Xiaolu Chu

As we look to finish up the third quarter of the year, there are a number of names that aren’t in great shape. Economic concerns, rising interest rates, a stronger dollar, and Fed tightening have hit growth stocks quite hard. One name that definitely fit that bill a few months ago was Tesla (NASDAQ:NASDAQ:TSLA), which was significantly off its all-time highs. However, things have certainly changed recently, and it appears that the bulls are now back in control here.

Back in late July, I talked about how the name receiving the distinction of most shorted in the market didn’t mean what many might think it did. While the dollar value of shorted shares was the highest in US markets, short interest as a percentage of the company’s outstanding shares or the stock’s tradeable float was rather low. Since that time, we’ve received another three updates on bearish bets against the stock, and as the chart below shows, short interest has come down even more.

While there was a slight tick up in short interest in the back half of August, the split-adjusted number is still down more than 9.7 million shares since the mid-July figure. Since that summer of 2019 peak shown above, the number of shares short is down more than 90%. The percentage of the float short is now just 2.32%, which is down 40 basis points since my previous update. Using the finviz stock screener, Tesla is now just the 165th most shorted name in the S&P 500 (using % of float), down from 112th in my last article. With such little short interest in the name overall, Tesla is no longer the major short squeeze candidate it was when over 30% of its float was shorted.

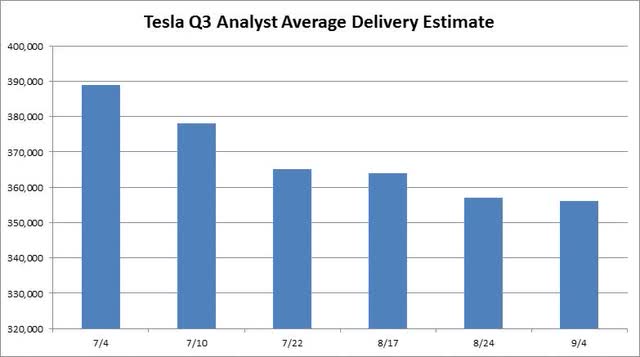

The second reason I think bulls are in a good spot is the setup for Q3 vehicle deliveries, which we should know in about three weeks. As I have discussed extensively in the past, Tesla analysts have kept their estimates low quite often, helping the company to beat in a number of periods. As key company watcher Troy Teslike has pointed out over the past couple of months on his Twitter page, analyst estimates for Q3 deliveries have come down quite a bit since the start of July. The chart below shows the analyst data he’s publicly provided so far during this quarter.

Tesla Q3 Delivery Estimate Average (Troy Teslike)

I’m currently expecting a little less than 370,000 deliveries in Q3, or about 600 units less than Troy. That would be a quarterly record for Tesla, up from the just over 310,000 units reported in Q1 of this year. The company is working on ramping two new factories in Texas and Germany, while also upping the production capacity of its two main facilities in the US and China. Based on where things are trending, the company could exit this year with a global production run rate around 500,000 vehicles per quarter.

In early July, my Q3 delivery estimate would have been almost 20,000 units shy of where the Street was, but now I am more than 13,000 units ahead. The more that analysts lower their bar, the easier it will be for the company to beat, which is rather obvious but needs to be repeated given recent history. Right now, there seems to be a high probability that Tesla will beat, as Troy and myself have consistently had better delivery estimates than the Street in recent years.

As for Tesla shares, the technical setup is also looking rather nice at the moment. As you can see in the chart below, the 50-day moving average (purple line) is on the rise. This key short term trend line could potentially cross its longer term counterpart, the 200-day (orange line), in the next couple of weeks if the stock holds up here or goes even higher. In recent years, some of the biggest rallies in this name have come once this key technical event known as the golden cross has occurred.

Tesla Last 12 Months (Yahoo! Finance)

At the moment, perhaps the only groups that could stop this momentum are the Federal Reserve and its counterparts around the globe. Should interest rate be hiked more than the market is expecting to combat inflation, markets will likely come under pressure like we saw earlier this year. Cutting global economic growth too much could result in a major hit to auto sales. That could result in a slowdown to electric vehicle adoption with average EV pricing remaining higher than ICE counterparts. It doesn’t help the EV picture right now that gasoline prices in the US could be back to pre-Russian invasion levels in the coming months, or that high electricity prices in Europe could make EV charging more expensive than gasoline refueling.

In the end, it appears that Tesla bulls have taken control again. Short interest in the stock continues to decline over time to new multi-year lows, putting it barely in the top third of most shorted names in terms of float in the S&P 500. At the same time, analysts have been cutting their Q3 delivery estimates, increasing the chance of an announcement beat in early October. Finally, the stock could have a bullish technical event occur as long as the Fed doesn’t crash the markets, meaning we could see more to this recent breakout.

Be the first to comment