deliormanli/E+ via Getty Images TG

People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences – Peter Lynch

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on October 07, 2022.

In biotech investing, a highly intriguing time is when a company is sending its drug to the FDA for approval. After all, such a catalyst event usually moves the needles on your stock price. While a non-approval typically causes the shares to tumble substantially, an approval does not always mean the stock would rally. It all depends on the market condition and the specific catalyst.

That being said, TG Therapeutics (NASDAQ:TGTX) has an upcoming regulatory binary for its lead medicine, ublituximab. Specifically, shareholders and patients are eager to hear from the FDA by yearend. As such, I’d like to revisit this thesis to share with you my forecasting, analysis, and expectations of this turnaround equity.

Figure 1: TG chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in the prior article,

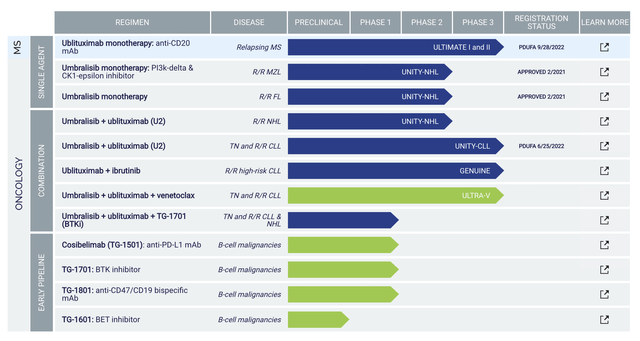

Operating out of New York, TG Therapeutics is focused on the innovation and commercialization of stellar medicines to serve the unmet needs in blood cancers and autoimmune diseases. As shown below, the pipeline has two intriguing medicines ublituximab (i.e., Ubli) and umbralisib (Umbra). Due to safety and efficacy concerns, TG pulled Ubli off the market for its approved indications: marginal zone lymphoma (MZL) and follicular lymphoma (i.e., FL). The company also canceled their application of the U2 (Ubli plus Umbra) combo for chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL). As such, you now only have Ubli’s upcoming potential approval for multiple sclerosis (i.e., MS). There are also other early-stage molecules such as TG1501 (cosibelimab), TG1601 (i.e., a BET inhibitor), TG-1701 (BTK inhibitor), and TG1801 (CD47/CD19 bispecific antibody).

Figure 2: Therapeutic pipeline

Ublituximab For Multiple Sclerosis

Shifting gears, let us dive deeper into the analysis of Ubli’s upcoming regulatory decision for MS. Accordingly, the FDA already accepted the Biologic License Application (i.e., BLA) for Ubli as a treatment for relapsing forms of MS (i.e., RMS). Moreover, the agency set the Prescription Drug User Fee Act (i.e., PDUFA) for December 28 this year.

Given that the FDA is about to make its decision, you should focus on forecasting its outcome. Before making a forecast, you should note that it’s an imperfect science. Therefore, you have to rely on “probability analysis.” With probability analysis, you’re not guaranteed a result. Instead, you can only size up the best chances that a certain outcome could happen.

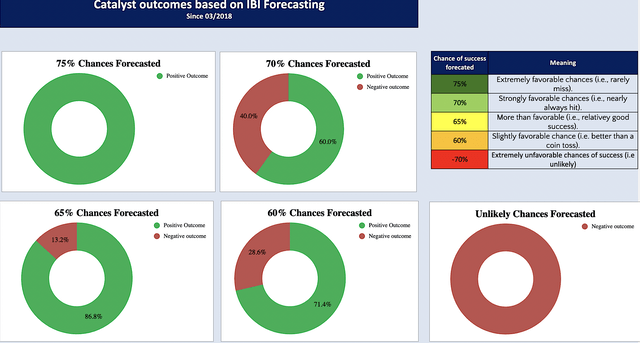

Leveraging my Integrated System of forecasting, I ascribed a 65% (i.e., more than favorable chances) that Ubli would gain approval by December 28. I based my forecasting on decades of experience, mechanism of action, available data, disease context, and most importantly, my intuition.

Unless the MS data reported by the management is not truthful, you expect that approval is forthcoming. As I alluded to, you can see that the management took Ubli off the shelf after its launch in the market for MZL/FLL and also pulled the U2 application for CLL/SLL. Hence, there is a lingering concern about the quality of the data that we read from the press release.

As a general rule of thumb, you can trust what the management reports in the press release. Though they can try to “spin the data,” it has to be accurate. After all, if the management is not honest, they would lose investors’ trust the following year and thereby potentially be removed by the Board or the majority shareholders.

Forecasting Records

Now, I want to share with you the accuracy of my forecasts since 2018. Don’t shoot the messenger here. I simply show you the system that I’ve been using for over a decade that has worked for me. That way, you’d know what to expect.

The first thing you should notice is that my forecasting is “categorical” rather than numerical data. As such, the 65% category simply means a “more than favorable chance” of a positive outcome. Given that 86.8% of my 65% category hit, that’s your odds of seeing Ubli approval in December. If you want to translate that into numerical, my 65% would equate to 86.8%; whereas, my 75% would equate to a 100% hit rate.

Figure 3: Forecasting data

Disease Context

To appreciate the upcoming approval event, you should go over the disease context & other variables that I employed in my analysis. After all, having intelligence through “reading the tea leaves” can give you an advantage over the market.

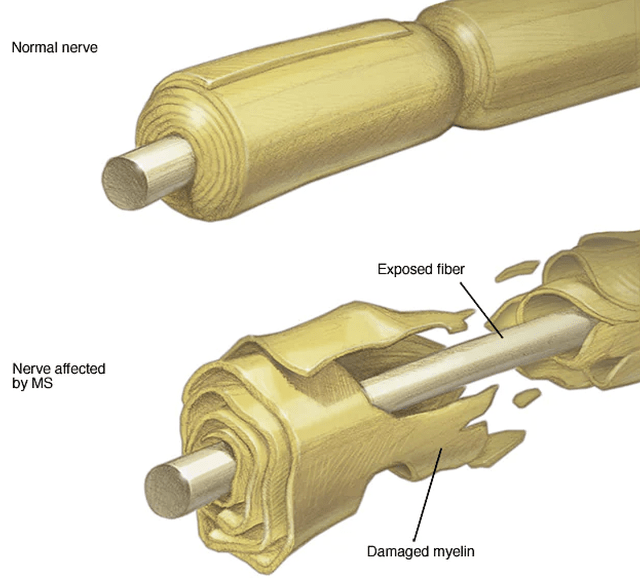

As a debilitating autoimmune condition, multiple sclerosis is due to the immune system attacking the myelin sheath (i.e., protective covering) of the brain and spinal cord (i.e., the central nervous system or CNS).

Figure 4: Disease context

Consequently, it causes either temporary or permanent disruptions in the signaling of the body and thereby manifesting various symptoms of neuronal signaling defects. Because the disease comes and goes, you’d see symptoms relapsing after a period of recovery. Some of these symptoms include bodily weakness, loss of bowel/organ functions, muscle fatigue, and blindness.

Current MS treatments focus on supportive care and immunosuppressants. That is to say, the mainstay management is to “hit (or suppress) the immune system” so that it won’t attack the CNS. After all, it’d make sense to calm down the immune system during a relapse and prevent future attacks. As you’ll later see, this disease context is crucial to Ubli because it harmonizes with the drug’s mechanism of action. In other words, they are two puzzle pieces that fit together.

Ublituximab’s Mechanism of Action

As an engineered monoclonal antibody, Ubli works by binding to crucial cells of the immune system dubbed B-cells. Precisely speaking, Ubli binds to the CD20-expressing B-cells. After binding, it causes those B-cells to be destroyed via two different cellular processes: antibody-dependent cellular cytotoxicity (i.e., ADCC) and complement-dependent cytotoxicity (i.e. CDC).

On that note, you can see that Ubli calms down the immune system (i.e., the body’s natural defense system) by knocking out one of the two commanding officers (i.e., the B-cells). Based on the disease context (i.e., an overactive immune system) and the drug Ubli (i.e., calming down the immune system), you can see that it should be efficacious. And, it is based on the supporting data. Nevertheless, knocking out any commanding officer has adverse effects. For Ubli, those effects are strong enough to cause the drug to be withdrawn from the shelf. According to TG,

Company has voluntarily withdrawn the pending BLA/sNDA for the combination of Ubli and Umbra (i.e., U2) for the treatment of adult patients with CLL/SLL. The decision to withdraw was based on recently updated overall survival (i.e., OS) data from the UNITY-CLL Phase 3 trial that showed an increasing imbalance in OS.

You should keep in mind that all drugs have adverse effects. The key to their utility is whether efficacy trumps toxicity. That is to say, the drug will be approved and prescribed if the benefits outweigh the risks. For CLL/SLL/MZL/FL, you can see that knocking out the B-cells (with Ubli) would devastate the immune system because cancer already significantly suppressed the immune system itself. Hence, that explained why the overall survival of patients (afflicted by cancer) who took Ubli was reduced. As you’ll see, Ubli is nevertheless an excellent drug for MS.

Supporting Data

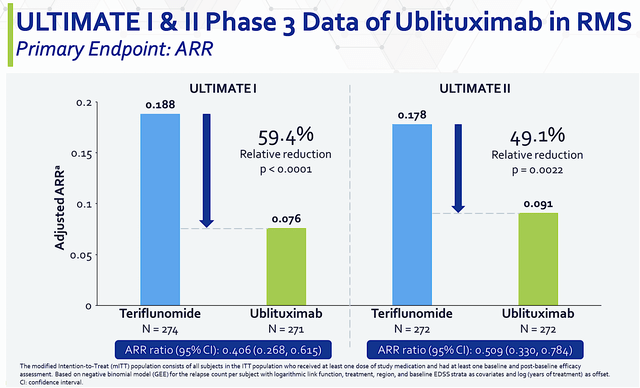

As you know, all the sound mechanisms of action and the appropriate disease context would be meaningless: if the drug doesn’t perform in actual clinical studies. As you’d expect, Ubli cleared both the Phase 3 (ULTIMATE 1 & 2) trials with flying colors.

From the figure below, you can see that Ubli trumped teriflunomide by 49.1% to 59.4% superior reduction in annualized relapse rate (i.e., ARR). With both p-values all less than 0.05, you’d know the results are real rather than random occurrences. In the statistical and clinical sense, those results are statistically significant and clinically meaningful.

Figure 5: ULTIMATE primary endpoint in ARR

Financial Assessment

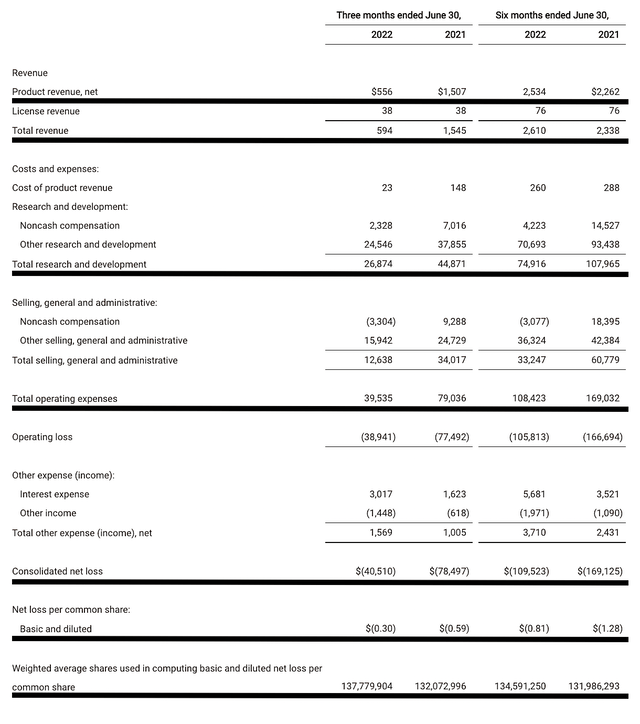

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 2Q2022 earnings report for the period that ended on June 30.

As follows, TG procured $556K in product sales compared to $1.5M for the same period a year prior. As you can see, the company pulled its drug off the shelf which explicated the revenue drop. That aside, the research and development (i.e. R&D) for the corresponding periods registered at $26.8M and $44.8M. The lower R&D is attributed to the conclusion of trials as well as TG gearing down to focus on the MS franchise.

Additionally, there were $40.5M ($0.30 per share) net losses compared to $78.4M ($0.59 per share) decline for the same comparison. As you can see, the bottom line improved by nearly 50%. And, that’s due to the various implementations that the management executed. According to the Chairman and CEO (Michael Weiss),

Our primary focus for the remainder of this year is working toward the approval of Ubli, which has a PDUFA goal date of December 28, 2022, and preparing for its potential launch in early 2023. If approved, we believe Ubli has the potential to be a meaningful treatment option for patients with relapsing forms of multiple sclerosis. During H1 of the year we implemented a number of cost-saving measures, and we are pleased to report those efforts have resulted in a lower than expected 2Q burn, which we believe puts us in a good financial position as we approach the potential launch of Ubli.

Figure 6: Key financial metrics

About the balance sheet, there were $231.8M in cash, equivalents, and investments. Against the $39.5M quarterly OpEx, there should be adequate capital to fund operations into 1Q2024 before the need for additional financing. Simply put, the cash position is adequate relative to the burn rate.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with an investment regardless of its underlying strength. At this point in its growth cycle, the most important concern for TG is whether Ubli can gain approval for MS by December 28. As I forecasted a 65% (i.e., more than favorable) chance of a positive decision, there is a 35% corresponding risk of failure. If Ubli is either delayed or not approved, you can see that TG shares would tumble over 50% and vice versa.

The other risk is that the management might not be forthcoming with investors about the data. You can only know what is reported — and what you can read from the “tea leaves” — are not 100% accurate. Furthermore, TG might run into a potential cash flow constraint because therapeutic development is highly capital-intensive.

Conclusion

In all, I raise my hold to buy recommendations on TG Therapeutics with 4.2/5 stars rating (i.e., an increase from 3.98 stars). TG Therapeutics is a stock that is testing the most patient/sophisticated of all investors. After securing approval and rallied to over $54.00 back in late 2020, the stock gave up most gains in the subsequent years. And it seems like there is no light at the end of the tunnel. The Ubli/U2 withdrawal due to safety concerns came unexpectedly that left a sour taste.

Now as you’re heading into December 28, TG has one last and most powerful shot left to redeem itself: a Ubli approval for MS. Notably, the MS market is huge (i.e., $28B) that is in dire need of novel therapeutics like Ubli. Riding extremely robust efficacy with acceptable safety, you can expect that Ubli is positioned to be the answer for MS. Who knows, the FDA might deliver an early Christmas Present for shareholders/patients again this year.

Be the first to comment