Adam Gault

It’s been a tough year for the stock market, but it’s likely going to get tougher. In this article, we’ll point to historical data to explain why the market is likely to continue falling. Using macroeconomic factors, we will estimate the potential drop in the S&P 500 (SPY), Microsoft (NASDAQ:MSFT), and Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL). In addition, we will highlight why Alphabet likely has more downside despite having a lower valuation multiple than Microsoft.

Federal Reserve Rate Hikes Will Lead to a Recession

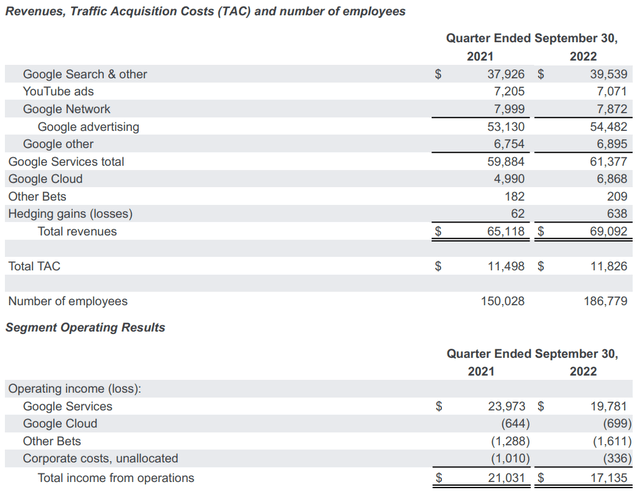

Previously, we argued that a recession is unlikely to happen unless we get a yield curve inversion between the 10-Year and 3-Month Treasury yields. This is because the 3-month yield inversion has never been wrong, at least not yet. Indeed, below is a picture of the inversion’s track record:

A likely explanation for this is that the 3-month yield closely follows the Federal Funds Rate, which is the interest rate that banks charge each other to borrow or lend excess reserves overnight. For the 3-month yield to climb higher than the 10-year yield, it means the Federal Reserve has raised the Federal Funds rate above the 10-year yield.

Since the 10-year yield is often used as a proxy for long-term growth expectations, an even higher Federal Funds rate means that the cost of borrowing is higher than the expected growth rate. In our view, this would suggest that the Federal Reserve has tightened too much, thus, eventually leading to a recession.

As a result of the central bank’s rate hikes year-to-date, the yield first inverted on October 25th, and has since fallen deeper into negative territory.

Therefore, the countdown has already started, and it would be wise for investors to begin looking at what the potential impact on earnings will be.

How Will Earnings Be Impacted During a Recession?

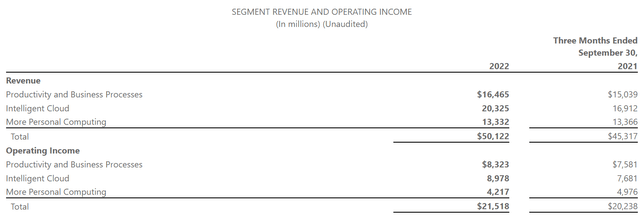

According to history, we can expect (on average) to see earnings decline by 29.5% from peak to trough.

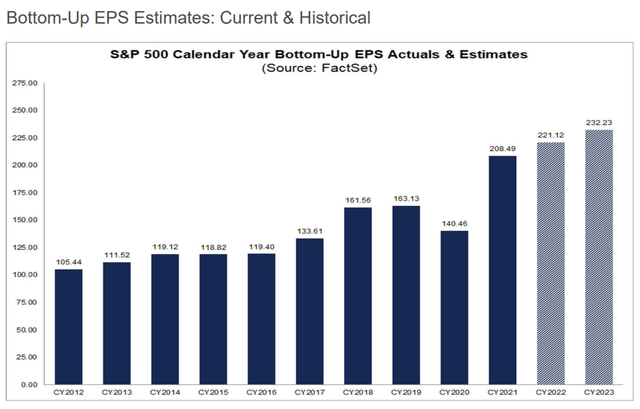

At writing, the market is expecting S&P 500 earnings per share to increase in 2023 to $232.23, meaning that investors aren’t actually pricing in an earnings recession yet.

If we assume that the $221.12 EPS estimate for 2022 will be the peak in earnings, then a 29.5% drop from there will equate to an EPS of $155.89. If we assign the average 10-year trailing P/E ratio of 20.4x, the price of the S&P 500 will fall to approximately $3,180. The reason why we chose 2022 as the peak is that analysts are expecting a year-over-year decline for Q4. Thus, it’s likely that earnings will continue to be negatively impacted in early 2023 as well as the Fed’s restrictive policy begins to take effect.

A more optimistic scenario could be derived from looking at the declines from the 1970s and 1980s. Given that we are facing an inflation problem, it makes sense to look to another time period where inflation was the main culprit behind economic volatility. The average earnings decline during those 4 recessions was 12.85%. In this scenario, EPS will fall to $192.71. When applying the same 20.4x valuation multiple, the price of the S&P 500 comes out to approximately $3,931.

However, will valuation multiples contract? And how can we estimate a reasonable valuation multiple based on the current market conditions? To answer these questions, we will look at the current P/E ratio, the 3-Month Treasury yield (the risk-free rate), and the Fed Funds futures.

According to FactSet, the current P/E ratio is 19.2x on a trailing basis or an earnings yield of roughly 5.21%. With the 3-Month yield at 4.25%, this implies that investors require an approximate 1% in earnings yield over the risk-free rate.

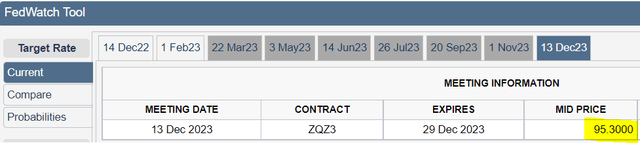

In addition, the Fed Funds rate is currently 3.83%, meaning that investors require an approximate 0.4% premium over the fed funds rate. A look at the futures market shows that investors are expecting the Fed Funds rate to be 4.7% by December 2023 (calculated as 100 – 95.3 = 4.7).

When adding the approximate total required premium that S&P 500 investors require, we arrive at an earnings yield of 6.1% or a P/E ratio of 16.4x. When applying this multiple to the scenarios above, we get a high of $3,160 and a low of $2,556.

Here’s Why Microsoft Will Outperform Alphabet in a Recession

For investors who are considering Microsoft and Alphabet, it’s worth noting that Microsoft is more likely to outperform at this time. From a macroeconomic perspective, both stocks will fall with the overall market if we see an earnings recession. However, Microsoft will fall less because it has a lower downside beta.

Unlike the traditional beta measure, which combines both upside and downside volatility, downside beta focuses exclusively on how a stock moves when the overall market falls. For our calculations, we chose a 2-year lookback period because it captures both a strong bull market and the current bear market.

When using daily price moves from the past 2 years, we calculated downside betas for Alphabet and Microsoft of 1.24 and 1.22, respectively. These numbers make sense since both stocks have fallen more than the S&P 500 year-to-date while Alphabet has dropped more than Microsoft.

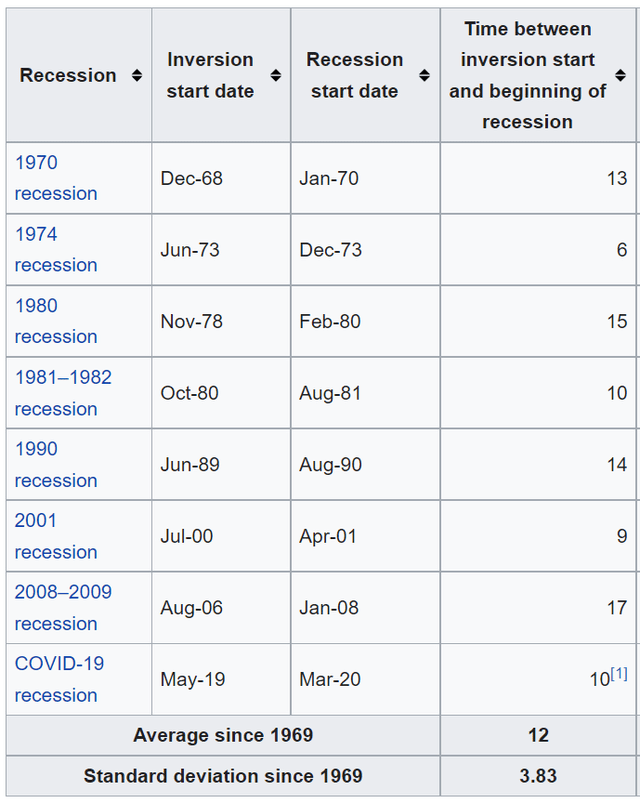

However, moving beyond the statistical argument for Microsoft’s relative outperformance, there are fundamental reasons as well. To begin with, Alphabet’s main source of revenue comes from advertisements. Although it does have other revenue streams such as Google Cloud, that segment isn’t profitable yet. Indeed, Alphabet posted an operating loss of $699 million on $6,868 million of revenue in its cloud business during its most recent quarter.

Alphabet’s Q3 2022 Earnings Release

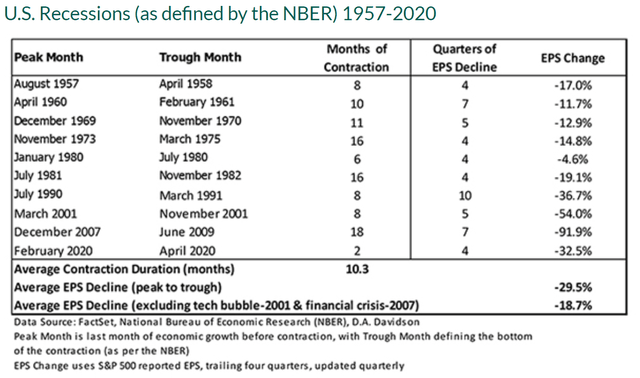

Since advertising is negatively impacted during recessions as companies try to cut costs, Alphabet’s earnings will also be affected. Alternatively, Microsoft has more diversified revenue streams. In fact, Microsoft’s biggest contributor to both revenue and earnings is its Intelligent Cloud segment, which also happens to be its fastest-growing segment. That, along with its Productivity and Business Processes segment, is more critical to businesses during a recession than advertisements.

Businesses still need Microsoft’s office products and its Azure platform to simply function. In addition, its Intelligent Cloud segment is very profitable compared to that of Alphabet.

Microsoft’s Q1 2023 Earnings Release

As a result, it seems likely that Microsoft will see less of an impact on earnings than Alphabet will.

Takeaway: Recession Is Likely, but Microsoft Appears Better Equipped for It

Both stocks are likely to produce great shareholder returns in the long run, and for investors who don’t care about downside volatility, dollar-cost averaging is probably a better idea. Nonetheless, investors who fall into this category should be aware that Microsoft has more upside potential than Alphabet. Alternatively, investors who would rather remain patient have good reason to do so, as historical data indicates that the bear market isn’t over yet.

Be the first to comment