akinbostanci

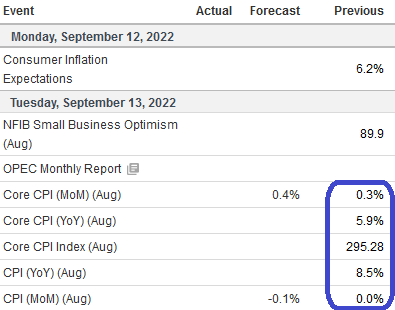

As I have been saying since before Jackson Hole, the most important data point for 2022 will come on September 13 when CPI data is released. Nothing like having an 80’s hairband Europe lead us into the most pivotal print of the year.

Investing

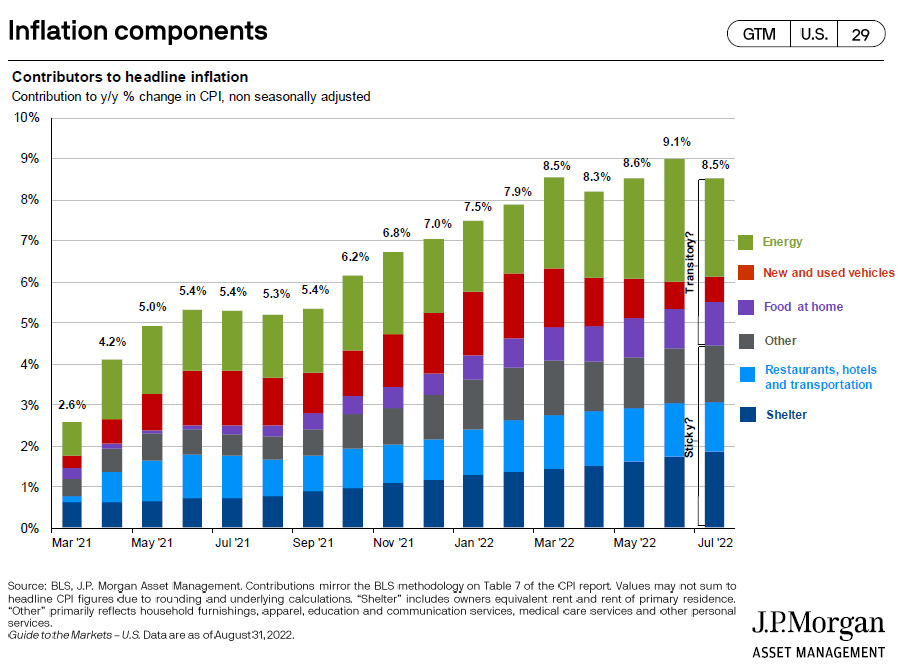

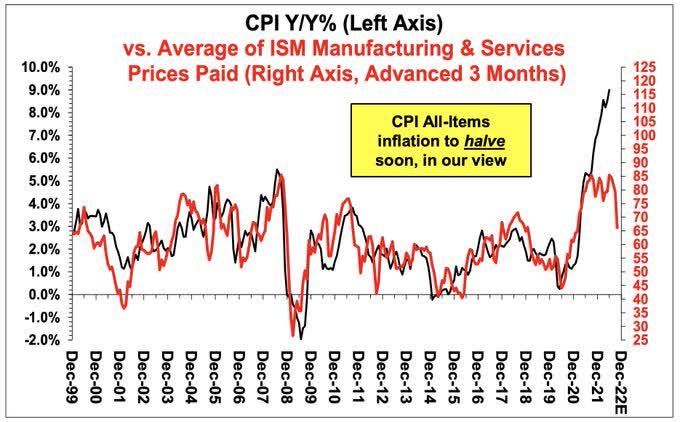

Expectations are high, but as we covered in last week, the underlying data points to a downside surprise (inflation coming in lower than expected)

JPM STIFEL

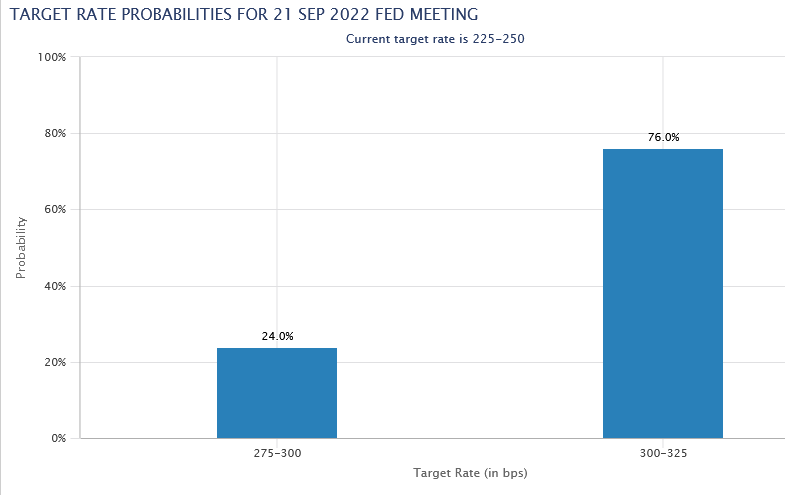

The key will be whether the numbers come in low enough for the Fed to raise 50bps (or less) on September 21 – versus consensus (75bps):

FED FUND

In late August two Fed Presidents made the following statements:

*Fed Pres (KC) Esther George said, “lags (from policy) are long and variable”

*Fed Pres (Phili) Harker said, “86 hikes since 1983. 75 were under 50bps. 75bps is unusual. 50bps is still substantial.”

-The implication is they want to see the lagged effect of recent 75bps hikes before going too aggressively on 75bps or QT schedule.

This was reiterated on Wednesday (yesterday):

Fed Pres (Cleveland) Mester: Our challenge is to engineer a slowdown in activity without causing a recession.

*Mester: Fed Not Aiming for Recession or Tanking Any Markets

After two quarters of negative GDP growth this year, Mester said she expects positive growth in the last six months.

“But for this year as a whole and for next year, I expect growth to run well below 2%, which is my estimate of trend growth,” Mester

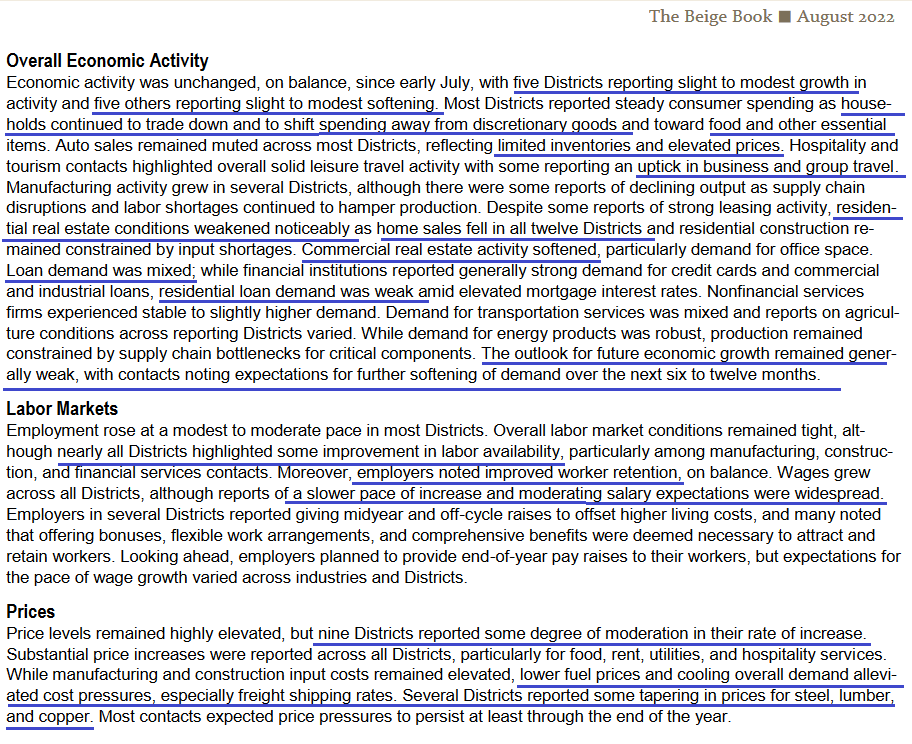

Beige Book

BEIGE BOOK

We’ve pounded the table in recent weeks’ that the playbook is to “Talk Hawkish and Act Dovish.” In a regime where CPI was 9% and the Fed Funds rate was 2.25%, that’s all you need to know. This strategy has not only worked to bring down demand and inflation (without having to aggressively tighten), as we covered in last week’s note, it worked post WWII as well. Same plan, different decade…

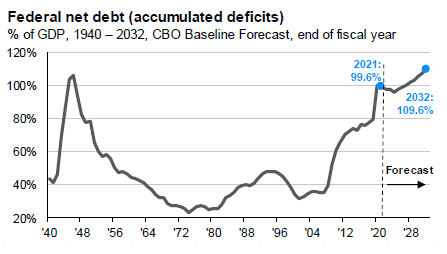

NET DEBT

If we are correct and the Fed raises less than 75bps, the market will view this as a pivot from “extreme measures” to a more moderate stance (i.e. “The Beginning of the End”).

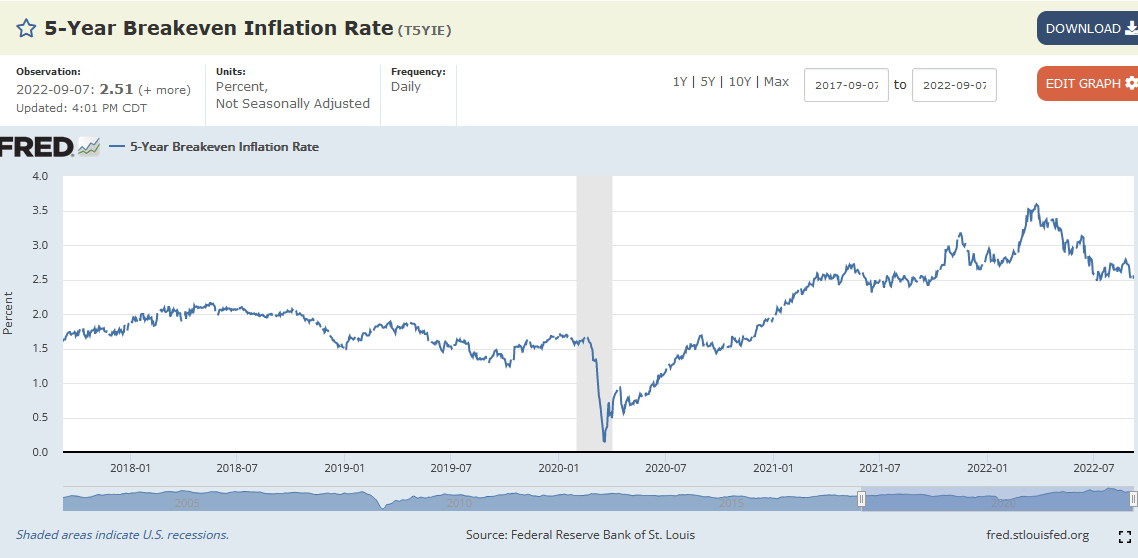

For anyone doubting the efficacy of the Fed’s plan, one only need look at 5yr inflation breakevens – which have collapsed from 3.59% in March to 2.51% today:

FRED

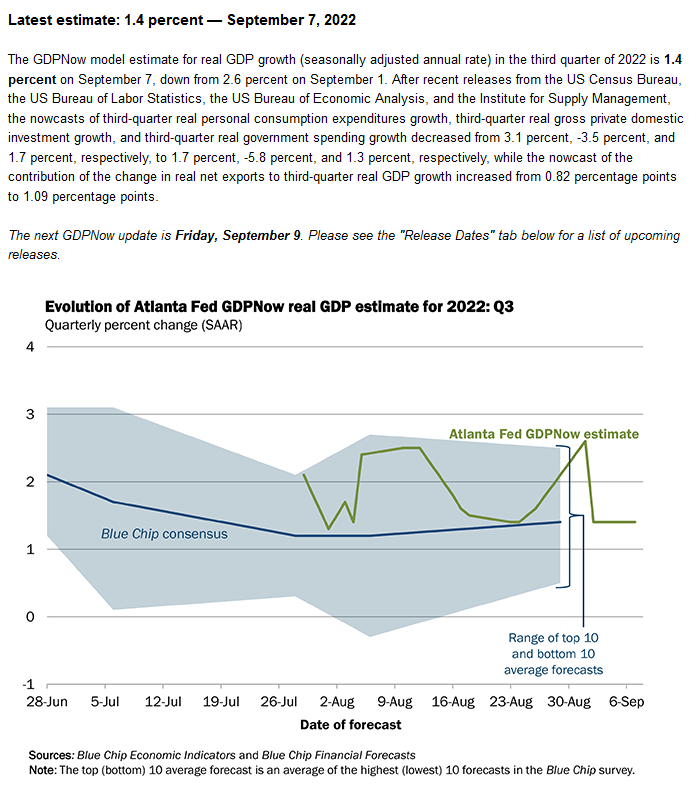

GDP also remains below trend:

BLUE CHIP

We covered these factors in detail on Tuesday with Mitch Hoch on Benzinga. Thanks to Mitch and Zoltan Suranyi for having me on.

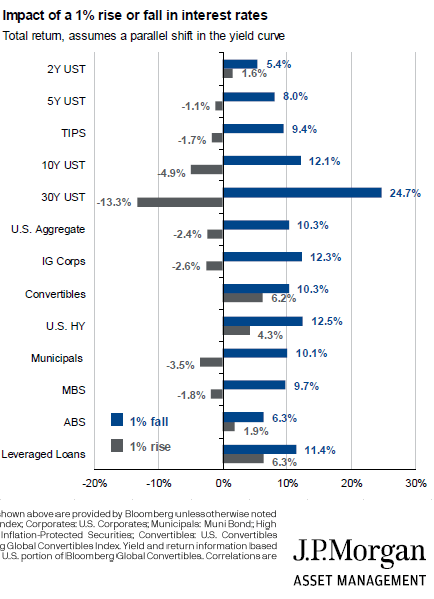

If the Fed goes less than 75bps on September 21, it will catalyze the following:

1) USD Weakness

2) High Yield Credit Markets Reopening (for companies to refinance debt)

3) A bid in risk assets (Equities, Emerging Markets, China, Biotech, etc).

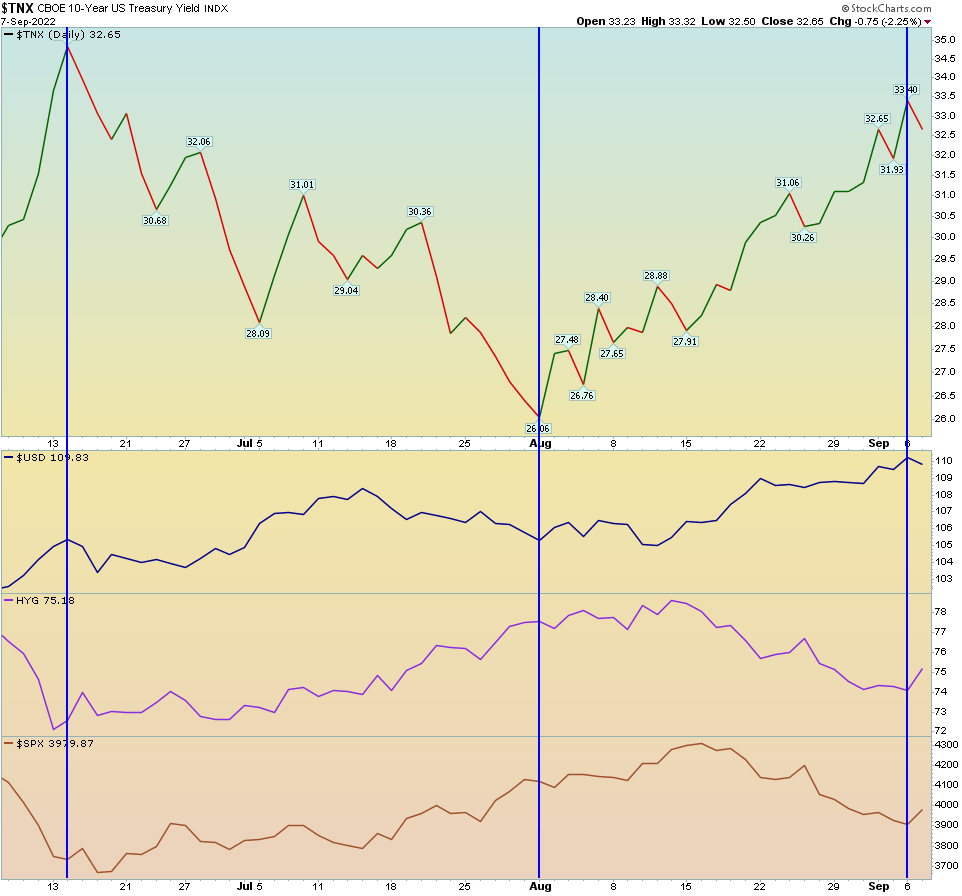

STOCKCHARTS

You can see this clearly demonstrated from the June lows (SPY) to the August highs. As rates came down, High Yield (HYG – Junk Bonds) and Equities were bid higher.

JPM

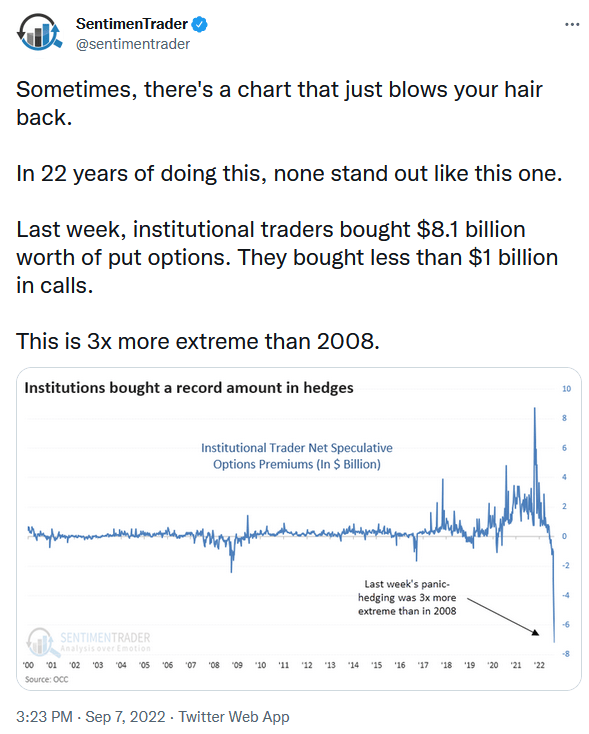

The set up for a pivot is ideal as most managers are still off-sides and hiding in cash after chasing the top in early August (and getting flushed).

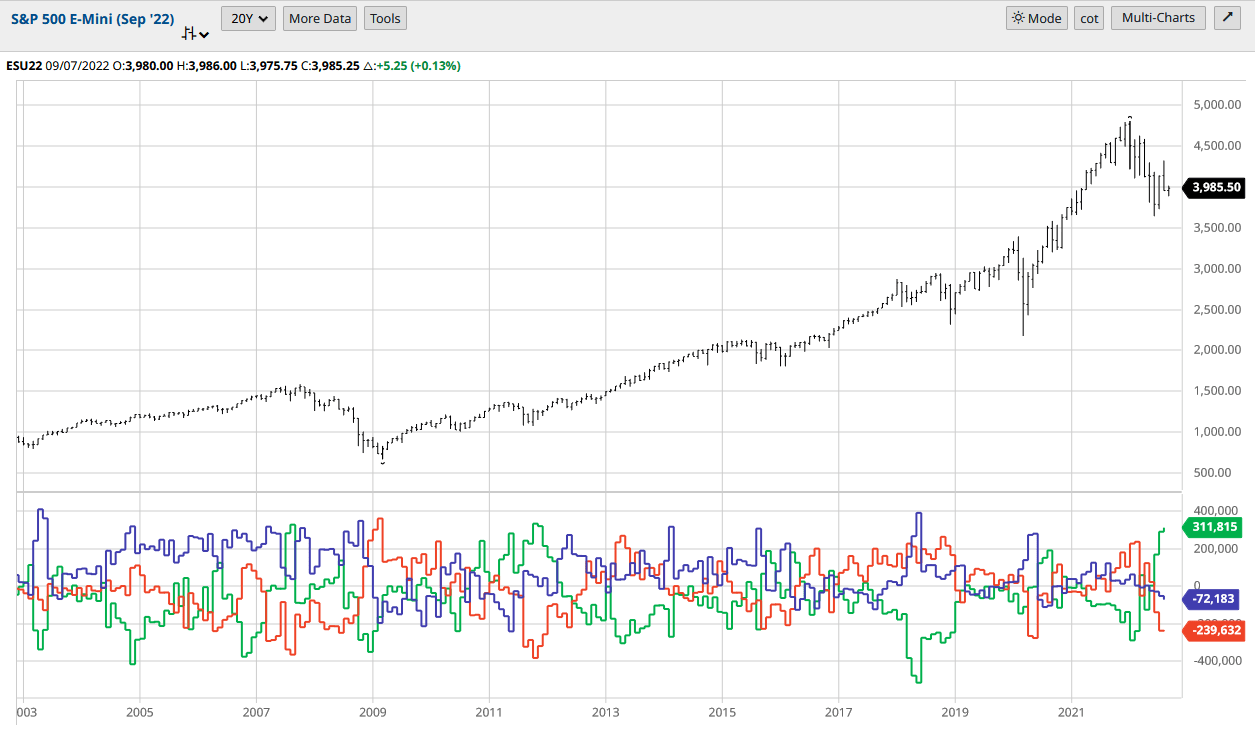

While “Dumb Money” (Large Traders – Red line at bottom of chart) are the most short equities since the pandemic lows, “Smart Money” (Commercials – Green line at bottom of chart) are the most aggressively long equities since the 2011 lows:

BARCHART BARCHART TWITTER

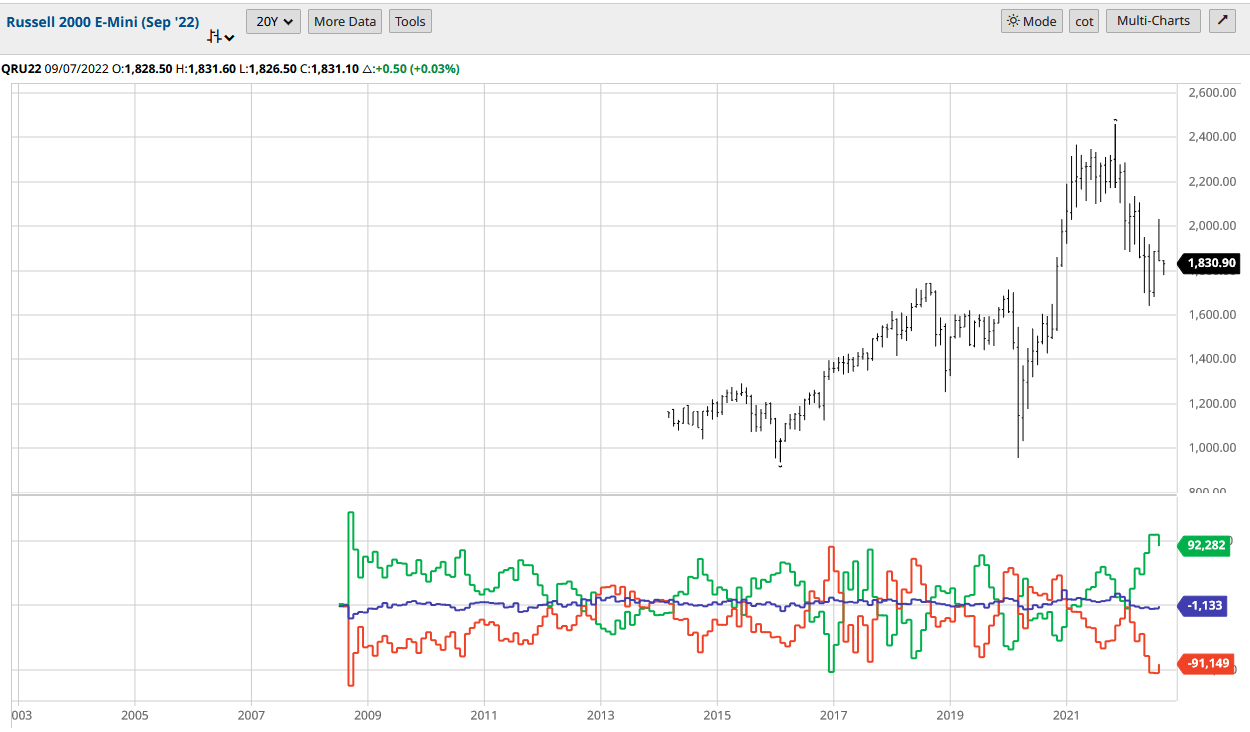

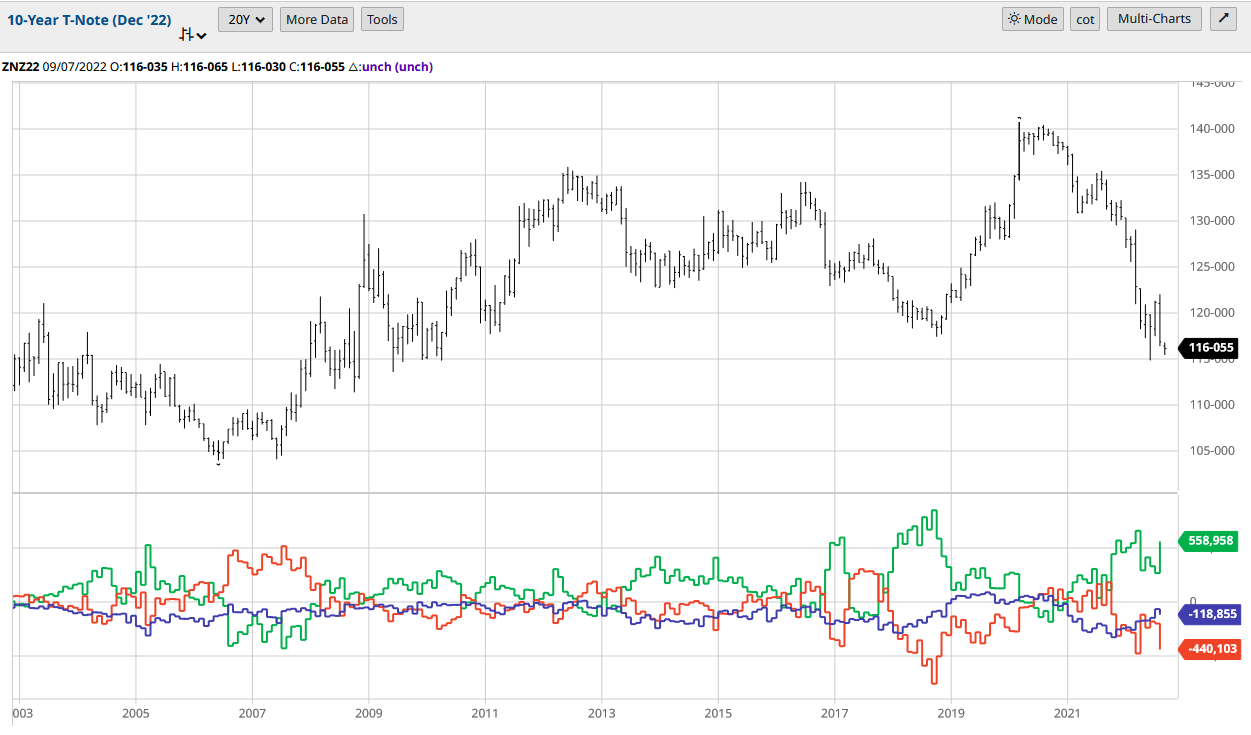

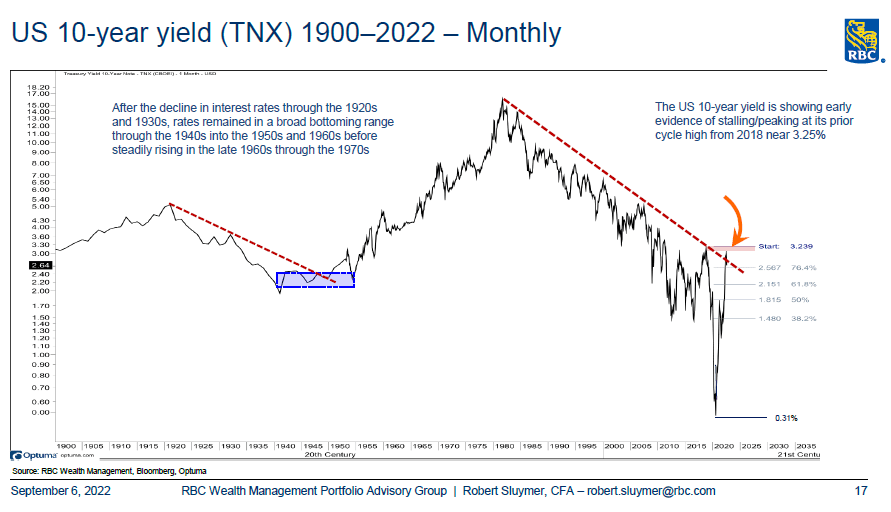

While “Dumb Money” (Large Traders – Red line at bottom of chart) are the most short 10yr Treasuries since the 2018 lows (lows in price, highs in yields), “Smart Money” (Commercials – Green line at bottom of chart) are the most aggressively long 10yr Treasuries since the 2018 lows (in price, highs in yields):

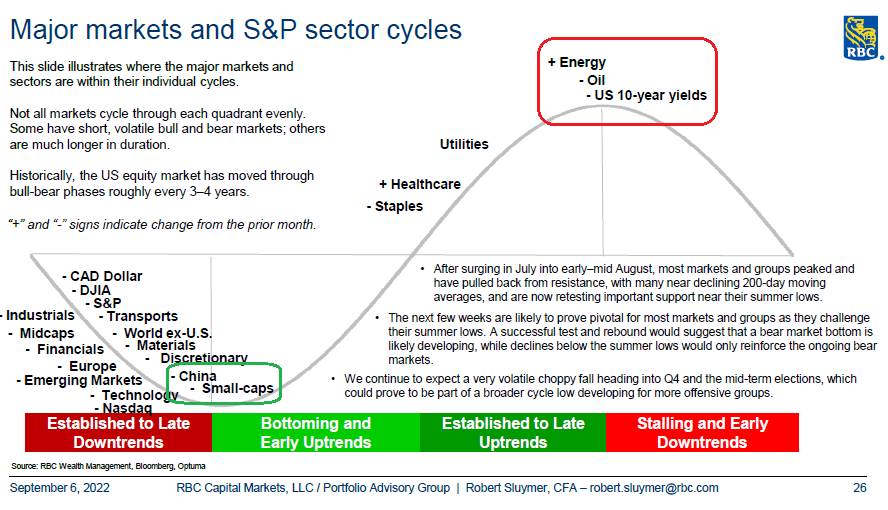

BARCHART RBC

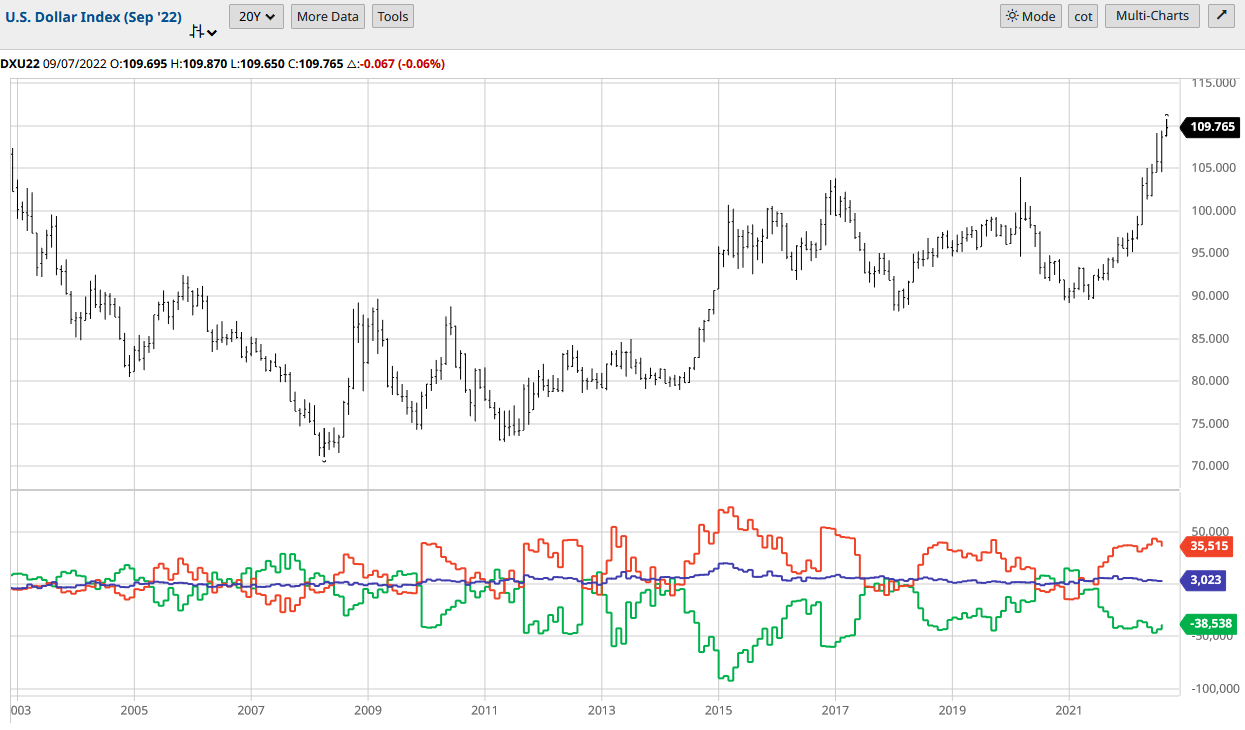

And finally, while “Dumb Money” (Large Traders – Red line at bottom of chart) are the most long US Dollar since the 2017 and 2020 highs (in price), “Smart Money” (Commercials – Green line at bottom of chart) are the most aggressively short US Dollar since the 2017 and 2020 highs (in price):

BARCHART

What side of the trade do you want to be on going into Sept 13 and Sept 21?

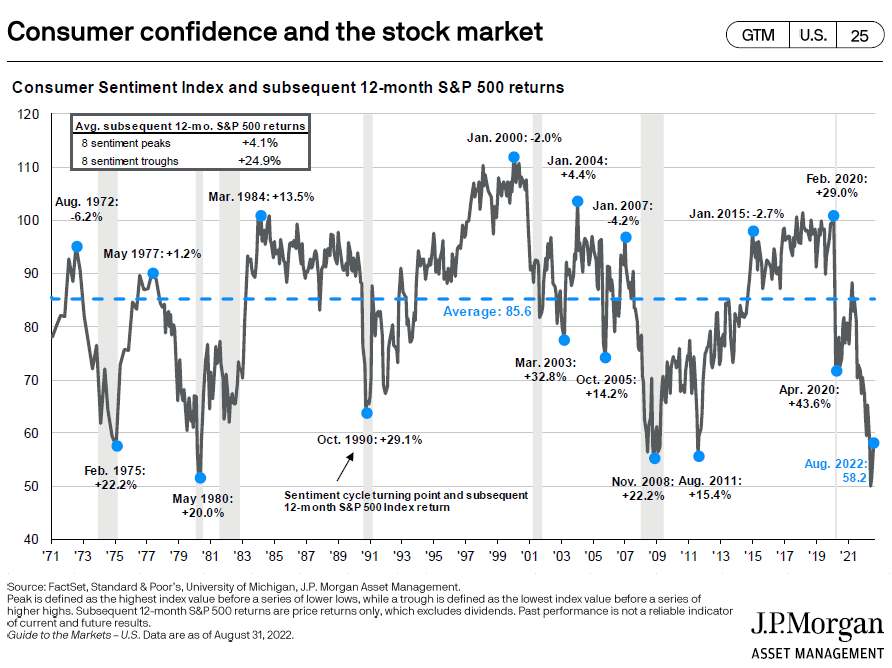

Consumer sentiment has bottomed – in line with previous major inflection points (bottoms) in previous bear markets:

JPM

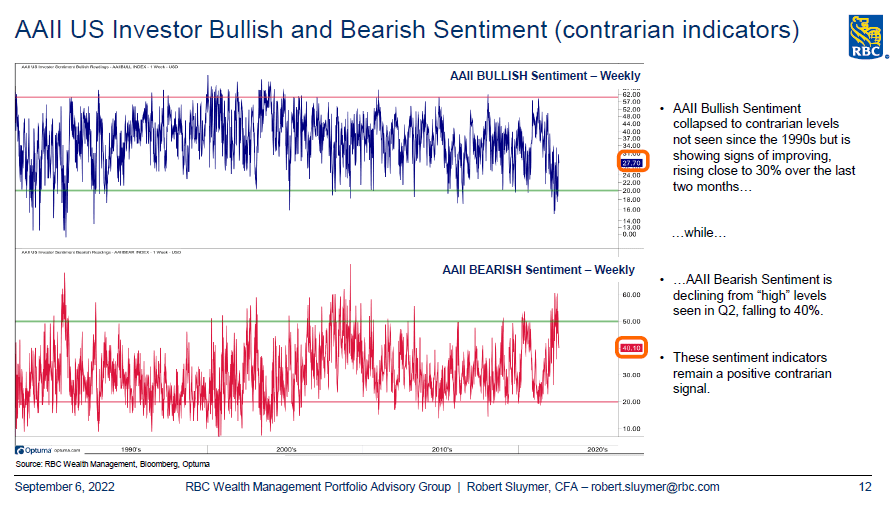

Retail Sentiment is completely flushed:

RBC

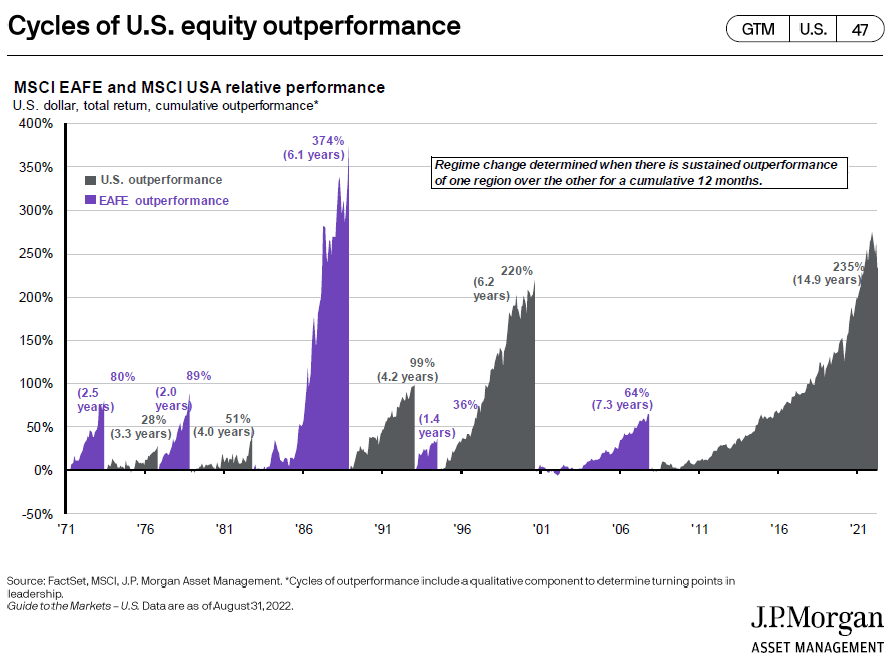

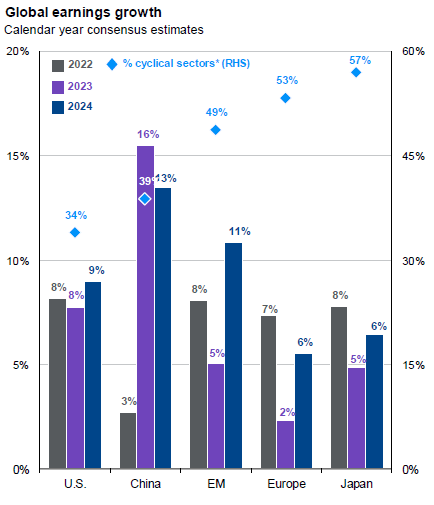

We’ve repeatedly talked about what will happen to the USD (weaker) and Emerging Market Equities (stronger) when the Fed pivots (hikes at a slower pace). Here’s a look at cycles of US vs. Non-US performance over time – followed by earnings expectations by country for next year:

JPM JPM JPM

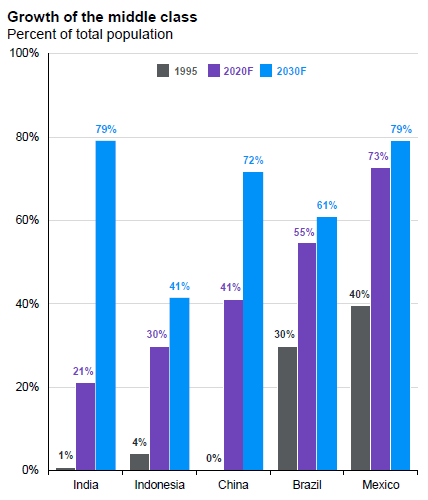

For those of you doubting the long China thesis, know that these trends are too strong for even the government to screw it up (no matter how hard they try with Zero Covid policies). They are working full time to destroy their own prosperity but will fail miserably based on demographics in the next 3-5 years (and the fact that like 1918-1920 the virus eventually dies on its own). We covered this theme extensively two weeks ago.

RBC

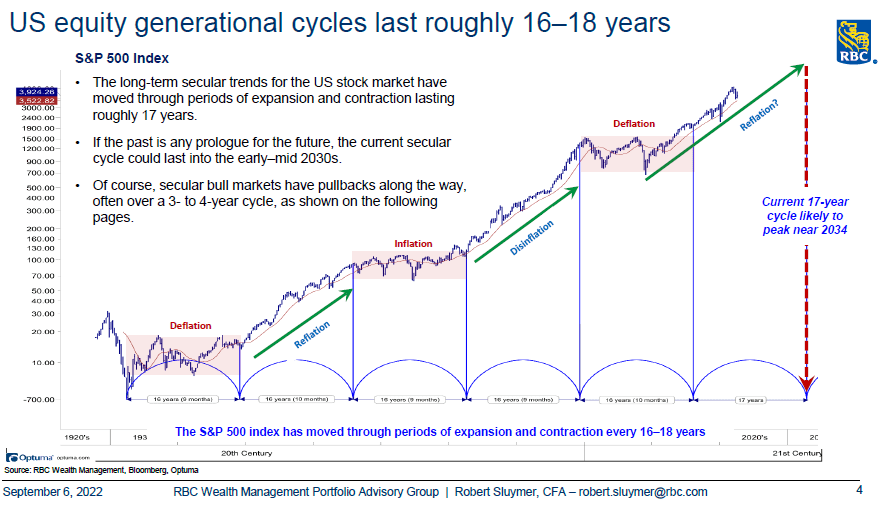

While China is well positioned for the next 3-5 years, the US is also well positioned with the Millennial population beginning housing and family formation:

RBC

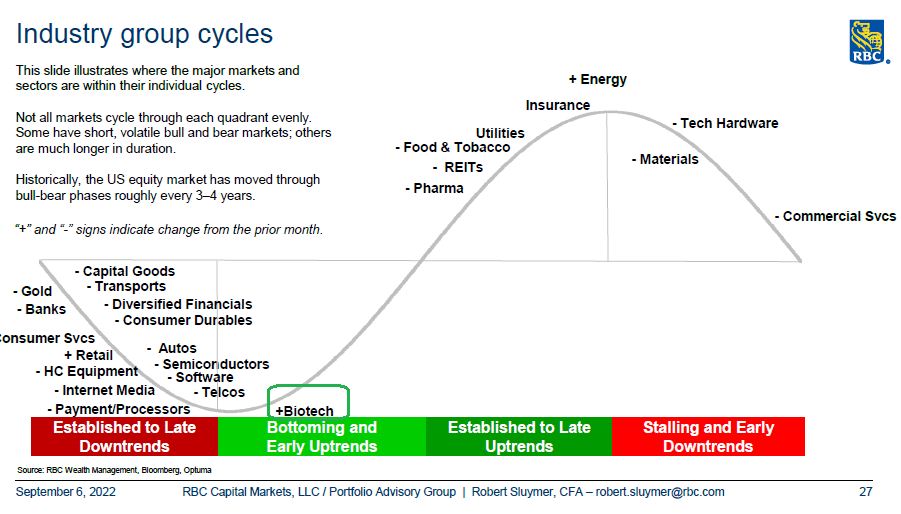

Last but not least, don’t forget about Biotech:

RBC

Now onto the shorter term view for the General Market

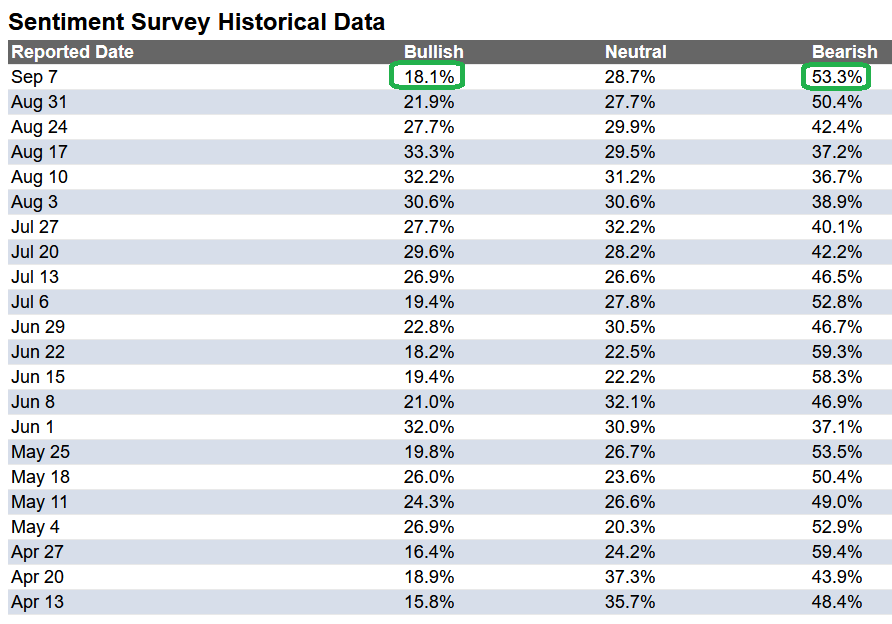

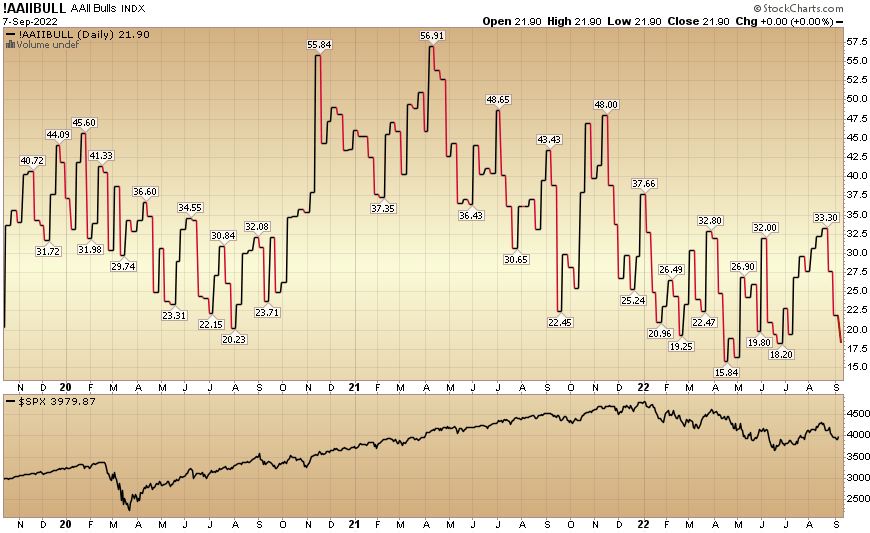

In this last week’s AAII Sentiment Survey result, Bullish Percent dropped to 18.1% from 21.9% the previous week. Bearish Percent rose to 53.3% from 50.4%. Retail investors’ fear is at June low levels again.

AAIII STOCKCHARTS

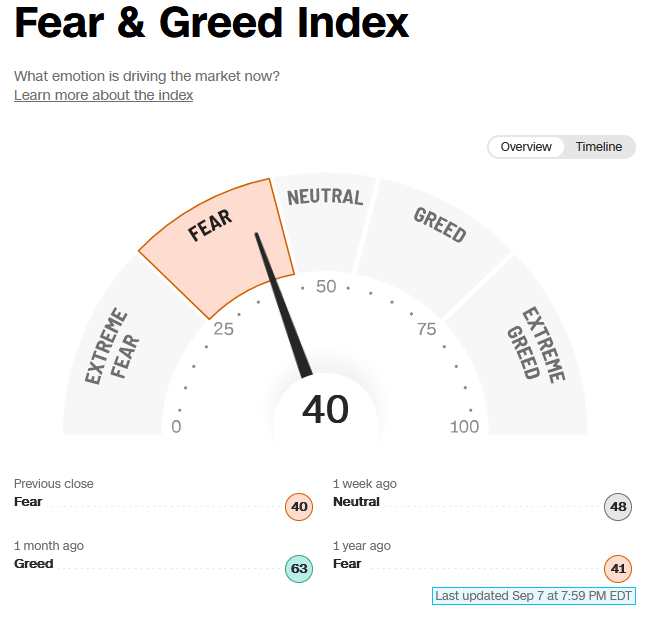

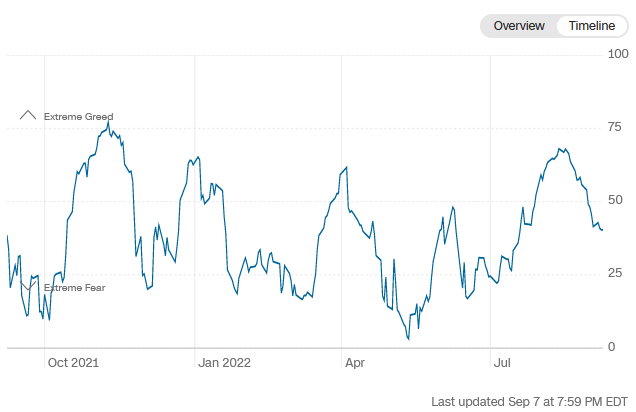

The CNN “Fear and Greed” fell from 48 last week to 40 this week. Sentiment is still fearful.

CNN CNN

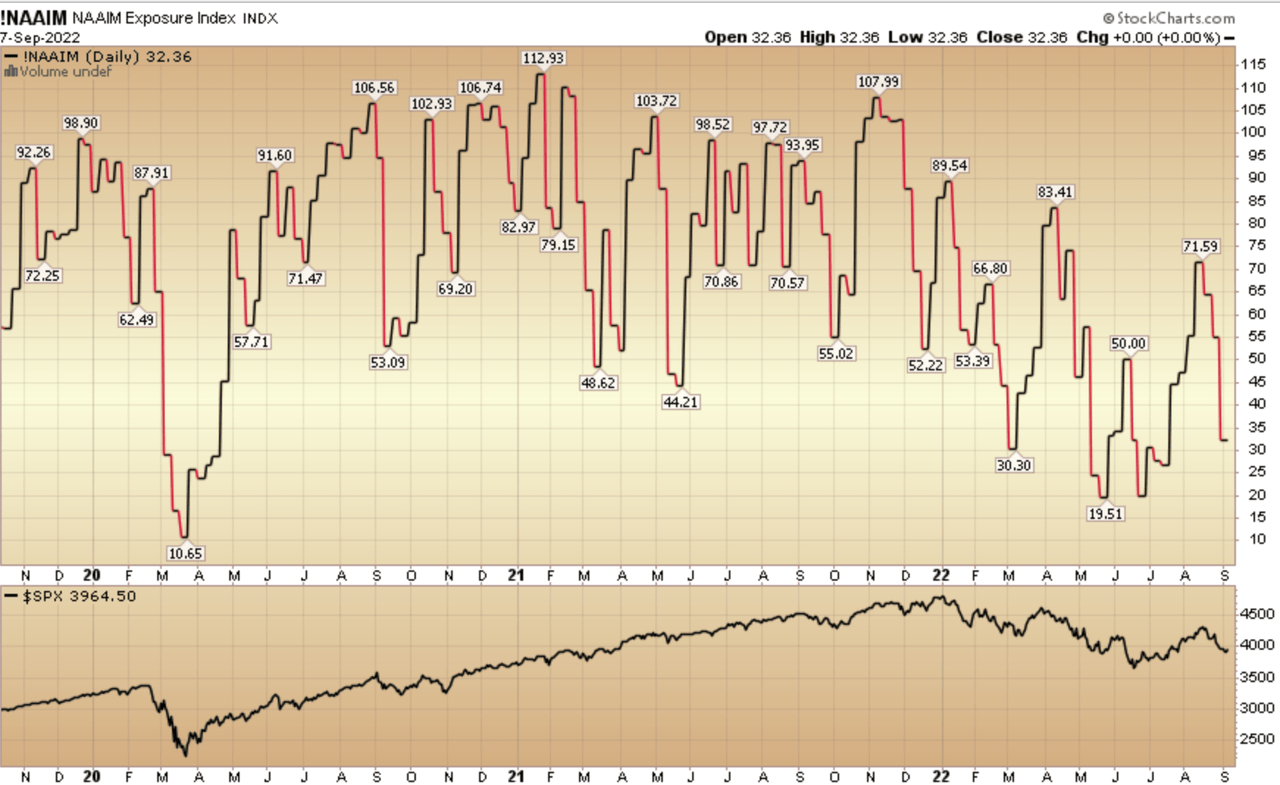

And finally, the NAAIM (National Association of Active Investment Managers Index) dropped to 32.36% this week from 54.86% equity exposure last week. Any good news and managers will be forced to chase up into year-end:

STOCKCHARTS

Author and/or clients may have beneficial holdings in any or all investments mentioned above.

Be the first to comment