uschools/E+ via Getty Images

The Korea Fund

The Korea Fund (NYSE:KF) is a closed-end fund that invests directly in Korean equities. This is one of my favorite ways to gain exposure to South Korea, as it invests in some of the same companies as large ETFs. Korean equities are also trading at a very deep discount to global and emerging markets, despite the favorable characteristics of the stock market and economy. I plan to primarily use this fund to invest in Korea and will also slowly accumulate some of my other favorite value stocks (ADRs) trading in this market.

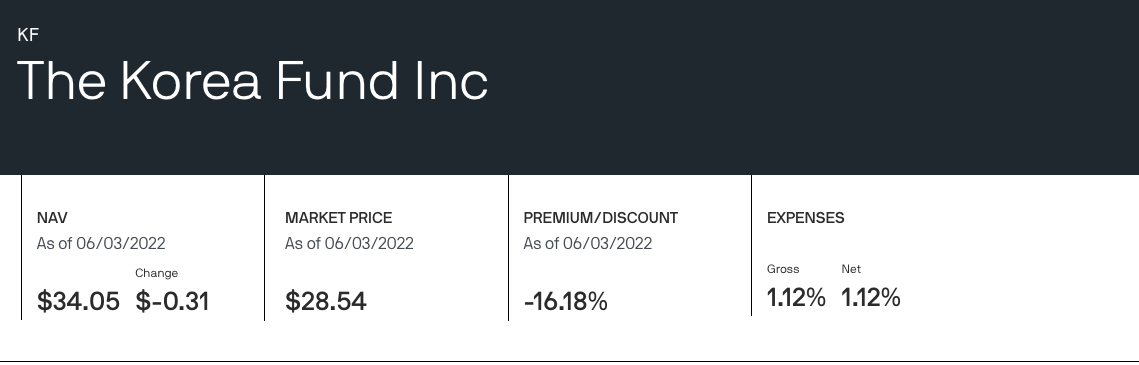

Discount is Appealing

One of the most appealing things about this fund is the strong discount to NAV. From what I observed, a discount below 10% is not really that noteworthy and can be common among certain closed-end funds, especially in international markets. However, a discount north of 10% in a market like South Korea is well worth noting, especially since it invests in lots of large-cap companies like Samsung (OTC:SSNLF) and Kia (OTCPK:KIMTF).

The Korea Fund

The circa 16% discount is extremely appealing. Its expense ratio of 1.12% is somewhat attractive but relatively higher than its peer iShares MSCI South Korea ETF (EWY) which has an expense ratio of 0.57%. I don’t personally mind the extra fee, as I anticipate that the tightening of the discount to NAV, in the long run, will make up for it.

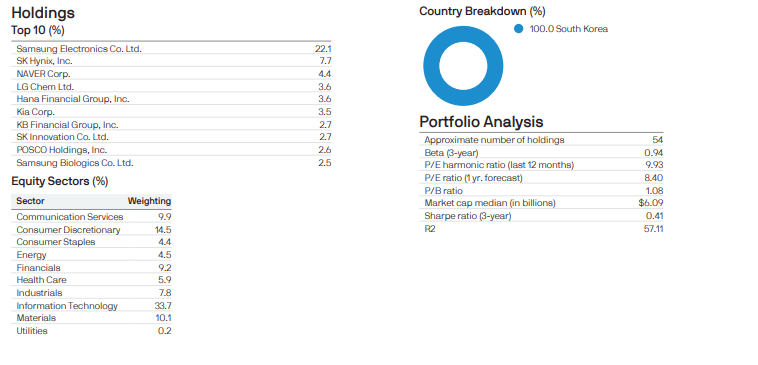

Fund Overview

The Korea Fund invests in a basket of 54 companies, with a heavy focus on information technology (33.7%) and consumer (28.8%) stocks. The fund also has a relatively lower weighting in energy (4.5%) and financials (9.2%). Notably, the portfolio of companies trades at 9.93x PE and trades at 1.08x book value. This is easily one of the most attractive setups I have seen within other MSCI emerging markets. To access these shares at a 16% discount is an added bonus.

The Korea Fund

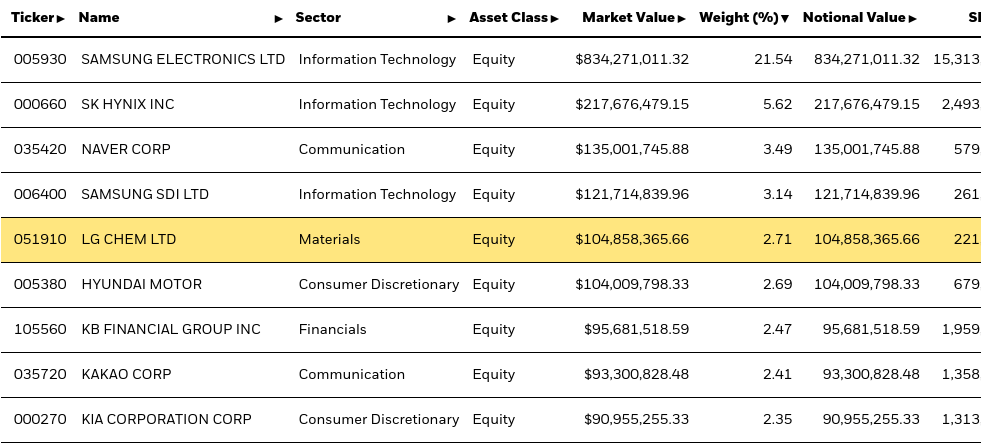

Comparison to the iShares MSCI South Korea ETF

The fund’s top 10 holdings are similar to that of the iShares South Korea ETF. Notably, the funds share 6 of the same companies in their top 10 holdings and Samsung of both of their #1 holdings (over 20% of assets).

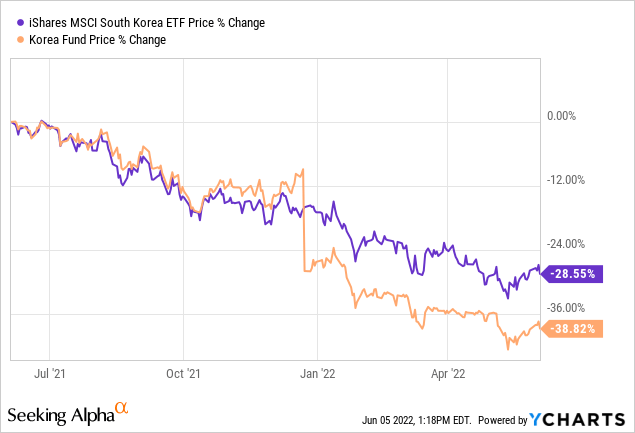

iShares

The Korea Fund has also underperformed this ETF substantially, although it did pay out a very large dividend on January the 10th last year.

YCharts

Moving forward, I am focusing on the potential for long-term capital gains rather than dividend income, and don’t see too much potential for a higher dividend yield (this previous payment was based on capital gains and dividend income) in the future. The dividend for South Korea’s stock market, in general, is not very attractive. The MSCI Korea High Dividend Yield Index only has a dividend yield of 4.2%.

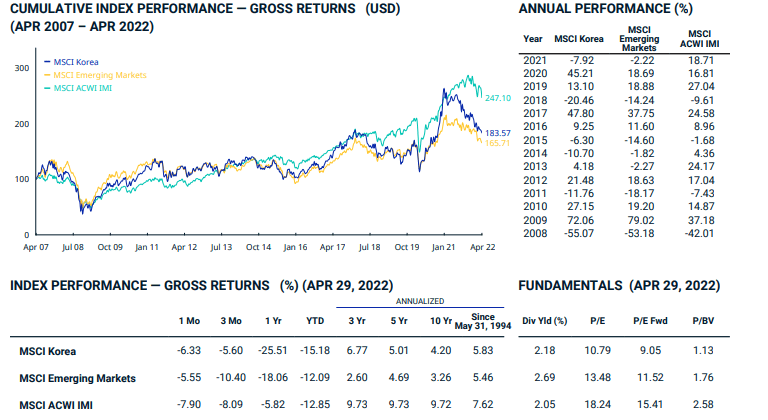

Korea Equities Performance: Korean equities, along with MSCI Emerging Markets, underperformed MSCI ACWI during 2021. Korea massively outperformed other markets during 2020 and was actually able to return a stellar 45% in 2020. Shares are now attractively priced after a 7.9% decline during 2021 and a circa 12% YTD decline during 2022.

MSCI

MSCI Korea currently trades at around 10.8x PE and 1.13X book value, which is a significant discount to most equity markets. South Korea is also one of the largest emerging markets according to MSCI classification, but the economy is actually a global giant and is unlike many other emerging markets. Other countries that are classified as emerging markets by MSCI include Egypt, Turkey, the Philippines, Peru, and Mexico. If it continues to stay in the MSCI emerging markets index, its weighting would likely have to rise, which would bode well for the equity market.

|

Country |

Weighting |

|

China |

30.57% |

|

Taiwan |

15.45% |

|

India |

13.64% |

|

South Korea |

12.51% |

|

Brazil |

5.25% |

Source: MSCI

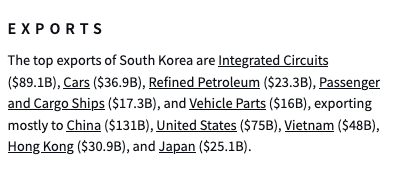

Growth and Innovation

South Korea is a relative stand out among other emerging market peers, notably for its sophisticated export structure, strong global economic market share, and a higher level of innovation. South Korea is ranked as a top 10 global economy in terms of GDP and is the world’s 5th largest exporter. It has a strong standing in tech exports, which also includes exporting components to other frontier markets that then assemble electronics. South Korea is highly exposed to China and the United States (circa 39% of total exports during 2020), which is one of the biggest risks of this investment. For example, April exports to China recently fell by 3.4% due to lock-downs in China.

OEC

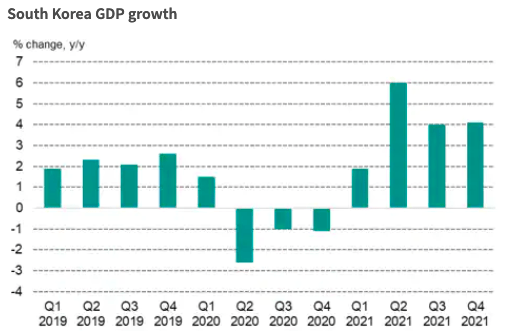

South Korea’s economy expanded by 4% in 2021, which was driven by favorable export growth (26%) and strong domestic consumption. South Korea’s economy was easily able to recover following Q1 2021. This was strongly driven by the growth in semiconductors. The IMF most recently lowered its growth forecast for South Korea to 2.5%. However, growth could be slower in 2022 based on the economic performance of China and the United States.

Bank of Korea/IHS Market

Equity markets have been slow to respond to the economic progress made in 2021, and Korea’s economy has also been off to a solid start this year. However, Korea remains extremely vulnerable to any form of geopolitical tension or economic slowdown in Asia, particularly in China.

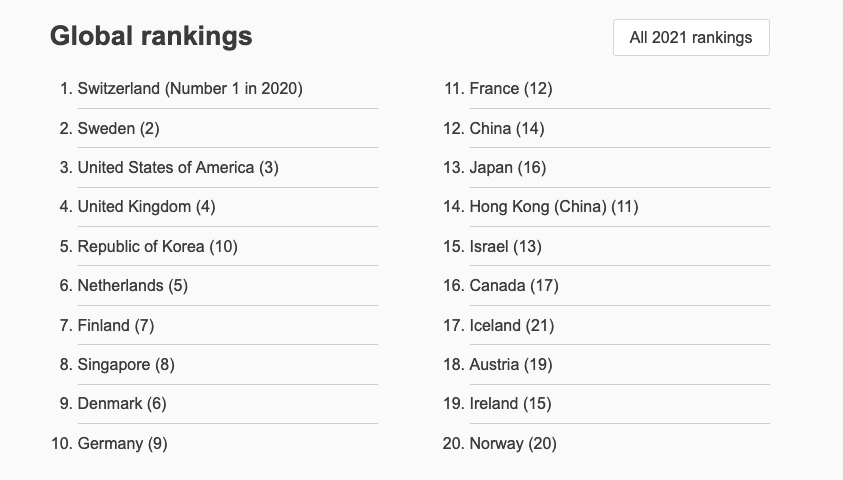

Innovation

South Korea also has an extremely innovative economy, yet it is still ranked as an emerging market by MSCI and even trades at a discount to MSCI emerging markets.

WIPO

As global growth stalls in the coming years, innovation may be one of several ways that South Korea can unlock additional economic growth.

How Significant is the Discount?

The 16% discount is extremely attractive, but this is not that uncommon among other closed-end funds that invest in Asia. I think that the fund may trade at an 8-10% discount under more positive economic conditions. I plan to accumulate shares when the discount range is between 15-20%. This provides a level of safety, given that the underlying shares are also very attractively valued (trading at circa 10x PE).

|

Fund |

Discount |

|

The Korea Fund (KF) |

16.2% |

|

Aberdeen Asia Pacific Income Fund |

14.25% |

|

The Taiwan Fund |

16.05% |

|

The India Fund |

8.39% |

|

Aberdeen Japan Equity Fund |

11.46% |

Discount to NAV as of June 3, 2022

Issues to Consider

Illiquidity Discount: It is also very important to consider the relatively lower liquidity of this fund. The iShares South Korea ETF has an average daily trading volume of 2 million, and the shares currently trade for over $60. Liquidity is not an issue here. Meanwhile, the Korea Fund’s average trading volume is 2,190 (current share price of $28.53). The 16% discount is therefore largely an illiquidity discount. This shouldn’t be a serious issue for a retail investor who is initiating a small $1,000-$2,000 position.

Market Correction: However, additional general market turmoil could result in a much larger pullback for this closed-end fund, relative to other liquid stocks or ETFs. I would take advantage of this if it allowed me to buy shares at a 20+% discount to NAV. One should consider this if they are in a situation where they may need to sell shares during a downturn. In this case, it is better to initiate a relatively smaller position, and have cash on hand to buy potential dips. This fund invests in a lot of large-cap South Korean companies, which are commonly held by larger passive funds. A general market sell-off could hit these companies harder.

Macro: Growth projections for South Korea are less favorable relative to 2021. 2021 growth was driven by a stellar rise in exports, which may be harder to replicate in the next few years. A global recession, particularly in its key export markets such as the United States and China, could cause a further pullback in Korean equities, even though valuation is at an extreme low.

How I’m Playing This

I initiated a small position this month, and will continue to accumulate if the discount is 15% or higher, and as long as Korean equities trade at 9-11x earnings. This closed-end fund is definitely more vulnerable to a pullback, relative to ETFs and Korean equities. I would take advantage of this to add to my Korea exposure. I do not anticipate that this closed-end fund will ever trade at less than a 5% discount to NAV. I do think that a 5-10% discount is possible eventually, while a premium to NAV is extremely unlikely given the highly liquid ETF alternative. The risk of a general macroeconomic/stock market downturn is very high and almost inevitable, yet I think now is an appropriate entry point. I want to have exposure to South Korea for the next 5-10 years and am not concerned with finding the exact bottom. South Korea also has a large number of ADRs, which is particularly useful if you want to increase your exposure to South Korean banks.

Be the first to comment