Editor’s note: Seeking Alpha is proud to welcome Vittorio Bertolini as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

svetikd

In this article, we’ll explore the results of integrating 5% of Bitcoin (BTC-USD) into a traditional portfolio.

The traditional 60% equity and 40% bond portfolio

The notion of efficient portfolio management is based in modern portfolio theory. The work on this theory was done by Nobel Prize-winning economists such as Harry Markowitz, William Sharpe, and Eugene Fama. Since this seminal work, the “60/40 portfolio” has long been revered as a trusty guidepost for a moderate risk investor – a 60% allocation to equities with the intention of providing capital appreciation, and a 40% allocation to fixed income to potentially offer income while mitigating risk.

For the purposes of representing the “traditional portfolio,” we have chosen two ETFs from iShares, a brand by BlackRock, one of the biggest ETF providers worldwide. The equity component is the iShares Core S&P 500 ETF (IVV), while the bond component is represented by the iShares 7-10 Year Treasury Bond ETF (IEF) and the iShares $ Treasury Bond 7-10yr UCITS ETF (IBTM). These two ETFs together, with a monthly rebalancing logic (a process that will revisit the portfolio every month and adjust the weighting back to 60% equity and 40% bond), cover the component of equity and fixed-income exposure that we need to build a moderate risk portfolio in accordance with the efficient portfolio management theory.

Adding a Bitcoin component to the traditional Portfolio

We explored the effects of adding Bitcoin to a traditional portfolio. The Bitcoin exposure can be best replicated by buying directly into Bitcoin via Interactive Brokers or at a brokerage account with FTX, Coinbase, Kraken, Binance, etc. – just to mention a few of the most prominent ones.

We constructed a modified portfolio as follows:

- 57% equity – IVV

- 38% bonds – IEF

- 5% direct Bitcoin exposure at Interactive Brokers

We analyzed the results against the traditional 60% equity/40% bond portfolio, and the results are surprising.

On the one hand, we do know that Bitcoin performed well during this period, improving the returns over the traditional portfolio. On the other hand, Bitcoin suffered two large drawdowns of over 70% and had a consistently high volatility. As such, we would expect the modified portfolio to indeed have higher returns, but also much higher risk levels. The results might surprise you: While the returns of the modified portfolio improved substantially, the risk in terms of volatility and maximum drawdown only increased marginally.

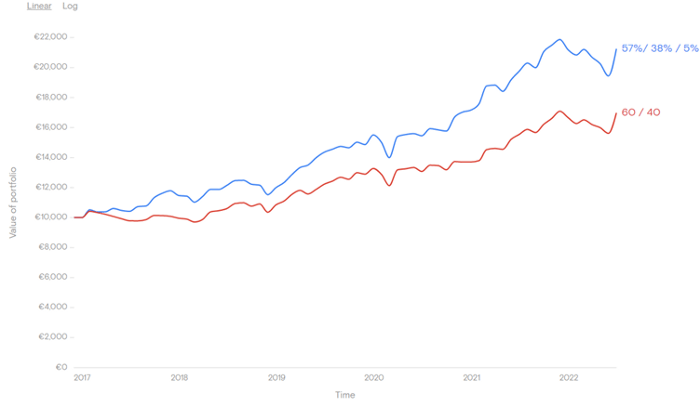

The chart below shows the performance evolution of the two portfolio strategies. Starting both from a $10,000 investment the portfolio with Bitcoin adds $11,000 to the initial investment and the traditional only $7,000. That is ~50% outperformance.

Chart: Modified and traditional 60/40 Portfolio January 2017-July 202 (www.coinfolio.capital)

Risk considerations and the efficient frontier implications

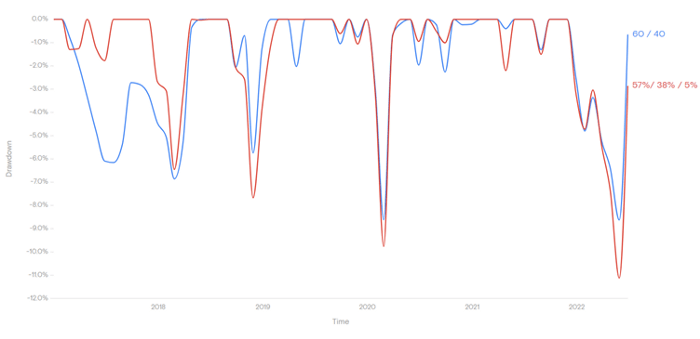

The conventional risk metrics that are used to analyze portfolios are volatility and maximum drawdown. While the traditional portfolio has returned 10.2% per year with 9.6% volatility and a Sharpe ratio of 1.1, the modified portfolio with a 5% Bitcoin allocation had a 14.85% yearly return with 10.9% volatility and a Sharpe ratio of 1.35. The other measure of risk is the overall maximum drawdown of a portfolio (see chart below). This metric is particularly helpful in addressing the weakness of the Modern Portfolio Theory, which assumes normally distributed price returns. The drawdown allows us to capture the left tail distribution during a market turmoil, providing us with an additional risk measurement.

We can observe in the graph below how the drawdowns of the two portfolios almost shadow each other. To be more precise, the modified portfolio had a maximum drawdown of 11.2% vs. a drawdown of 8.7% in the traditional portfolio. This is a solid test that even in a broad market sell-off our modified portfolio is not adding too much risk. In short, for a very limited incremental risk, we position our portfolio for a higher risk-adjusted return.

Chart: Drawdown comparison January 2017-July 2022 (coinfolio.capital)

YTD performance and forward-looking arguments

As of Sept. 22, the traditional 60/40 portfolio is down YTD 18.6%, outperforming the modified variant during this bear market. The reason can be found in the more severe Bitcoin drawdown compared to the traditional assets. Our modified portfolio has a YTD performance of -20.6%, which is indeed a worse performance in comparison. However, the amplitude is reasonable and in line with the drawdowns we saw in the past.

Trying to look into the future, we can observe that the inclusion of Bitcoin tends to slightly underperform our traditional portfolio during a bear market. But, at the same time, it is well-positioned to outperform by a considerable margin, giving it an overall better risk/reward profile.

Conclusion

The efficient frontier graphically represents portfolios that maximize returns for the risk assumed. The less synchronized the securities (i.e., the least correlated), the lower the standard deviation of the combined portfolio. In plain English: the lower the risk.

Cryptocurrencies tend to have some correlations with traditional assets, but not all the time and not in a perfect way. This fact allows us to include cryptocurrencies in a portfolio with a good chance of increasing our Sharpe ratio (a measure where risk and reward are evaluated together, which is the focal point presented in Modern Portfolio Theory). The expended asset mix choice improves our efficient frontier making for a strong case for adding a cryptocurrency component to your investment portfolio.

Be the first to comment