bjdlzx

Elevated Energy Cost Continues to Fuel Inflation Despite Aggressive Monetary Tightening and Fiscal Policies to Dampen the Rapid Rise in Goods and Services Prices

Although somewhat better compared to previous readings, global annual inflation rates remained at historic highs in August. This was driven by continued strong pressure from unusually higher electricity, gas and other utility prices, which companies are passing on to their customers by raising the prices of the goods and services they provide.

So far, aggressive central bank rate hikes combined with government fiscal policies trying to stem the soaring prices of goods and services have done little but create a real recession risk.

With inflation fueled by factors such as the war in Ukraine, geopolitical fighting between Western countries and Russia/China, and uncooperative OPEC, all beyond the control of the world’s top monetary authorities, the task to restore price stability while maintaining maximum employment is of even greater complexity.

Therefore, these powerful factors of galloping inflation reflected in rising oil and gas and other commodities prices in the futures contract markets could last for a very long time.

Analysts See Crude Oil and Natural Gas Prices Rising from Current Levels. Texas Pacific Land Corporation Offers Good Leverage

Roughly based on the above factors, analysts see crude oil and natural gas assets rising from the current $85.02 per barrel and $7.81 per metric million British Thermal Units [MMBtu], respectively.

At the time of writing, they expect Crude Oil West Texas Intermediate [WTI] futures expiring in October 2022 to trade at $100.71 a barrel within 52 weeks, an increase of 18, 5% compared to current levels.

Regarding natural gas futures expiring in October 2022, they forecast the asset to rise 32.14% over the next 52 weeks to $10.32 per MMBtu.

Stock market investors would be better off tying a larger portion of their portfolio to the performance of energy stocks, as not many are likely to rise as fast as these publicly traded stocks, which will benefit from the expected continued bull market in oil and natural gas.

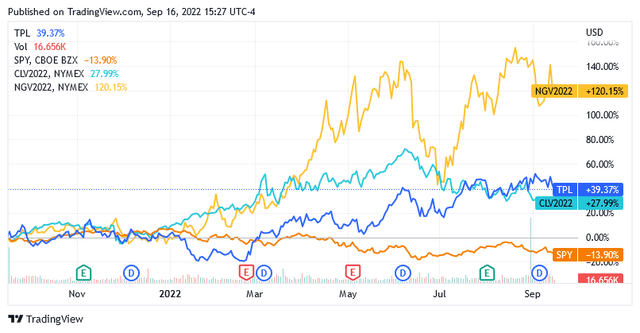

In the oil & gas industry, Texas Pacific Land Corporation (NYSE:TPL)’s stock appears well-positioned to continue trading higher and contribute to its more than 40% gain over the past year as its shares remain faithful to the bullish oil & gas market, as the following chart indicates.

Over the past year, crude oil futures were up 27.99%, natural gas was up 120.15%, and shares of Texas Pacific Land Corporation were up 39.37%.

Conversely, the stock market, represented by the SPDR S&P 500 ETF Trust (SPY), the benchmark, fell 13.9%, paying the price for headwinds from highly uncertain times with inflation soaring. Moreover, despite the unpredictable results, hawkish monetary policy was pursued, and the supply chain crisis caused by the COVID-19 pandemic persisted.

Oil and gas operators are excited when the price of hydrocarbons rises in the futures market because those prices allow them to capture the extra profits that some governments try to return in part to citizens and small/medium businesses by enacting well-suited taxation.

Oil and gas operators increase their revenues by selling more, and to do this they need to increase oil and gas throughput by intensifying the exploration and extraction of the mineral resources. And they will continue to do so if oil and natural gas prices continue to rise as analysts predict.

Texas Pacific Land Corporation’s Role in the Oil and Gas industry. Segments Are on Track to Grow Sales, Giving the Stock Strong Upside Potential

And with more extra profits on the way, Texas Pacific Land Corporation shareholders surely envision the pleasure of higher royalties from the exploitation of their company’s land property by other oil and gas explorers and miners. Texas Pacific Land Corporation, based in Dallas, Texas, is one of the largest landholders in all of Texas and owns approximately 880,000 acres in west Texas. Most of those acres are located in the mineral-rich Permian Basin area.

Describing how the rise in fossil fuel prices has contributed to the increase in oil and gas royalties for Texas Pacific Land Corporation [see table below] could give an idea of how the company’s revenues could evolve in the coming months when oil and gas prices are expected to improve. The data in the table is from the company’s financial results report for the second quarter and first six months of 2022.

|

Items |

Q2 2022 |

Q2 2021 |

Variation [Q2 22 over Q2 21] |

H1 2022 |

H1 2021 |

Variation [H1 22 over H1 21] |

|

Total revenues [in Million] |

$176.27 |

$95.93 |

+84% |

$323.61 |

$180.09 |

+79.7% |

|

Total oil and gas royalties [in Millions] |

$121.27 |

$58.20 |

+108.35% |

$225.44 |

$107.74 |

+109.24% |

|

Production volumes [Million Barrels of Oil Equivalent] |

1.805 |

1.493 |

+20.9% |

3.676 |

2.973 |

+23.65% |

|

Realized prices [per Barrel of Oil Equivalent] |

$70.36 |

$40.83 |

+72.32% |

$64.22 |

$37.94 |

+69.27% |

Currently, oil and gas royalties from the use of Texas Pacific Land Corporation’s land by hydrocarbon well operators represent approximately 70% of the company’s total revenues. As such, royalties are a major driver of the company’s revenue. Therefore, any continuation of the oil and gas bull market should create a positive catalyst that continues to drive the stock price to higher levels, as it has done in the past year.

However, not only the producers, the so-called upstream sub-sector, benefit from the strong growth of the spot markets for oil and gas [and Texas Pacific Land Corporation’s royalties benefit too], but also the entire energy sector, including the downstream and midstream sub-sectors.

Texas Pacific Land Corporation’s 880,000-acre land also enables midstream and downstream operations, and as those activities grow, the company will benefit from permits issued to the gas pipeline and power line operators.

This segment is expected to be a strong contributor to Texas Pacific Land Corporation’s revenues in the coming months. The activities of this segment should be intensified as more and more gas tankers for loading will sail off the coast of the Gulf of Mexico to reach the European regasification plants and help European countries reduce their dependence on Russian gas.

The trend in this sense is identified by comparing the annual increases in easements and commercial leases for the second quarter with those for the first 6 months of 2022. For the second quarter of 2022, easements and other land-related revenues segment grew 55.6% year-on-year versus 29% for the longer 6-month period. Therefore, income from this segment is on the rise.

In the short term, this segment is expected to gain momentum as Europe has yet to prove that it can do without Russian gas, as winter has not yet arrived. However, Russia has closed virtually all gas ports to the EU in response to Western sanctions. As a result, Europe also needs more natural liquefied gas from America, which is also routed through the Texas Pacific Land Corporation lands.

Easements and commercial lease revenues account for approximately 7%-8% of total revenues.

Texas Pacific Land Corporation also generates revenue from sourcing water and/or treated water used in past production, revenue from saline water disposal on its land, and revenue from the sale of caliche, the raw material used to make cement used by infrastructure construction companies worldwide.

This segment accounts for 23% to 24% of total revenue, is doubling year over year as its second-quarter and first-half 2022 results show, and is expected to continue growing as production of oil and gas and other commodities increases higher water consumption, which can be bought on site.

Instead, operating expenses relative to the second quarter and first six months of 2022 have remained fairly flat from year to year and should remain so for the period to come, which bodes well for future income lines.

Net income was $118.9 million, or diluted earnings per share were $15.37, up 109% year over year for the second quarter of 2022.

Net income was $216.8 million or diluted earnings per share was $28.01, up 102.8% year over year for the first half of 2022.

The Balance Sheet and The Dividend

The company appears to have approximately $390 million in cash and no debt as of June 30, 2022.

Texas Pacific Land currently has an Altman Z score of 73.04, meaning its balance sheet is in safe areas, so the probability of bankruptcy in the next few years is zero.

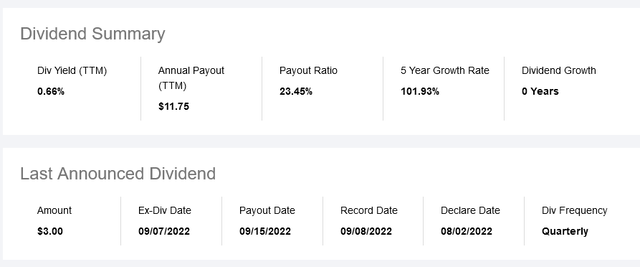

On Sept. 15, the company paid a quarterly dividend of $3 per share — the same level as the previous payout — for a yield [TTM] that stands at 0.66% as of this writing.

Wall Street Growth Estimates for Earnings and Revenue. Recommendation Ratings and Price Target

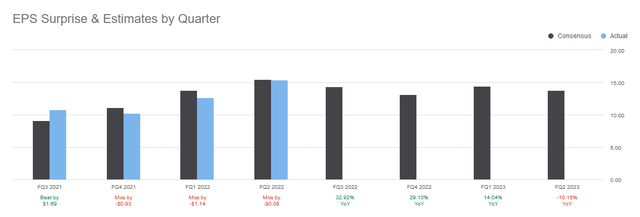

Wall Street analysts estimate earnings per share [EPS] to increase from $10.82 in Q3 2021 to $14.38 in Q3 2022 and from $10.21 in Q4 2021 to $13.18 in Q4 2022.

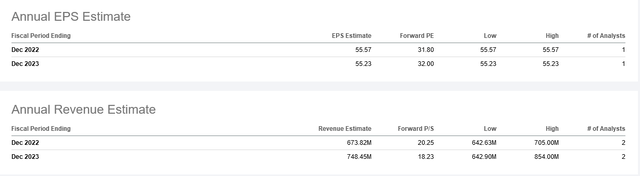

Analysts are forecasting EPS of $55.57 in 2022 [vs. $34.83 actual in 2021] and $55.23 in 2023 [but on Yahoo Finance it says $64.1 for 2023, as of this writing].

Analysts are forecasting revenue of $673.82 million in 2022 [vs. $450.96 million actual in 2021] and $748.45 million in 2023.

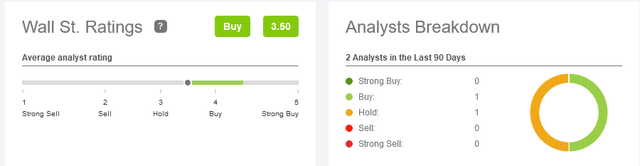

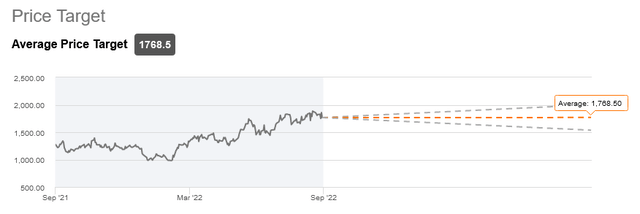

On Wall Street, the stock has a median buy rating with an average price target of $1,768.50.

Wall Street’s Recommendation Ratings:

Wall Street’s Average Price Target:

The Stock Valuation: The Stock Price is Not Low, but Chances are it will Trade Higher

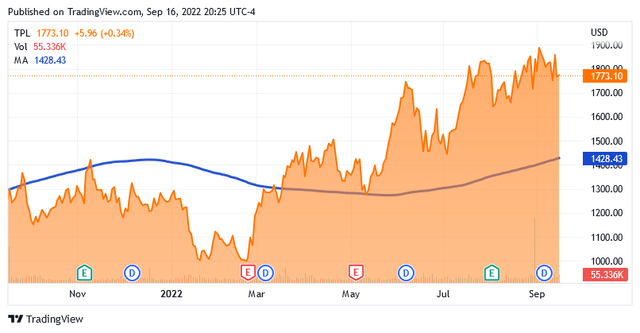

Currently, the stock price of $1,773.10 with a market cap of $13.693 billion as of this writing is not low compared to the 52-week range and its long-term trend.

In fact, it is 24.6% above the median of $1,422.65 from the 52-week range of $946.29 to $1,899.01 and well above [approx. 24.13%] the 200-day moving average of $1,428.43.

The stock price has risen significantly over the past year, but it is far from overbought as suggested by the 14-day RSI of 48.83.

So if the stock wants to keep going higher, there seems to be room for it, and also there are the conditions described above for that to happen.

Both oil and gas are currently pulling back slightly in futures markets after hitting record highs in early September, which could lead to some profit-taking in Texas Pacific Land Corporation’s stock.

Looking a little further beyond what’s happening right now, the likelihood of an uptrend seems greater than a downtrend.

Conclusion: Hard to Abate Factors for Higher Oil and Gas Prices/More Extra Earnings for the Energy Industry as a Whole

When oil and gas grow, it’s good for their producers’ profits, as well as for companies that give them the ability to exploit the mineral resources as these assets lie on their properties.

Texas Pacific Land Corporation’s royalty on crude oil and natural gas explored and mined on its tenements has benefited greatly from the rise of fossil fuels in the spot markets.

These increases are being caused by factors beyond the control of central banks, which are pursuing tightening policies aimed at calming inflation.

These are factors that are very difficult to eradicate and should continue to generate additional profits for the energy industry, which is also positive for Texas Pacific Land Corporation’s royalties.

Be the first to comment