KanawatTH

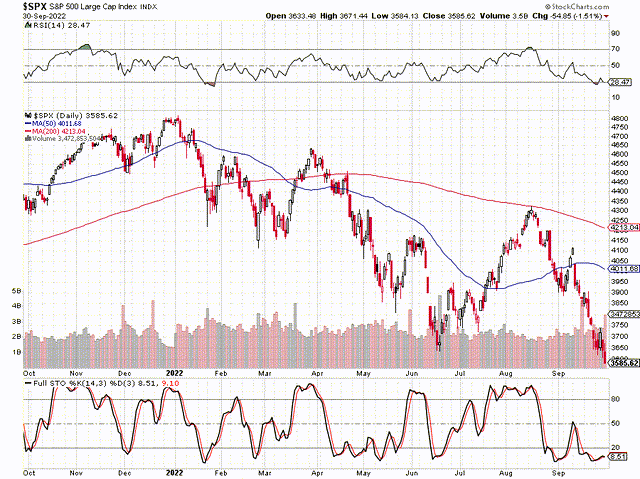

The S&P 500/SPX (SP500) ended trade around a new 52-week low to close the quarter on Friday. The SPX finished the quarter below 3,600, declining by roughly 26% since the bear market began.

S&P 500 1-year

SPX (StockCharts.com)

We see that the SPX put in a new 52-week low on Friday, implying that further downside is probable in the coming months. The next leg of this bear market may take the major stock market average down to approximately the 3,400-3,200 zone. However, the ultimate bottom to the bear market may materialize lower, around the 3,000 support level. The SPX declined by roughly 5% in the third quarter, and it appears that Q4 may present another challenging phase.

The AWP’s Performance

While Q3 was challenging, the All-Weather Portfolio “AWP” delivered a positive return. The AWP increased by approximately 3% in the third quarter. Diversification, rotation, adjustments around peaks and troughs, and effective hedging enabled the AWP to outperform the S&P 500 and other stock market averages significantly.

The All-Weather Portfolio – Segment by Segment

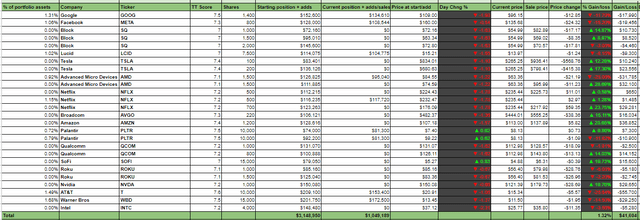

Technology – 10.2% of holdings

The technology segment of the AWP concluded the quarter with a weight of approximately 10.2%. Some of the top performing holdings last quarter included Amazon (AMZN) 29%, Netflix (NFLX) 24%, and AMD (AMD) 29%. The combined gain (not including dividends and hedging) was approximately 1.3% for the quarter. Furthermore, effective hedging enabled it to mitigate the downside and boost returns in the tech segment throughout the third quarter.

Going Forward

Q4 Outlook – Technology remains the top sector to watch in the fourth quarter. Many quality growth tech companies have declined by significant margins (50% or more) during the decline phase. Therefore, I will look for compelling buying opportunities in top technology companies throughout the fourth quarter. Several of the leading candidates on my buy list include Amazon, Tesla (TSLA), Nvidia (NVDA), AMD (AMD), Roku (ROKU), Zoom (ZM), Shopify (SHOP), and more.

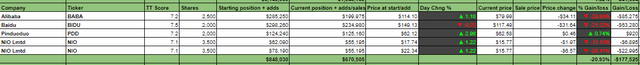

China – 6.5% of holdings

China (The Financial Prophet )

China was the worst performing sector of the AWP last quarter, declining by roughly 21%. Several positions were down significantly, about 20-30%. Moreover, the lack of hedging in this segment did not mitigate losses and proved a significant misstep in the quarter.

Q4 Outlook – The China segment is badly beaten down and remains undervalued. Despite the increased risk, quality Chinese companies offer substantial reward potential. Therefore, I will continue holding Chinese equities here. Additionally, Chinese stocks offer significant covered call premiums and are strong candidates for collar option strategies.

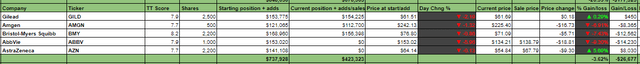

Healthcare – 4.1%

Healthcare (The Financial Prophet )

The healthcare basket declined by roughly 3.6% in the third quarter. I reduced this segment after the August top, which enabled me to mitigate the losses throughout the third quarter. Dividends provided additional support for this segment.

Q4 Outlook – Healthcare is relatively defensive and offers decent substantial value here. However, it isn’t easy to get too excited about the healthcare segment right now. Therefore, I remain neutral on the healthcare sector and have an equal weight rating on most stocks.

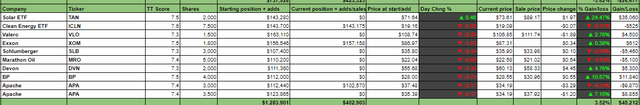

Oil & Energy – 3.9%

Oil and Energy (The Financial Prophet )

The oil and energy segment was reduced significantly throughout the third quarter. The quarter closed with just three holdings. Also, APA was hedged in the final weeks of the quarter, helping mitigate losses in the O&E segment. The O&E portion of the portfolio appreciated by approximately 3.5% in Q3 (not including hedges and dividends).

Q4 Outlook – Oil declined considerably in the third quarter and is now in a difficult position, technically and from a fundamental standpoint. The world has substantial supply, and demand may worsen due to the economic slowdown. Nevertheless, inflation is a positive catalyst for higher oil prices, and we should remain vigilant for compelling buying opportunities in the fourth quarter.

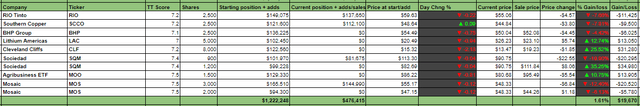

Metals & Materials – 4.6%

Metals & Materials (The Financial Prophet )

The M&M segment appreciated by approximately 1.6% in the quarter. Adjustments around the August highs enabled the M&M segment to increase returns last quarter. Additionally, late quarter hedges in Southern Copper (SCCO) provided supplemental returns in Q3.

Q4 Outlook – Despite the economic slowdown, metals and material names are relatively attractive due to the rising inflation dynamic. Many quality stocks are badly beaten down in these segments. While more near-term downside is probable, we should expect compelling buying opportunities to materialize in this space in the fourth quarter. Some names at the top of my list include Cleveland-Cliffs (CLF), Lithium Americas Corp. (LAC), and others.

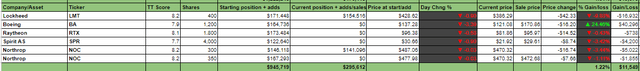

Defense – 2.9%

Defense (The Financial Prophet )

A timely sale in Boeing (BA) enabled this portion of the AWP returns to be positive. The defense basket brought a return of approximately 1.2% for the quarter.

Q4 Outlook – The world is full of conflict again, and this dynamic provides a strong backdrop for defense stocks. America makes many of the best war and defense systems in the world, and there should be robust demand for American war products as the world advances. I will look to add positions to this segment. Boeing, Spirit AS (SPR), and Raytheon (RTX) are at the top of my defense buy list.

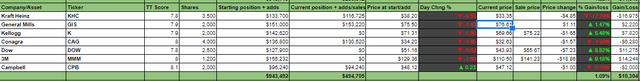

Staples – 4.8

Staples (The Financial Prophet )

The staples segment provided a return of approximately 1.1% for the quarter. Returns were further boosted by around 0.5% due to healthy dividends. Timely adjustments around the highs in August provided attractive exit points for several names in the staples sector.

Q4 Outlook – Staples remains a relatively defensive segment. Recession-proof qualities and rich dividends should continue to enable staple names to outperform in Q4. I will look for compelling opportunities to add positions in the staples sector.

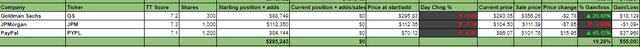

Financials – 0%

Financials (The Financial Prophet )

The financial segment was the best performing sector of the AWP, providing a 19% return in the quarter. I exited financial positions early in the quarter, selling some around the top in mid-August. Therefore, most profits got locked in effectively despite increased volatility towards the back half of the quarter. PayPal’s (PYPL) 45% appreciation was the AWP’s best performing holding in the third quarter.

Q4 Outlook – There will likely be more near-term downside in financials, but we should get a significant buying opportunity to load up on quality financial stocks in the fourth quarter. Some top names on my buy list include Goldman Sachs (GS), JPMorgan (JPM), PayPal, Visa (V), and Citigroup (C).

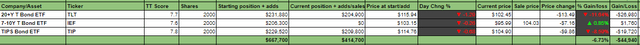

Bond Instruments – 4%

Bond instruments (The Financial Prophet )

Despite reducing bond instruments by about one-third, the segment declined by approximately 6.7% in the quarter. Bond instruments are a hedge against tightening monetary policy. While this hedge could begin paying off soon, it may be early for a significant position in this space.

Q4 Outlook – The Fed’s tightening path should slow and eventually reverse. Thus, bond instruments like (TLT), (TIP), and others should do well as long-term interest rates decline in the coming quarters.

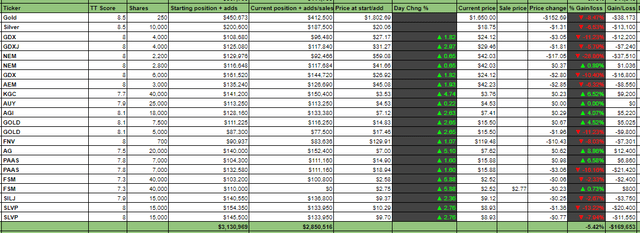

GSMs – 27.7%

Gold/Silver/Miners (“GSMs”) remain a significant portion of the AWP. While the physical side is at about 5.8%, the non-physical GSM position is roughly 21.9%. This segment declined by approximately 5.4% in the quarter, but dividends and hedging helped mitigate the losses in this space.

Q4 Outlook – GSMs remain a substantial part of the AWP as gold and silver are underappreciated by the market. Inflation is still very high, and the Fed may need to return to easing in the coming months as the economy continues to slow. GSMs should do particularly well when the Fed pivots to a more neutral or dovish monetary stance.

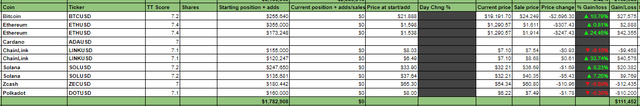

The Digital Asset Basket – 0%

Cryptocurrency Basket (The Financial Prophet )

While the cryptocurrency basket is empty now, I held some coins throughout parts of the third quarter. The cryptocurrency basket appreciated by approximately 6.25% in Q3.

Q4 Outlook – It is unlikely that we’ve seen the bottom in Bitcoin and other digital assets yet. While we may see temporary rebounds, we will not likely witness sustainable gains in the digital asset segment until a long-term bottom is reached.

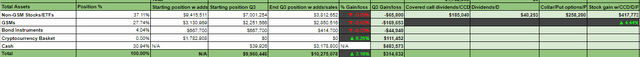

The Bottom Line

Q3 results (The Financial Prophet )

The AWP returned 3.16% in the third quarter. This return was substantially better than the S&P 500’s loss of approximately 5% in Q3. Without dividends and hedging premiums, the AWP’s non-GSM stock segment also beat the S&P 500, falling by just 0.7% in Q3. YTD, the AWP is up by approximately 6.4%, significantly outperforming the SPX’s 25% YTD decline. The AWP will continue looking for ways to outperform and optimize returns in Q4. The fourth quarter should be exciting and present numerous buying opportunities in stocks and other risk assets as we advance into year’s end.

Be the first to comment