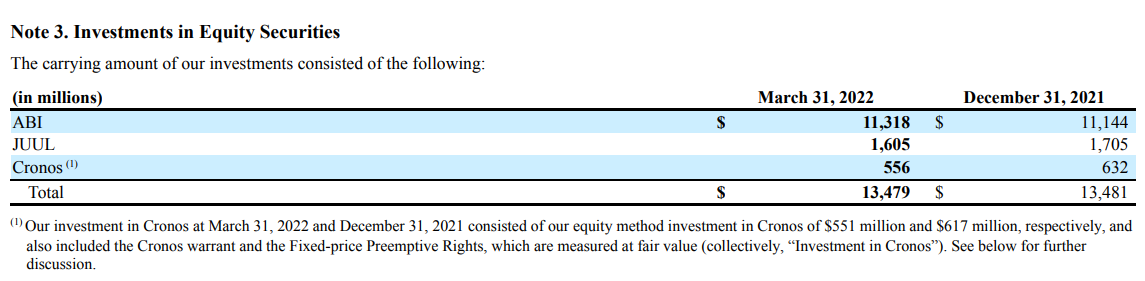

The cigarette company acquired a 35% ownership interest in Juul Labs in 2018, paying $12.8B for its investment that was meant to accelerate the firm’s strategic shift to non-traditional tobacco categories. In March, Altria’s disclosures showed that the 35% stake in the company was only valued at $1.6B at quarter-end, down from $1.7B at the end of last year. Since acquiring its ownership position in Juul Labs in 2018, Altria has written down the value of its equity investment in the company by 87.5%.

Altria

An FDA ban of Juul Labs’ e-cigarettes would obviously have devastating consequences for Altria as well as other companies that sell similar vape products. Companies like Altria have doubled down on strategic investments in non-traditional tobacco categories in part to stem the decade-long decline in the share of smokers in the U.S. and diversify their businesses.

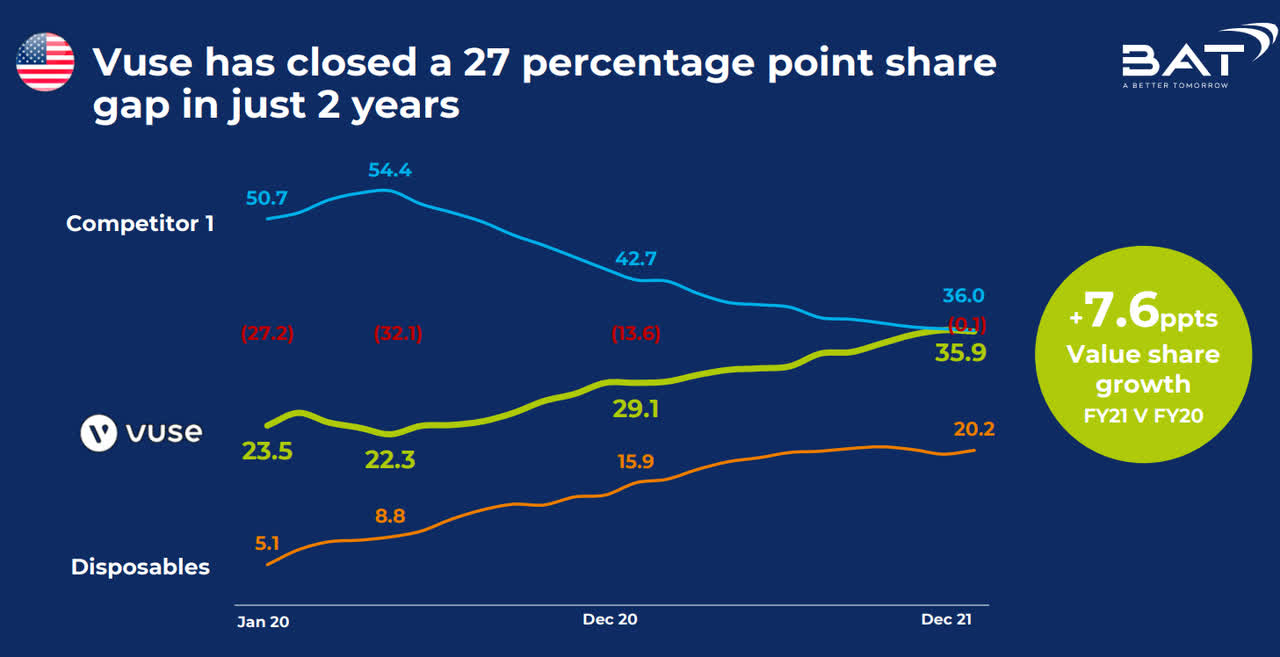

Juul Labs quickly became a dominating force in the e-cigarette market, largely because of its popularity with younger smokers, and gained a market share of more than 70% in 2018. Since then, however, other players have moved into the space and especially British American Tobacco (BTI) has made inroads in the segment with its highly successful Vuse vape brand.

Vuse is the most formidable rival for Juul Labs, and British American Tobacco has achieved serious market share gains, at the expense of Juul Labs, in recent years.

British American Tobacco

FDA stays its ban

A federal court recently blocked the FDA ban from being enforced while Juul Labs appeals the decision. The Food And Drug Administration just suspended its order to ban Juul’s e-cigarettes, which effectively means that Juul Labs can keep selling its products while appealing the FDA decision in the court system.

Altria’s current yield is above historical norms

Shares of Altria trade at an irresistible 8.8% yield due to fears that the company will have to further write down the value of its equity investment in Juul Labs and potentially lose its ability to sell e-cigarettes in the U.S. market. I believe an ultimate ban will not happen, in part because the FDA still allows the sale of traditional tobacco products. Altria’s yield right now is significantly above the historical range. Moving outside of this range implies that Altria’s shares have become too cheap.

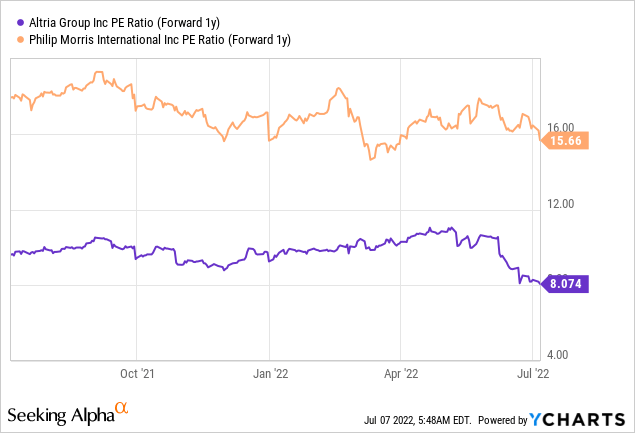

Very cheap P/E ratio

At the current price-to-earnings ratio, I believe Altria represents deep value. The firm’s shares trade at 8.1 X FY 2023 earnings, which is about half of Philip Morris International’s (PM) price-to-earnings ratio. I believe Altria represents enormous value here, both regarding yield and valuation.

Risks with Altria

Short term risks include continual weakness in Altria’s shares. A longer term challenge for Altria will be to fight the FDA’s e-cigarette ban to ensure that it can keep selling its products to U.S. consumers. Besides this challenge, tobacco companies including Altria are faced with growing regulation and restrictions on advertising which could further limit the industry’s potential for top line growth going forward. The long term trend indicates a continual decline in traditional cigarette smokers which requires Altria to strategically prioritize alternative product categories, like e-cigarettes. A complete ban of Juul’s e-cigarettes in the U.S., as unlikely as it is, would likely affect Altria’s valuation in a very negative way.

Final thoughts

I believe the market is wrong about Altria and the stock price has declined too much lately as fear over the e-cigarette ban spread. This weakness, however, creates an opportunity to engage as the tobacco firm has already secured a small court victory and will fight tooth and nail against the initial FDA decision. Considering that traditional tobacco and other vape products are still freely available in the market, a complete ban on e-cigarettes seems unlikely!

Be the first to comment