Rob Pinney

As retail earnings season wraps up, there are growing signs that the lower-end consumer is stretched right now. Several consumer companies with exposure to low- and middle-income segments voiced caution about the coming quarters. One firm with significant exposure to the middle-income consumer reports Q2 results after the bell on Thursday.

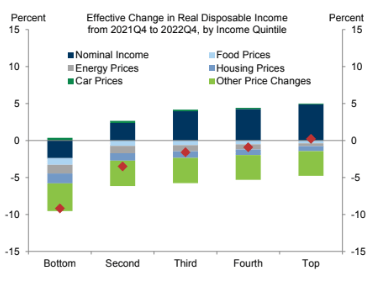

The Low-End Wage-Earner Is Getting Squeezed

Goldman Sachs Investment Research

According to Bank of America Global Research, The Gap (NYSE:GPS) sells private label merchandise through four main retail concepts, The Gap, Old Navy, Athleta, and Banana Republic. The company also sells its products through its company websites. The $3.7 billion market cap San Francisco-based Specialty Retail firm within the Consumer Discretionary sector has negative earnings over the last year, but still pays a hefty 6.1% dividend yield on a trailing 12-month basis. Importantly ahead of Thursday night’s earnings, the stock carries a high 14.7% short float according to The Wall Street Journal.

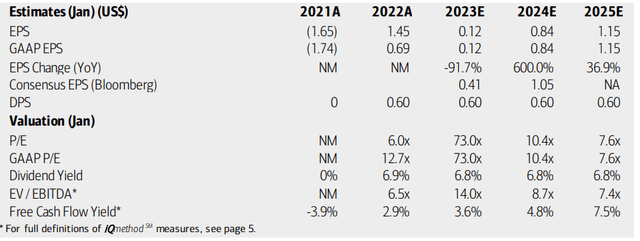

Analysts at BofA see a big markdown in earnings next year after this fiscal year’s rebound. In the years ahead, though, earnings are seen as only gradually recovering to where they might top out in 2022. BofA is more bearish on GPS than the Bloomberg consensus EPS forecast for next year. On valuation, the stock trades at a high EV/EBITDA multiple using next year’s numbers while its free cash flow yield does show some signs of life in the years ahead. Overall, the company faces many challenges as was evidenced by a recent management shakeup.

GPS Earnings, Dividend, Valuation Forecasts

BofA Global Research

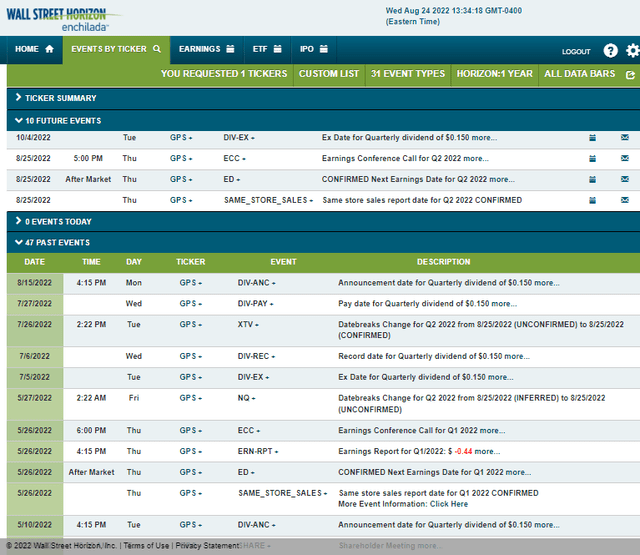

Looking forward, Gap Stores has an ex-dividend date of Tuesday, October 4 before its Q3 projected earnings date of Friday, November 25, according to Wall Street Horizon.

Gap’s Corporate Event Calendar

Wall Street Horizon

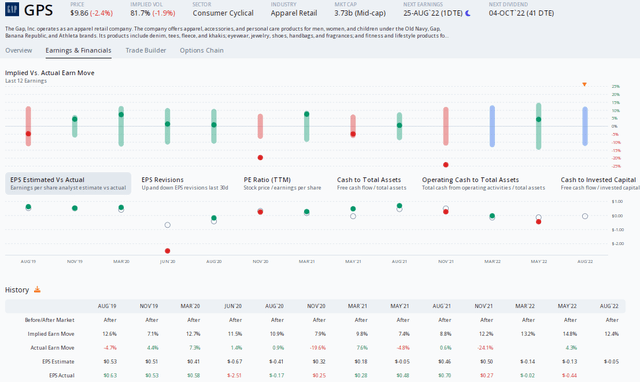

Digging into Thursday’s earnings report and expectations, options traders currently price-in a high 12.4% stock price swing using the nearest-expiring at-the-money straddle. That’s about in-line with the past three quarters, but on the high-end of the implied earnings-related move going back a few years.

Data from Options Research & Technology Services (ORATS) shows a consensus EPS estimate of a $0.05 loss, a steep decline from a $0.70 per share profit as was reported in the same quarter a year ago. It is important to recall Gap Stores’ massive Q1 earnings miss back on May 26 – shares managed to stage a rally in the days after, but then the stock fell to a 52-week low by mid-July. Similar price action could happen this time.

Options Action: Traders See A Big Move in Gap Shares

ORATS

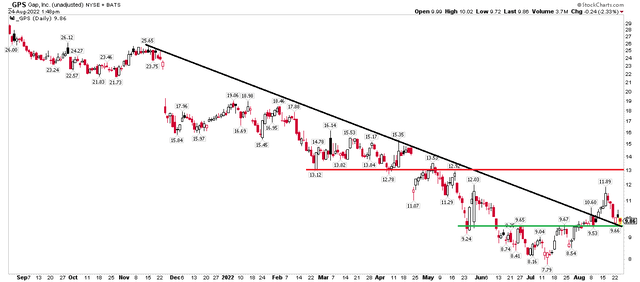

The Technical Take

Like many speculative niches of the market, GPS has rallied big off its summer lows. The stock bottomed after the S&P 500’s June 16 low, but GPS played big-time catch up to its high last week. Unfortunately, weakness in the SPDR S&P Retail ETF (XRT) has contributed to several nasty days for GPS. Shares are down nearly 20% in just six trading days. More big moves are expected, per the options market.

I see near-term support in the $9.24 to $9.66 zone, and the stock has actually broken its rate of trend to the upside. So this could be an interesting long setup with a tight stop. I see resistance, however, near $12 and just above $13. Overall, there is undoubtedly significant overhead resistance should GPS rally. I’d take profits if we indeed see a fast move to $12 to $13. Longs should certainly exit with a sell stop below $9.

GPS: Downtrend Broken, But Overhead Supply Is Robust

Stockcharts.com

The Bottom Line

GPS had a nice bounce off its July low, and the current price sets up an intriguing risk/reward long play around earnings considering the big anticipated stock price move on Thursday night and Friday as well as its high short interest. Swing traders are prudent to take profits if there’s a post-earnings pop given a very uncertain earnings picture. Long-term investors should simply window shop this one.

Be the first to comment