simonkr

In just over one week millions of Chileans will vote on a new constitution that aims to rewrite the soul of the Andean nation. The new constitution contains 388 articles, took a year to write, and is meant to offer a clean decisive break from the current heavily amended Pinochet-era charter. Seemingly at risk according to its detractors is the relatively successful Chilean capitalist model of free markets, small government, and robust property rights.

The new charter has been hailed by climate activists as its places a significant emphasis on strong environmental protections and climate justice in the face of the collective global effort toward net zero. Hence, while there are no articles that compel the government to ban mining and articles in an earlier draft to fully nationalize the sector were dropped, the new constitution is still set to radically reform a sector that is the world’s top producer of copper and the second largest producer of lithium.

Volkswagen

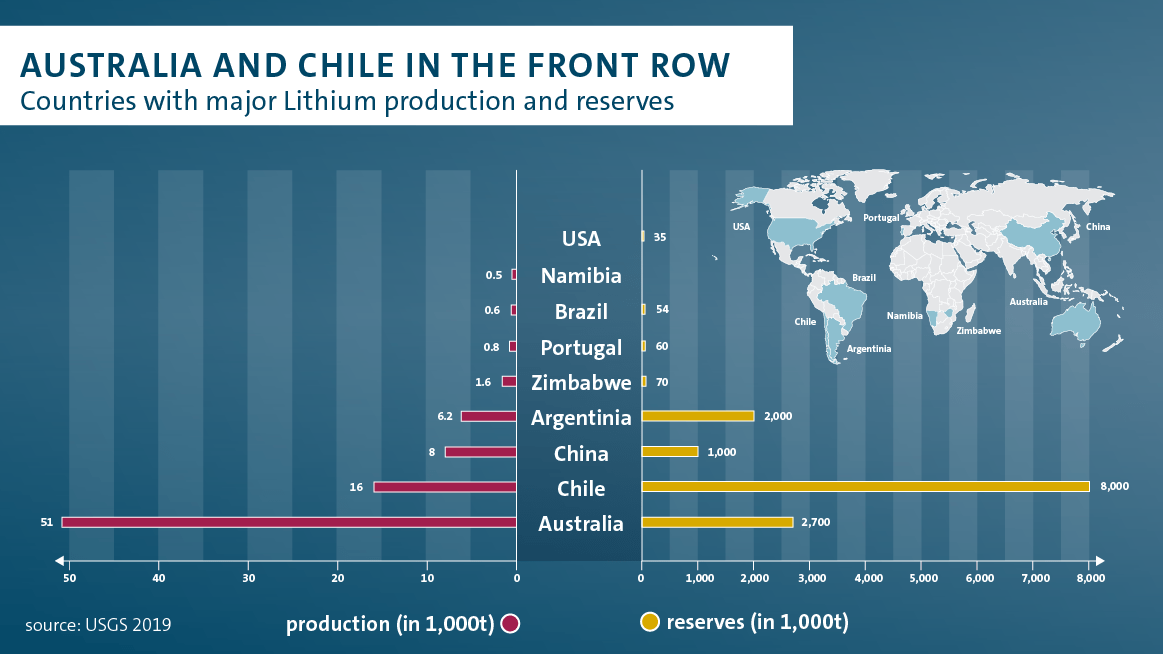

Chile has the world’s largest reserves of copper and lithium, with 8 million tonnes of the latter which amounts to around 55.5% of the global total. To state the South American country is instrumental to the global transition to new lower carbon technologies would be an understatement. Without consistent future output from current and new mines in Chile, there will be a material impairment of the world’s ability to build new electric vehicles, utility-scale energy storage for renewables, and high voltage cabling required for upgrades to the electricity grid.

The potential passing of the constitution provides a vision of a future where EVs remain ever out of reach from the mainstream due to copper and lithium supply constraints pushing up input costs for automobile manufacturers like Tesla (NASDAQ:TSLA). Batteries currently constitute around 40% of the cost of manufacturing an EV and with demand set to structurally rise on the back of ambitious targets by state and national governments to phase out the sale of fossil fuel vehicles by certain future dates, the world stands at a pivotal moment in its journey. For Tesla, the outcome of the vote presents a long-term negative catalyst that could reverse what has been a more than decade-long decline in lithium-ion battery pack prices. This has fallen by 89% in real terms from $1,200 per kilowatt-hour in 2010 to $132/kWh in 2021.

The World Retreats From Mining As It Embraces EVs

California recently announced a ban on the sale of new internal combustion engine vehicles from 2035. This is the latest iteration in the long list of countries that plan to totally phase out the sale of non-EV vehicles on their roads. The list includes the European Union, South Korea, the United Kingdom, Taiwan, and Chile itself. The list of states and countries on a planned phase-out of combustion engine vehicles is growing quickly and has been supercharged by COP26, the 2021 United Nations Climate Change Conference held in Glasgow. A key output of COP26 was the Glasgow Declaration which commits signatories to ensure sales of all new cars and vans to be zero emission by 2035.

This is set to raise lithium and copper demand to levels never before seen. It will require an astronomical expansion of mines across every continent and archipelago on earth on a scale simply unimaginable to current advocates for zero-emission transportation.

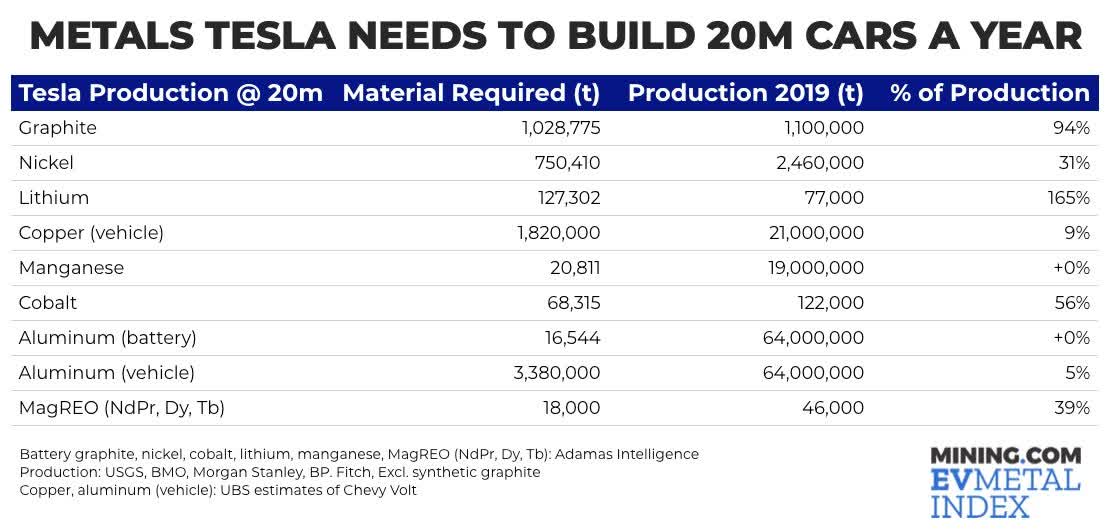

Mining.com

Tesla’s CEO Elon Musk has shared an aspiration to reach 20 million cars made per year by 2030. This would need 127,302 tonnes of lithium to produce and 1.82 million tonnes of copper. The lithium side of this aspiration in 2019 would have required an 165% increase in lithium production the same year. Herein lies the fundamental catalyst of the upcoming vote. An embrace of onerous environmental regulations that have been standard in Europe and North America for decades could see a slow decline in total volume produced in Chile at a time when new mines would ideally be going up every year. This will not be a short-term catalyst, but a long-term slow reversal of the progress that has been made to reduce lithium-ion battery pack prices. The market is yet to be fully cognizant of the potential impact of the proposed constitution as bullish analyst models still price in almost unending demand growth for Tesla far into the 2030s.

The situation is severe.

In Serbia, Rio Tinto’s (OTCPK:RTPPF) proposed $2.4 billion Jadar lithium mine, which would have become the largest lithium mine in Europe, was cancelled by the Serbian government after huge protests against it. In the United States, the Thacker Pass lithium mine being developed by Lithium Americas Corp (LAC) is currently in a legal battle for its survival after multiple suits by environmental and indigenous groups. The region forms one of the largest lithium deposits in the US. In Portugal, the proposed Barroso lithium mine which was meant to begin production in 2020 has had to reset this date to 2026 due to protests and the inclusion of an additional phase by Portugal’s regulator in the environmental approvals process.

A Contradiction In The Reality That Is

Chile’s embrace of greater environmental protections and water stewardship is laudable. The democratically elected government of the Chilean populace was faced with protests in 2019 that called for change and they rightly responded with a promise of a new constitution. However, the world needs Chile for its transition to net zero otherwise it will be stuck with a limited supply pipeline which will drive up the costs for everyone and leave EVs forever out of the hands of the masses.

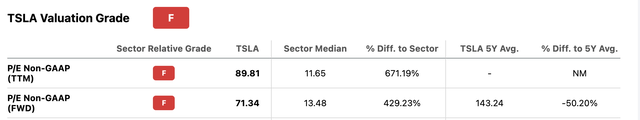

For Tesla, whose valuation currently stands at $927 billion, the prospect of higher input costs will impact the long-term bull story that has driven much of the euphoria and excitement around the stock. With this being at nearly 11x forward sales, a 1,035% difference from its sector average of 0.96x, the market is pricing in growth that might simply not be as profitable if the constitution is approved and Chile retreats from copper and lithium mining.

And whilst, lithium battery recycling like that being developed by Redwood Materials and Li-Cycle (LICY) could dampen the potential supply bottlenecks posed by the passing of the new constitution, it will be negligible when looked at from a global and more holistic perspective.

The significant negative impact on the planet from the proliferation of mines required to produce EVs is often not talked about by those who advocate for their expansion. Mining even when conducted with high standards is polluting, destructive, and highly water intensive. The new Chilean constitution aims to correct these negative externalities but will likely setback the global race towards net zero in the process.

Be the first to comment