Sashkinw

Dividend Kings are great companies that have increased their annual dividend payouts for 50 or more consecutive years! This achievement is remarkable because these companies have delivered ever-increasing dividends to investors through economic recessions, market crashes, technological revolutions, and changes in consumer tastes!

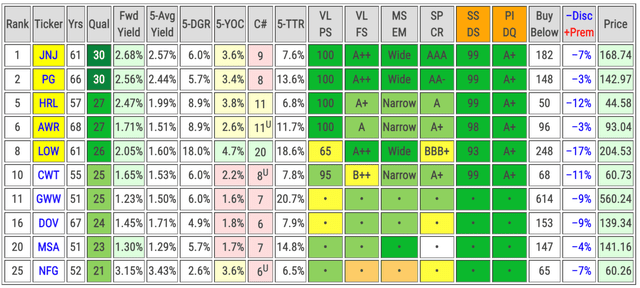

In this article, I rank the Dividend Kings using quality scores obtained from a variation of DVK Quality Snapshots in which I replaced one quality indicator and added another. With a total of six quality indicators, each scored out of 5 points, the version of Quality Snapshots I’m using in this article has a maximum quality score of 30 points.

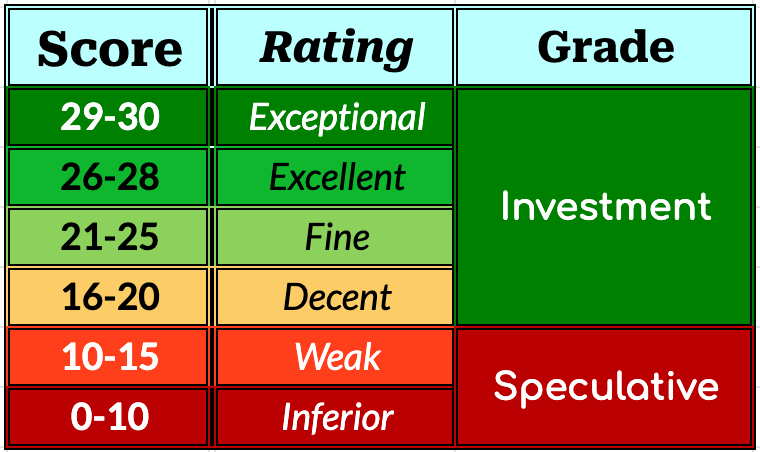

Based on their quality scores, I rate stocks as Exceptional (29-30), Excellent (26-28), Fine (21-25), Decent (16-20), Poor (11-15), and Inferior (0-10). Investment Grade ratings have quality scores in the range of 16-30, while Speculative Grade ratings have quality scores below 16 points.

This article updates one I wrote in April 2022. While the scoring system is different, the general layout of this article is quite similar, and, inevitably, I’m using similar descriptions and explanations.

Membership

Membership of the Dividend Kings is not defined by any organization or authority but is based on the stock’s dividend increase streak. We use ten different bases to determine membership of Dividend Radar, retaining the longest as a stock’s dividend streak. We consider only actual payouts declared and paid when determining dividend streaks. Stocks like Altria (MO) and AbbVie (ABBV) do not qualify as Dividend Kings based on how we calculate dividend streaks.

However, as with last year’s article, I decided to be inclusive and use multiple membership sources.

Here are those sources and the number of Dividend Kings recognized by each source:

- Portfolio Insight (39)

- Simply Safe Dividends (47)

- Dividend Power (39)

- Dividend Growth Investor (45)

- Dividend Value Builder (45)

- The Motley Fool (43)

Combining these membership lists resulted in 49 different stocks, but I only included stocks with agreement from at least four of the six sources. With six stocks so eliminated, I’m ranking 43 Dividend Kings in this article.

Quality Snapshots

In April 2019, David Van Knapp presented a simple yet elegant quality scoring system for dividend growth [DG] stocks. The system (dubbed Quality Snapshots) employs five widely used quality indicators from independent sources and assigns 0-5 points to each quality indicator for a maximum of 25 points.

While Quality Snapshots does a remarkable job of identifying high-quality stocks, it has a shortcoming in that two of the five quality indicators are supplied by Value Line. This means that a stock not covered by Value Line will miss out on 10 of 25 quality points.

To make matters worse, one of Value Line’s quality indicators (Safety Rank) is an average of two other Value Line metrics, Financial Strength and Price Stability. But Financial Strength already serves as a quality indicator, so, effectively, Price Stability accounts for 2.5 points and Financial Strength for 7.5 points out of 25.

I’ve been experimenting with variations of Quality Snapshots in an attempt to address these shortcomings. In recent articles, I’ve replaced Safety Rank with Price Stability to have each quality indicator contribute exactly 5 points. Of course, this change does not address the issue of having two quality indicators from the same source and having an outsized impact on a stock’s quality score.

This month, I’ve added a sixth quality indicator to Quality Snapshots, Portfolio Insight’s Dividend Quality Grade. Adding one more quality indicator boosts the maximum quality score to 30 points, so a stock lacking Value Line coverage can still earn 20 points (and a Decent rating).

See December’s edition of my 10 Dividend Growth Stocks series for details on the Dividend Quality Grade.

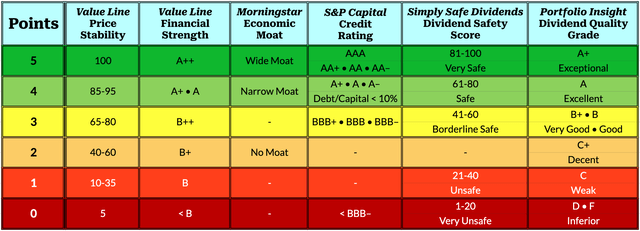

The following table shows how I assigned quality points per quality indicator:

Created by the author

Here are the changes I introduced to DVK Quality Snapshots for this article:

[1] Value Line’s Price Stability replaces Value Line’s Safety Rank

Price Stability is based on a ranking of the standard deviation (a measure of volatility) of weekly percent changes in the price of a company’s stock over the last five years. It is reported on a scale of 100 (highest) to 5 (lowest) in increments of 5. I assigned scores for Price Stability to somewhat match the distribution of scores of the other quality indicators.

[2] Value Line’s Financial Strength is scored differently

A scores 4 points instead of 3 points, and B++ moves up to fill the 3 points slot. I decided to make this change after comparing the distribution of scores for Financial Strength to the other quality indicators.

[3] Added a new quality indicator, Portfolio Insight’s Dividend Quality Grade

With access to a pre-release version of the Dividend Quality Grade, I considered the distribution of Dividend Quality Grades of Dividend Radar stocks to assign grades to different point slots.

With six quality indicators and up to five points available per indicator, the maximum quality score is 30 points (instead of 25):

Created by the author

Key Metrics and Valuations

The following sections present 43 Dividend Kings ranked by quality score. I use the following tie-breakers to rank stocks with the same quality score:

- Simply Safe Dividends Dividend Safety Scores

- S&P Global’s Credit Ratings

- Forward Dividend Yield

Each table below presents key metrics of interest to dividend growth investors, along with quality indicators and my Buy Below price:

|

Color-coding

|

My risk-adjusted Buy Below price allows a premium of up to 10% for stocks rated Exceptional and a premium of up to 5% for stocks rated Excellent. In contrast, my Buy Below price equals my fair value estimate for stocks rated Fine, while I require a discount of at least 10% for Decent stocks. I’m not interested in buying stocks rated Poor or Inferior.

I use a survey approach to estimate fair value, referencing fair value estimates and price targets from several online sources, including Portfolio Insight, Morningstar, and Finbox. Additionally, I estimate fair value using the 5-year average dividend yield of each stock using data from Portfolio Insight. With several estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my fair value estimate.

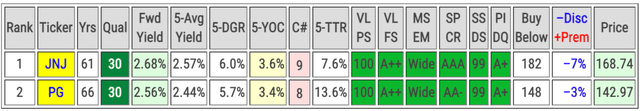

Dividend Kings rated Exceptional

The first table contains the highest-quality Dividend Kings.

Data sources: Portfolio Insight, Value Line, Morningstar, S&P Global, and Simply Safe Dividends

| Rank | Company (Ticker) | Sector | Supersector |

| 1 | Johnson & Johnson (JNJ) | Health Care | Defensive |

| 2 | Procter & Gamble (PG) | Consumer Staples | Defensive |

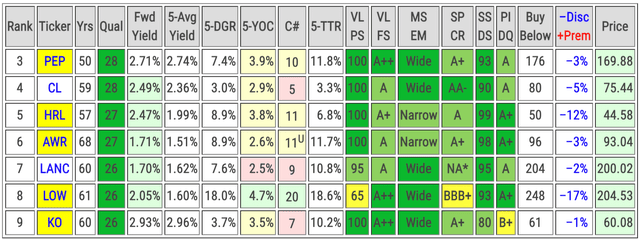

Dividend Kings rated Excellent

The following table contains high-quality Dividend Kings with quality scores of 26-28.

Data sources: Portfolio Insight, Value Line, Morningstar, S&P Global, and Simply Safe Dividends

| Rank | Company (Ticker) | Sector | Supersector |

| 3 | PepsiCo (PEP) | Consumer Staples | Defensive |

| 4 | Colgate-Palmolive (CL) | Consumer Staples | Defensive |

| 5 | Hormel Foods (HRL) | Consumer Staples | Defensive |

| 6 | American States Water (AWR) | Utilities | Defensive |

| 7 | Lancaster Colony (LANC) | Consumer Staples | Defensive |

| 8 | Lowe’s (LOW) | Consumer Discretionary | Cyclical |

| 9 | Coca-Cola (KO) | Consumer Staples | Defensive |

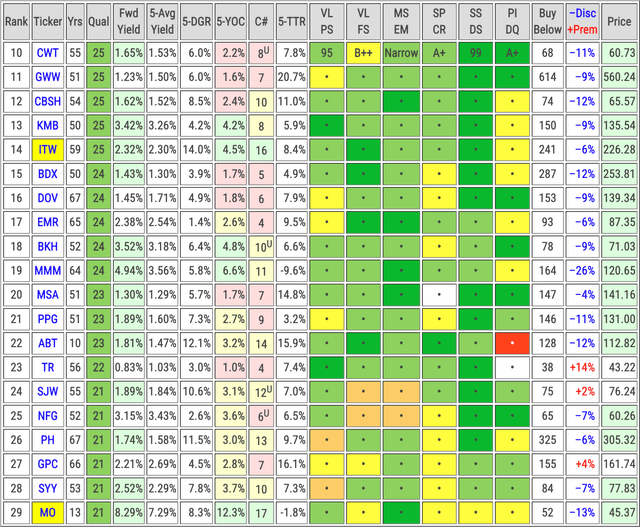

Dividend Kings rated Fine

The following table contains quality stocks with quality scores of 21-25.

Please note that I only show the grades/indices/ratings/scores of the ten top-ranked Dividend Kings in this article.

Data sources: Portfolio Insight, Value Line, Morningstar, S&P Global, and Simply Safe Dividends

| Rank | Company (Ticker) | Sector | Supersector |

| 10 | California Water Service (CWT) | Utilities | Defensive |

| 11 | W.W. Grainger (GWW) | Industrials | Sensitive |

| 12 | Commerce Bancshares (CBSH) | Financials | Cyclical |

| 13 | Kimberly-Clark (KMB) | Consumer Staples | Defensive |

| 14 | Illinois Tool Works (ITW) | Industrials | Sensitive |

| 15 | Becton, Dickinson (BDX) | Health Care | Defensive |

| 16 | Dover (DOV) | Industrials | Sensitive |

| 17 | Emerson Electric (EMR) | Industrials | Sensitive |

| 18 | Black Hills (BKH) | Utilities | Defensive |

| 19 | 3M (MMM) | Industrials | Sensitive |

| 20 | MSA Safety (MSA) | Industrials | Sensitive |

| 21 | PPG Industries (PPG) | Materials | Cyclical |

| 22 | Abbott Laboratories (ABT) | Health Care | Defensive |

| 23 | Tootsie Roll Industries (TR) | Consumer Staples | Defensive |

| 24 | SJW (SJW) | Utilities | Defensive |

| 25 | National Fuel Gas (NFG) | Utilities | Defensive |

| 26 | Parker-Hannifin (PH) | Industrials | Sensitive |

| 27 | Genuine Parts (GPC) | Consumer Discretionary | Cyclical |

| 28 | Sysco (SYY) | Consumer Staples | Defensive |

| 29 | Altria (MO) | Consumer Staples | Defensive |

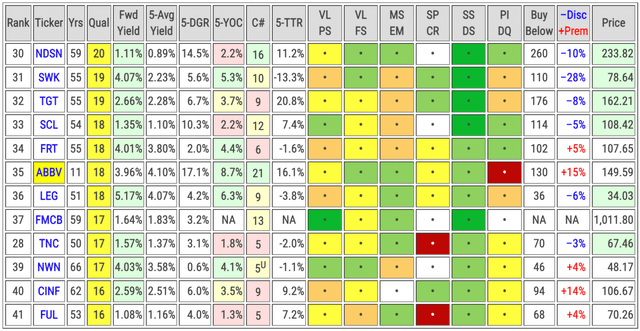

Dividend Kings rated Decent

The following table contains stocks with quality scores of 16-19.

Data sources: Portfolio Insight, Value Line, Morningstar, S&P Global, and Simply Safe Dividends

| Rank | Company (Ticker) | Sector | Supersector |

| 30 | Nordson (NDSN) | Industrials | Sensitive |

| 31 | Stanley Black & Decker (SWK) | Industrials | Sensitive |

| 32 | Target (TGT) | Consumer Discretionary | Cyclical |

| 33 | Stepan (SCL) | Materials | Cyclical |

| 34 | Federal Realty Investment (FRT) | Real Estate | Cyclical |

| 35 | AbbVie (ABBV) | Health Care | Defensive |

| 36 | Leggett & Platt (LEG) | Consumer Discretionary | Cyclical |

| 37 | Farmers & Merchants Bancorp (OTCQX:FMCB) | Financials | Cyclical |

| 38 | Tennant (TNC) | Industrials | Sensitive |

| 39 | Northwest Natural (NWN) | Utilities | Defensive |

| 40 | Cincinnati Financial (CINF) | Financials | Cyclical |

| 41 | H.B. Fuller (FUL) | Materials | Cyclical |

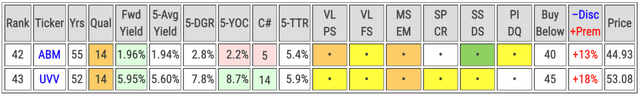

Dividend Kings rated Poor

The stocks in the last table are the lowest-quality Dividend Kings and stocks I consider to be Speculative Grade stocks.

Data sources: Portfolio Insight, Value Line, Morningstar, S&P Global, and Simply Safe Dividends

| Rank | Company (Ticker) | Sector | Supersector |

| 42 | ABM Industries (ABM) | Industrials | Sensitive |

| 43 | Universal (UVV) | Consumer Staples | Defensive |

Dividend Kings: Top Opportunities

In this section, I’ll use several screens to identify Dividend Kings with favorable valuations and compelling metrics.

By favorable valuations, I mean stocks trading below my risk-adjusted Buy Below prices and stocks whose forward dividend yield exceeds the 5-year average dividend yield. In the tables, these are the stocks with green cells in the Fwd Yield and Price columns.

By compelling metrics, I mean stocks with the best growth and income outlooks and those offering the safest dividends.

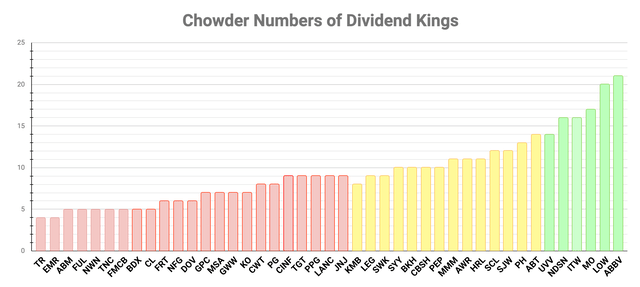

Best Growth Outlook

The Chowder Number is a popular metric for screening DG stocks. It sums a stock’s forward yield and 5-year DGR and measures the likelihood that it will deliver annualized total returns of at least 8%, according to the Chowder Rule.

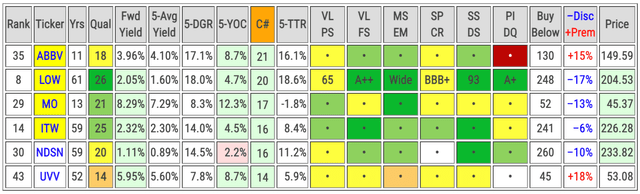

Here are the Dividend Kings sorted by their Chowder Numbers:

Created by the author (Data Sources: Portfolio Insight and Simply Safe Dividends)

Stocks with favorable Chowder Numbers are colored green in the chart above. Based on their Chowder Numbers, these stocks will likely deliver annualized total returns of at least 8%.

Data sources: Portfolio Insight, Value Line, Morningstar, S&P Global, and Simply Safe Dividends

Four of these stocks are trading below my Buy Below prices and have forward dividend yields exceeding the 5-year average dividend yields.

Lowe’s (LOW) has the highest quality score and an impressive 5-year dividend growth rate [DGR] of 18%, though its forward dividend yield is a bit low at 2.05%.

Some DG investors avoid low-yield stocks, perhaps because they’re income investors who use dividends to cover expenses. But investing in some high-DGR/low-yield stocks could be quite lucrative! Compare LOW’s total returns to the S&P 500 (represented by SPY). LOW significantly outperformed the S&P 500, returning 539% versus SPY’s 219% for a margin of 2.46-to-1!

Portfolio-Insight.com

Sustainably high dividend growth is only possible on the strength of comparable earnings growth, and the market tends to recognize such growth by bidding up the stock price, which in turn keeps the yield low. (LOW’s 5-year non-GAAP EPS growth rate is about 25%).

LOW’s non-GAAP payout ratio is very low at only 35%, so LOW has plenty of room to continue paying and raising its dividend!

Best Income Outlook

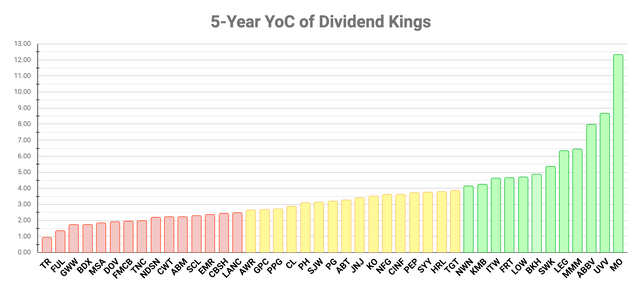

The 5-year yield on cost is an income-oriented metric indicating your expected yield on cost after you buy a stock and hold it for five years, assuming the same 5-year dividend growth rate is maintained. I look for a 5-year yield on cost of at least 4.0%.

To calculate the 5-year yield on cost is easy:

5-YOC = Fwd Yield × (1 + 5-DGR)^5

Here, ^5 means to the 5th power.

Here are the Dividend Kings sorted by the 5-year yield on cost metric:

Created by the author (Data Sources: Portfolio Insight and Simply Safe Dividends)

The following stocks have a 5-year yield on cost of at least 4%:

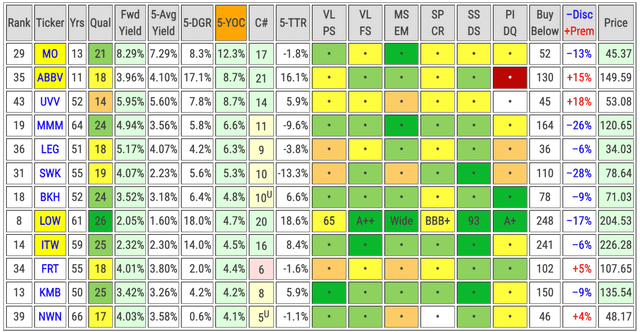

Data sources: Portfolio Insight, Value Line, Morningstar, S&P Global, and Simply Safe Dividends

Eight candidates are discounted relative to my Buy Below prices, and all of them have forward dividend yields above their 5-year average dividend yields.

Altria (MO) tops the list with a 5-year yield on cost of 12.3%, thanks to a very high forward yield of 8.29%. I’m skeptical of such high yields, especially if the stock’s non-GAAP payout ratio exceeds 60%. MO’s payout ratio is 82%, and it is not surprising that Simply Safe Dividends deems the dividend Borderline Safe.

3M (MMM) is rated Fine with a quality score of 24, but I divested from the stock due to the company’s litigation risks. While the 26% discount looks attractive, I don’t recommend buying MMM at this time. Stanley Black & Decker (SWK) offers an even larger discount, but its quality score of 19 gives me pause. The company faces macroeconomic headwinds, falling margins, and high debt.

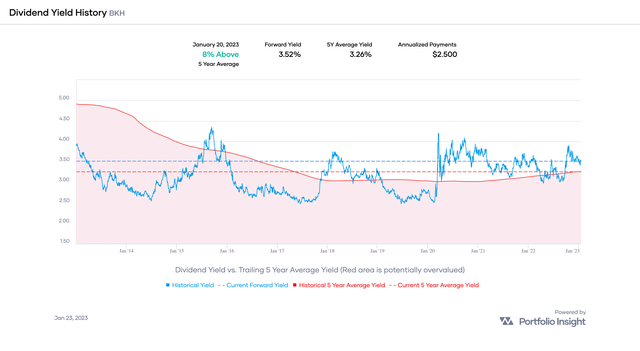

Further down the list of discounted stocks, Black Hills (BKH) has a generous forward dividend yield of 3.52% and a Safe dividend, according to data Simply Safe Dividends. It also has an A+ Dividend Quality Grade from Portfolio Insight.

Portfolio-Insight.com

The stock’s current yield is attractive compared to its 5-year average yield, suggesting an upside of 8% should the current yield revert to historical levels.

Safest Dividends

I strongly favor DG stocks that are deemed Very Safe or Safe by Simply Safe Dividends. Nobody likes seeing a dividend cut or suspension soon after investing in a DG stock, so targeting the safest candidates is a good strategy.

Using the Dividend Quality Grade adds another dimension. In assigning the grade, Portfolio Insight considers all dividend-paying stocks and determines the likelihood of a dividend increase in the next 12-month period. In backtesting the system, they found the Dividend Quality Grade accurately predicted a failure to continue dividend increases in more than 98% of cases.

The following stocks have Very Safe Dividend Safety Scores and A+ Dividend Quality Grades:

Created by the author (Data sources: Portfolio Insight, Value Line, Morningstar, S&P Global, and Simply Safe Dividends)

All these stocks are discounted relative to my Buy Below prices, but three of them have forward dividend yields below their 5-year average dividend yields (GWW, DOV, NFG), meaning that these stocks are overvalued relative to their past dividend history.

Looking at the seven remaining candidates, note that LOW makes yet another appearance! But there are four stocks with higher quality scores, Johnson & Johnson (JNJ), Procter & Gamble (PG), Hormel Foods (HRL), and American States Water (AWR).

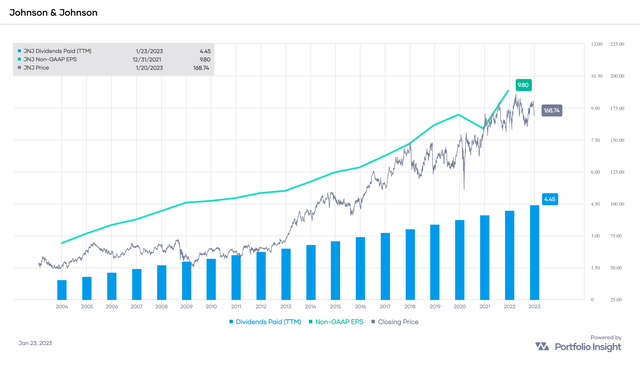

JNJ and PG are the only Dividend Kings rated Exceptional, and I like JNJ just a little more here, given its higher forward dividend yield and dividend growth rate.

Portfolio Insight

JNJ’s history of dividend growth is stellar and a model of consistency! With a non-GAAP EPS payout ratio of 46%, JNJ has plenty of room to continue paying and raising its dividend. I expect annual dividend increases of around 6% to continue well into the future.

Concluding Remarks

This article ranked 43 Dividend Kings using a new version of Quality Snapshots using six quality indicators for a maximum quality score of 30.

To compile the Dividend Kings list for this article, I referenced six sources of Dividend Kings and looked for agreement from at least four sources. This resulted in a list of 43 Dividend Kings.

Of the 43 Dividend Kings, 2 are rated Exceptional, 7 are rated Excellent, and 20 are rated Fine. This means no fewer than 29 Dividend Kings (or 67%) have quality scores in the 21-30 range. These truly are high-quality stocks!

I’ve highlighted a few stocks trading below my Buy Below prices that also offer compelling metrics, and the best opportunities appear to be LOW, BKH, and JNJ.

Here are the candidates to consider depending on your investment style:

- For income: BKH

- For growth: LOW

- For value: LOW

- For safety: JNJ

I hope this article provided readers with some good candidates worth considering! As always, though, I encourage you to do your due diligence before investing.

I’m providing a downloadable spreadsheet of the Dividend Kings. The spreadsheet includes the data presented in this article. I hope readers will find this snapshot of fundamental and added value metrics useful in analyzing the Dividend Kings.

Note that I cannot grant permission for you to edit the spreadsheet, as it is a read-only file that every Seeking Alpha reader can access!

But you can create a copy for yourself to edit! Click on this link to access the Dividend Kings spreadsheet. To copy the spreadsheet, sign in with a Google account and select File | Make a Copy and save the spreadsheet on your computer.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment