Imgorthand

Co-produced with “Hidden Opportunities”

The 4% rule is often touted as the gold standard for retirement finances. Designed by financial adviser Bill Bengen in 1994, the concept tells retirees to plan to withdraw 4% of their assets every year, increasing or decreasing that distribution annually based on inflation.

Sounds great, right?

There are several issues.

-

The 4% rule is almost 30 years old. The economic parameters have changed, and investment holding periods have significantly declined due to a heavy focus on the short-term outlook. This retirement rule can cause significant harm during a prolonged period of depressed market conditions since more shares need to be sold at poor prices to generate the same income as the previous year.

-

This method provides minimal flexibility in your spending habits. It is fair to assume that retirement expenditure is expected to be higher during the initial stages as retirees pursue travel and new hobbies. Spending reduces after a couple of years but is expected to rise as retirement gets older due to healthcare costs. The 4% rule doesn’t offer flexibility for such variability in your spending habits and needs.

-

You would need to retire with a substantial nest egg. For the average individual in the workforce, early retirement would raise serious questions about the longevity of their savings for additional years and the overall higher life expectancy. The 4% rule focuses on trying to avoid going broke, but it ignores another risk: Depriving yourself by being unnecessarily cautious.

You don’t want to outlive your savings; you want your retirement strategy to be sustainable through bull and bear markets. And most importantly, you don’t want to compromise your quality of life during your golden years.

This is why we believe in the sustainability of the income method. As dividend investors, we work hard to transform our portfolio into a cash-producing machine that can fuel our lifestyle – one that doesn’t have to be adjusted for varying market conditions. This technique supports early retirement, and you don’t have to worry about outliving your savings.

Every year you know how much you are receiving in dividends, allowing you to reinvest a portion and live on the rest without regrets. Since you aren’t selling, every year you own more shares, generating more income.

Here are two picks with up to 9% yield to get your income machine up and running.

Pick #1: EVA, Yield 5.9%

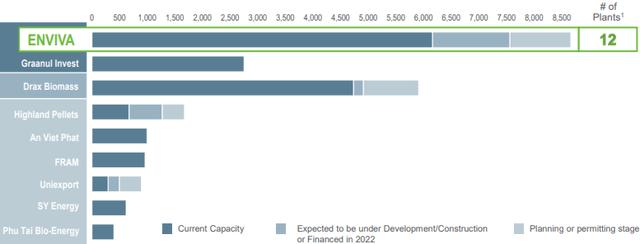

Enviva Inc. (EVA) is an investment where money literally grows on trees. This company is the largest producer of wood pellets in the world, and it ships them to countries looking to transition away from using coal for their energy needs. (Source: May 2022 Investor Presentation).

May 2022 Investor Presentation

Sustainably sourced wood pellets are considered carbon-neutral even after considering the entire supply chain. They have been proven to reduce greenhouse gas emissions by up to 85 percent on a lifecycle basis compared to coal. EVA establishes long-term take-or-pay contracts with credit-worthy customers from leading economies and passes on shipping costs to them.

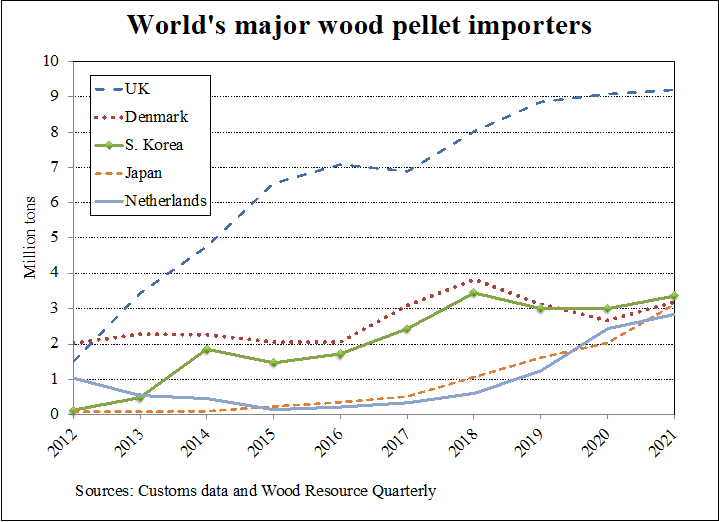

Customs data and Wood Resource Quarterly

EVA currently has a $21 billion worth of Take-Or-Pay contracted backlog with a weighted-average remaining term of 14.5 years

During Q1 2022, EVA reported adjusted EBITDA of $36.6 million and $25.3M of DCF (distributable cash flow). The company declared a quarterly dividend of $0.905 per share, a 6.5% annualized yield. This payout represents a 15.2% YoY growth, and it is noteworthy that EVA has a stellar track record of 26 consecutive quarterly dividend hikes since its IPO in 2015. EVA’s current quarterly dividend is 3.5x higher than the one they issued during their IPO, indicating that the company is a solid dividend-growth investment.

Note: Enviva Inc. has eliminated the pesky schedule K-1 by pursuing a transformation into a C-Corp. The company now pays Qualified Dividend Income (‘QDI’) that is eligible for favorable taxation.

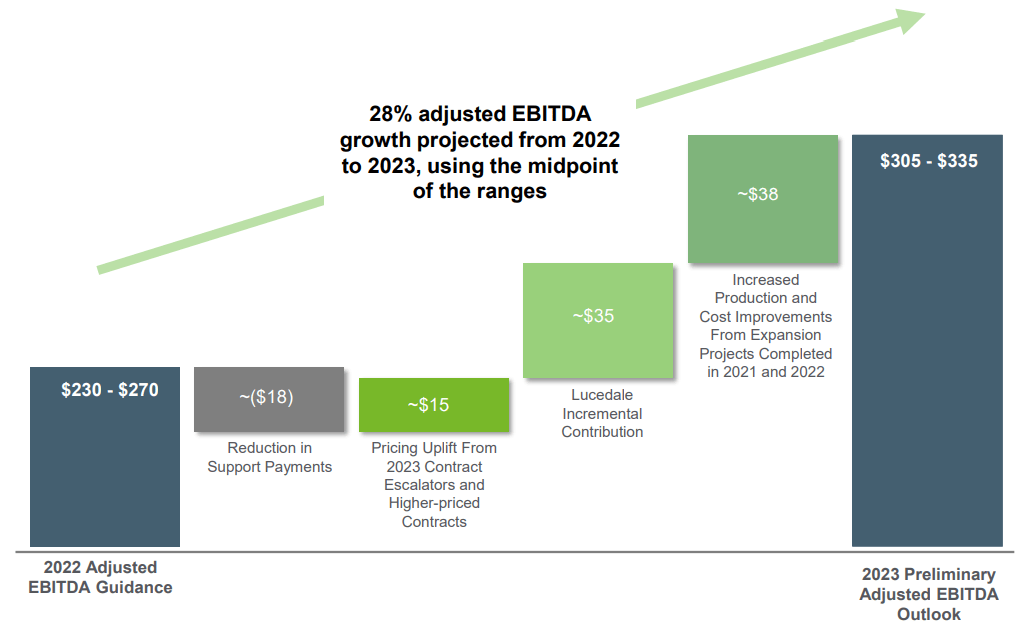

As part of its transition from an MLP, the incentive distribution rights held by its former sponsor were canceled and eliminated. This means the DCF is fully accessible to the common shareholders. EVA projects ~$35M-$40 million in adj. EBITDA for Q2 and EVA’s 2023 guidance show 28% higher EBITDA from FY 2022 due to increased production, higher-priced contracts, and reduced support payments to the former general partner.

May 2022 Investor Presentation

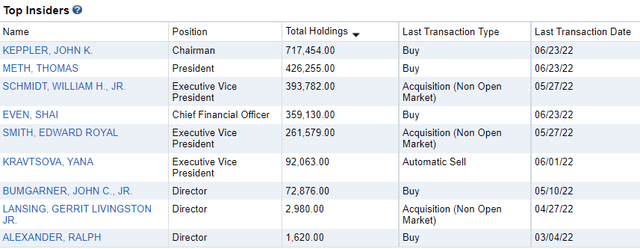

EVA recently announced the issuance of a $250 million green bond and intends to use the proceeds towards the acquisition, construction, equipping, and financing of the company’s fully contracted wood pellet production plant to be located in Epes, Alabama. EVA insiders have been accumulating shares through this bear market, indicating their confidence in the long-term value proposition.

This business is just getting started. EVA announced plans to double its production over the next five years to cater to the growing demand, as the wood pellet industry is expected to exceed $23 billion by 2028. Investors will continue to see growing dividends as the company expands its moat and caters toward global cleaner energy targets.

Pick #2: MMP, Yield 8.6%

Magellan Midstream Partners, L.P. (MMP) owns the mission-critical infrastructure that supports the transportation, storage, and distribution of petroleum products. The partnership owns the longest refined petroleum products pipeline system in the country, with access to ~50% of the nation’s refining capacity, and can store more than 100 million barrels of petroleum products such as gasoline, diesel fuel, and crude oil.

With 72% of the operating margin coming from refined products, MMP is less exposed to hydrocarbon energy commodities and primarily caters to feedstock for essentials such as chemicals, paints, plastics, clothes, etc. Moreover, 85% of the net operating margin is fee-based, making it immune to hydrocarbon price volatility. MMP has been (and continues to be) an income investor’s dream. Not only have they raised dividends annually for 20 years, but they have also been using their excess profits to buy back shares and pay down debt. (Source: May 2022 Investor Presentation).

May 2022 Investor Presentation

When the number of outstanding shares shrinks, the existing pool of CAFD is allocated to a smaller number of shares, making sufficient room for raises. Moreover, a reduction in interest payments keeps more profits available for distribution. For income investors, it is a win in all aspects.

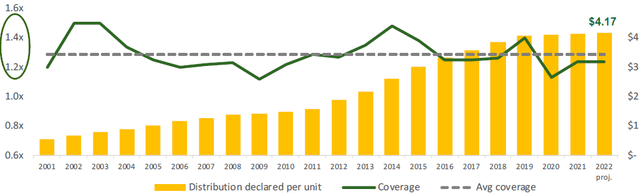

At the end of Q1, MMP reported a modest 3.8x leverage, and the partnership has no bond maturities until 2025. This gives significant flexibility with cash-flow management, allowing MMP to repurchase $850 million worth of shares in Q1, leaving $650 million available for use in the existing repurchase program. Shareholder income is well-protected with MMP’s 1.2x distribution coverage. The firm’s projected 2022 distribution of $4.17 calculates to a 8.6% annualized yield – an attractive opportunity to get paid to wait for capital upside. WSJ analysts have a $49-64 price target for MMP, indicating as much as 32% upside from current levels. Energy independence will be the top pursuit for leading economies over the next decade. MMP presents the highest quality income investment to be part of this quest by owning a piece of essential infrastructure that supports secure storage and transportation of vital energy commodities.

Note: MMP is a partnership and issues a K-1 tax form.

Conclusion

Following the 4% rule is like treating your financial assets like a bar of soap; it is bound to disappear someday, and poor timing and neglect will be like running water over it. The question is whether it will last long enough to take care of you and your needs through a long-lasting retirement.

If you depend on the sale of equities to fuel your retirement lifestyle, you will have a hard time sleeping at night. You must immunize your portfolio from market volatility to pursue a happy and stress-free retirement. Instead of dealing with the stress of timing the market during your golden years, why not treat your portfolio as an asset that produces income for your needs?

The good news is that a well-diversified dividend portfolio can keep income flowing through market turbulence. At HDO, our income method lets you ignore the market FUD and focus on building repeatable income from your portfolio. Have you watched The Dark Knight Rises?

“I was born in the darkness, molded by it.” – Bane to Batman

Just like that, bear markets are an income investor’s ally, they often give birth to new income streams, and these market conditions mold our portfolios. Why fear something when it makes you stronger? Grow your income today with yields of up to 8%.

Be the first to comment