S_Bachstroem/iStock via Getty Images

You don’t need me to tell you that a recession is likely brewing, or even here already. You don’t need me to tell you what the reasons are for this concern. It’s all over the media. I was even approached by a 7-year child the other day asking me plaintively whether this wasn’t time to shift her investment portfolio towards Treasuries. OK, it was a 67-year old accountant, but you get the idea.

But there are recessions and then there are Recessions. Will GDP shrink by 1% or 7%? I’m in the mild recession camp. For those of you who have read my stuff before, you know that I’m not a happy-go-lucky guy. Friends who I’ve bounced this idea off of have been surprised by my optimism. Ask me some time “All good?” and get my misanthropic answer. But I’m encouraged by three factors in today’s economy that nearly never existed going into prior recessions:

- A healthy and conservative banking system

- A strong labor market

- Healthy consumer balance sheets

On to the evidence.

“It’s different this time” #1: A healthy and conservative banking system

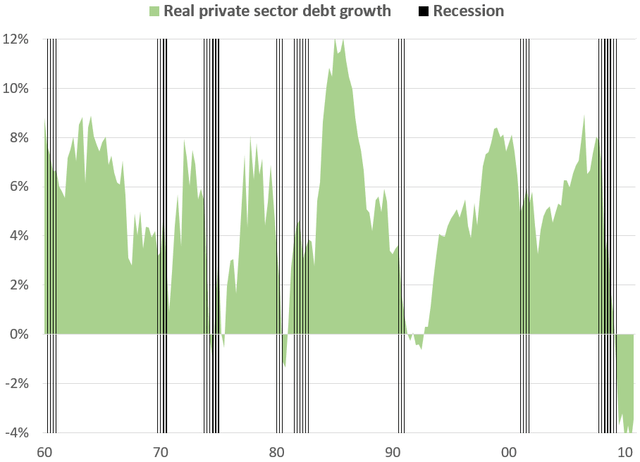

I published a book several years ago called Debt Cycle Investing (still available at Amazon, people!) which argued that economic cycles are driven by private sector debt cycles – when bank lending accelerates so does the economy, and vice versa. Which means that recessions historically were the result of banks pulling back on credit extension following a period of over-lending. This chart provides strong evidence for that theory:

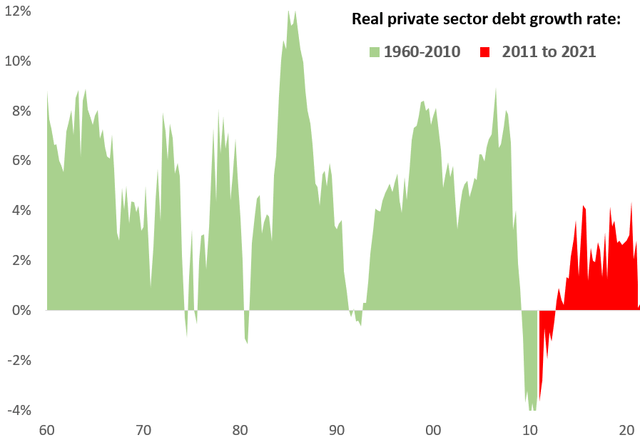

But the government got really tired of managing the banks’ boom/bust business model and having to pay for costly bail-outs. They therefore passed the Dodd-Frank bill and other bank regulation to break the boom/bust cycles. Their efforts worked pretty dramatically:

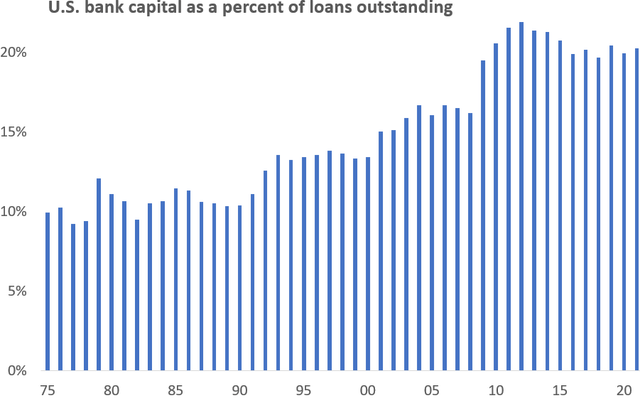

U.S. bank lending has had an unprecedented decade-plus streak of rational lending! Also, their capital positions remain very strong as a percent of loans outstanding:

Yes, an economic slowdown will encourage banks to pull back on their lending as households and businesses come under more strain. But no, bank lenders will not have to slam on their brakes in response to substantial over-lending or because of capital constraints.

One for a mild recession.

“It’s different this time” #2: A strong labor market

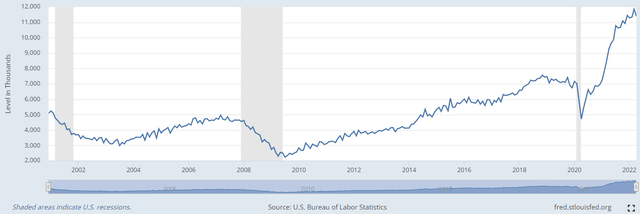

My next chart almost beats the bank lending chart for the “this time it’s different” award. I refer to the “JOLT”, or Total Nonfarm Job Openings data. Take a look:

FRED, from Bureau of Labor Statistics data

While we don’t have a long history for this data, it is shocking how many unfilled jobs American businesses currently have – roughly twice as many as the number of unemployed would-be workers. Theoretically American businesses could reduce their labor demand by 5 million jobs without the unemployment rate increasing. Almost certainly unprecedented.

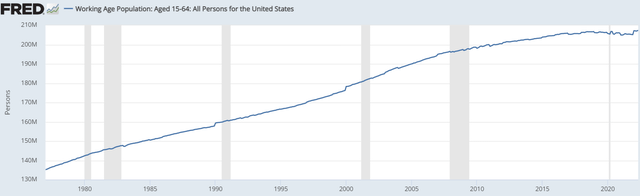

I am even more confident that the unemployment rate won’t shoot up based on another interesting piece of data, namely the growth in the working-age population (15-64 years old as defined by the government. Here it is:

FRED, from Organization of Economic Co-ordination and Development data

The combination of Baby Boomer retirements and slowing immigration has resulted in essentially no growth in the working population. This lack of labor supply growth further supports the likelihood of only a modest unemployment rate increase ahead, and of continued upward wage pressure.

Another one for a mild recession.

“It’s different this time” #3: Healthy consumer balance sheets

If consumers are getting squeezed by rising unemployment and slower wage growth, they may need to quickly call on some of their financial reserves or on more credit. This cash is called “liquidity”. One bank CEO doesn’t think that’s a problem:

“‘Consumers are in good shape, not overleveraged,’ Brian Moynihan, CEO of Bank of America, told Bloomberg Television from Davos, Switzerland. The bank’s customers have checking and savings accounts that are still larger than before the pandemic…, he said.” (Bloomberg, May 24, 2022)

Is Mr. Moynihan just blowing smoke at us as part of some nefarious plot by those elitists at Davos? I don’t think so; he’s got data on his side.

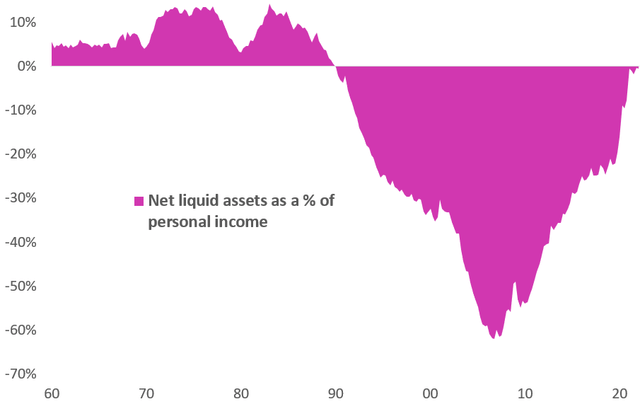

The U.S. consumers’ liquidity position is not great, but it’s far better than it has been in many years. To estimate liquidity, I compared U.S. household bank deposits and money market funds to their debt liabilities. Here is a history of the resulting net liquidity, as a percent of disposable personal income (DPI):

The Federal Reserve and the Bureau of Economic Analysis

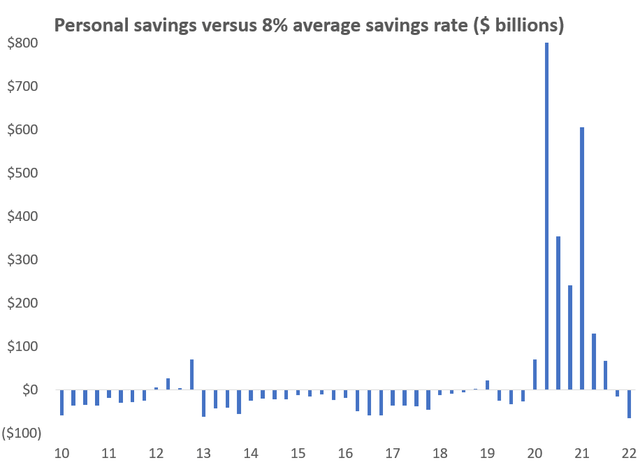

Our net liquid assets are about zero at present. That is worse than the good old days of the ’60s and ’70s, but far better than the last 30 years, with dramatic improvement since the ’08-’09 Financial Crisis. The last leg of the improvement came when the federal government flooded us with money after COVID hit. It still appears that over $2 trillion of the COVID money hasn’t been spent, as this chart on households’ quarterly saving rates shows:

The Bureau of Economic Analysis

We therefore have more money in the bank than normal, and more borrowing capacity than we have had going into the last few recessions. For example, the consumer debt service ratio calculated by the Federal Reserve is at present 15% below its average since 1980. And American homeowners have by far a record of $28 trillion of equity in their homes, and their current mortgage debt-to-equity ratio of 30% is the lowest since the early 1960s. I therefore expect that tapping home equity lines of credit will allow some households to tide themselves over until after the next recession is over.

A third one for the mild recession.

Summing up: The economic outlook should not be as bad as you may fear. Which makes cyclical stocks cheap

The fear is out there. You can see it clearly when you look at these cyclical companies:

- MGIC (MTG) one of my beloved mortgage insurance companies. MGIC is closed yesterday at $12.66, only 5 times its current cash flow per share rate of about $2.50. The only way that makes sense it if a serious and sustained recession is on the way, enough to force 5% or more of current U.S. homeowners into foreclosure.

- General Motors (GM) is selling at less than 5 times ’22 EPS estimates, despite lots of deferred auto demand from COVID supply shortages.

- Capital One (COF) is also at 5 times ’22 Wall Street estimates, which assumes a dramatic rise in credit card and auto loan defaults.

If I am right on the mild recession call, these and other cyclical stocks are going to look awfully cheap.

Be the first to comment