kynny/iStock via Getty Images

Long-term oriented management decision is a feature that is becoming scarce commodity in today’s world of short-termism, speculation and financial engineering. This is especially true in high growth segments of the economy, such as cloud computing, software and semiconductors.

Grappled with hunger for acquisitions to support their high topline growth rates, share repurchases, splits and generous stock-based compensation packages, many of today’s high growth companies have taken a lucrative and yet unsustainable approach to their corporate strategies.

This is not the case for Texas Instruments (NASDAQ:TXN), which over the coming years will benefit from its long-term oriented strategy that foregoes the temptation of achieving high topline growth at the expense of creating sustainable long-term competitive advantages and shareholder value.

A World Awash in Liquidity

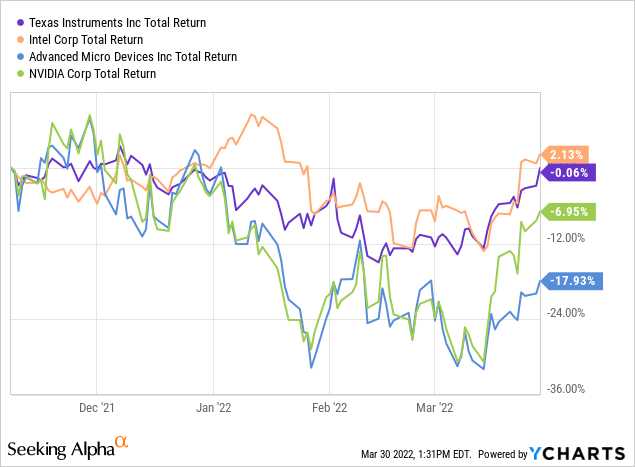

It has been only a few months since I first covered the company and explained why it is currently my top pick in the semiconductors space. The total returns since then has been flat, while the Wall Street darlings – AMD (AMD) and Nvidia (NVDA) lost 18% and 7%, respectively.

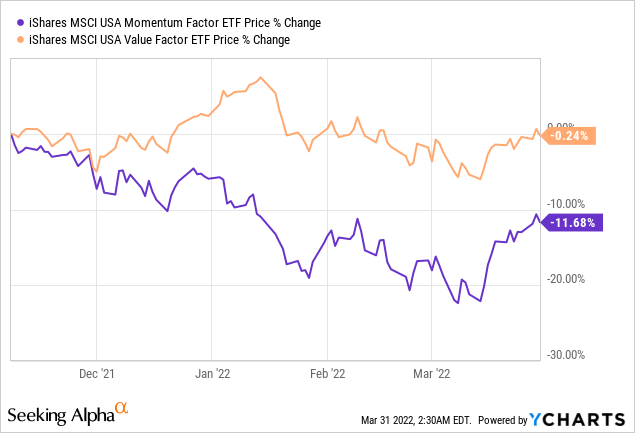

In all fairness, making comparisons over such a short period of time is meaningless and we should also note that the outperformance of Texas Instruments and Intel (INTC) over AMD and Nvidia has been largely driven by the outperformance of the value factor over momentum.

I analyzed this phenomenon in detail in my thought piece on Nvidia, called “Nvidia: Fundamentals Matter Less Than Ever”. In a nutshell, many people within the investment community nowadays assign the strong returns of these high companies to their superior stock-picking skills, when in fact they were largely driven by market-wide forces, influenced by political and monetary decisions.

Investing is Like Watching Grass Grow

As the famous quote goes, there isn’t as much excitement around TXN. People are often interested in flashy everyday breaking news that surround many of the semiconductor companies nowadays.

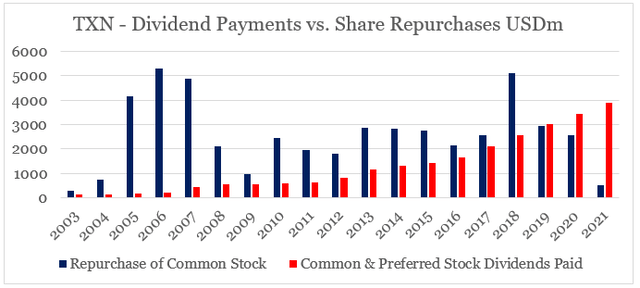

In terms of capital allocation, Texas Instruments’ management has been steadily increasing its dividend payments even through the violent cycles of the semiconductors industry. More importantly, however, as valuations reach new highs, the company has scaled down its share repurchase program.

Prepared by the author, using data from annual reports

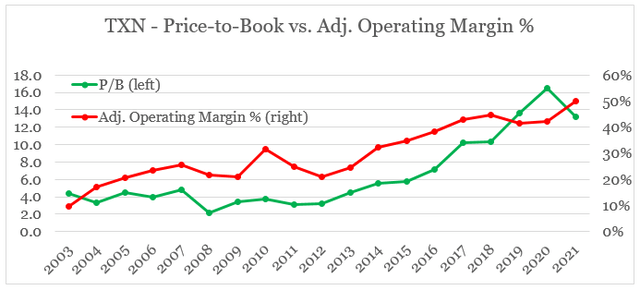

Although the current valuation is supported by Texas Instruments’ record high margins and return on capital, the management finds more value in reinvesting and expanding the business, as opposed to buying back its own shares.

Prepared by the author, using data from annual reports and Yahoo! Finance

* adjusted for acquisition and restructuring charges

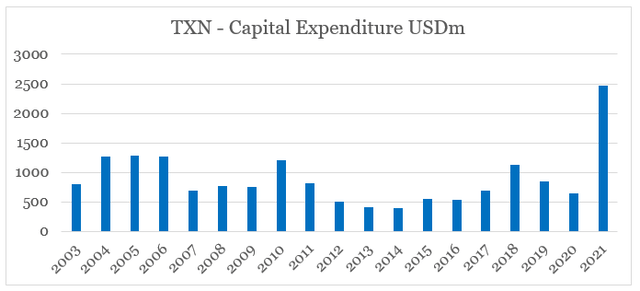

The sharp fall in TXN’s share repurchase program was largely used to finance its unprecedented increase in capital expenditure, aimed at expanding its production capabilities.

Prepared by the author, using data from annual reports

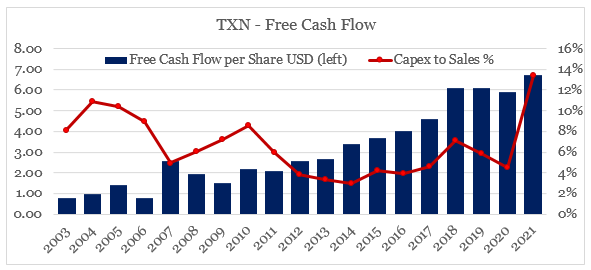

However, even after the unprecedented increase in capital expenditure, Texas Instruments still managed to grow its free cash flow per share, which is one of the key performance indicators of the management.

Prepared by the author, using data from annual reports

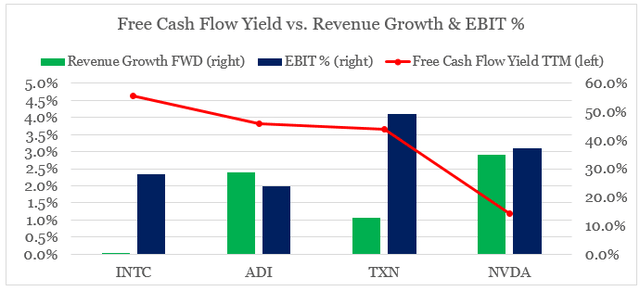

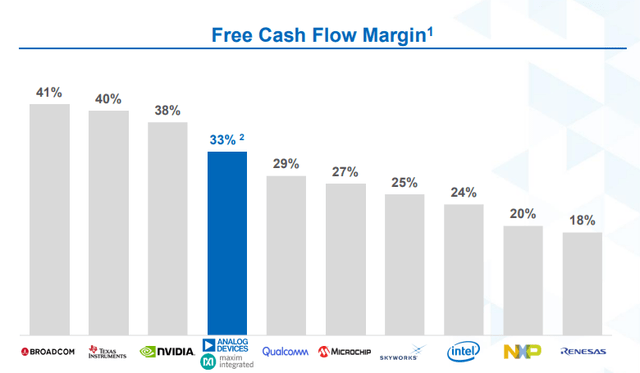

Even at the elevated level of capital spend, Texas Instruments still trades within the bounds of Intel and its major peer in the analog space – Analog Devices (ADI), on a free cash flow basis. However, there is a wide gap between TXN margins and those two peers, while at the same time Texas Instruments’ topline is expected to grow at double digits.

Prepared by the author, using data from Seeking Alpha

Securing Leadership

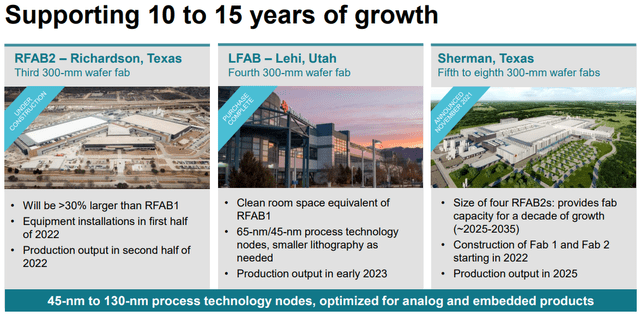

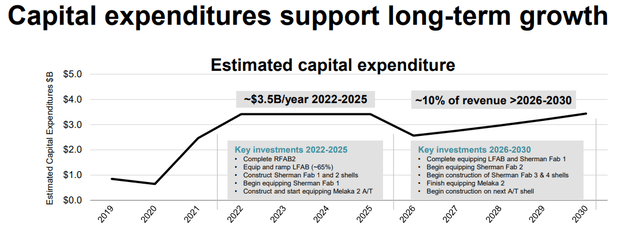

The time horizon of all these investments is rather long for most investors who care about meeting/beating quarterly analyst estimates. The three facilities under construction are expected to begin production in the second half of this year, in 2023 and 2025, respectively.

Texas Instruments Investor Presentation

The high level of Capex we saw above, will therefore become the new normal for Texas Instruments as it continues to expand its Sherman fabs.

Texas Instruments Investor Presentation

So far it appears that there will be demand for this new capacity as demand from the automotive and industrial sectors is likely to remain robust for the foreseeable future.

Discussions with customers confirm a high level of interest in our commitment to expanding our internal manufacturing capacity road map, including 300-millimeter wafer fabs; RFAB2 and LFAB; our recently announced plans for a multi-fab site in Sherman, Texas; and the associated assembly test expansions. These investments, to strengthen our manufacturing and technology competitive advantage, will provide lower cost and greater control of our supply chain.

Source: Texas Instruments Q4 2021 Earnings Transcript

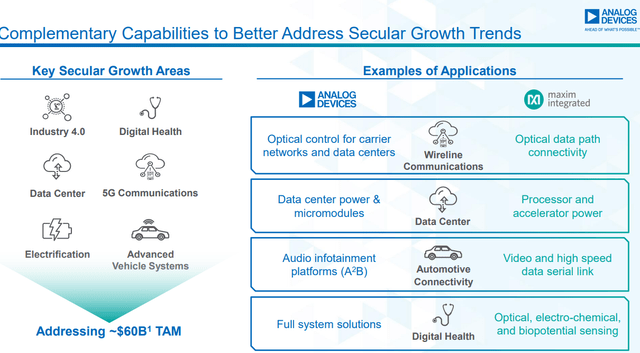

The number of applications of analog semiconductors in the automotive, industrial, communications and consumer space is expected to continue its steady increase and with that consolidation in the sector will likely intensify.

Analog Devices Investor Presentation

For example, the second-largest player – ADI has already closed on its $20bn deal to buy Maxim Integrated which will strengthen their positioning, even though the combined entity will remain significantly smaller than Texas Instruments.

More importantly, however, the free cash flow margin of the combined Analog Devices and Maxim Integrated will be significantly lower than that of TXN.

Analog Devices Investor Presentation

ADI’s smaller size, lower free cash flow margin and the higher risk in organic growth will keep the company at a disadvantaged position relative to TXN.

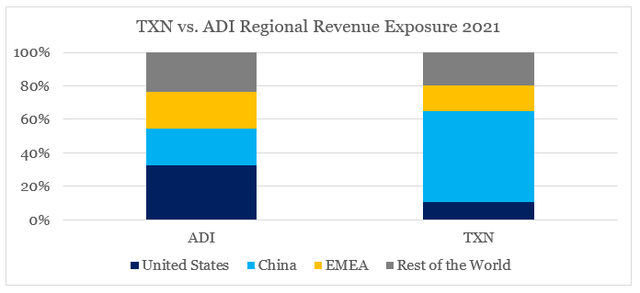

The two companies also have a very different regional exposure, with Texas Instruments having a much stronger footing in the highly growing Chinese market.

Prepared by the author, using data from annual reports

Although geopolitical tensions create risks for TXN’s large exposure to China, the capacity coming online in Utah and Texas will give the company a competitive advantage over ADI and allow it to compete more successfully in the United States.

Conclusion

Texas Instruments is among the highest quality semiconductor companies with a long-term-oriented strategy focused on shareholder value creation as opposed to meeting quarterly numbers. The company’s focus on analog devices and expanding fabrication capacity has resulted in far less attention from the broader investment community when compared to AMD and Nvidia. However, the highly profitable business model and sustainable competitive advantages make Texas Instruments a compelling long-term investment opportunity. Although more consolidation in the sector is expected, TXN is well-positioned to retain its leadership and reduce supply chain risks by bringing more production back in the United States.

Be the first to comment