Jasmin Pawlowicz

Powered by elevated oil and gas prices as well as attributable production growth, Texas Pacific Land Corporation (NYSE:TPL) has almost doubled in price. The company has a strong balance sheet with a net cash position in conjunction with a very lean cost structure. Nevertheless, the recent run-up of the share price puts the company at around 2% FCF yield. This seems very low, despite the low risk profile of the company, given the historical numbers and the rising interest rates. Moreover, recent land deals in the Permian basin suggest, that the company is also overvalued in terms of its land holdings. For these reasons, I think that a correction will likely follow.

Company overview

Texas Pacific Land Corporation as a successor of the Texas Pacific Land Trust has a rich history dating back to 1888. Based in Texas, the company is amongst the largest landowners with around 880k acres in the western part of the state.

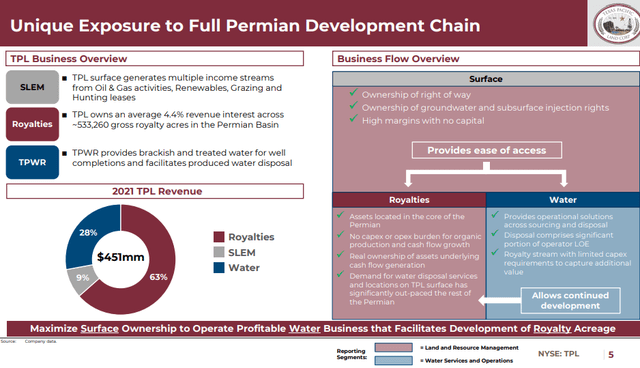

TPL’s business model (TPL)

TPL operates into two segments – Land and Resource Management, where recurring revenue comes primarily from oil and gas royalties and Water Services and Operations, where water royalties and sales are the source of recurring cash flow stream. The first segment, especially with the recent surge in oil prices is by far the bigger revenue contributor. It has a very diverse client base, which includes the US majors – Exxon Mobil (XOM) and Chevron (CVX) as well as many mid and small cap oil and gas producers.

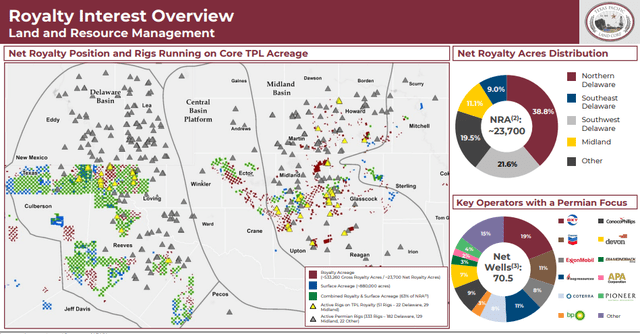

TPL’s Royalties Overview (TPL)

TPL has a simple capital structure with 7.7M shares and no warrants outstanding. However, on the Annual shareholder meeting scheduled for 14 February 2023 a 3:1 stock split will be on the agenda. The company has been returning capital to its shareholders through share repurchases and quarterly dividends of US$3.00/share, equating to an annual dividend yield of below 0.5%.

Recent results

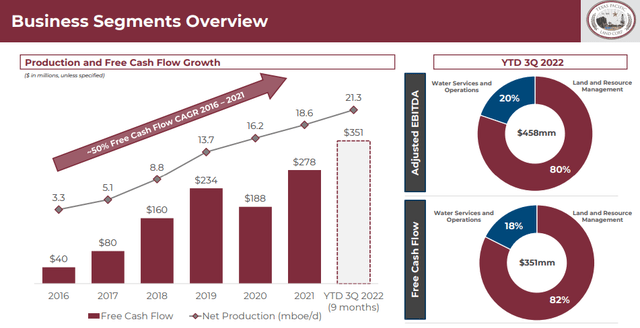

TPL’s operational performance (TPL)

Looking at the historical performance of TPL, it’s clear that the company has been on a remarkable growth trajectory when it comes to attributable daily oil equivalents production and is on track to achieve a record year in terms of free cash flow. Due to the royalty business model, the cost structure is very lean as evident from the 89% YtD adjusted EBITDA margin. The balance sheet is strong, as the company is debt free and has US$446.6M of cash and equivalents as of the end of Q3’22.

Share price and valuation

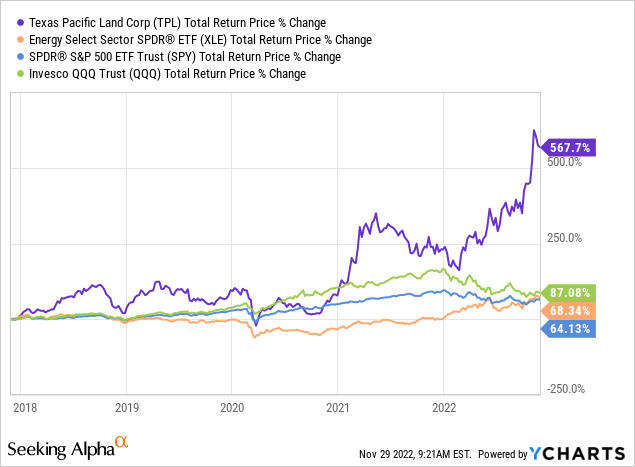

Zooming out in a 5-year time frame, TPL outperformed by a long shot the US energy sector, represented by the Energy Select Sector SPDR ETF (XLE) as well as the broad market, represented by the SPDR S&P 500 Trust ETF (SPY) and the tech sector represented by Invesco QQQ ETF (QQQ). YTD alone, TPL has nearly doubled. So the logical question is could this upward pressure to the share price persist? To answer that question I’ll first look at the historical FCF yield that the company has been trading, since it’s in a league of its own and a comparison to the broad energy sector won’t be fair.

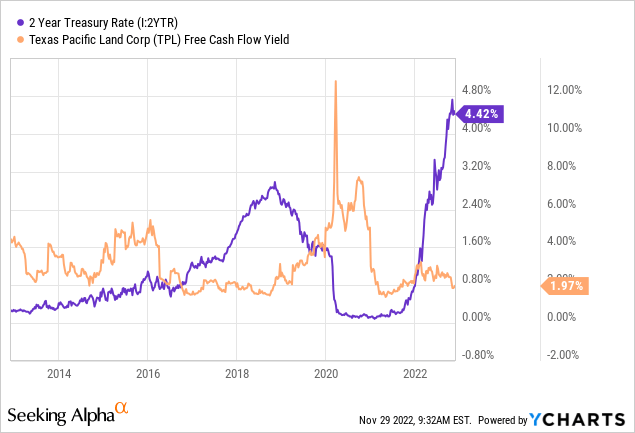

The data shows, that currently it’s trading at below 2% FCF yield, which is very close to a historical 10-year low. Figures in the 3-4% range seem more common over time. In addition, the recent moves in interest rates should be considered too. The 2-year US Treasury rate is above 4.4%, which is more than double the FCF yield of TPL. And while the royalty business model is very low risk, it’s hard to argues that it’s more riskless than government bonds.

Since TPL is an asset heavy company, some investors will probably argue that it’s not the cash flows that the business produces, but the assets that should have the most impact on valuation. While such argument may be debatable, it’s worth taking a look at the assets. The company has 880k acres of land in West Texas, primarily in the Permian basin. At the current EV of US$19.6B, this brings the price per acre to US$22.3k. For comparison, I’ll use two deals in the Permian basin of Sitio Royalties (STR), which is another royalties company. The first one was for the acquisition of 12.2k acres for US$224M, while the second one was for 19.7k acres for US$323M, which puts the average price/acre from the two deals at US$17.3, or 22.5% lower than the figure implied for the land of TPL.

Risks

The main risk before the bearish thesis would be for the perceived irrationality of the pricing to continue. This could be helped by a strong uptick of oil prices, but still, the yield would hardly catch up even the rate offered by 2-year US Treasuries. So given the risk-off environment in the market, a correction in the share price is likely to follow.

Be the first to comment