ugurhan/iStock via Getty Images

No investment strategy is perfect. Over the years, we have worked on many types of portfolio strategies. But we always wanted to have a portfolio strategy that would meet our four goals – Income, Growth, Capital-preservation, and Low-stress. Usually, it is very difficult (if not impossible) to achieve these goals in a single portfolio. For example, a high-growth portfolio would have high volatility and higher drawdowns, while to preserve capital, we need lower volatility and very low drawdowns. Portfolios that tend to preserve capital usually fall short on growth. Also, many times, portfolios that generate very high income usually end up providing no growth at all.

To resolve the conflicting demands, we came up with a solution to mix three or four different kinds of strategies (also called buckets or baskets) in such a way that the overall portfolio would meet most of our goals. Since 2015, we have been writing about a few select dividend and income-focused strategies. Over the years, we also introduced some ‘Rotational and Hedging’ strategies to lower the volatility and preserve capital.

Generally, we were looking for a strategy that performs reasonably well during the bull markets, preserves capital when the market throws a fit or performs poorly, and provides a decent-enough income stream on a consistent basis. So, by combining the dividend income, some high-income, and rotational strategies, we introduced a comprehensive portfolio strategy that we like to call NPP (Near-Perfect Portfolio) strategy. We admit the name may appear to be a bit over the top, but the underlying premise and goals fit the name. In a nutshell, this strategy strives for high performance with lower volatility. This is the basis of the Near-Perfect Portfolio.

Younger investors in their 20s and 30s obviously have more choices in terms of how they can invest. It is mainly because of the time factor they have on their side and the higher level of risk that they can afford. However, this apparent advantage also creates a lack of urgency to save and invest since retirement appears to be so far away. Otherwise, younger investors could probably do fine by investing in broad market indexes at regular intervals (with every paycheck or any other interval) and stay the course through good times and bad. Sure, they can do even better by learning and investing wisely in individual stocks and other specific strategies.

However, retirees and other older investors who are in their high 40s and 50s do not have the luxury of time, and their risk appetite continues to decline with age. They cannot afford to have large drawdowns in their portfolios. This becomes even more critical for retirees who live off the income from their investments. Since they need to withdraw income on a regular basis, they may be forced to sell when the prices are low. For this reason, the drawdowns can become deeper and last much longer. Retirees can also face another problem, commonly known as the risk of sequence-of-returns if the market happens to go into a deep correction for multiple years in the early phase of retirement.

So, if you are like us, someone who tends to avoid the extreme ups and downs and roller-coaster ride of the stock market and would rather sleep well even during the depth of a correction, the NPP strategy described in this article is worth a look and consideration. If you are a retiree or near-retiree and want to avoid the risk of sequential returns, in our opinion, the NPP strategy can be very helpful. If you believe that lower volatility leads to higher returns in the long term (and vice versa), then again, the NPP strategy may be the right strategy. That said, everyone’s situation is different, and one size does not fit all, so the NPP may not fit everyone’s needs or temperament. You are the best judge to determine if a specific strategy would suit your needs and goals.

We follow the NPP strategy in our Marketplace service, “High-Income DIY Portfolios,” but from time to time, we provide updates and the progress of the NPP portfolio here on SA public platform. As usual, we will provide an overview of the performance and a broad comparison of our NPP strategy vis-à-vis the S&P 500 (based on back-tested data since 2008, as well as our live performance since January 2020). In the end, we will provide a sample NPP 3-bucket portfolio.

Aim for a Stress-free way of Investing

The past 3 to 4 years have seen an incredible roller-coaster ride for the broader market. Going back to the year 2019 and early 2020, we witnessed a continued and strong bull market. However, the 11-year long bull-market was interrupted suddenly and violently by the once-in-a-century pandemic. Very few investors could see that coming. However, fortunately, the correction was very short-lived, and the next phase of the bull market started that took the S&P500 as high as 4790.

However, in the last six months, markets have faced very strong headwinds. The S&P500 has lost more than 23% from its most recent peak, and a vast number of individual stocks have lost even more. The biggest threat to the economy (and hence the stock market) that has emerged is the 40-year high inflation that shows few signs of abating any time soon. That has pushed the Fed from being dovish to extremely hawkish in a matter of few months. The current geopolitical situation and a prolonged war in eastern Europe have only made the situation worse. Inflation is the biggest threat to retirees and folks who are on a fixed income and their stock portfolios. Now, with rapidly increasing interest rates and an increasingly hawkish Fed, we are a step closer to a possible recession. Can we avoid the recession? Maybe or maybe not. But the market direction is likely to remain murky and volatile for the next few months, if not longer.

With all this turmoil going on in the market, it basically boils down to one simple question. Do we really want to constantly go through these ups and downs of the stock market and worry about the value of our portfolio on a daily or weekly basis? Or is there a better alternative, where a conservative investor or a retiree could have lower volatility, minimal drawdowns, and consistent income but still could enjoy the fruits of a rising market as and when that occurs? This is exactly the objective of this comparative analysis of the NPP strategy and the broader market indexes like the S&P 500.

What’s a Near-Perfect Portfolio Strategy?

We look for strategies that produce low volatility, preserve capital, and provide a decent income and reasonably high returns over the long term. In our view, these are the goals that most retirees and other conservative investors could agree on. Retirees, in particular, cannot afford large or deep drawdowns in their portfolios because they do not have the luxury of time. Also, most retirees need their portfolios to provide a consistent stream of reliable income. The S&P 500 provides a lowly yield of around 1.5%, so index investing would not be an ideal option for most income investors. In addition, the extraordinary streak of high performance of the S&P 500 during the past 13 years is unlikely to continue in the next decade.

So, what’s the best way to manage a stock portfolio and still sleep well at night? How can we preserve our capital, earn roughly 5% income (if we need to withdraw), and at the same time grow our investments to get a long-term total return of roughly 10% or better? At first glance, it sounds like a tall target. But we believe it’s possible to achieve all of these goals by adopting what we like to call a Near-Perfect Portfolio strategy. To summarize, we expect our Near-Perfect Portfolio to achieve these three objectives:

• Preserve capital by limiting the drawdowns to 15% but no more than 20%.

• Provide a consistent income of roughly 5% to those who need to withdraw.

• Grow the capital for the long term at an annualized rate of 10% or better (including the income).

We must caution that these strategies need some work on an ongoing basis and may not suit highly passive investors. In addition, they require patience.

NPP: A Bucket Based Portfolio of Divergent Strategies

The importance of the need to diversify cannot be overstated, especially for older investors. Sure, you can always find some investors who have done pretty well with highly concentrated portfolios. But for the vast majority of folks, that’s not the recipe for success. So, the question is how to diversify and how much to invest in various types of assets or strategies. It’s rather a complex topic. First, we need to diversify our stock holdings among different sectors or industry segments of the economy. But that alone may not be enough if you want to avoid volatility since the stock market is inherently volatile. High volatility brings in all kinds of emotions and issues, including fear, selling at the wrong time, fear of missing out, and above all, overall low performance.

So, as a second step, we recommend diversifying in terms of types of investment strategies. We try to combine strategies that are likely to perform in divergent ways under different market conditions. This helps bring down the portfolio volatility and improve overall performance. The NPP strategy combines monthly rotational strategies with some buy-and-hold DGI (dividend growth investing) and high-income strategies to perform well in different market conditions. Here is the basic structure, with three buckets serving three distinct objectives.

- The Core Bucket: This is our DGI bucket to serve as the foundation of the overall portfolio. We keep a minimum of 15 large-cap, stable, blue-chip stocks that have been paying and increasing their dividends over at least five years, but preferably more. These are the kind of stocks that we could own for a long time. In addition, this bucket will also provide a decent yield of 3% to 4% and will likely grow with time.

- The High-Income Bucket: This bucket is high-income but involves relatively higher risk. That’s why we limit our exposure to 15% to 25% of the assets. So, the result is a limited risk but oversized income to compensate for the yield from the DGI bucket.

- Capital Preservation (hedging) bucket: This is our hedging and capital preservation bucket. However, unlike some other strategies, there is no additional cost imposed on the portfolio. At the same time, this bucket is not a performance laggard in good times either.

Performance Behavior of NPP Strategy During Bull & Bear Markets

Before we go any further, it may be beneficial to discuss how our rotational and buy-and-hold portfolios would have performed since the year 2008. Moreover, this will demonstrate how rotational portfolios can act as a counterbalance to buy-and-hold portfolios during times of crisis. We run and manage many such rotational portfolios and three buy-and-hold portfolios inside our Marketplace service.

Note: All the tables and charts included in this article are sourced from Author’s work unless specified otherwise underneath the image. The stock market data, wherever used, is sourced from public websites like Yahoo Finance, Google Finance, Morningstar, etc.

Know Your Tolerance of Drawdowns

Let’s talk about drawdowns a little bit. During the good times (bull runs), it is natural that most folks do not think much about drawdowns. However, for retirees and older investors, it is of paramount importance to know their risk tolerance and have a realistic idea about how much of a drawdown would be tolerable to them. In addition to the level of tolerance to drawdowns, there is always the inherent risk of negative sequential returns during the early years of retirement. So, if you think that in a worst-case scenario, you could only tolerate a 20-25% drawdown, then you should not be invested in broad market indexes. Broad market indexes like S&P 500 routinely have a drawdown (loss from top to bottom) of over 30% or even 50% (examples include the dot-com crash of 2000-2002, the financial crisis of 2008-2009, and the Covid crash of 2020). Sometimes a downturn can end quickly, but at other times it can be long, slow, and painful.

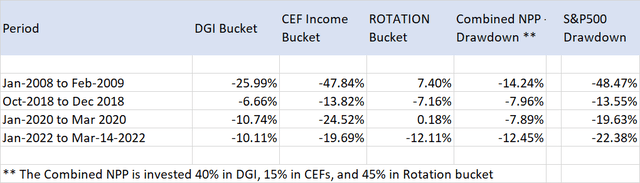

So, let’s compare the drawdown performance of our NPP portfolio and the S&P 500 during some of the worst times during the last 14 years (based on backtesting). We are not in a position to go beyond 2008 due to a lack of reliable data, but at least it would cover the financial crisis and a few other deep correction periods.

List of Drawdown Timeframes:

• Jan-2008 to Mar-2009 (Financial and Housing crash)

• Oct-2018 to Dec-2018 (Crash of 2018)

• Jan-2020 to Mar-2020 (Pandemic crash)

• Jan-2022 to June 17, 2022 (the current period)

Table-1:

As you can see above, the drawdown of the NPP portfolio was less than one-third of the S&P 500 during an extreme downturn and less than half at most other times. The current period is still an ongoing affair, and so the complete picture is not available as yet.

Combined Portfolio [NPP] Performance

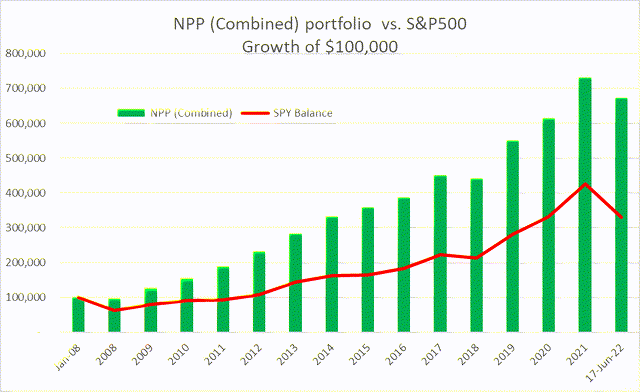

Below is the combined NPP portfolio performance (based on backtesting results from 2008 until June-17-2022). We will then provide more details on the three components of the NPP portfolio.

Table-2:

|

As of June 17, 2022: |

CAGR** |

|

CAGR of DGI bucket since 2008: |

13.41% |

|

CAGR of CEF-High-Income bucket since 2008: |

9.82% |

|

CAGR of ROTATION bucket since 2008: |

15.74% |

|

CAGR of Combined NPP strategy since 2008: |

14.08% |

|

CAGR of S&P 500 since 2008: |

8.62% |

** CAGR – Compound Annual Growth Rate

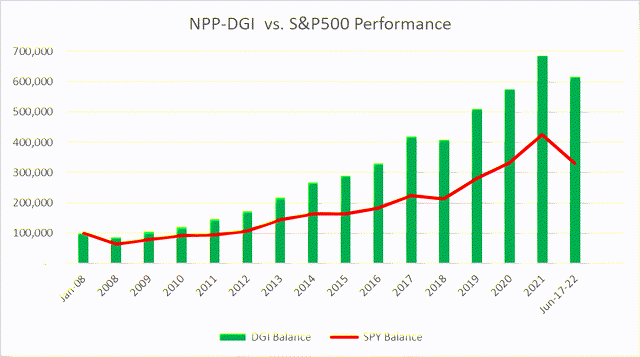

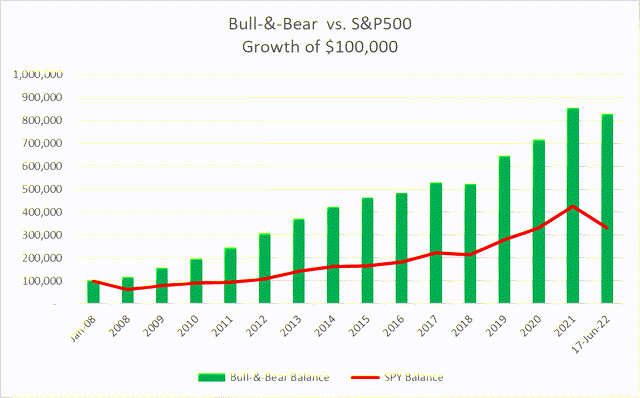

Chart-1: The Combined NPP portfolio vs. S&P 500 Since 2008

(If no Income was withdrawn)

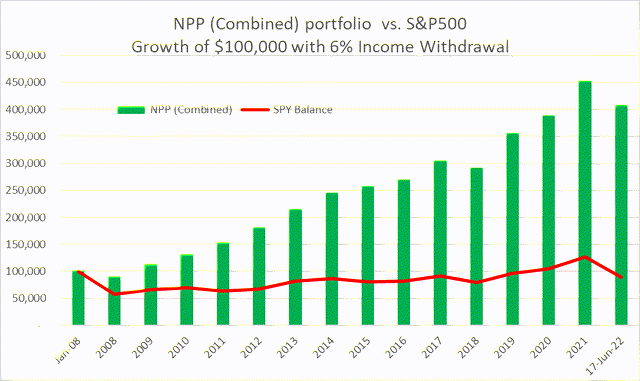

The chart below is the same as above, except that 6% (inflation-adjusted) income is withdrawn every year. It is very obvious that in terms of growth of capital, S&P 500 did pretty bad in spite of the fact that it has performed very well during the last 13 years. The reason was the huge drawdown right in the first year. This demonstrates very clearly the danger of risk of sequence returns mentioned earlier. However, due to very limited drawdowns, the NPP strategy balance grew very nicely.

Chart-1A: The Combined NPP strategy vs. S&P 500 Since 2008

(If 6% Inflation-adjusted Income was withdrawn)

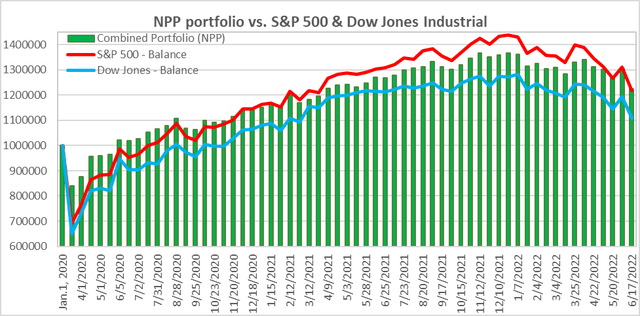

Below is the chart from the “live performance” of the NPP Portfolio since Jan. 2020. (Since this comes from our Marketplace service, it takes into account 6 Rotational portfolios and 3 Buy-and-hold portfolios). In practice, an investor would just need two buy-and-hold buckets and one (or maybe two) rotational buckets. In the chart below, you will notice that at the market bottom in March 2020, S&P 500 and Dow Jones were down nearly 30% and 35%, respectively; however, NPP was down only about 15%.

Chart-2: Live performance since 2020

An Example Portfolio: 3-Bucket NPP Strategy

In this section, we will provide an overview of each of the three buckets and their individual performances vis-à-vis the S&P 500.

Bucket 1: DGI Bucket (40% of the assets)

Bucket 2: CEF High-Income Bucket (15% of the assets)

Bucket 3: Rotational Bucket (45% of the asset).

Bucket-1: DGI-Core

We believe that a DGI (Dividend Growth Investing) bucket is a must-have for most investors. This forms the foundation of our portfolio strategy. In our view, a diversified DGI portfolio should hold roughly 15-25 stocks. For this bucket, we will look for companies that are large-cap, relatively safe, and have a solid history of paying consistent and growing dividends. We will present 15 such stocks based on our past research, current dividend payouts, and a high level of dividend safety.

The goals of the DGI Bucket are:

• Long-term investments 3%-4% dividend income

• Long-term total return in line with or exceeding the broader market

• Drawdowns to be about 70% (or less) of the broader market

This is our long-term buy-and-hold bucket. It will be our core investments in solid, blue-chip dividend stocks. It’s relatively easy to structure and form this bucket. However, we must put emphasis on diversifying among various sectors and industry segments of the economy.

For this part of the portfolio, our focus is to select stocks that tend to do well in both good times and during recessions/corrections. This is especially important if you are a retiree. Please note that this is just a list for demonstration purposes, and there can be many other stocks that would be equally qualified.

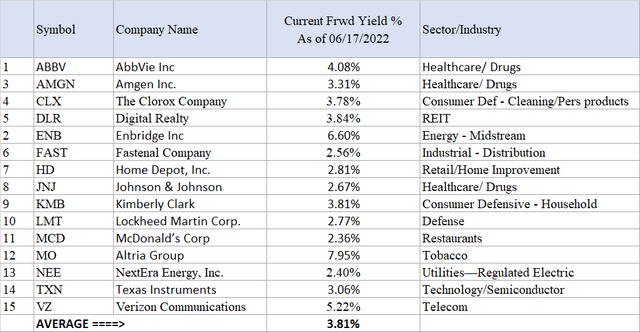

Stocks selected:

AbbVie Inc. (ABBV), Amgen (AMGN), Clorox (CLX), Digital Realty (DLR), Enbridge (ENB), Fastenal (FAST), Home Depot (HD), Johnson & Johnson (JNJ), Kimberly-Clark (KMB), Lockheed Martin (LMT), McDonald’s (MCD), Altria (MO), NextEra Energy (NEE), Texas Instruments (TXN), and Verizon (VZ).

Table-3:

The average yield from this group of 15 stocks is reasonable at 3.81% compared to 1.60% from S&P 500. If you still have some years before retirement, reinvesting the dividends for a few years would take the yield on cost up to 4% easily.

Chart-3: Comparative performance of DGI Bucket and S&P500 since 2008

Note: For performance analysis, ABBV was replaced with its parent company ABT, prior to the year 2013 (prior to spinoff).

Bucket-2: CEF High Income Bucket

Many readers may not agree with us, but we like CEFs (Closed-End Funds) and believe they have a place in a well-rounded income portfolio. Many investors tend to think that CEFs do not provide the necessary growth. But as we would demonstrate below, they could very well match or exceed the performance of the overall market over long periods of time. However, the following precautions and safeguards need to be taken by the investors:

- The CEF bucket (or portfolio) should consist of many funds diversified into many different types of asset classes.

- One should only invest in well-established funds with a solid history of NAV performance. The long-term NAV performance should exceed the distributions. Also, the fund should belong to a reputable fund family.

- We should invest in CEFs when they are being offered at discounts (to NAV) and not at premiums.

- Some of these securities use leverage to generate high income. Leverage works both ways, and in times of panic or recessions, these securities tend to lose more than the broader market. So, we will caution not to over-invest in them. We recommend a maximum of up to 25% exposure to this bucket.

For high income, besides CEFs, we could invest in investment vehicles like REITs (Real Estate Investment Trusts), mREITs, BDCs (Business Development Companies), and MLPs (Master Limited Partnerships).

For this income bucket, we need to be highly selective and choose the best of the best funds in each of the respective asset classes. Also, one should consider this part of the portfolio as a sort of “annuity” subset of the overall portfolio. However, we believe they are much better in many aspects compared to annuities.

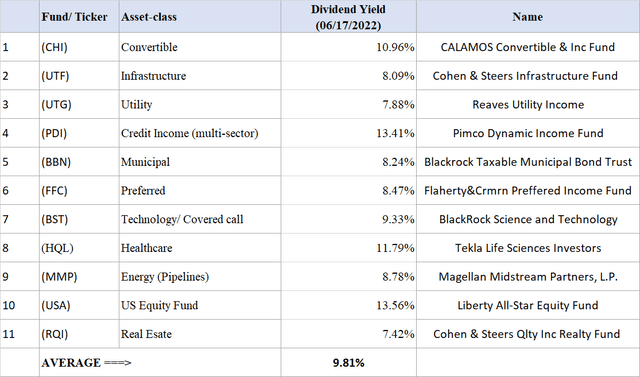

We present here a set of 11 high-income investment funds; most of them are CEFs. However, one of them is an individual stock (Magellan Midstream Partners (MMP)), being a partnership. Please be aware that a partnership usually issues a K-1 form (partnership income) at tax time instead of dividend income.

Below are some of the best funds within each asset class. The average yield of the portfolio presented below is roughly 9.80%.

The funds/securities that we would consider in a long-term portfolio would be: (CHI), (UTF), (UTG), (PDI), (BBN), (FFC), (BST), (HQL), (MMP), (USA), and (RQI).

Table-4:

Note: Please be aware that MMP being a partnership, would issue a K-1 form (partnership income) at tax time instead of dividend income.

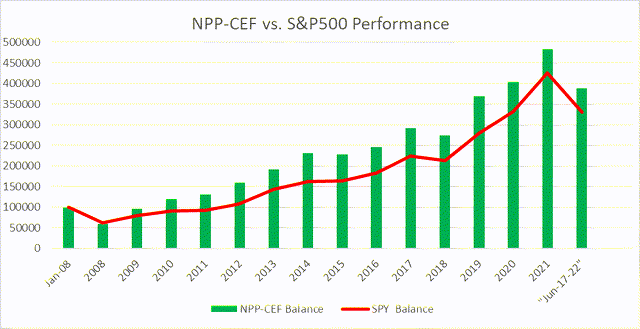

Chart-4:

Note: For performance analysis, a couple of funds did not have a history prior to 2013, so they were suitably replaced for the prior period.

Bucket-3: Rotational Bucket

We regularly write about Rotation strategies. For the new readers, let’s answer the basic question. What’s a Rotation strategy, and why invest in it? First, this is our insurance bucket (or hedging bucket), which should preserve our capital in times of crisis or panic. In addition, it would reduce volatility, provide a decent return, and some of them could provide a good income as well. Not all Rotation strategies are created equal. Some can be geared towards high growth and thus could involve high volatility. In this article, we are going to discuss only conservative strategies.

Along with the DGI portfolio, the Rotation strategy is an essential part of our overall portfolio. Investment in stocks is inherently risky, and the Rotational strategies provide the necessary hedge against the risk. They help bring the overall volatility of the portfolio down and limit the drawdowns in a panic or a major correction scenario. The biggest advantage is that they let the investor sleep well at night. They bring a level of assurance that helps the investor to maintain calm and stay invested in good times and bad.

However, we must caution that this strategy requires a bit of regular work on a monthly basis. One can start with one rotation strategy, but as one gains more experience and confidence, one could diversify into at least two such strategies. We provide eight Rotation strategies in our Marketplace service, but for most folks, two or three such strategies should be more than enough.

Note: A word of caution for new investors – just because we’re allocating 45% of the portfolio to this strategy, we are not recommending that you change to this strategy overnight with large sums of money. Rather, any change or conversion should be done gradually over time in smaller steps, and one should preferably use more than one such strategy.

A Rotation Strategy for both Bull and Bear Markets

In the Rotational bucket, we normally rotate between a fixed set of securities on a periodic basis (usually a month), based on the relative performance of each security during the previous period of defined length.

This portfolio is designed in such a way that it aims to preserve capital with minimal drawdowns during corrections and panic situations while providing excellent returns during the bull periods. Due to much lower volatility, this portfolio is likely to outperform the S&P 500 over long periods of time. However, it may underperform to some extent during the bull runs.

The strategy is based on eight diverse securities but will hold any two of them at any given time, based on relative positive momentum over the previous three months. Basically, we will select the two top-performing funds. The rotation will be on a monthly basis. The eight securities are:

- Vanguard High Dividend Yield ETF (VYM)

- Vanguard Dividend Appreciation ETF (VIG)

- iShares MSCI EAFE Value ETF (EFV)

- iShares MSCI EAFE Growth ETF (EFG)

- Cohen&Steers Quality Income Realty Fund (RQI)

- iShares 20+ Year Treasury Bond ETF (TLT)

- iShares 1-3 Year Treasury Bond ETF (SHY)

- ProShares Short 20+ Year Treasury ETF (TBF)

Chart-5: Comparative performance (backtested) for B&B Model and S&P 500

Concluding Thoughts

At first glance, many readers may feel that the strategy outlined above is too complex. But if you care to give it a second look, you would notice that 60% of the portfolio is buy-and-hold and mostly buy once and forget it. Only the Rotational part requires some regular but minimal work. Even then, we agree this approach or strategy may not be appropriate for everyone. These strategies require a long-term investment horizon, discipline, some time, and effort on a monthly basis. Also, the Rotational strategies normally work best inside a tax-deferred account. The main idea of this series of articles is to get the readers to think and explore a multi-basket investment approach.

It is obvious that the market is going through a highly uncertain period caused by conditions not seen in a long time. However, as long-term investors, we have a different approach to facing uncertainties in the market. The diverse investing approach with the three baskets presented above would provide lower volatility, an extra layer of safety, and reasonable growth, often matching or exceeding the broader market. Above all, income investors could expect a decent income of 5%, with the added benefit of in-built protection from bigger drawdowns.

Be the first to comment