jetcityimage

Interest rates are still high and may increase further. Also, the macroeconomic and geopolitical environment is still uncertain. Consumer expenditures on heating oil and natural gas from October 2022 to March 2023 will be significantly higher than last winter. Moreover, COVID-19 daily cases in the United States are decreasing. Thus, I expect the demand for 3M’s (NYSE:MMM) products will decrease further in 4Q 2022. I am bearish on MMM as I expect the company’s financial results in 4Q 2022 will be weaker than in 3Q 2022.

Quarterly results

In its 3Q 2022 financial results, MMM reported net sales of $8619 million, compared with 3Q 2021 net sales of $8942 million and 2Q 2022 net sales of $8702 million. The company’s total operating expenses of $8592 million in 2Q 2022, decreased to total operating expenses of $4463 million in 3Q 2022, driven by lower cost of sales, lower selling, general and administrative expenses, and gain on business divestitures of $2724 million during the third quarter. The company reported 3Q 2022 operating income of $4156 million, compared with 3Q 2021 and 2Q 2022 operating incomes of $1788 million and $110 million, respectively. MMM reported net income attributable to 3M of $3859 million in the third quarter of 2023, compared with $1434 million in 3Q 2021 and $78 million in 2Q 2022. On 30 September 2022, 3M reported cash and cash equivalents of $3404 million, compared with $4878 million on 30 September 2021 and $2722 million on 30 June 2022.

“We continue to execute our strategies and deliver for our customers in a highly uncertain environment,” the CEO said. “Excluding the impact of the decline in disposable respirator sales, our team posted over 3 percent organic growth. We delivered sequential and year-over-year margin expansion, amidst macroeconomic challenges and the strengthening U.S. dollar,” he continued.

Figure 1 shows that 3M’s net cash provided by investing activities of $1874 million in 3Q 2021, decreased to $1127 million in 2Q 2022, and then, increased to $1531 million in 3Q 2022. Also, its net cash used in investing activities of $389 million in 3Q 2021, increased to net cash used in investing activities of $551 million in 2Q 2022, and then, turned into net cash provided by investing activities of $156 million in 3Q 2022. Finally, 3M’s net cash used in financing activities of $1299 million in 3Q 2021, decreased to $1048 million in 2Q 2022 and decreased further to $933 million in 3Q 2022.

Figure 1 – 3M’s cash flow categories

3Q 2022 and 2Q 2022 results

In its 2Q 2022 financial results, 3M announced full-year 2022 net income attributable to 3M of $4.2 to $4.5 billion, and adjusted net income attributable to 3M of $5.9 to $6.2 million. In 3Q 2022, the company increased its estimated full-year 2022 net income attributable to 3M to $4.9 to $5.6 million and decreased its full-year 2022 adjusted net income attributable to 3M to $5.8 and $5.9 million.

The market outlook

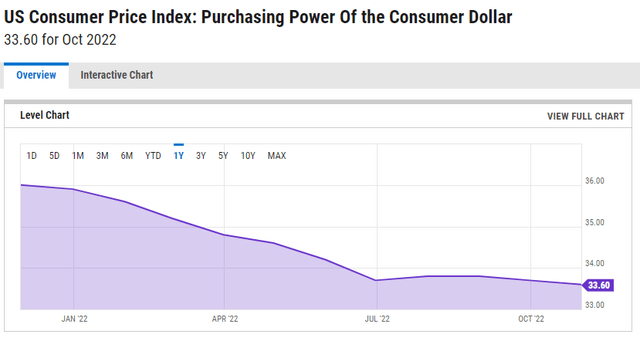

U.S. Federal Reserve interest rates and inflation play a major role in MMM’s income. Inflation in the United States decreased the purchasing power of the consumer dollar in the past months (see Figure 2). I do not expect the purchasing power of the consumer dollar to increase in 4Q 2022. Figure 2 shows that the purchasing power of the consumer dollar in the United States decreased from 33.70 in September 2022 to 33.60 in October 2022.

According to Goldman Sachs, due to easing in supply chain constraints, a peak in shelter inflation, and slower wage growth, U.S. inflation is expected to decrease in 2023. As a Fed governor announced that Federal Reserve may consider slowing the pace of rate increases, Goldman Sachs forecasts that the core personal consumption expenditure (PCE) will decrease to 2.9% by December 2023. On the other hand, some of other Wall Street’s biggest banks agree that Federal Reserve will increase U.S. interest rates further into 2023. Also, St. Louis Federal Reserve President announced that the central bank might have to raise short-term interest rates as high as 7% to ensure that inflation goes away.

Due to the war in Ukraine and continuing zero-COVID-19 policy in China that has affected energy prices, logistics, supply chains, and trade flows, inflation rates will remain high and the global economic recession will continue. I don’t expect Federal Reserve to give up on its tight monetary policy that has been started in 2022 (see Figure 3).

Figure 2 – US CPI: purchasing power of the consumer dollar

ycharts.com

Figure 3 – Federal funds rate

www.weforum.org

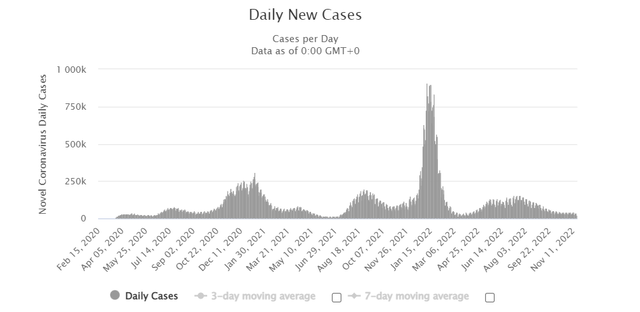

According to EIA, due to colder forecasted temperatures this winter and higher heating oil prices, the average U.S. home expenditure on heating oil will increase by 45% compared with last winter. Also, the average U.S. home expenditure on natural gas will be higher than last winter. Thus, U.S. consumers will spend a greater portion of their disposable income on energy in 4Q 2022 and 1Q 2023. As a result, I expect expenditures on MMM’s product to decrease in 4Q 2022 and 1Q 2023. Also, due to the decreasing demand for disposable respirators as a result of lower COVID-19 cases in 4Q 2022 (see Figure 4), MMM’s disposable respirator sales will decrease. It is worth noting that in 3Q 2022, MMMs’ disposable respirator sales declined $130M (34% YoY) and reduced the safety & industrial segment’s organic growth by 4.6 ppts.

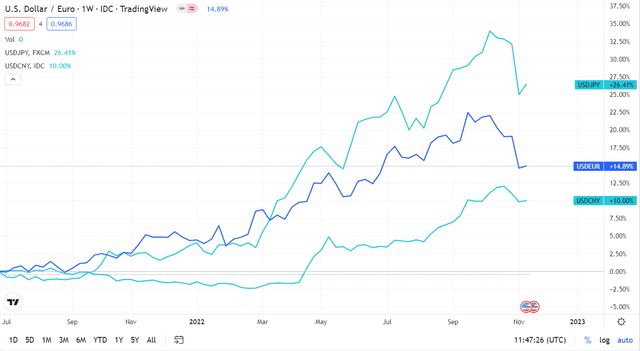

Moreover, as a result of the U.S. dollar appreciation, MMM has increased its full-year 2022 total sales negative growth of 4.0% (announced in 2Q 2022) to 4.5% (announced in 3Q 2022). Figure 5 shows that USD/EUR, USD/CNY, and USD/JPY in the first two months of 4Q 2022 are higher than in the first two months of 2Q 2022. Thus, I expect the negative effect of increased USD strength on MMM’s 4Q 2022 financial results to be higher than in 3Q 2022.

Figure 4 – COVID-19 daily new cases in the United States

www.worldometers.info

Figure 5 – USD against EUR, JPY and CNY

tradingview

The performance outlook

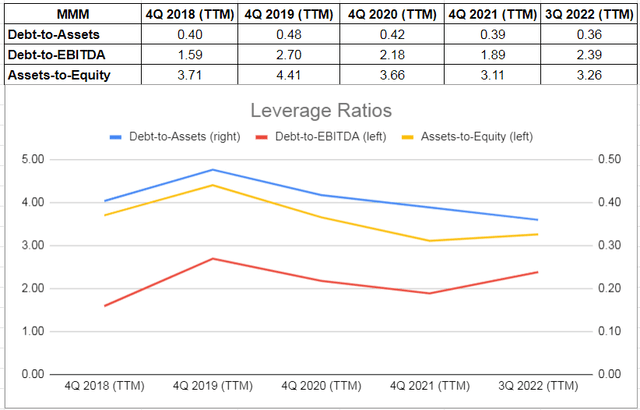

The debt-to-assets ratio measures MMM’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. The higher the ratio, the greater the degree of leverage and financial risks. The company’s debt-to-asset ratio decreased from 0.42 in 2020 to 0.39 in 2021 and decreased further to 0.36 on 30 September 2022. Thus, the decreasing debt-to-asset ratio of MMM (that has occurred as a result of significantly lowered total debt in the first nine months of 2022), shows that MMM decreased its debt financing in 2022. It implies that the company expects its future free cash flow to be weaker than before.

Also, MMM’s debt-to-EBITDA ratio (which determines the probability of defaulting on debt) decreased from 2.18 at the end of 2020 to 1.89 at the end of 2021. However, due to the lower adjusted EBITDA, it jumped to 2.39 on 30 September 2022. Finally, MMM’s asset-to-equity ratio decreased from 3.66 at the end of 2020 to 3.11 at the end of 2021. Due to lower equity, MMM’s asset-to-equity ratio increased to 3.26 on 30 September 2022. I expect MMM’s 4Q 2022 financial results to be weaker than in 3Q 2022. Thus, MMM’s leverage ratios get worse by the end of the year (see Figure 6).

Figure 6 – MMM’s leverage ratios

Author (based on SA data)

Summary

Due to the uncertainty of the macroeconomic and geopolitical environment, I believe MMM sales will decrease in the following quarters. Inflation, Federal Reserve’s tight monetary policy, and significantly higher consumer expenditures on energy in the following months will decline the demand for MMM’s products. Also, I expect its leverage ratios to impair by the end of the year. Sell MMM.

Be the first to comment