Ibrahim Akcengiz

Reshoring / nearshoring to improve the resiliency of supply chains has been proposed as a source of structural inflation going forward. While reshoring is currently a hot topic, a normalization of supply chains could make it a short-lived phenomenon. Even if reshoring becomes an ongoing trend, it is likely to be less inflationary than most expect, dependent on how quickly supply chains are relocated.

Reshoring predates the pandemic and is being driven by a number of factors:

- Increasing geopolitical risks

- Rising trade tensions

- Technology

- Increased focus on supply chain resiliency in the wake of the COVID pandemic

The relocation of supply chains is likely to occur on a case-by-case basis, with consideration given to the costs and strategic benefits. Supply chains do not necessarily have to be onshored to improve resiliency, they can also be geographically diversified by relocating production to low-cost countries like Vietnam and India. Even in cases where production is localized for strategic reasons, improved productivity through technology investments may offset higher labor costs.

Offshoring

Globalization has been underway for many decades, but appears to have accelerated after China entered the World Trade Organization in 2001. Many multinational companies invested heavily in China and relocated production there. Foreign companies have accounted for one-third to one-half of China’s overall exports for much of the previous three decades, indicating the extent to which production has been relocated.

Offshoring has been proposed as a deflationary force over the past few decades. For example, when the US inflation rate was stable at around 2%, goods inflation was often negative. US import prices of manufactured goods from industrialized countries rose by 33% between 1990 and 2008, compared to 3.4% for goods from developing countries.

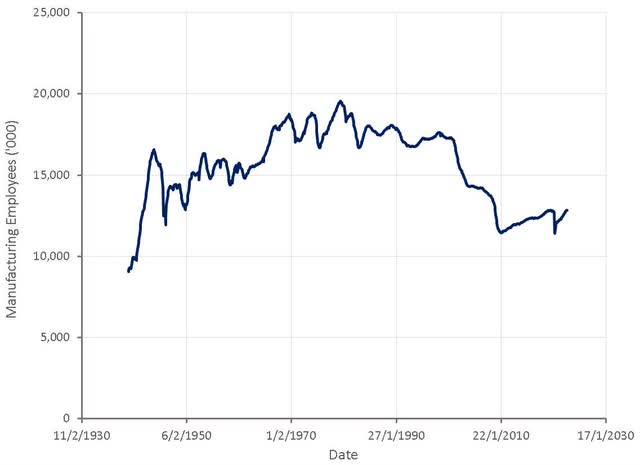

Offshoring potentially directly reduced inflation by lowering the production cost of goods and indirectly by creating slack in the domestic labor force. The US has lost over 4 million manufacturing jobs since 2001, and while the number of US manufacturing employees has crept up over the last decade, it still hasn’t reached the levels from before the Great Recession.

Figure 1: US Manufacturing Employees (source: Created by author using data from The Federal Reserve)

Reshoring / Nearshoring

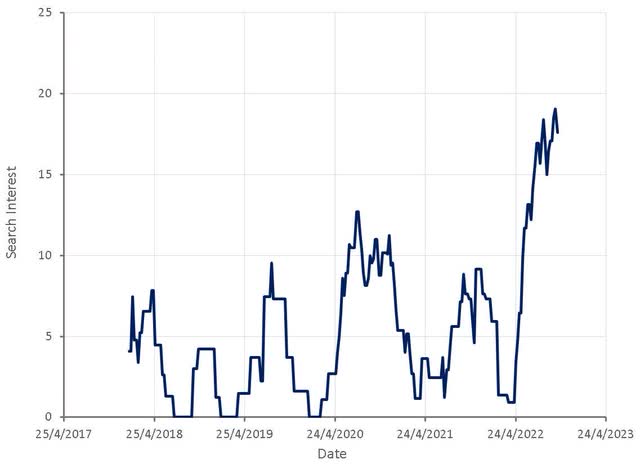

Reshoring is something that has been under discussion for at least a decade, but gained momentum under Trump’s presidency, and has been accelerated by the COVID pandemic. Corporate attention increased early in the pandemic due to supply chain disruptions and has spiked again in recent months due to the war in Ukraine and ongoing lockdowns in China.

Figure 2: Index of Search Interest for Terms Related to Supply Chain Resiliency (source: Created by author using data from Google Trends)

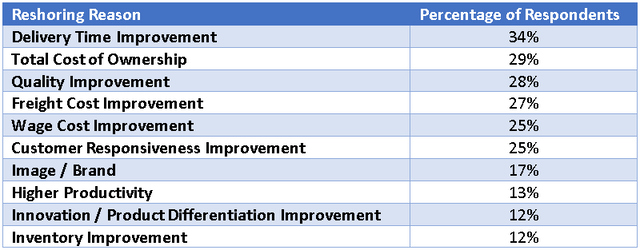

According to an AT Kearney survey from 2017, reducing costs, improving product quality and improving responsiveness appear to have been the primary drivers of reshoring prior to the pandemic.

Table 1: Top Reasons for Reshoring Production (source: Created by author using data from AT Kearney)

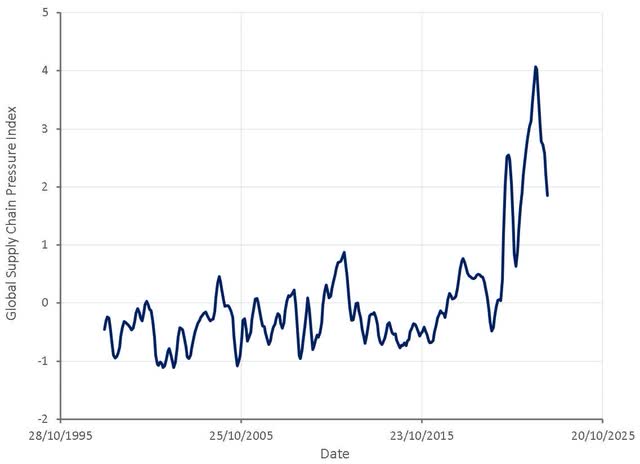

Over the past few years, the focus has likely shifted to supply chain resiliency, as delivery times have blown out and costs increased dramatically. In many cases, this situation is beginning to normalize though, which may reduce the focus on reshoring, particularly if a recession causes a drop in corporate profits.

Figure 3: Global Supply Chain Pressure Index (source: Created by author using data from the Federal Reserve Bank of New York)

Reshoring is likely to be difficult, expensive and a long-term process in most cases, which will probably limit how much it occurs. Supply chains also often involve a complex network of suppliers, meaning that in some cases a critical mass of activity may need to be reached to ensure a supplier ecosystem can thrive.

Construction activity for manufacturing facilities in the US is currently concentrated in areas that are deemed critical, such as microchips and certain commodities. The extent of reshoring has been modest so far, with imports still growing faster than domestic manufacturing output, although this may change in time. Diversification of supply chains and inventory overstocking are short-term measures to improve supply chain resiliency that appear to be further along.

Kearney’s annual Reshoring Index, tracks the reshoring of manufacturing from 14 Asian countries to the US. The 2021 Reshoring Index found that rather than localizing manufacturing, US companies were even more reliant on offshore manufacturing operations Asia.

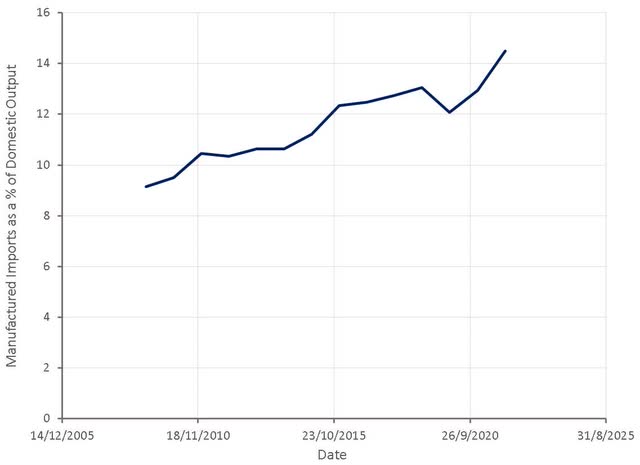

Figure 4: US Manufacturing Imports as a Percentage of Domestic Output (source: Created by author using data from AT Kearney)

A survey of CEOs and manufacturing executives found that despite an increasing reliance on offshore manufacturing, reshoring sentiment was positive and improving. It is likely just a case that reshoring plans have yet to be realized and that their impact will be felt in coming years.

A spring poll of more than 1,600 executives by global conglomerate ABB (ABB) showed that 70% of companies are planning to invest in new production capacity close to home. The Reshoring Initiative reported that investments last year climbed 46% to a record and forecast that 2022 will shatter that mark.

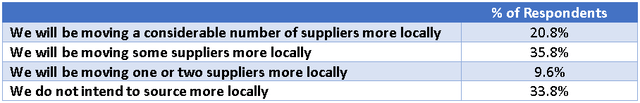

Table 2: Survey of Firms Reshoring Plans in September 2020 (source: Created by author using data from raconteur.net)

The construction of manufacturing facilities in the US increased 116% over the past year, compared to a 10% gain for all building projects. Examples include:

- Intel (INTC) and Taiwan Semiconductor Manufacturing (TSM) are constructing factories in Phoenix

- A number of aluminum and steel plants are being built in the south, including Alabama (Novelis); Arkansas (U.S. Steel (X)); Kentucky (Nucor (NUE))

- Peloton (PTON) had planned a 400 million USD facility in Ohio that was supposed to be incremental to its Asian manufacturing footprint

- Schneider and Deere (DE) are investing 76 million USD in reshoring projects with Schneider citing the economic and energy environment as reasons

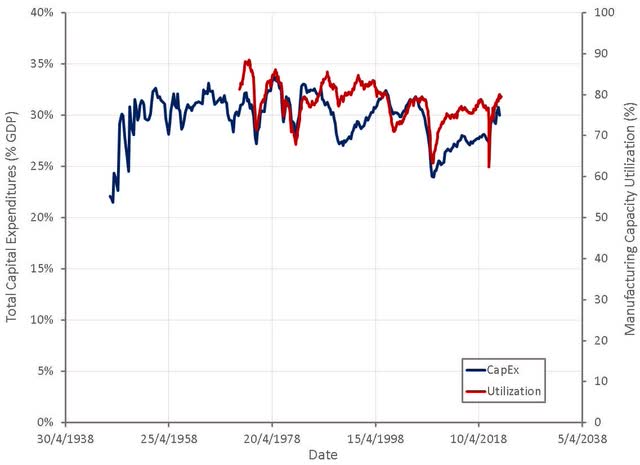

Capital goods spending is increasing, as companies invest in manufacturing assets in the US and Mexico. Manufacturing capacity utilization is also high, which is another indicator of increased domestic production.

Figure 5: Capital Expenditures and Manufacturing Capacity Utilization in the US (source: Created by author using data from The Federal Reserve)

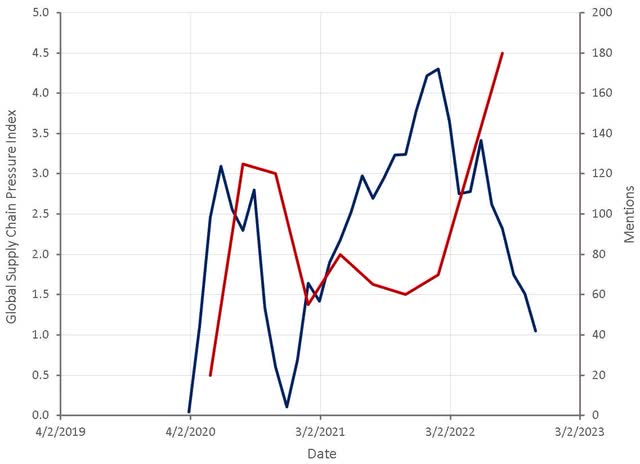

Corporate attention on reshoring appears to be closely aligned with supply chain pressures though and now that these are easing it is possible that reshoring becomes less of a priority.

Figure 6: Global Supply Chain Pressure Index and Reshoring Mentions During US Corporate Presentations (source: Created by author using data from The Federal Reserve and company presentations)

Inflationary Impact

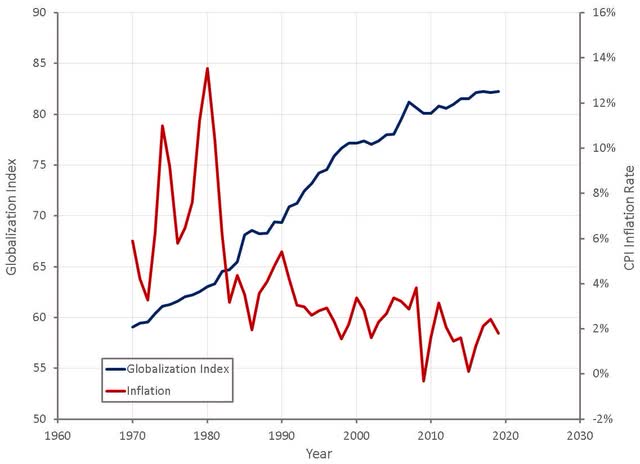

While it makes intuitive sense that deglobalization would be inflationary, it may not be that straight forward. Analysis suggests that globalization is linked to lower persistent inflation through trade integration, informational globalization and global value chain participation. Estimates suggest that the impact is small though and that globalization was unlikely to be a primary cause of the synchronization and decline in interest rates observed across developed economies. In developed economies, it is estimated that globalization has decreased Producer Price Index inflation by approximately 0.15% on average.

Deglobalization could be expected to have a similar impact, depending on the extent to which it occurs and how quickly it occurs. In addition, technology could impact productivity and reduce labor intensity, thereby limiting cost increases.

In addition to contributing to inflation, deglobalization is likely to reduce trade and output. It is estimated that if the US, the euro area, and Japan reshore enough production that their nominal imports decline by 10%, advanced economies could experience a 1-2% decline in output, and emerging economies about 0.5%.

Figure 7: Globalization and Inflation Rates (source: Created by author using data from KOF and The Federal Reserve)

Productivity

Companies are unlikely to reshore manufacturing without significant modifications to operations due to the change in relative labor costs. For reshoring to be feasible the productivity of labor will need to increase, likely driven by investments in technology like robotics and automation. Operations where labor intensity cannot be significantly reduced are likely to be poor candidates for reshoring.

Some studies have shown that the adoption of robotics is correlated with declines in offshoring. In developed economies, a 10% increase in robotics applications results in -0.54% growth in offshoring. A survey by the Reshoring Institute found that over 80% of respondents are looking into new software systems and that 70% are considering investing in robotics. Industrial robot sales grew at a compound annual growth rate of 15% between 2013 and 2019, reaching approximately 420,000 installments in 2019. The International Federation of Robotics estimates that annual installations will increase to 584,000 by 2022.

The increased use of technologies could contribute to a partial relocation of production back to developed countries, but will likely result in a smaller number of high-skilled jobs relative to the large number of low-skill jobs initially lost. If this is the case, reshoring may not impact labor markets as much as expected and will be less inflationary.

Conclusion

Large scale reshoring is likely to be inflationary, although the impact may be less than many expect. In any case, it remains to be seen to what extent manufacturing ends up being relocated. It is easy for executives to make promises at a time when profits are high and demand is generally exceeding supply. A downturn that pressures profits margins could quickly cause most companies to abandon reshoring plans as they pivot to focus on cost control. Reshoring is more likely in industries that have strategic importance or involve advanced technologies and require more skilled labor. The reshoring of industries like semiconductor manufacturing is likely to be a long-term process as time will be needed for ecosystems to develop.

Reshoring has the potential to tighten labor markets and improve the bargaining power of labor over capital. Not only could this be inflationary, but it is also likely to reduce profit margins. If this were to occur, it would not be unreasonable to expect a long period of multiple compression in stock markets. There could be beneficiaries though, in areas like Mexican industrial real estate, manufacturing technologies and domestic logistics. There is a risk that reshoring never really materializes, and investing now could be buying into the peak of the hype. The recent overinvestment in transportation capacity and the ongoing collapse in freight rates may be indicative.

Be the first to comment