Fritz Jorgensen/iStock via Getty Images

The balance of risk and return

This is a follow-up on a disruptive growth strategy that is based on the view of the corporate life cycle. Here the basic principle is to find the optimal entry point for the next disruptive compounder. The earlier you buy into a successful disruptive growth story, the higher returns you get. However, buying increases the risk of a non-delivered promise and one wants to find the optimal balance between risk and reward.

There are several reasons why buying earlier equals higher returns. First, buying early equals higher risk and higher risk equals higher returns. Second, small, loss-making, illiquid companies are initially less attractive for analysts and fund managers but become more attractive upon sustained growth. One should avoid hype, keep buying at a constant pace over business cycles and aim at a portfolio diversified across market capitalization but ceteris paribus, the earlier you buy into successful disruption, the higher returns you get.

However, the earlier you buy, the bigger the chance of stalled growth. There are three things that happen from the theoretical discounted cash flow point of view when future growth becomes uncertain. The peak height of future profits is set lower, the sustainability of those profits is deemed weaker and the risk premium demanded by investors shifts higher. All these events result in lower share prices. In other words, start investing too early in the corporate life cycle and you will likely hit something that does not make it into the mass market and as a result, you start losing money.

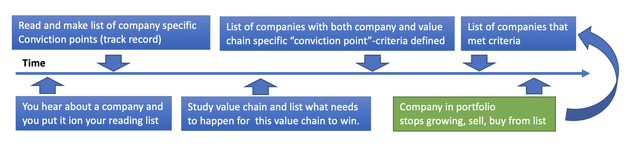

The name of the game is thus to have a list of potential disruptive companies waiting for the initial listing hype to cool off and strong enough signals to emerge to justify the investment. This focus on disruptive growth results in a better understanding of risk, a better understanding of risk allows for higher risk-taking, and higher risk-taking results in higher returns. This article focuses on the additional insight brought by ecosystem analysis into optimizing this overall framework of corporate life cycle disruptive growth investing.

All stock pickers should aim for a unique insight

Within somewhat efficient markets one should benefit from unique points of view. Think like everybody else and you probably have your view priced in. Think different and you might find a unique opportunity. It comes naturally to focus analysis on the actual stock we are planning to invest in. We might look up peers and competitors and maybe factors like total addressable market, but we still focus on that single company we are interested in.

Supply chain analysis is relevant for emerging technologies because initially, value chains do not exist. One would easily find the knowledge of the total addressable market, competitive advantages competitors, etc. from investor materials. However, one is unlikely to find statements of non-existing crucial ecosystem components. Thus, there is a competitive advantage for investors who deliberately try to go after such information.

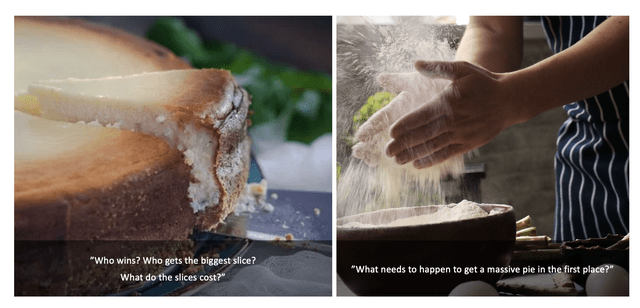

In other words, we end up evaluating the size of the pie, how the cake is sliced and what price one needs to pay for each of those slices. What we naturally put less weight on is determining what needs to happen for there to be a huge pie in the first place. Any investor identifying a crucial missing component to be filled by a third-party provider is likely to have an edge.

The importance of supply chains in the process of disruption

The way we usually tend to think is that we have outstanding products because we have outstanding companies.

Key point: we tend to analyze one company at a time and aim for things like track record of company and management, balance sheet, financials and size of market opportunity. We might also compare peers to understand valuation and competitive advantage. This view is narrow. (Author)

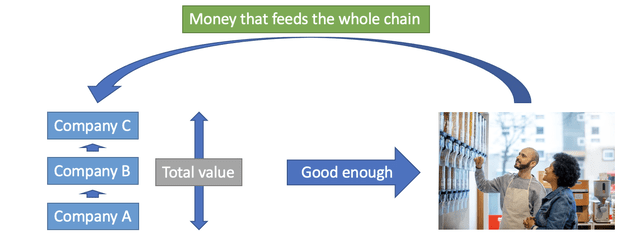

The core concept to grasp is that there are several situations where the ultimate value of the product used by the end consumer does not derive from a single company. Instead, there is a value chain, a list of companies that all add value to the final product. The way to think about this is that we have outstanding products because we have outstanding value chains. Let us study one example, Apple (AAPL).

Now think of the iPhone. The value lies in the combination of the actual phone designed by Apple and all the applications created by third-party providers. We buy the iPhone because this value chain works. All participants want to invest in this ecosystem because money flows from the end consumer into the entire ecosystem. And money flows from the end consumer because the value chain is able to deliver a superior product.

The power comes from analyzing supply chains of emerging technologies

Now, the power of using this framework of the supply chain for evaluation of emerging technologies comes from the fact that technology comes first, value chain second. First comes a new technology (VCR player), then comes a supply chain (Block Buster) and ultimate value comes from the combination of both. Apple is obvious because the value chain is ready and exists, but how would one have evaluated the value of the VCR player before Block Buster came into play? The one focusing on the importance of Block Buster and any third-party-built service on top of the VCR player would likely have had an edge.

Key point continued: although competitive edge and execution of Company A is important, the more important determinator of success might not be related to company A but to how company B executes and whether company C exists. The optimal time point to invest in company A is when company B starts to execute and company C emerges, i.e., one can see a value chain that delivers the value all the way down to the end customer. (Modified from Pixabay by author)

For any emerging technology the relevant questions are as follows: Do we have a well-working supply chain that works and brings genuine value all the way down to the end customer? If we do not have this, what needs to happen to get this supply chain to work?

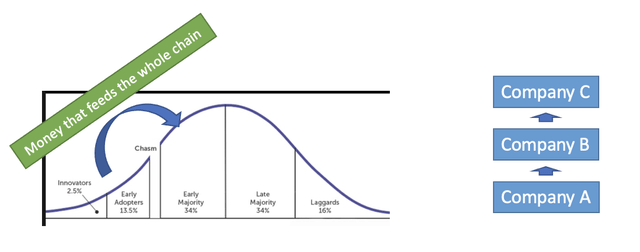

There will be initial growth without supply chains. Initial adaptors will try to get a competitive advantage by adopting new technology and some people are eager to try out new things just for the fun of it. Thus, revenue growth alone does not prove that a well-functioning supply chain would exist.

Without a complete supply chain, your ideal company is unlikely to cross the chasm from the early adapter to the heard. Without a proper value chain, we are unlikely to reach a situation where new users adapt to superior new technology just because all other users are also adapting to new technology. The growth of your company might not last although it executes well because the keys to genuine success are held outside the company.

Key point continued: why is the emergence of company C relevant for an investment decision on company A? Company C is needed to transform the benefit of company A’s technology to the end user in a way that secures crossing the Chasm and bring the final product to mass market. (Author)

Why analyze company C to buy company A?

Now, it may sound counterintuitive to study company C and buy company A. It takes work to study several companies at once and it takes patience to wait for crucial components of the value chain to emerge. Why put so much effort into company C with the aim of buying company A? If company C makes the final piece of the value chain, why should we not buy company C? Why complicate things by going from A to C and C to A to B?

Back to the example of Apple. The value of Apple comes from its ability to command its value chain. Resources are limited, updates demand work, and there are limits to how many programming languages developers want to learn. Ecosystem participants are invested in the ecosystem and because of this, they do not want Apple to fail. Second, like all other ideal companies, Apple wants to keep the most valuable business in its own hands and outsource the rest. This made Apple, not the other value chain participants, the most ideal long-term investment.

Thus, the optimal time to buy for long-term investment is when A) one sees the emergence of a complete and powerful value chain that goes all the way down to the end customer B) the company that “commands” or sets the parameters for this value chain can be identified and C) is in a position to generate high returns in the long run.

Go for supply chain bottlenecks

As part of a life cycle disruptive growth strategy, supply chain analysis can bring additional insight into determining your own conviction point, i.e., the point in time where the odds for success are deemed good enough to invest. First, you determine the issues holding the whole supply chain back. Second, you observe and invest as soon as these issues are solved.

One way to find key issues is to look for a complementary build-up of a proper value chain. First comes new technology, then comes the supply chain. The question to ask is whether value flows all the way to the end customer. For example, 3D printing allows reducing the weight and number of parts. However, being able to print those parts (company A) is not enough because the design and manufacturing of different kinds of end products would have to be altered as well (company B). The mere use of technology is not enough, and execution must be on a level that makes new technology genuinely superior to more traditional alternatives.

Second, look for compatibility with values, beliefs, needs, and previously introduced ideas. This sounds complex, so let us take some examples. Setting up a crypto account can be deemed tedious for traditional investors. A crypto ETF resembles stock investing and suits the needs of a broader set of investors. For merchants, accepting global payments through a Shopify integration is more appealing compared to accepting direct bitcoin payments. The key is compatibility with previously introduced ideas. General acceptance is likely when genuine value can be brought to the proximity of previously used solutions. Here the point is that developments in one set of companies (Strike and Shopify) support general acceptance of new technology and benefit other companies working in the same field such as Coinbase (COIN), Voyager Digital (OTCQX:VYGVF), and Block (SQ).

Now, in some cases supply chain-related developments are obvious. Take Upstart (UPST), which finds that the car purchase process ranks among the worst consumer experiences, acquires Prodigy Software Inc, integrates acquisition and launches UpStart Auto Retail, and gets major brands onboard to ensure that value flows all the way to the end customer. This is an example of excellent execution. However, from the investor’s point-of-view the framework presented in this article is likely to be most useful when 1) execution within company X is great but the investor notices problem in the non-existing value chain 2) determines what needs to happen for the value chain to win 3) detects such development from third-party service provider 4) invests in company X at this time-point.

“When one talks about market efficiency, it is important to distinguish between ideas whose implications are obvious and consequently travel quickly and ideas that require reflection, judgment, and special expertise for their evaluation and consequently travel slowly.“

Be the first to comment