Bill Pugliano/Getty Images News

The Thesis

Tesla (NASDAQ:TSLA) has captured the minds of investors the world over. The company has become more of a gambling machine than an investment; in 2021, TSLA was the most traded stock among retail investors.

Most Traded Stocks (Degiro)

So why is Tesla not crumbling entirely in the face of this bear market? Well, autos are still riding an all-time hot wave of sales, and investors aren’t pricing in the cyclicality of earnings. In a deep recession, Tesla’s earnings can and likely will decline, along with all other automakers. At which time, the air will come out of Tesla’s stock.

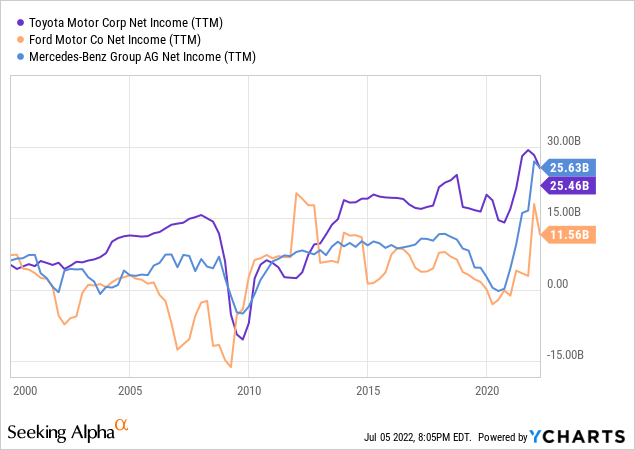

Autos vs. Recession

Recessions get nasty for auto manufacturers. History has shown that it doesn’t matter who you are, when big recessions hit, auto earnings not only decline but usually go negative in this capital-intensive industry. In 2009, auto manufacturers got absolutely crushed, reporting negative net income across the board:

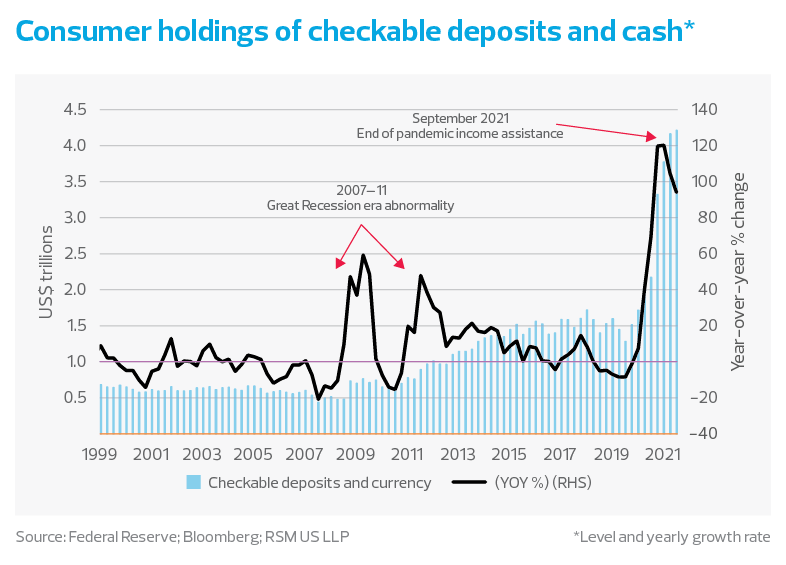

You may ask, “What about the recession of 2020?” Well, 2020 was unlike any recession in the past. The government sent out so many stimulus checks, that consumers’ bank accounts actually ballooned. Combined with the lowest interest rates in 5000 years, buying a $50,000 car became more affordable than ever.

Cash Balances of American Consumers (RSM)

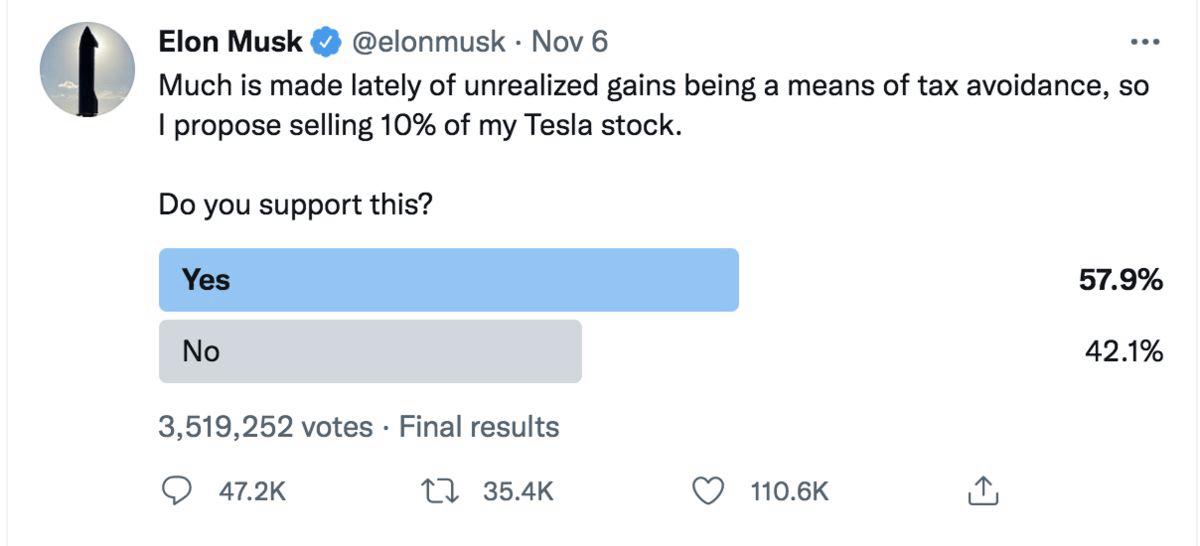

Disconnected Management

As the bubble booms on, Elon Musk has been selling Tesla shares hand-over-fist, with excuses like this:

Elon Musk Tweet (Bloomberg)

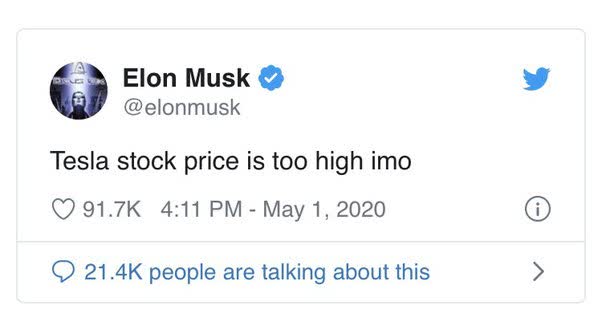

This is not what we like to see from our CEO. To be fair to Musk, he did tweet this back in 2020, when the stock was at $140 per share:

Elon Musk Tweet (Quora)

TSLA currently has a 1% earnings yield on what is likely an industry peak. It appears to us that Elon’s getting out.

With the proceeds, Musk is attempting to buy Twitter (TWTR) outright. Keep in mind that Musk is not only focusing his time and attention on this, but to SpaceX, which is arguably a more promising business. The space industry is projected to reach $1 trillion in revenue by 2040.

A Fundamental Look At Tesla’s Growth

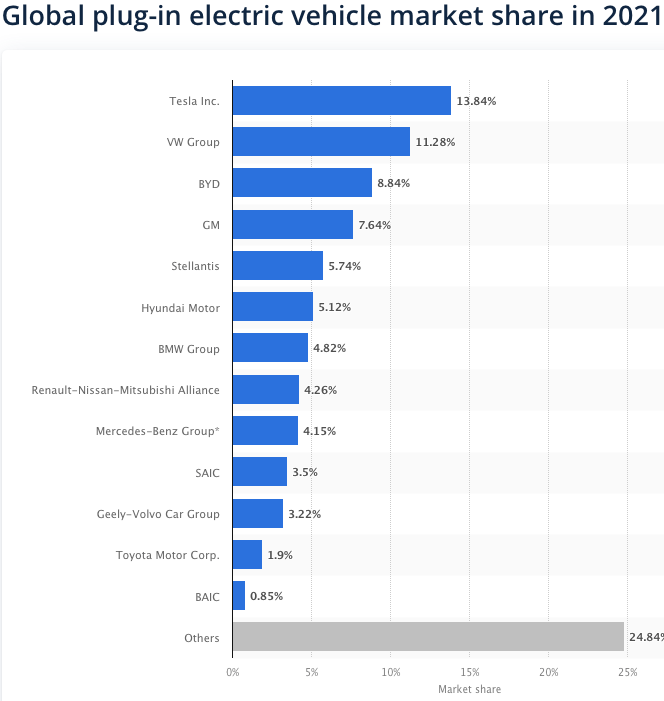

Tesla is going global and getting closer to its customer base, with new factories in Shanghai, China, as well as Berlin, Germany. You would think this move would expand Tesla’s market share. But from 2020 to 2021, Tesla’s global market share actually shrank from 17% to just under 14%.

Competition is coming from everywhere. With a 14% market share, Tesla is more likely to lose share than to gain it. Companies like Honda (HMC) (OTCPK:HNDAF), BMW (OTCPK:BMWYY), Ford (F), GM (GM), Hyundai (OTCPK:HYMTF), Jaguar, Kia (OTCPK:KIMTF), Mazda (OTCPK:MZDAY) (OTCPK:MZDAF), Mercedes (OTCPK:DDAIF) (OTCPK:DMLRY), Mitsubishi, Nissan (OTCPK:NSANY) (OTCPK:NSANF), Stellantis (STLA), Subaru (OTCPK:FUJHY) (OTCPK:FUJHF), Toyota (TM) (OTCPK:TOYOF), Volkswagen (OTCPK:VWAGY) (OTCPK:VLKAF) (OTCPK:VWAPY), and Volvo (OTCPK:VOLAF) (OTCPK:VLVLY) (OTCPK:VOLVF) are all adding EVs to their lineups. Many of these companies have strong and entrenched brands and are partnering with EV titans like BYD (OTCPK:BYDDF). On top of that, they’re producing EVs that are more affordable for the average consumer.

Global EV Market Share (Statista)

Tesla’s margins could also decrease. A cooler economy, increased competition, and used EVs coming online means the price of buying an EV could actually fall over time. Tesla’s benefited from government credits, but these credits could dissipate now that EV companies like Tesla are profitable and highly valued.

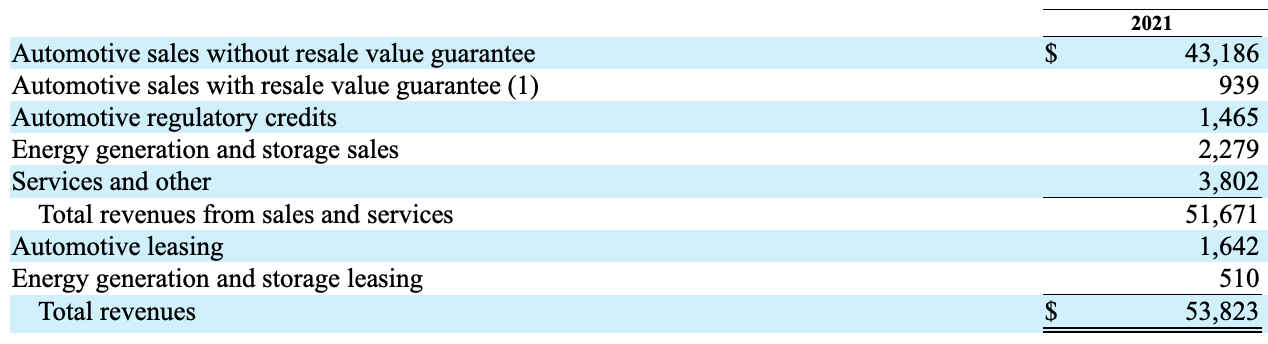

To understand where Tesla is going, we need to understand where the industry is going. The number of electric vehicles sold globally is projected to grow at 17.5% per annum through to 2030. Tesla’s energy business has grown revenue at 21% per annum over the past 3 years.

95% of Tesla’s revenue still comes from the automotive arm:

Tesla’s Revenue Breakdown (2021 Annual Report)

Given the market share, margins, and industry risks, we estimate Tesla will simply match the growth of global EV sales, growing 17.5% per annum. The energy business should continue to grow and become profitable, which will partially make up for the issues cited above.

The Valuation

Our 2032 price target for TSLA is $683 per share, indicating a return of 0% per annum, with no dividends.

- Tesla has earnings of $7.78 per share, giving it a PE of nearly 100. If Tesla’s EPS should grow at 17.5% per annum, we get 2032 earnings of $39 per share. While the typical car company trades at just 10x normalized earnings, Tesla continues to benefit from the transition to EVs, and should have a more prominent footprint in clean energy generation and storage in 2032. We’ve applied a terminal multiple of 17.5x earnings, which is a 75% premium to the average car company. Remember, the auto business is cyclical, competitive, and prone to bankruptcy. It’s difficult to justify a higher multiple unless our risks to the thesis play out.

Risks To The Thesis

Tesla’s future is very up in the air. Elon Musk has all sorts of stories for investors revolving around autonomous drive, robotics, ride-sharing, and artificial intelligence. However, we do not yet have substantial revenues from Musk’s many grand ideas. When those revenues do materialize, the businesses are likely to be loss-making, much like TSLA’s energy business thus far. Competition will be strong in these fields. Autonomous drive, for instance, has attracted competition from Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Uber (UBER), General Motors, Nvidia (NVDA), Baidu (BIDU), Ford, Aptiv (APTV), and Luminar Technologies (LAZR).

Tesla Bot (Wired)

If Elon Musk’s focus doesn’t stray too much, the company could win in one or more of these fields, which would be a boon for long-term profits and Tesla’s terminal multiple.

For more on the Tesla bull thesis, readers can review claims by Cathie Wood, who says the stock will quintuple in a few years.

Conclusion

Tesla is in an uncomfortable position. With an enormous market cap, 1% earnings yield, and some empty promises, Tesla’s stock is full of air. What will be the pin that pops the bubble? The next recession should signal the end. Almost everyone in the auto industry reported negative net income in 2009. On top of this, Elon Musk has been selling shares hand-over-fist and diverting his attention to SpaceX and Twitter. This is not a positive for Tesla’s plans in autonomous drive and AI. Competition is growing stronger in every business Tesla’s in, which could pressure the company’s margins and market share. Despite our estimated growth being higher for Tesla than any other company we’ve covered, the valuation just doesn’t make sense. We have a “strong sell” rating on the shares.

Be the first to comment