Sky_Blue

Investment Thesis

Tesla (NASDAQ:NASDAQ:TSLA) is the world’s leading electric vehicle manufacturer, with an inspiring mission to “accelerate the world’s transition to sustainable energy”. It has been at the forefront of this industry since its inception almost 20 years ago, but it is in the last five years where Tesla has truly transformed itself from a challenger into an industry behemoth.

I analysed and outlined my investment case for Tesla in a previous article, but I will summarise my investment thesis in short.

The company has already shown an ability to achieve operational efficiencies and margins that are far greater than its incumbent ICE (internal combustion engine) competitors, but this is only the beginning. The transition from ICE vehicles to EVs is still in its very early innings, with Facts and Factors forecasting the Global Electric Vehicle Market to grow at a CAGR of 24.5% from 2022 to 2028, eventually reaching a size of $980B. Tesla also has a ton of optionality within the business, meaning there are a number of different routes to success. The most talked about one is autonomous driving, and rightly so, as this could open up a whole new, extremely lucrative industry.

Tesla Q2’22 Earnings Presentation

Quite frankly, there are a whole host of ways in which Tesla could continue to transform the automotive industry (and beyond), and the impressive execution of this business over the past few years should be applauded.

Yet perhaps Tesla is starting to run into some risks that could pose a threat to its recent momentum, namely the difficult economic climate that the global economy appears to be in right now. Investors will be looking at Tesla’s Q3’22 earnings to provide more clarity and see just how much pain (or lack of) this business is going to feel.

Latest Expectations

Tesla is set to report its Q3’22 results on Wednesday, 19th October, after the market closes, and there are a bunch of different items that I will be watching. Looking at the headline numbers, analysts are expecting revenues of $22.26B (representing YoY growth of around 65%) and EPS of $1.06.

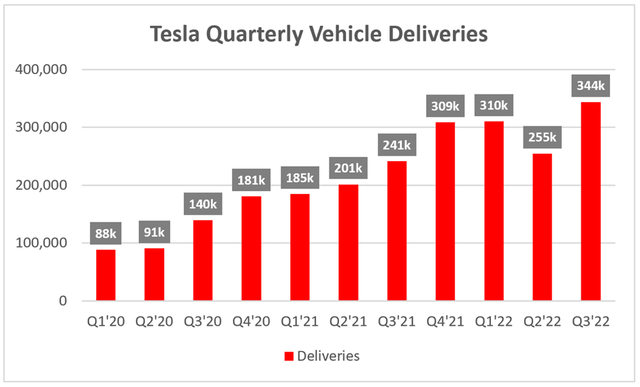

However, it’s worth noting that Tesla just released quarterly deliveries of 343,830 vehicles, which came in below analysts’ consensus estimates of 358,520. Despite this being a record-breaking quarter in terms of deliveries, the miss of ~4% could be an early indication that Q3 revenues may come in below expectations.

Tesla / Excel

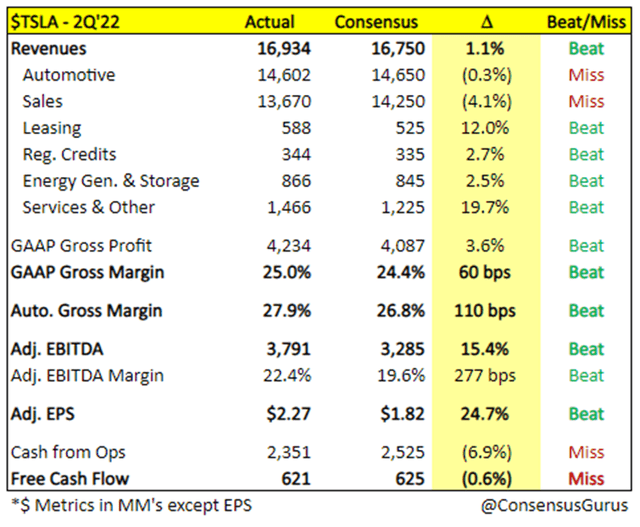

If we take a look back at Tesla’s Q2 earnings, which also occurred in a tough economic environment, the company actually did pretty well – beating on most of the key metrics, even if there was a small miss on automotive.

Consensus Gurus

So whilst the latest news on missed delivery numbers could cause panic for some investors, and evidently, panic for the market, I’ve learned that Tesla has a habit of exceeding expectations – even more so when the odds are stacked against them. I’ll be watching to see how the revenue number looks against analysts’ estimates, but what else should investors be watching when Tesla reports in a couple of weeks?

Production Update: Back To Normal?

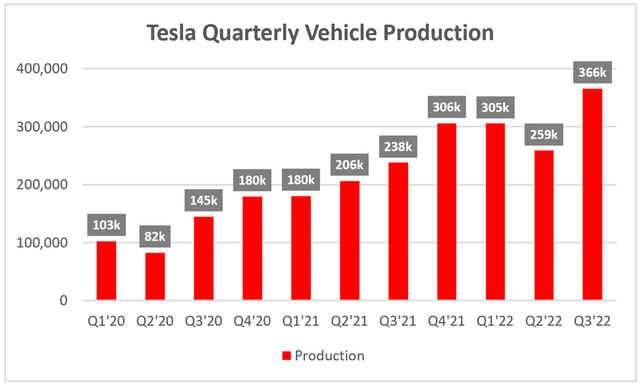

Not only was Q3’22 a record-breaking quarter in terms of deliveries for Tesla, but unsurprisingly it follows that it was a record-breaking quarter in terms of vehicle production. The company produced 366k vehicles in Q3’22, a substantial ramp up from its production of 259k in Q2’22.

Tesla / Excel

In order to understand what to watch in the upcoming quarter, it’s important to know why there was a dip in Q2 – as CEO Elon Musk explained on the Q2 earnings call:

Q2 was a unique quarter for Tesla due to a prolonged shutdown of our Shanghai factory. But in spite of all these challenges, it was one of the strongest quarters in our history. Most importantly, in June, we achieved production records in both Fremont and Shanghai. And as a result, we have the potential for a record-breaking second half of the year.

Mr. Musk might have a reputation for underdelivering on his extreme promises, but his implication of a record-breaking second half of 2022 may well come to pass. The lockdowns in Shanghai hit Tesla’s production hard in Q2’22, but the latest figures show that production has come back with a bang – and this will be in no small part due to the Shanghai factory.

In fact, the majority of Tesla’s factories are in expansion mode, and this should enable the company to keep ramping up production whilst hopefully benefitting from the economies of scale that come with it. I will certainly be looking closely at the factory updates, but as we know, supply is just one side of the equation…

How Robust Is Consumer Demand?

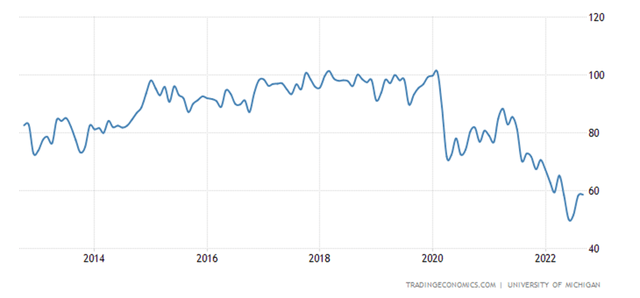

As mentioned, the economy is not looking too rosy right now. Inflation is through the roof, central banks are raising interest rates, and consumer sentiment in 2022 is lower than it has been for the past decade.

University of Michigan US Consumer Sentiment (Tradingeconomics.com)

The question is whether now is the time for people to be going out and buying a new, high-end vehicle? Well, CEO Musk certainly didn’t see signs of a slowdown in Q2:

I think we have said this now for many years, I know has proven true. Tesla does not have a demand problem, we have a production problem

…Consumer sentiment is all over the map. So, it’s – manage price, frankly. But we have so much excess demand. That is really just not an issue for us. It might be an issue for some other companies but it is not an issue for us.

Whilst Tesla may have ramped up production to new highs in the current quarter, deliveries have fallen short of analysts’ estimates. This may well be due to poor forecasting by analysts, but it does imply that maybe, just maybe, demand is starting to waver a bit more than it has done in the past.

I’m sure there will be plenty of questions asked on the Q3 earnings call about demand, so it will be extremely interesting to hear whether or not Musk will have the same blasé response, or if Tesla is once again immune to the worsening economic climate.

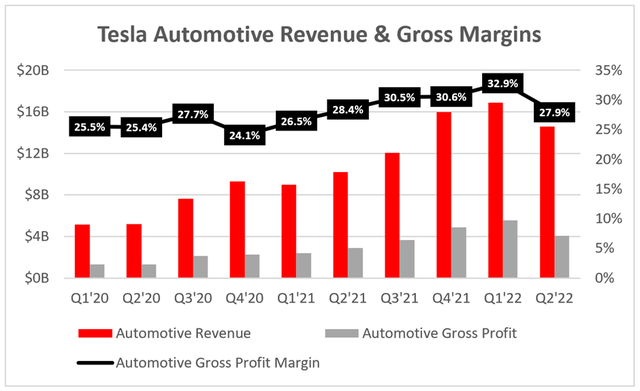

All Eyes On Gross Margins

The disruptions to Tesla’s Shanghai factory in Q2’22 led to a sudden drop off in automotive gross margins, falling from 32.9% in Q1’22 to 27.9% in Q2’22. Perhaps unsurprisingly, I am expecting to see a substantial recovery as we approach Q3’22.

Tesla / Excel

For me, the gross margins this quarter will be key to understanding my two prior focus points: production and demand. Tesla has said that production was back up and running towards the end of Q2 (and so for the whole of Q3), and I would expect each factory to be more and more efficient as time passes – this is the implication we’ve seen from Tesla, as the company increased its gross margins every single quarter from Q4’20 onwards (excluding the Shanghai issues in Q2).

The gross margin in Q3 should help investors understand whether or not the demand for Tesla vehicles is as powerful as Musk claims it is. The cost of materials for these cars should not really be any higher in Q3 than in any of the prior quarters (inflation and shortages have been around for a while now), and with production ramping up again, it’s the selling price of Tesla’s vehicles that will drive this gross margin.

Quite frankly, if management is to be believed when it comes to their confidence in demand for Teslas, then I would expect to see gross margins back above 30% in Q3’22 at minimum. In my eyes, if management’s confidence is backed up in the numbers, we should be seeing a gross profit margin of at least 33%.

Personally, I think Tesla will be more impacted by the poor consumer sentiment right now than management-led investors to believe in Q2, and would personally accept automotive gross profit margins of 30%-32%. Yet if this company can achieve automotive gross profit margins of at least 33%, I think it will be more evidence that Tesla is a company and a brand with demand that is truly in a league of its own.

Full Self-Driving Updates

A smaller note here, as it’s still early days (relatively speaking), but I will once again be watching for any update on full self-driving – especially since, once again, CEO Musk had some very optimistic words on the Q2 earnings call:

I’m highly confident we will solve full self-driving and it still seems to be this year. I know people are like say that. But it does seem to be epic. It does seem as though we are converging on solving full self-driving this year.

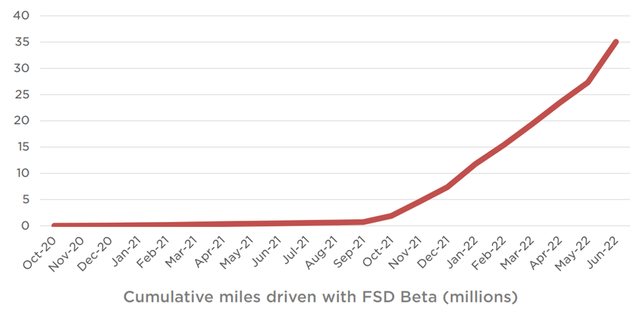

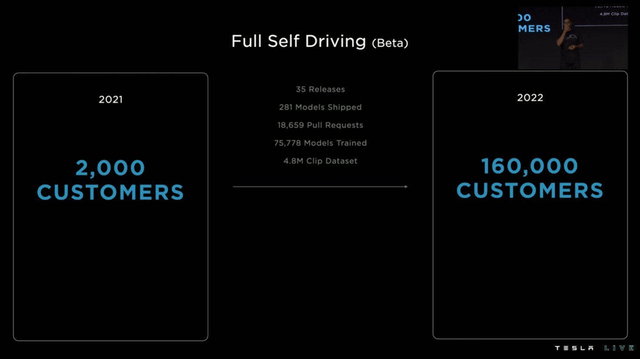

It is clear to see how this might be possible when you consider that the number of Tesla drivers using its FSD beta has risen from 2,000 one year ago to a whopping 160,000. As a result, the amount of data obtained by Tesla has risen exponentially, and this perhaps explains Musk’s confidence.

Tesla

There is still a load of regulatory and testing hurdles that Tesla will need to clear before its technology is ready for a global, non-beta rollout, but it certainly feels as if we’re getting closer – so, this is the final item that I will be keeping an eye on, mainly to see if there’s any backpedalling on Musk’s previously stated goal of solving self-driving this year.

Valuation Seems… Surprisingly Reasonable

As with all high-growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Tesla is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

Let me start by saying one thing. I used to be bearish on Tesla, and I certainly used to be in the camp that saw this business as insanely overvalued. I will admit that I was looking simply at the revenues, cash flows etc. and Tesla’s current market capitalisation and seeing a disconnect.

Not only was I ignoring the quality of the company and its execution, but I was also ignoring the potential margin expansion, future growth, and optionality. After analysing Tesla further, and doing a detailed 5-year valuation model, I changed my opinion on its shares.

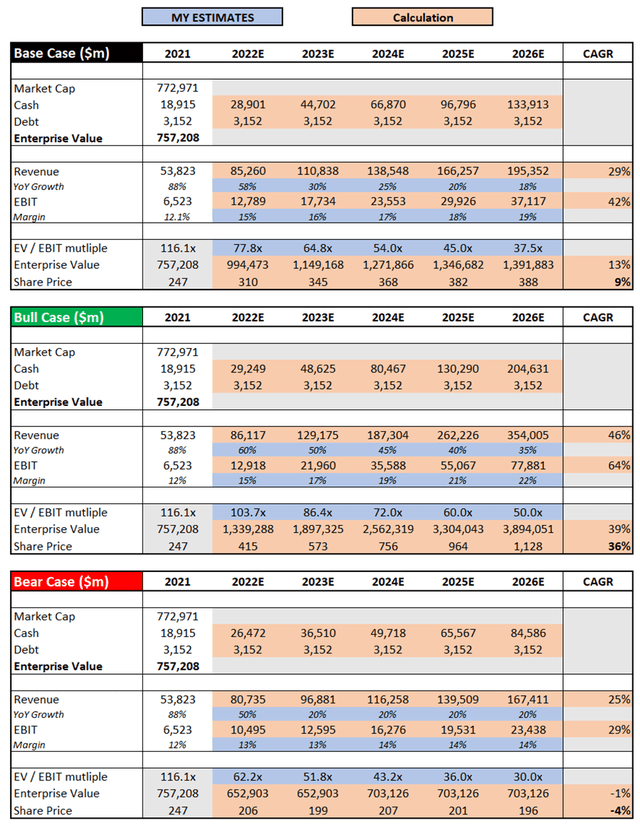

Tesla / Excel

I have changed the style of my valuation model slightly from my previous article, as I believe this methodology does a better case of highlighting both the potential upsides and downsides in the bull and bear case scenarios.

The base case scenario assumes that Tesla’s revenues will fall in line with analysts’ $85.26B revenues, as per Seeking Alpha, with EBIT margins increasing at it continues to scale up production whilst also benefiting from its pricing power. For context, Tesla’s EBIT margins over the trailing 12 months have been an impressive 16.1%. Given this company’s constant focus on efficient production, with the industry-leading margins to show for it, and the fact that it isn’t operating at full scale yet, I believe that Tesla’s margins can continue to expand over time. I have also, as with every scenario, used an EV / EBIT multiple that I believe to be appropriate given Tesla’s future growth and margin expansion prospects from 2026 onwards.

My bull case scenario assumes that the growth story at Tesla powers on, with the company achieving a revenue CAGR of 46% over the period; this is not far off Tesla’s regular guidance of “50% average annual growth in vehicle deliveries”, with the company able to potentially extract further revenue growth through software, insurance, batteries, and who knows – maybe even autonomous driving. My bear case scenario is essentially the opposite, assuming that Tesla gets hit hard by a recession and its growth does not end up living up to expectations.

Put all that together, and I can see Tesla shares achieving a CAGR through to 2026 of (4%), 9%, and 36% in my respective bear, base, and bull case scenarios. I think this demonstrates that an awful lot of growth is currently priced into Tesla shares (pretends to be shocked), but if it can deliver on these lofty ambitions, then there is certainly potential for shares to be a great investment at the current price.

Bottom Line

Unsurprisingly, there are an awful lot of things to watch out for in Tesla’s Q3’22 earnings. To recap, the four main things I’ll be looking at are: production, demand, gross margins, and any updates on full self-driving.

Whilst the market may currently be digesting the impact of Tesla’s lower-than-expected delivery numbers, I’m certainly not put off – at least not yet, because if management is to be believed, then this reduction in delivery numbers is not demand driven. As such, I am looking at Q3’22 gross margins to back up claims that demand isn’t an issue.

Given that, for now, the thesis has not changed for Tesla and I believe that shares are reasonably priced (especially following this pullback), I will reiterate my previous ‘Buy’ rating.

Be the first to comment