Getty Images/Hulton Archive via Getty Images

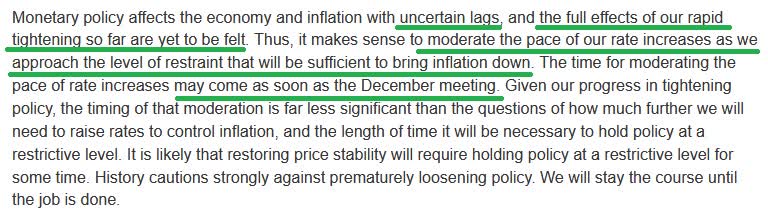

On Wednesday, Fed Chair Jay Powell shifted his messaging just enough to cancel the Grinch from stealing Christmas this year. In his prepared speech on Wednesday, he made the following statements which eased market participants’ jittery sentiment over the past few days:

FED

In the press conference, Powell made two unexpected statements:

-

“I don’t want to over-tighten.” Up until now, the Fed has consistently implied it would lean toward over-tightening.

-

It’s “not appropriate to execute some ‘shock and awe’ strategy to crash the economy and clean up afterwards.” Fed was on track to do this. It’s nice to see it is finally recognizing the impact of its aggressive tightening.

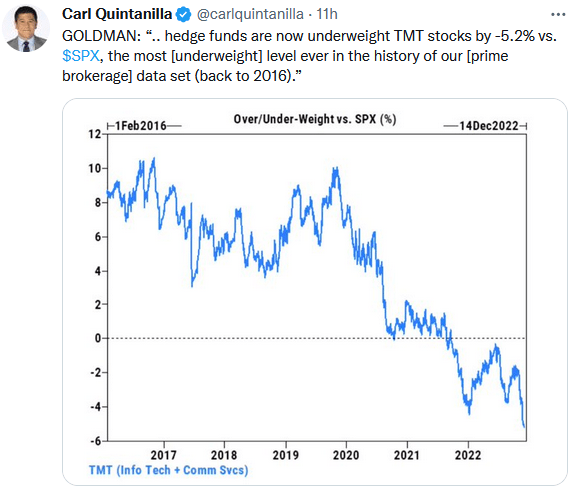

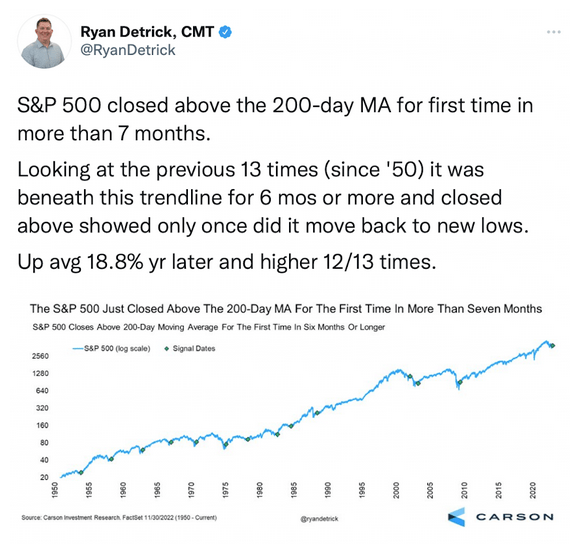

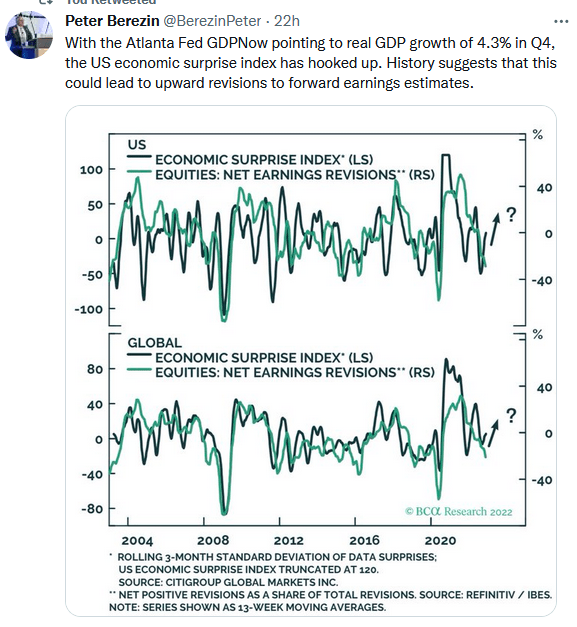

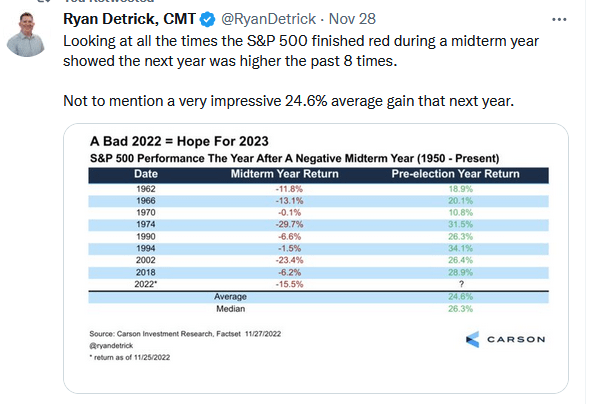

The market abruptly rallied on the news led by China Tech, Biotech, U.S. Tech and Semiconductors. We’ve covered the opportunity in all of these unloved groups in recent weeks and this was the shift that caused a bid. We expect to see continued follow-through in fits and starts through year-end. Some data points to pay attention to moving forward:

Twitter Twitter Twitter Twitter Twitter Twitter Leuthold Leuthold Leuthold

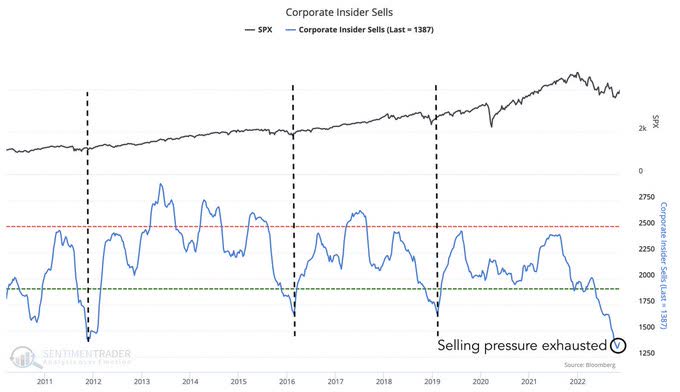

Sentiment Trader:

Bloomberg

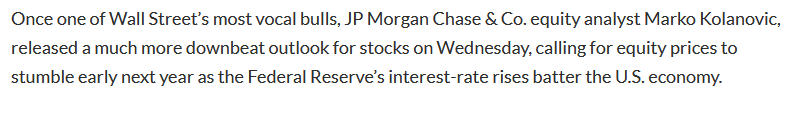

One of the best strategists on the Street – Marko Kolanovic of JPM (who has been bullish all year) – literally threw in the towel and finally capitulated/went bearish (exactly 1 hour before Powell spoke):

Article Article

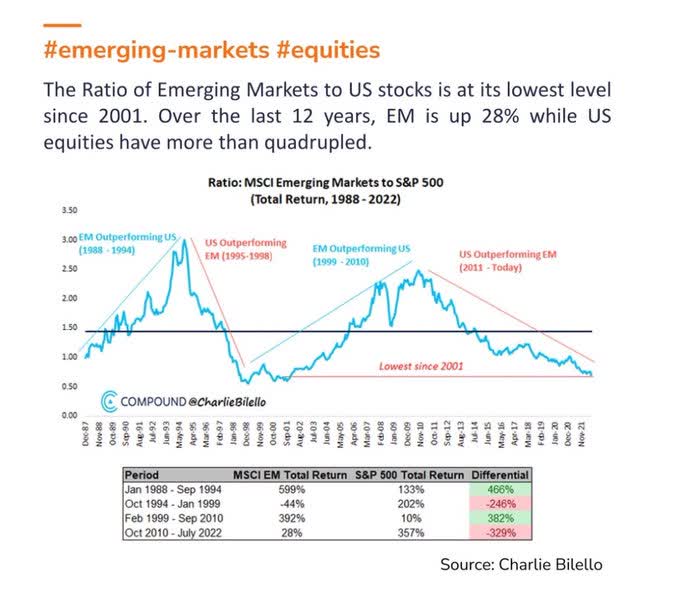

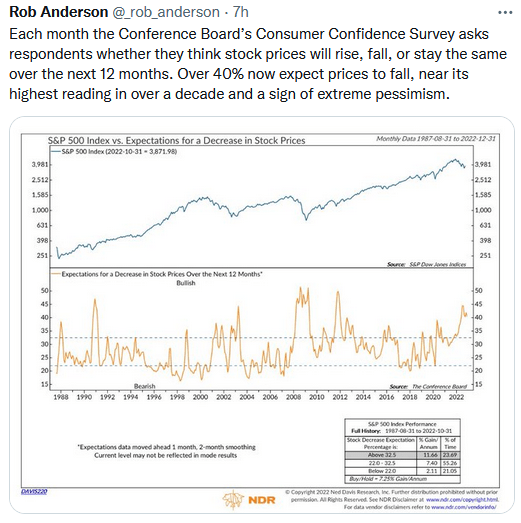

On Tuesday, I joined Mitch Hoch “Money Mitch” on Benzinga to discuss stock market end of year outlook (the best trades for 2023-2024), U.S. dollar, Emerging Markets, the Fed, Inflation, Tech, clearance sale, Black Friday, China, casinos, oil, Volcker, rail strike, and “thumb suckers.” Thanks to Mitch and Zoltan Suranyi for having me on. Pay special attention to the commentary on Tech and Emerging Markets in this segment:

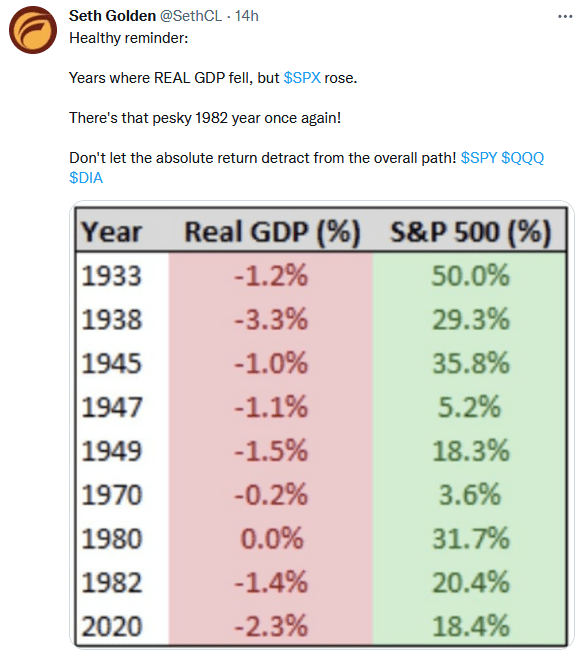

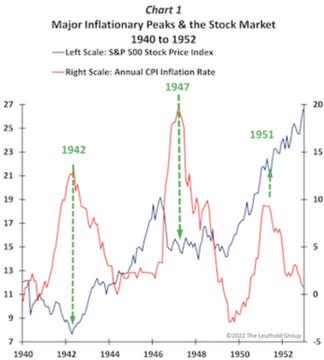

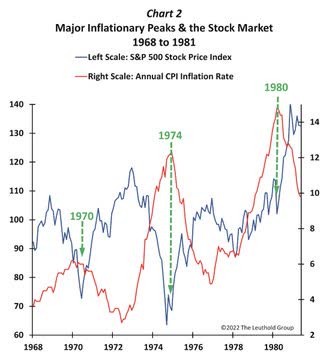

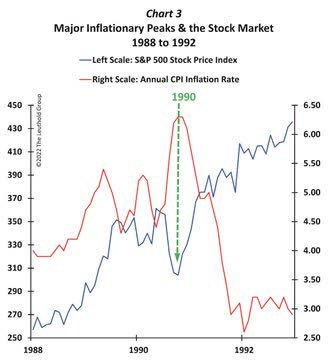

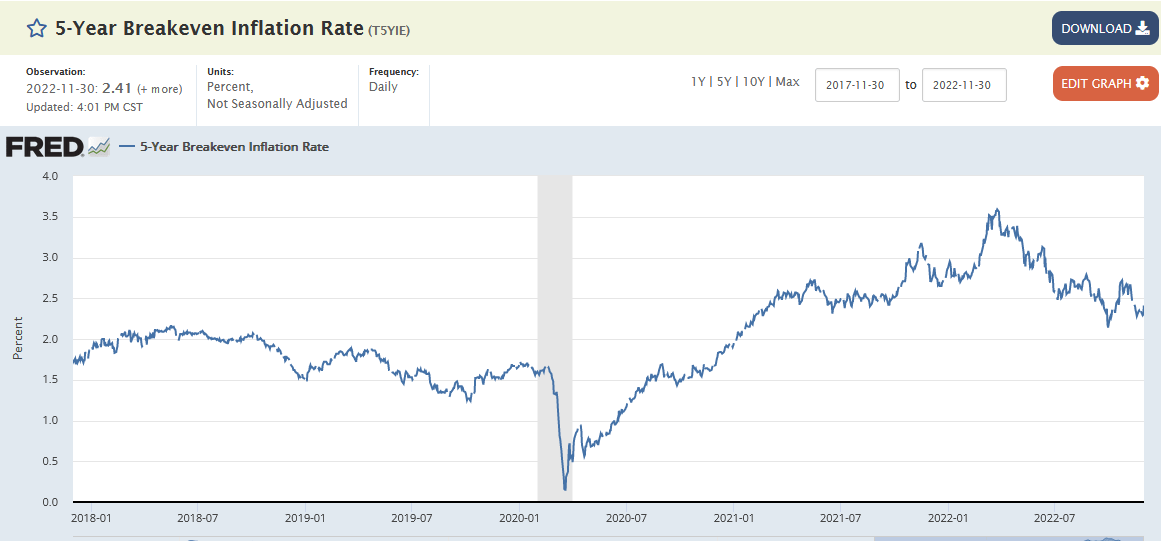

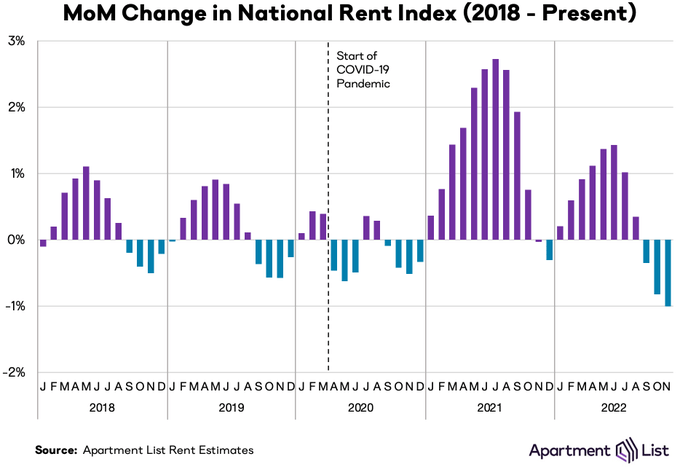

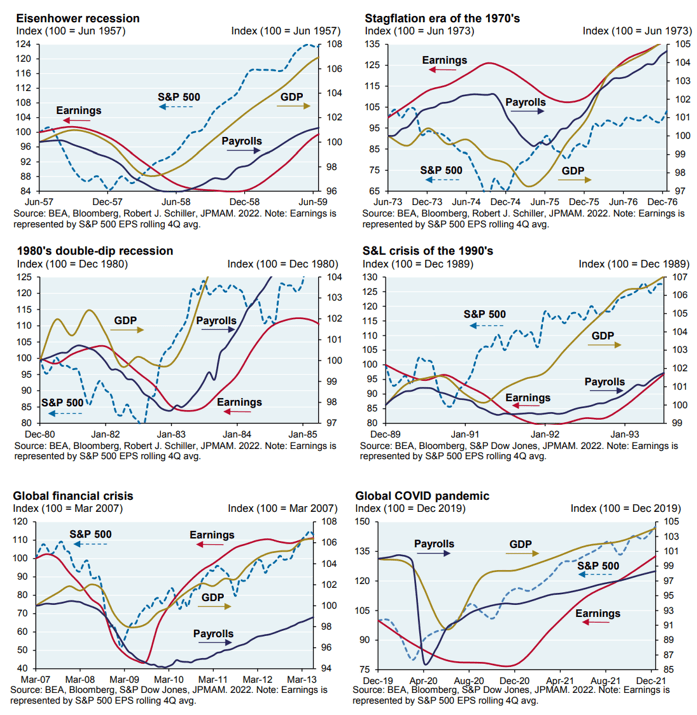

Compound Twitter FRED Apartment List

For the fourth consecutive weekly reminder: Most analysts are calling for earnings to come down another 20% and are therefore bearish on the market. History shows the stock market bottoms WELL BEFORE earnings. In most cases the S&P 500 had recovered to new highs by the time earnings bottomed 6-12 months later: 1957, 1974, 1982, 1990, 2009, 2020.

Bloomberg

Over the weekend, I joined Xen Sams on 710 AM WOR iHeart radio to discuss capital markets and market outlook. Thanks to Xen for having me on. Pay special attention to the farm analogy I lay out to understand why short-term volatility does not bother us and why growth and value are joined at the hip.

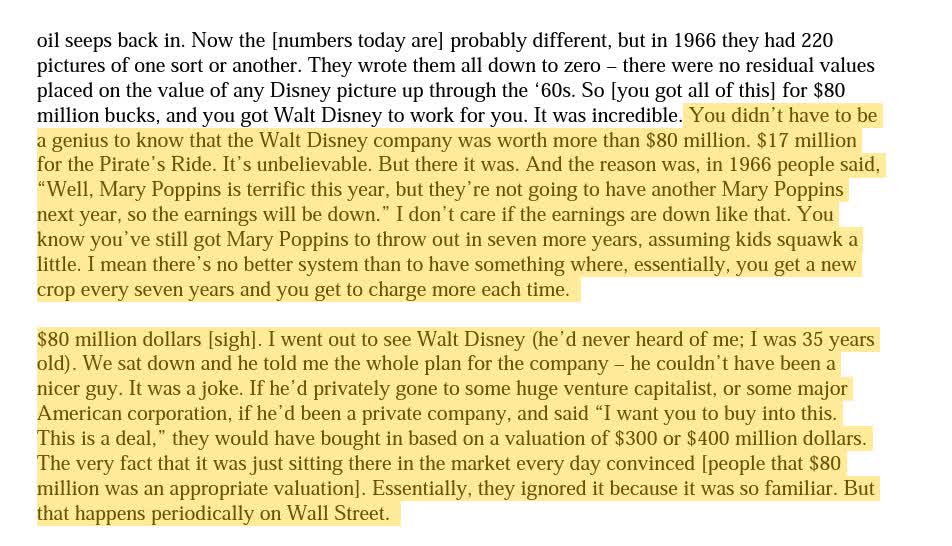

Funny how history rhymes. One stock I spoke about with Xen was Disney (DIS). Here’s what Warren Buffett had to say about it at a previous time this quality franchise was “out of favor.” From 1966 (via Q compounding):

Buffet

China Update

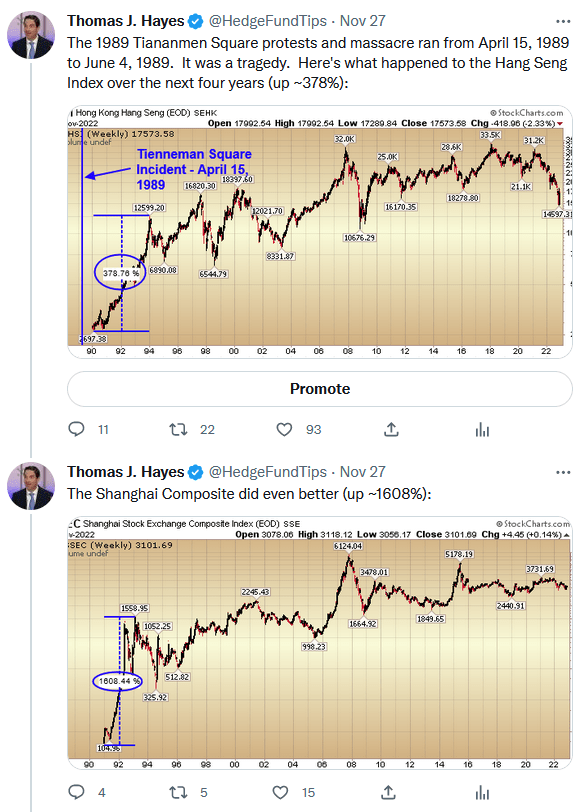

On Sunday night when China/HK futures were down big (on the protests over the weekend), I sent the following note to clients and also posted on Twitter:

Twitter Bloomberg Bloomberg Twitter

Since we posted these 18 points on Twitter – during the October final capitulation flush to ~$58 – Alibaba (BABA) has rebounded ~50% off the lows:

‘It’s Five O’Clock Somewhere’ Stock Market (And Sen…

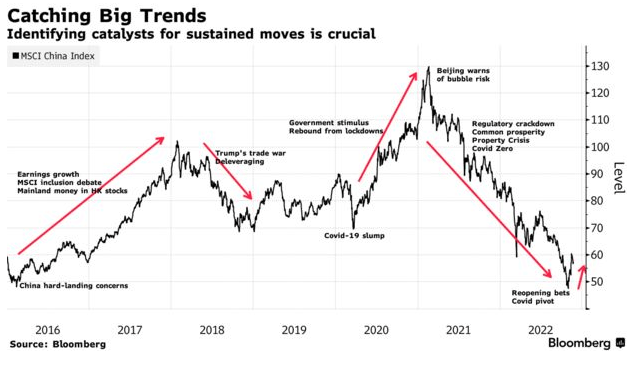

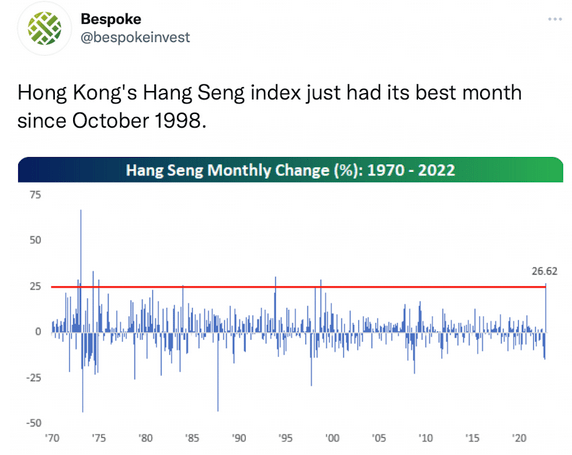

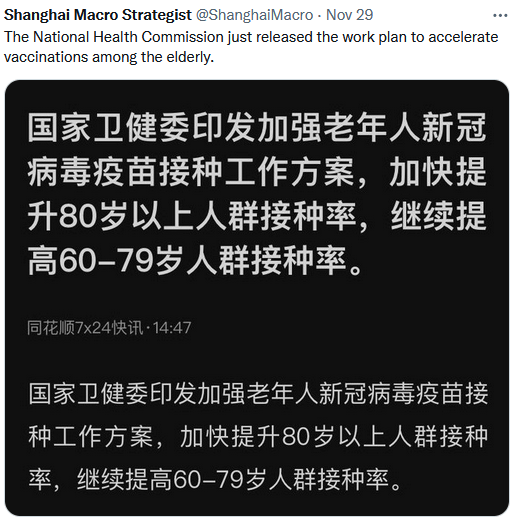

Conditions are improving to create a playing field conducive to climb back to fair and ultimately full valuation. There will be more “fits and starts” but we are making progress:

Article Twitter Twitter Financial Times Financial Times Twitter Twitter Twitter

Cooper Standard

No change since the last comprehensive update. View it here:

The ‘Pain Trade’ Stock Market (And Sentiment Results)

Now onto the shorter-term view for the General Market:

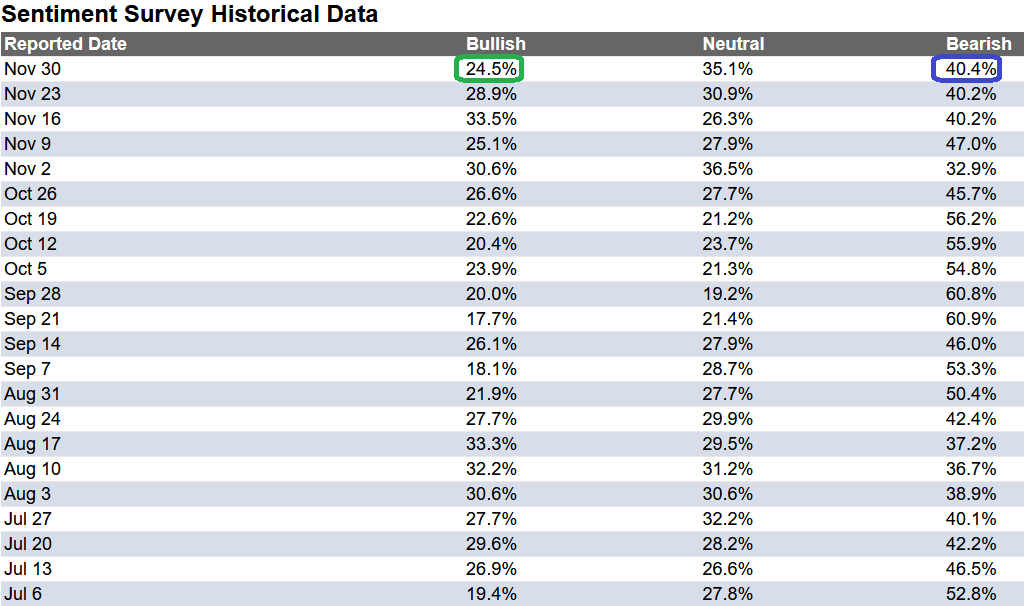

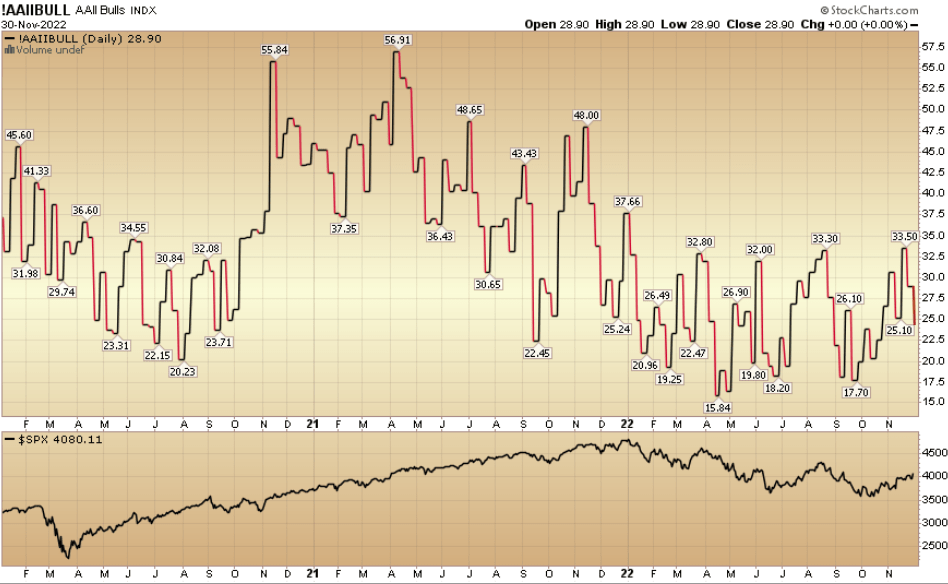

In this week’s AAII Sentiment Survey result, Bullish Percent ticked DOWN to 24.5% from 28.9% the previous week. Bearish Percent ticked up to 40.4% from 40.2%. Sentiment is STILL despondent for retail traders/investors.

AAII StockCharts

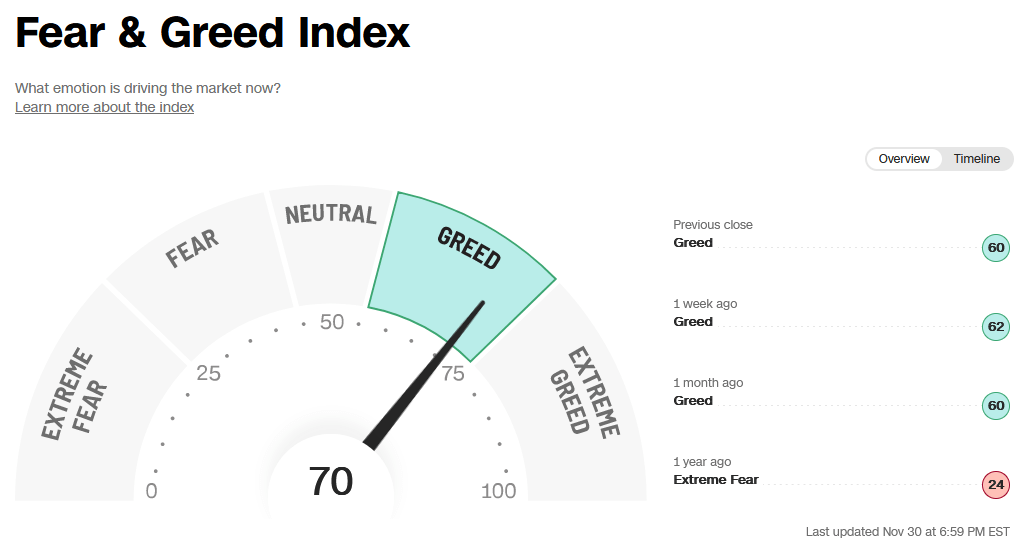

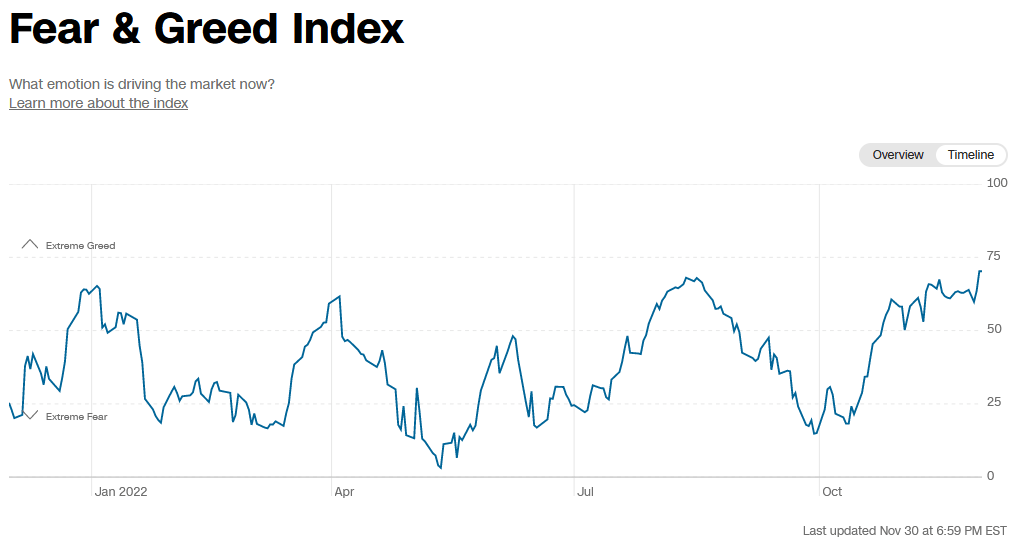

The CNN “Fear and Greed” moved up from 62 last week to 70 this week. Sentiment is accelerating.

CNN CNN

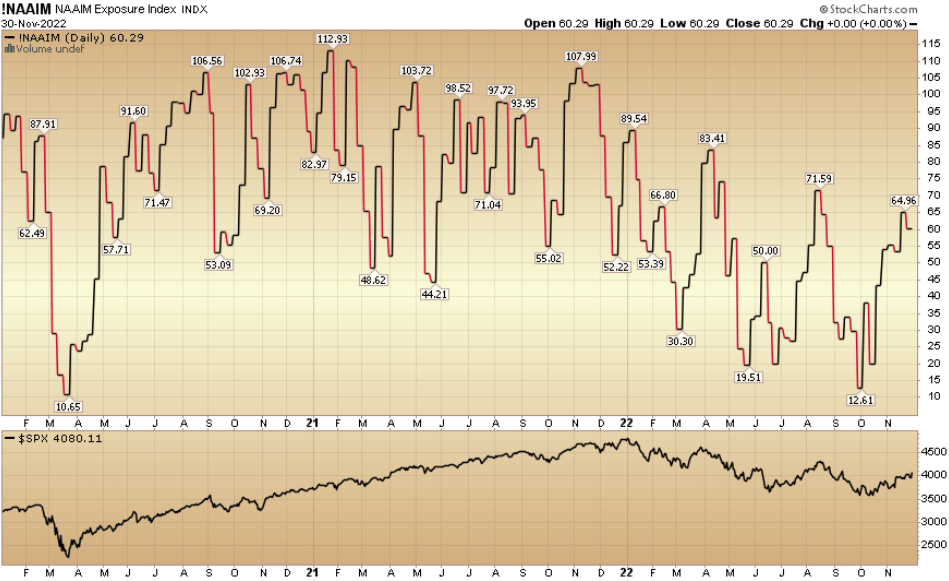

And finally, the NAAIM (National Association of Active Investment Managers Index) moved down to 60.29% this week from 64.96% equity exposure last week. This likely changed overnight as managers were caught flat-footed yesterday and will have to chase into year-end.

StockCharts

Be the first to comment