Win McNamee

Shares of electric vehicle maker Tesla (NASDAQ:TSLA) jumped nicely last week after the company’s Q2 earnings report. While it wasn’t a blowout quarter by any means, the results were good enough for investors and sent analyst estimates for the year a little bit higher. The nearly 10% rally again put short sellers in the spotlight, but the headlines surrounding this key stock item don’t exactly tell the whole story.

After the post-earnings rally, articles were published like this one detailing how short sellers lost a billion dollars in early trading last Thursday. By the end of the day, I believe the number was nearly twice that as the rally extended. Of course, with the stock currently down almost $300 for the year, 2022 has been a very profitable year overall for Tesla bears.

Regardless of who is winning, when you look at Tesla and the naysayers, the above article talked about Tesla being the most shorted name in the market. That is true in terms of pure dollars, i.e., the dollar value of the shares short. So for Tesla, when you had roughly 27 million shares short at the end of June and a price of say $800, you’d be talking about $21.6 billion worth of Tesla shares short. No other stock in today’s market is that high, even a name like Apple (AAPL) that has a much higher overall market cap.

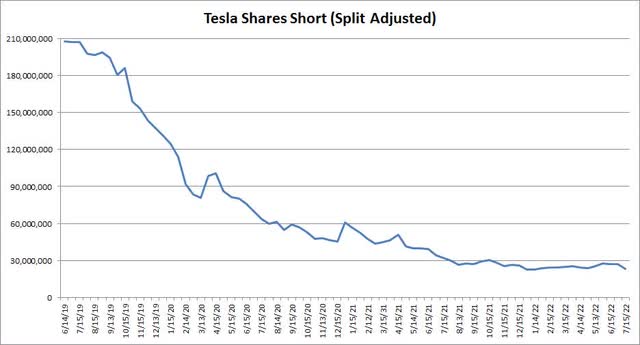

Before I get into today’s main point, I just wanted to update everyone on where short interest stands. After Tuesday’s closing bell, NASDAQ released its bi-monthly update on this important item. For the first half of July, Tesla short interest came down by more than 3.6 million shares to less than 23.5 million shares. As you can see in the chart below, the number of shares short is near its lowest point in a number of years.

For a lot of investors, a headline like “most shorted” would make them believe that a massive short squeeze could be possible. However, this really isn’t the case for Tesla today. The reason why is that even though there is a large dollar amount of shares short, the number of shares short is a very low percentage of Tesla’s float and/or outstanding shares. If we use Yahoo! Finance data, just 2.72% of Tesla’s float is short, which is a rather low number. When I’ve discussed short squeeze candidates over the years, I’ve been talking about names that have 20%, 30%, or more of their float short. That’s where Tesla was years ago, but it is not anywhere close to being there anymore.

In a similar way, Tesla’s days to cover ratio has been under 1 at many of the recent NASDAQ updates on short interest. This number is the number of days it would take all short sellers to cover their short positions, based on average trading volume in the stock. If you are looking for short squeeze candidates, a day to cover ratio in the high single digits or even double digits is worth a look, but less than 1 like at Tesla doesn’t help this argument.

In fact, I ran a stock screener on Finviz for S&P 500 companies to see where Tesla stands. It turns out that Tesla was only the 112th most shorted name in this major index in terms of percentage of float short. Finviz also has a lower float number for Tesla than Yahoo does, and it may not yet have Tuesday’s drop in short interest updated yet. If I use the 2.72% of float figure based on Yahoo data, Tesla drops another roughly 20 spots, meaning it’s not even in the top quarter of S&P 500 names in terms of short percentage of float.

I bring up the idea of a potential short squeeze here today because of the upcoming stock split. Tesla bulls like Gary Black, who manages the Future Fund Active ETF (FFND) with Tesla as its largest holding, has the split on his catalyst list as seen in the graphic below. When Tesla split last time in 2020, shares rocketed higher, and a number of bulls are hoping for a repeat of that situation this year.

Tesla Catalysts (Gary Black Twitter)

A couple of months ago, I warned investors not to expect the same results this time around for this upcoming stock split. You have a much higher market cap this year, and there is no major catalyst like the S&P 500 inclusion to really help out. Additionally, short interest has actually decreased by more than 2.15 million shares since I last discussed this item, with the percentage of float short down by about 50 basis points. Tesla is even less of a short squeeze candidate than it was two or so months ago when I first discussed the stock split.

Twitter (TWTR) investors are set to vote on Elon Musk’s proposed buyout on September 13th, while Elon’s legal team and Twitter’s lawyers are currently fighting over the date for their October trial regarding the CEO’s attempt to back out of the deal. The potential purchase has caused an overhang on Tesla shares for a couple of months, as investors wonder whether Elon Musk will need to sell any additional shares to fund the purchase.

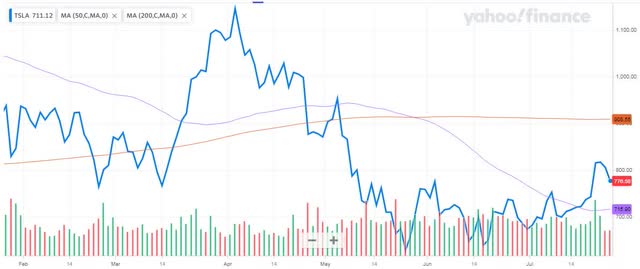

As for Tesla shares, they closed a little under $777 on Tuesday, so they’ve lost a bit of their post-earnings gains. In the past couple of weeks, we’ve seen the average price target on the street rise by about $20 to more than $911 per share, implying a decent upside from here. However, that target is down about $100 from where it was a little more than three months ago. As the chart below shows, the stock is currently stuck between its two key moving averages. The good news for investors is that the 50-day (purple line) is starting to rise again, which could provide some support, but the stock remains well below its 200-day moving average (orange line).

Tesla Last 6 Months (Yahoo! Finance)

In the end, recent headlines have talked about Tesla being the most shorted name out there, but that doesn’t tell the entire story. The electric vehicle maker has the highest amount of dollars bet against it in today’s market, but it’s not a highly shorted name in terms of days to cover or percentage of float. As a result, investors looking for a short squeeze are likely to be disappointed, especially with the number of shares short close to multi-year lows. The upcoming stock split may help the stock a little, but for a repeat of the 2020 surge to occur, investors are going to need a lot more bullish catalysts.

Be the first to comment