dima_zel

On November 3, 2022, Teva Pharmaceutical (NYSE:NYSE:TEVA) released its Q3 2022 financial report, demonstrating that the business strategy built under the leadership of Kåre Schultz is helping to reduce debt and the effects of the opioid crisis. At the same time, in recent quarters, the company’s medicine sales showed mixed dynamics, but Teva Pharmaceutical’s net income most often beat Wall Street analysts’ expectations. As a result, this indicates that the company’s management has leverage that helps increase business margins during the period of the strengthening of the US dollar and rising inflation in Europe and some Asian countries.

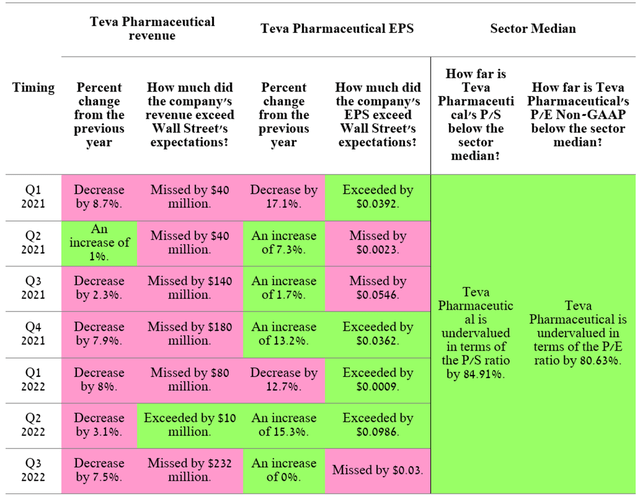

Source: Author’s elaboration, based on Investing.com

This article will analyze how the factors contribute to maintaining a positive vector for the development of the company’s business and will also explain the main reasons that led to the deterioration of some of Teva Pharmaceutical’s financial indicators and their impact on the future of the pharmaceutical giant.

Teva Pharmaceutical Approved Medicines Portfolio

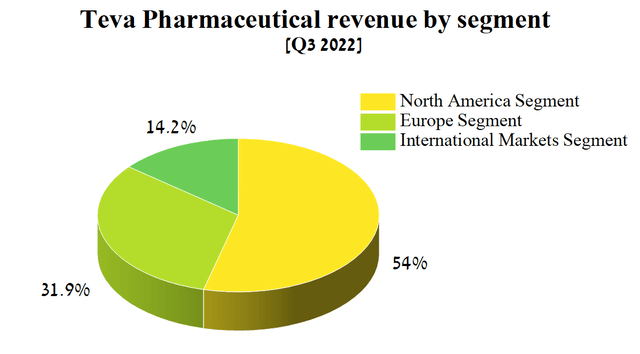

Teva Pharmaceutical operates in three segments, namely North America, Europe, and International Markets, focusing primarily on the sale of generic, over-the-counter, specialty medicines and active pharmaceutical ingredients, which combined generated $3,595 million in Q3 2022, down 5% from the previous quarter.

Source: Author’s elaboration, based on quarterly securities report

Of these four divisions, the largest contributors to the company’s revenue were generics and Teva Pharmaceutical’s branded medicines, which target central nervous system diseases such as multiple sclerosis, migraine, and neurodegenerative disorders. Thus, I believe that these segments have a priority status for their analysis after the publication of Teva Pharmaceutical’s financial report for the 3rd quarter of 2022.

Generic medicines division of Teva Pharmaceutical

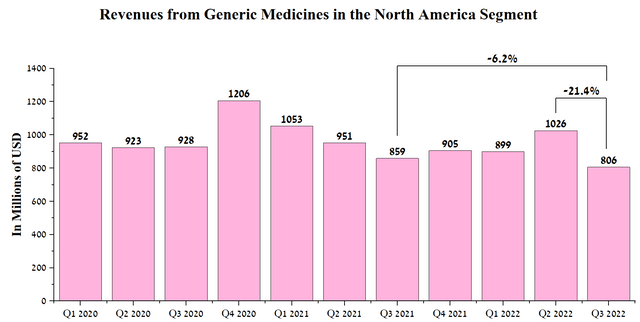

Sales of generic medicines and biosimilars in North America were $806 million in the third quarter of 2022, down 6% year-on-year, mainly due to increased competition in the industry, which also leads to price cuts for certain company products.

Source: Author’s elaboration, based on quarterly securities reports

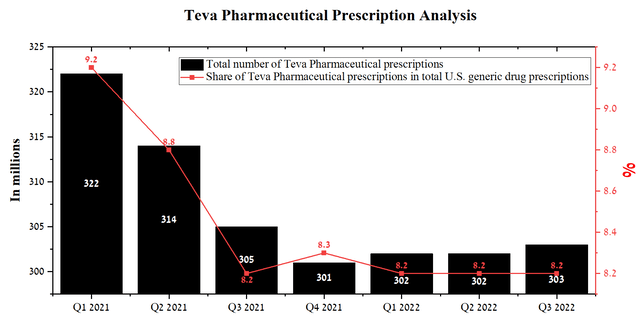

From a global perspective, the generics industry is going through difficult times. For example, Viatris’s generic drug sales in North America were $235.7 million in Q3 2022, down 35.3% year-over-year. As a result, Viatris shows significantly worse dynamics than Teva Pharmaceutical and thus once again indicates the efficiency of the Israeli company’s business model relative to its competitors. Moreover, Teva Pharmaceutical’s total generic prescriptions were around 303 million over the past twelve months, up slightly from the previous quarter, with the company’s share remaining stable over the past year.

Source: Author’s elaboration, based on quarterly securities reports

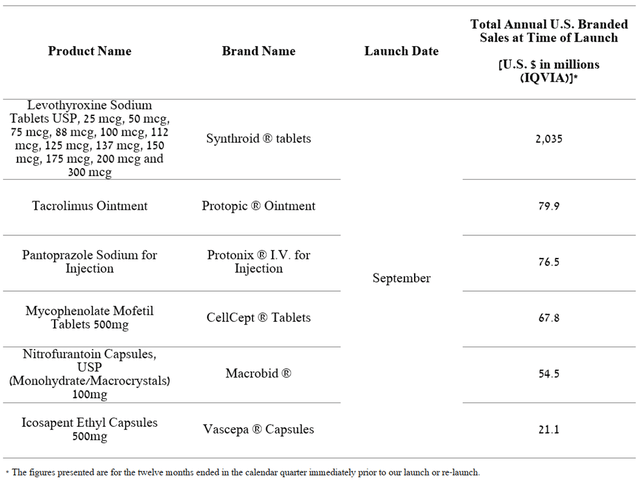

However, despite the decline in the company’s revenue in the last quarter, the portfolio of generic drugs continued to expand throughout the second half of 2022. The most significant events for Teva Pharmaceutical’s financial position are the launch of the commercialization of generic versions of AbbVie’s Synthroid (NYSE:ABBV), which has combined sales of more than $2 billion, and Amarin Corporation’s Vascepa (NASDAQ:AMRN) used to reduce the risk of certain types of heart disease and to lower triglycerides.

Source: Author’s elaboration, based on 10-Q

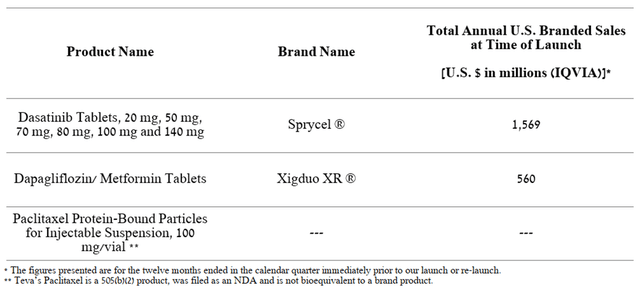

What’s more, the company is moving forward, and Teva Pharmaceutical’s generic portfolio includes 173 drug applications pending FDA approval. According to IQVIA, sales of the branded medicines underlying these applications totaled $108 billion over the past twelve months. Given that Teva Pharmaceutical is an industry leader with an extensive manufacturing and distribution network, I believe in the company’s ability to capture an 8-14% share of sales of generic versions of these branded drugs. Also, in the third quarter of 2022, the company received tentative approvals for three generic equivalents of the products whose combined sales exceeded $2 billion over a 12-month period.

Source: Author’s elaboration, based on 10-Q

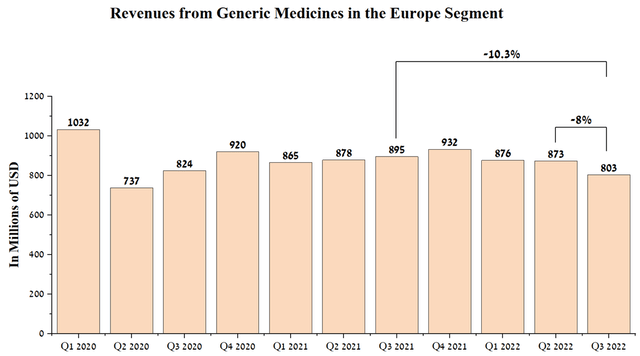

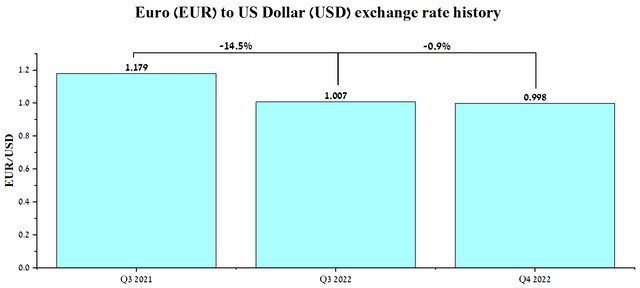

Sales of generic medicines and biosimilars in the European segment were $803 million in the third quarter of 2022, down 10% year-on-year and mainly due to the significant strengthening of the dollar against the euro and pound sterling.

Source: Author’s elaboration, based on quarterly securities reports

On the other hand, the company’s European segment revenue in local currency increased by 5%, supported by higher demand for generic and OTC drugs and also the launch of sales of newly approved products. Overall, I believe that euro weakness, driven primarily by high energy prices, will continue to put pressure on the company’s dollar-denominated revenue in the coming quarters, reflecting Teva Pharmaceutical’s ability to pursue a more aggressive R&D policy. However, the launch of high-margin biosimilars in 2022-2024, which includes the recently approved biosimilar of Roche’s blockbuster (OTCQX:RHHBY) (OTCQX:RHHBF), will have a positive impact on the company’s cash flow and reduce the impact of currency risks.

Source: Author’s elaboration, based on Investing.com

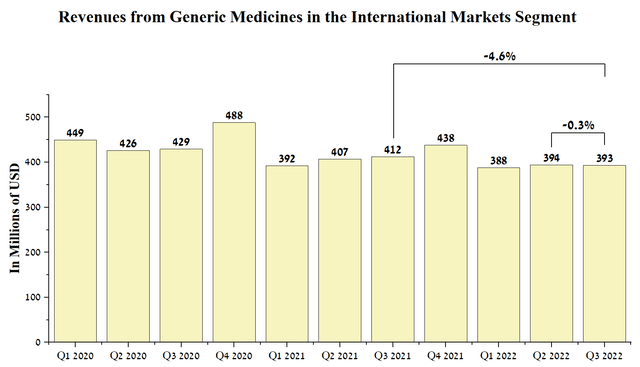

Revenue from the company’s generic medicines in the International Markets segment was $393 million in the third quarter of 2022, down slightly from the previous quarter.

Source: Author’s elaboration, based on quarterly securities reports

As with the Europe segment, the company’s local currency-denominated revenue increased compared to the third quarter of 2021 due to an increase in medicine prices in certain countries caused by an urgent need to offset inflationary pressure on the cost of their production. On the other hand, I do not expect a significant increase in revenue in this segment as the inflation situation improves, mainly due to lower regulatory prices in Japan, which is the third largest pharmaceutical market in the world after the US and Europe.

CNS division of Teva Pharmaceutical

Teva Pharmaceutical’s CNS drug portfolio includes three drugs, namely Ajovy, which is approved in most countries for the treatment of migraine, Austedo for the treatment of tardive dyskinesia and chorea associated with Huntington’s disease, and Copaxone. Unlike the generic portfolio, sales of Teva Pharmaceutical’s patent medicines did not disappoint overall, making a major contribution to the company’s improved cash flow relative to previous quarters.

Source: Author’s elaboration, based on quarterly securities reports

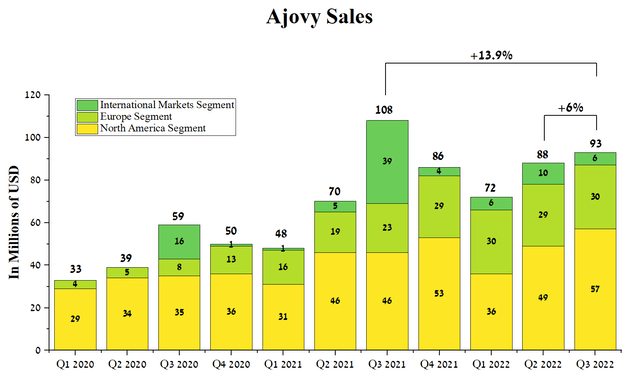

Significantly contributing to the growth in the company’s operating income was Ajovy, which was approved for migraine prevention and had sales of $93 million in Q3 2022, up 6% QoQ mainly due to increased reimbursements in additional European countries and growth in market share in the USA. On the other hand, Ajovy’s revenue was down 13.9% year-on-year due to a $35 million payment received from Otsuka in Q3 2021 for the drug’s launch in Japan. As a consequence, excluding this payment, Ajovy’s sales rose year-on-year as well.

Source: Author’s elaboration, based on quarterly securities reports

Ajovy has extensive patent protection expiring after 2031 in Europe and between 2035 and 2039 in the US as a result of the issuance of additional patents relating to the use of the company’s migraine drug. Despite strict patent laws in the US, it is not uncommon for pharmaceutical companies to violate them, leading to years of litigation. One such lawsuit was filed against Eli Lilly (LLY) alleging that Emgality (galcanezumab) approved for migraine treatment infringed several Teva Pharmaceutical patents. After more than two years of litigation, a federal jury in Boston awarded Teva Pharmaceutical $176.5 million in damages in the lawsuit. So, according to the jury, the Israeli company lost about $90 million as a result of patent infringement by Eli Lilly between 2018 and 2022. Also included in the total amount of compensation was a payment of $49.8 million for future loss of profits. Despite Teva’s victory, in this case, the Israeli company has an additional lawsuit against the same company for patent infringement related to the treatment of refractory migraine. In my estimation, it is highly likely that Teva Pharmaceutical will win in the additional court case, which will improve the company’s cash balance necessary to pay off the debt.

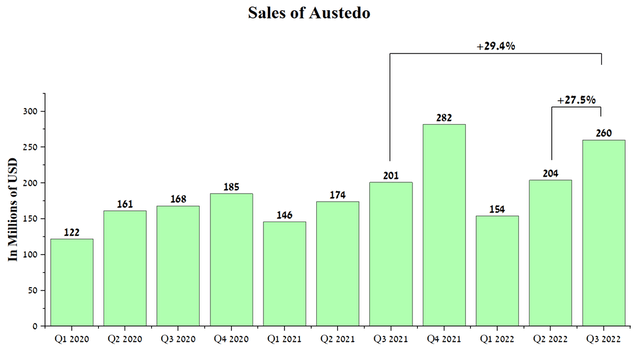

The company’s best-selling drug is Austedo, whose sales account for 7.2% of Teva Pharmaceutical’s total revenue. Austedo’s revenue was $260 million in Q3 2022, up 29.4% year-over-year due to higher prescription volumes. In addition, this drug is covered by several patents that expire between 2031 and 2038 in the US and 2029 in Europe. Given the high effectiveness of Austedo and the absence of high competition, I expect that the average annual increase in sales of this drug will be at least 12%, which will offset the loss in revenue from Copaxone.

Source: Author’s elaboration, based on quarterly securities reports

On the other hand, a black spot in Teva Pharmaceutical’s portfolio is the company’s former blockbuster, namely Copaxone, whose sales amounted to $177 million in Q3 2022, down 25.6% year-on-year due to increased competition from generics and the desire of doctors to prescribe more effective medicines for the treatment of multiple sclerosis. What’s more, Copaxone patent lawsuits continue to haunt Teva Pharmaceutical. In early 2022, an Israeli company defeated Pharmascience in the Federal Court of Appeal of Canada over a patent that expires in 2030. Despite Teva’s victory, Pharmascience has an opportunity to resume the re-examination process, which could lead to the commercialization of generic Copaxone in Canada before 2030.

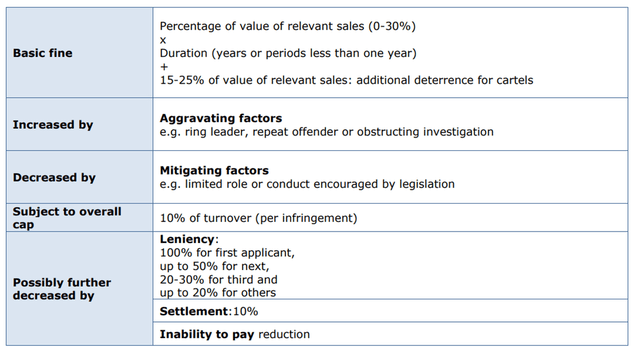

However, the main concern with Copaxone is the European Commission’s claim that Teva Pharmaceutical may have violated certain EU antitrust rules. A statement released on October 10, 2022, states that the Commission has previously found that an Israeli company has abused its dominant position in seven European countries. If this is confirmed in the court proceedings, then Teva Pharmaceutical has violated Article 102 of the TFEU, which provides for penalties. In my estimation, there are a lot of questions about this case at the moment. Firstly, the European Commission will have to prove that Teva did have a dominant position, that is, it will be necessary to provide evidence that Copaxone’s share of the glatiramer acetate market exceeded 40%. With the commercialization of generic versions of Copaxone in Europe in 2016 and the availability of many medicines from companies such as Biogen (NASDAQ:BIIB), Novartis (NYSE:NVS), and Roche Holding that are highly effective in the fight against multiple sclerosis, it will be quite difficult for the European Commission to prove that Teva’s policy has caused damage to patients and competitors. In general, under Article 102, the following fines are possible, which must be taken into account by both the company’s management and Teva investors.

In the last earnings call, the company’s management did not mention the litigation with the European Union, nor is Teva’s financial assessment of the potential damage in the 10-Q report. As a result, it is currently difficult to determine the maximum amount that the company can be fined, but Teva has $4,077 million in provisions for legal settlements and loss contingencies to keep the company afloat.

Conclusion

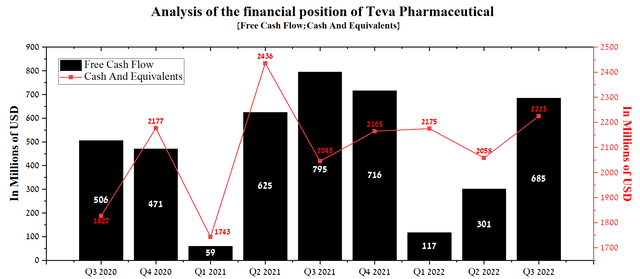

Teva Pharmaceutical’s management, led by Kåre Schultz, has demonstrated the ability to effectively overcome any challenge that comes along the way. In the summer of 2022, the company was able to reach a nationwide settlement totaling $4.25 billion to end the lawsuit over the opioid crisis. What’s more, the final nail in the saga was hammered in by reaching an agreement with the New York Attorney General’s office totaling $523 million, $210 million of which was included as part of a nationwide settlement.

The company has reserves in excess of $4 billion, which have been accumulated to cover legal settlements and loss contingencies, and as a result, nothing threatens the financial position of the company at the moment. In my estimation, Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A, NYSE:BRK.B), who bought Teva shares in the $17-$20 range and exited with huge losses, made a terrible mistake. The reasons for this are the reduction of the company’s total debt to $21.6 billion, which is more than 40% lower than its peak value, and the growth in sales of patent medicines with high margins, contributing to a significant increase in cash flow over the last quarter. On the other hand, sales of the company’s generics in local currency continue to grow in Europe and International Markets. However, due to the strengthening of the US dollar against most currencies, the revenue of this division of Teva will continue to experience difficulties with growth, which will continue to affect a slight decrease in investment interest in the company in the short term.

In terms of technical analysis, I expect the company’s shares to continue to move sideways in the next two quarters due to the increase in interest rates by the Fed and high inflation in Europe. However, as early as 2023, Teva Pharmaceutical shares will feel upward pressure, and the bullish trend will resume as new drugs are approved and the macroeconomic situation in the world improves.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment