Neilson Barnard/Getty Images Entertainment

THE COMPANY

Business Overview

As I stated in my previous article, The Duckhorn Portfolio, Inc. (NYSE: NYSE:NAPA) (the “Company”) is a producer of luxury wines, or wines sold for $15 or higher per 750ml bottle, in North America.

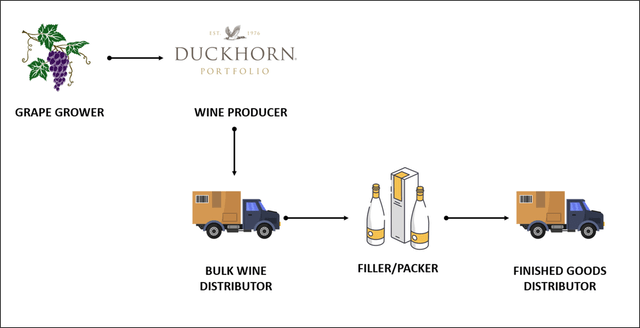

Supply Chain

Especially these days, the supply chain analysis is very important, and, for this reason, I tried to understand possible issues the Company may face along its supply chain in the future. Below, from the left to the right, you can see a representation of the typical supply chain for wine.

- Grape Grower: in the near term, this step doesn’t represent an issue for two reasons: first, because most of the grape is bought from third-party growers (more than 322 counterparties around the world); second, because of the grape’s oversupply (and hence I don’t expect near-term pressure on margins). If we think long-term, however, we can identify a clear challenge the industry may face, water shortage. Water shortage, combined with other adverse weather conditions, may adversely affect the supply of grapes and thus the price for this commodity. Since the Company is not engaged in commodity hedging, it may adversely affect its margins.

- Wine Producer: this is the step in charge of the Company.

- Bulk Wine Distributor: this step may represent a future issue for the Company due to sector consolidation, through M&A, which gives bulk wine distributors a strong contractual power.

- Filler/Packer: this step is not a major issue for the Company due to a high diversification of suppliers and the purchase of those inputs through relatively long-term contracts that cap the amount those items can increase. In fact, glass bottles come from Mexico & China (even if the Company’s aim is to have glass bottles coming 100% from the U.S.), cork comes from Portugal and metal packaging components come from the U.S. and E.U.

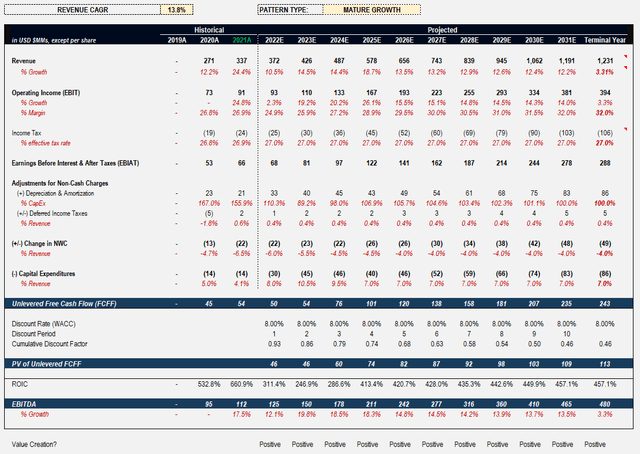

Growth Stage

I believe that the company is currently between the “high growth” and “mature growth” phases, with the latter being more likely. It doesn’t belong to a fast-growing industry. As a matter of fact, the global wine market is expected to grow at a CAGR of 5.52% in the next 10 years, while the U.S. grows at a CAGR of 6.80%, but I see enough room to expand within this slow-growing industry.

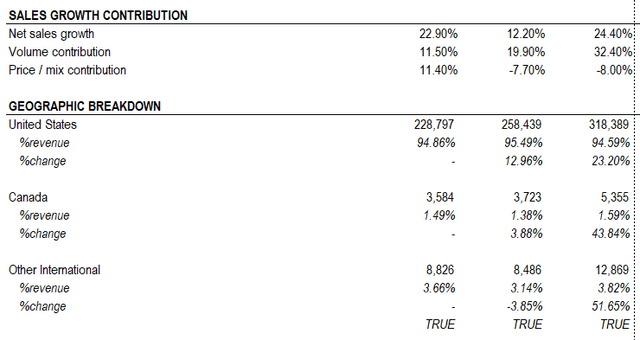

In fact, thanks to the premiumization (or shift to higher-priced wines), customers becoming more conscious about wine’s health benefits, effective marketing to attract younger generations along with its further expansion in the U.S. (the biggest wine consumer in the world) and Canada (the two markets I believe the Company should primarily focus) will allow the Company to expand within this low-growing industry by taking over the market share of competitors.

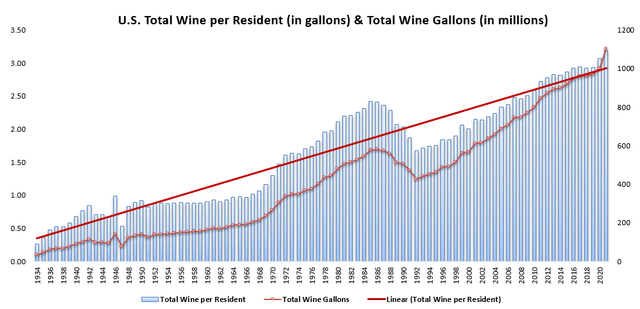

Moreover, the U.S. total wine per capita keeps growing at a steady rate.

COMPANY VALUATION

Financial Statement Analysis

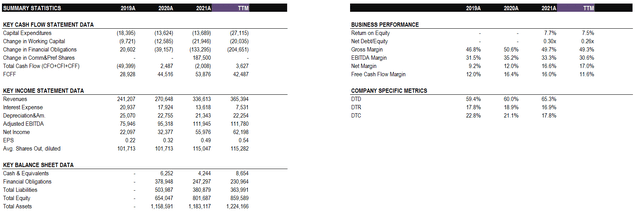

Below, is a summary of the key statements data.

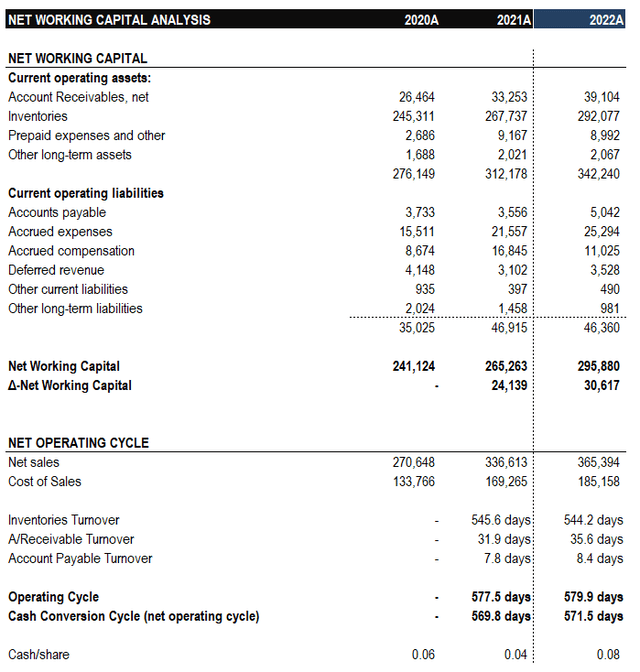

As you can see from the numbers, the Company is free cash flow positive, which is good but not as much as it could be if the Company was able to unlock its full potential. In fact, by analyzing the cash conversion cycle we can identify some of the issues which cannot be assessed by looking only at the free cash flow number.

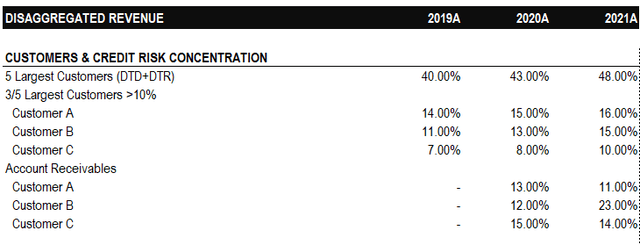

As you can see the net working capital is positive, which is good in theory, since our current assets are growing at a faster rate than our current liabilities, however, it’s not that good from the cash flow perspective since more cash is tied to operations. So, I asked myself a question: “Is there any way in which the company can improve its free cash flows by managing effectively its net working capital?” the answer is Yes.. but with a caveat. In fact, by increasing the number of days it takes on average to pay its suppliers (the “easy” part) and reducing the time it takes on average to collect credit from its customers (the “hard” part) it can improve its free cash flow structure. The latter, however, is the hard part due to the Company’s customer concentration risk which leaves the company without the selling power/negotiating leverage. In fact, as you can see below, the 5 largest customers account for more than 45% of the Company’s total revenue.

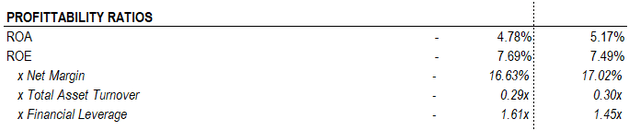

For the remaining part of the analysis, I tried to assess the Company’s financial health. Overall, the Company is very healthy with a strong balance sheet and strong top-line and bottom-line numbers. The interest-bearing debt component is very low and ROE is currently 7.5% vs Cost of Equity of 8.45%.

How much do we expect to make?

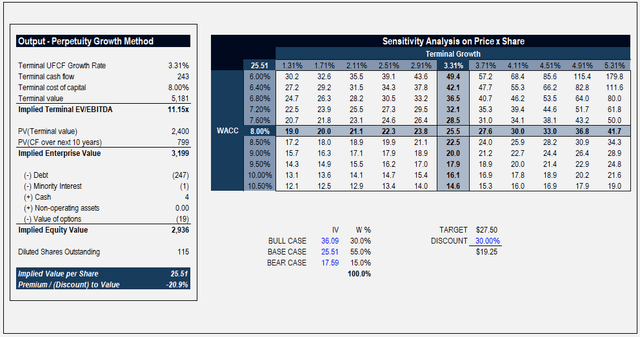

In order to answer the above question, I performed a discounted cash flow analysis under 3 different scenarios and in the end I computed the probability-weighted target price. The target price is $27.50/share.

The three scenarios with their respective probabilities are:

- Bear-Case Scenario (15% probability) – $17.59/share: Under this scenario, the Company’s current valuation doesn’t reflect any upside. This scenario assumes a positive price/mix with on-premise converging to but remaining below its historical norms. The impact of inflation is much higher than initially expected translating into the bottom line margin compression. Finally, I also assume that customers retain their buyer power due to the Company’s inability to diversify its customer base.

- Base-Case Scenario (55% probability) – $25.51/share: This is where consensus lies. This scenario assumes a slightly positive price/mix, a strong volume growth for off-premise, off-premise to on-premise going back to its historical norm 80-20, and the e-commerce segment taking off. The impact of inflation is in line with current expectations and it is effectively managed through a price increase that doesn’t affect the overall demand.

- Bull-Case Scenario (30% probability) – $36.09/share: This is where the true opportunity lies. This scenario assumes a negative price/mix demonstrating that increased sales volumes continue to be the primary driver for the top line. In fact, the pace of volume growth for off-premise is strong and on-premise keeps growing at a steady state. The impact of inflation is effectively mitigated and the Company is able to effectively lower its customer concentration risk and increase the value of its free cash flows. Finally, an effective marketing campaign attracts new young customers.

Finally, below you can see the numbers obtained under my base-case scenario.

Competition

The competition is represented by established and well-known companies, with many of them being private. In particular, in the U.S., wine sales are relatively concentrated among a limited number of large suppliers like E&J Gallo, Constellation (STZ), Trinchero, Jackson Family Wines, Ste. Michelle and The Wine Group.

Investment Risks

Inflation Risk (near-term): if not effectively managed, inflation may represent a big headwind and cause a bottom-line margins compressions. According to the latest updates provided by the management so far inflation has not been a big headwind, with the Company seeing its effect through relatively higher prices for glass, higher costs of new equipment (that’s why the management provided an updated CapEx number which is driven by higher cost of new equipment), higher travel costs (for salesmen).

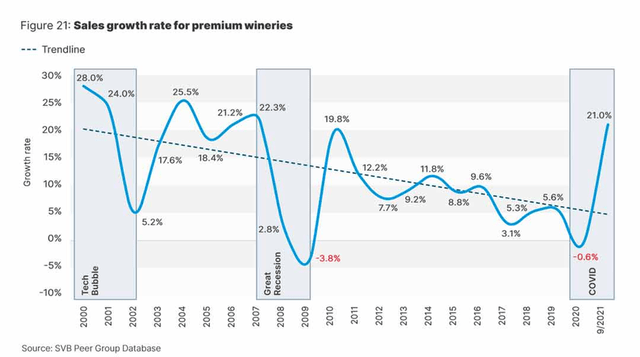

Recession Risk (near-term): I put it in the risk category even if I don’t see it as a real headwind for the Company. Historically, the wine sector performed very well notwithstanding the recessionary period. Moreover, the Company’s focus on high-end customers should guarantee a higher shield against an industry’s drop in demand. Below you can see the sales growth rate for premium wineries from 2000.

Customer Concentration Risk (near to long-term): In my opinion, this is the biggest headwind I see for the Company since without customer diversification it cannot create “selling power” and this may negatively affect the dollar value per sale.

Access to water (long-term): this is a very big challenge as the water supply is becoming less secure and may transform into severe shortages. Water shortages may drive prices for grapes higher and thus adversely affect the Company’s overall profitability.

Key Catalysts

On-premise / e-commerce: Currently, we are well below the historical norm for off-premise to on-premise, however, it continues to move back toward pre-COVID levels. Recalling that, on-premise/e-commerce carries higher dollar value per sale and higher margins, if the company is able to grow effectively its on-premise and e-commerce, it will represent a big tailwind for its top and bottom line.

Premiumization: Over the last decade, wine-drinkers spent more dollars on bottles of wine. This trend can be interpreted as a whole generation getting wealthier and older (and thus willing to buy high-quality wine), as a new generation willing to pay more for items perceived to be superior, or as a mix of both. I believe it’s a mix of both and if the Company will be able to effectively attract younger customers, it will allow it to gain significant market share.

Market expansions: As of December 31, 2021, Canada represents only 1.59% of the Company’s total revenue. If the Company will be able to effectively replicate the job it is doing in the U.S., Canada will be a big long-term catalyst.

FINAL REMARKS

I keep the “BUY” rating on the stock with a fair value of $27.50/share, which implies a 26.6% discount vs. the current price of $20.17.

What am I doing personally? With the release of the Q3 results, I reduced my overall position driven by the belief of seeing additional downward pressure on the whole stock market, and thus on the Company too. Since then, I haven’t increased my stake in the Company. My plan is to increase my stake, if affordable and not overpriced at that point in time, through LEAPS call options.

Be the first to comment