halbergman

There are always conflicting data points in investment, but rarely do they reach the extremes of what is currently happening in the industrial real estate sector. Looking at the following two data points, it is hard to believe they can coexist.

- Terreno (NYSE:TRNO) just pre-announced 3Q22 operating results with a 65.9% increase to cash rental rates on new and renewed leases – an acceleration from the 50.3% increase on those signed year to date.

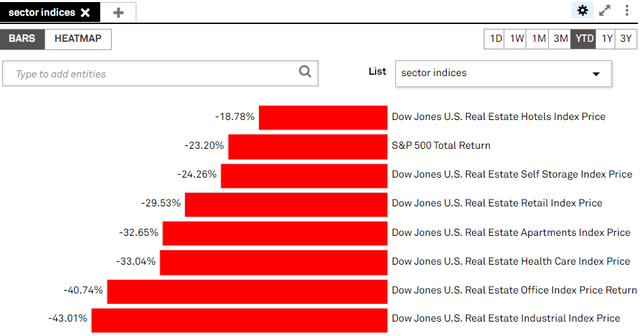

- Industrial REITs are the worst performing real estate sector, down 43.01% year to date.

S&P Global Market Intelligence

So what is going on that there can be this much growth and yet the market prices are collapsing?

This article will take a deep dive into the underlying drivers of industrial real estate and attempt to form an unbiased opinion of the future outlook for Terreno and the sector as a whole.

Taking the other side

In analyzing a company or sector it is really easy to have a biased interpretation of new data points based on one’s pre-existing viewpoint. Depending on how one slices the data, there are usually data points both for and against a given viewpoint. Confirmation bias will cause one to pay more attention to or overweight the data points that agree with their thesis.

I am bullish on industrial real estate, so confirmation bias would tend to cause me to look more at data points that affirm its future success. In order to combat potential bias, I like to deliberately try to make a strong opposing argument. So, here are what I view as the best arguments against industrial REITs.

1) The pulled forward demand thesis

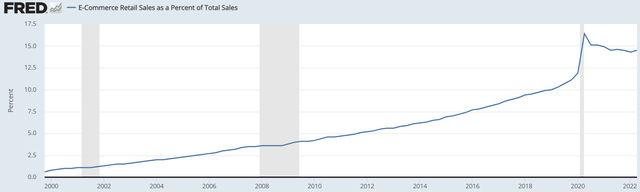

The pandemic benefited e-commerce, but the gains in market share were short lived with brick and mortar taking back that market share. We have seen similar pandemic pull forward of demand in other sectors and it appears the same is happening here.

FRED

The boom of e-commerce has been fueling demand for logistics space as each sale made online requires about four feet of logistics space for each square foot of retail space no longer needed due to online sales.

Another pandemic benefit to industrial real estate was that it halted the purchase of most experiences. Traveling, nights out on the town and various other activities slowed to a crawl and people instead diverted those purchases to material goods.

Warehouses don’t deal in experiences, they deal in material goods. Thus, this spending pattern shift greatly benefitted industrial real estate. Post-pandemic, demand is shifting back toward experiences such as travel which could potentially reduce spending on goods that go through the logistics pathways.

2. The recession thesis

During the GFC, industrial REITs were one of the worst performing sectors, both fundamentally and in market price. Heading into the GFC, industrial was oversupplied and as demand dropped off due to recession, occupancy dropped which caused increased competition among landlords leading to rapidly declining rental rates.

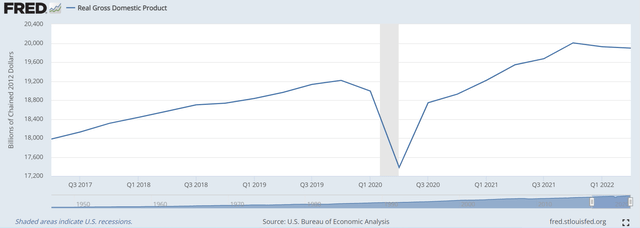

There are traces of a similar setup now. Industrial construction activity is ample and there are indications of a potential recession with real GDP dropping in each of the last two quarters.

FRED

Some also cite an inverted yield curve as an indicator of an upcoming recession and the 2-year treasury yield has been higher than the 10-year for a while now.

Further, Fed activity is likely to slow down the economy. Economic growth is one of the main drivers of demand for industrial real estate – manufacturers expanding production and retailers joining the omni-channel game. Both of these will have reduced volume in a recession.

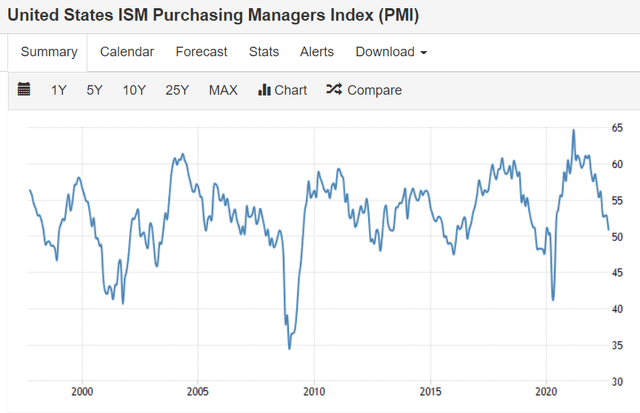

Weakening reads on producer sentiment are also seen as a signal of a slowdown of the sort of economic activity that fuels industrial real estate.

Tradingeconomics

The arguments presented above are what I view as the legitimate bear arguments. There are also narrative based arguments that have already been debunked such as the Amazon re-leasing of warehouses.

My take on the bear arguments

I think both bear arguments are true and real headwinds. We of course do not know if a recession is actually coming, but it is certainly a plausible scenario and I think more likely than normal. If the average year has a 15% chance of being a recession, 2023 is probably closer to 30% (a guesstimate).

For me it comes down to magnitude. There are always headwinds in basically every industry. It is good to keep aware of the headwinds, but also important to keep them in perspective of valuation and of the broader economic and historical context.

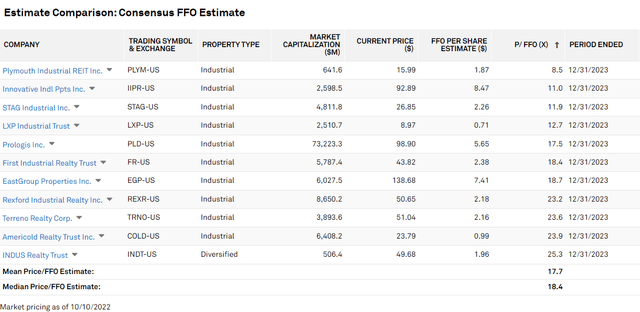

If Industrial REITs were trading at 30X funds from operations (FFO) the slowdown in demand growth would be a big concern because that multiple requires a long runway of growth. However, given the 43% fall in market prices, the industrial REITs now trade at a mean and median of 17.7X and 18.4X 2023 FFO, respectively. Terreno has consistently been on the expensive end of the spectrum and even it is down to 23.6X.

S&P Global Market Intelligence

This new index multiple only demands stability with perhaps a bit of long term growth in order to deliver a good return for shareholders.

At this price, it is a healthy going in cashflow yield. With slight growth they are set up for an 8% annual return and with moderate long-term growth the expected return is north of 10%.

I think of the valuation as setting the hurdle rate. The slight downtick in real GDP and E-commerce market share is scary for something with an aspirational valuation, but I don’t see it as a problem at this level.

In fact, I still see significant growth ahead for industrial REITs coming from five sources:

- Mark-to-market: Current contractual rents are far below market rents

- Domestic manufacturing boom

- Substitution of real estate for workers

- Current undersupply of industrial real estate

- Nominal GDP is strong (nominal drives rental rates more than real)

Mark-to-market – a huge source of FFO/share growth

Leases in industrial real estate are usually for fairly long terms ranging from 3-25 years. For REITs a typical lease duration is around eight years at signing with a bell curve around that. W.P. Carey (WPC) would be toward the higher end with some 20-year leases and Plymouth Industrial (PLYM) specializes in extracting value out of shorter leases.

With long terms like this, it takes a while for market rents to actually convert into lease rates. Aside from minor built in lease escalators, the REIT only gets to up the rent when the lease comes due.

Thus, the massive upswing in market rates that has taken place over the past five years will work its way into lease rates over the next five years.

How big is the delta between market rates and lease rates?

It depends on the company. Property locations and lease vintage play a big role.

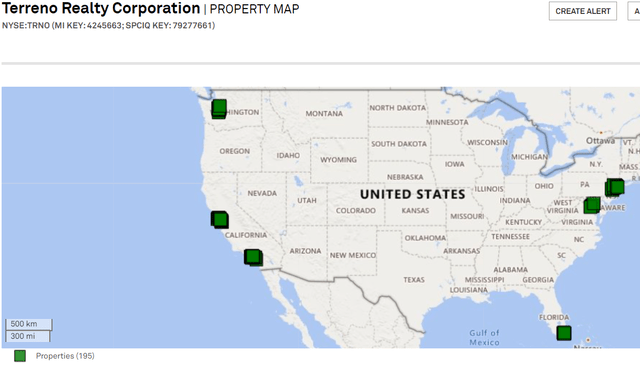

Terreno owns properties in six coastal markets where land is scarce.

S&P Global Market Intelligence

This scarcity of land has kept supply growth at a level that is insufficient to handle the demand growth, so rental rates have shot up to equilibrate quantity demanded with quantity supplied.

As we stated at the outset, TRNO’s mark to market in 3Q22 was 65.9%. It will take a few years, but I suspect the entire portfolio will be re-leased at similar spreads.

Rexford (REXR) is also in a landlocked market and the Inland Empire where they operate is arguably the single strongest market. Their mark to market will probably be 70%+ for leases of a vintage of at least four years ago.

Prologis (PLD) is probably a better measure of overall industrial mark to market as they have properties everywhere, including internationally. 3Q22 earnings call is on 10/19/22 so until then we have to work with 2Q22 data. Mark to market was 45.6% and notably properties in the United States had a mark to market of 54%.

Secondary market REITs like STAG Industrial (STAG) and Plymouth have less land scarcity so supply is moderating it to some extent. These are coming in closer to +20%. We have summarized mark to market opportunity into a table.

|

Location type |

Mark-to-market growth opportunity |

Notes |

|

Primary land locked markets |

~60%-80% |

Constrained supply |

|

U.S. as a whole |

~50% |

More benefit the longer the lease vintage is |

|

Secondary and tertiary markets |

~20% |

Benefit from domestic manufacturing boom |

Domestic manufacturing boom

Manufacturing has gone through many phases in modern history.

As the world became more interconnected companies started to see opportunity in outsourcing a large portion of production overseas where labor is cheaper. As this continued, domestic manufacturing slowed down and the rust belt got its unfortunate name in reference to closed factories abandoned to a state of disrepair.

Increasingly, however, the world and particularly the U.S. are realizing that having domestic manufacturing is essential for national security. It is also essential for supply chain reliability and given the supply chain struggles in the post-COVID environment this is top of mind for many industries.

As a result, a wide variety of manufacturing is returning to the U.S. We have seen major plant openings in the following categories:

- Semiconductors/Chips

- ICE vehicles

- Electric vehicles

- Solar production

- Wood-pellet energy plants in the southeast

- Manufactured housing and lumbermills

A notable exception is steel plants in which I believe there have been at least two significant closures. Steel demand is strong, but tariffs have been removed and China is flooding the market with cheap steel.

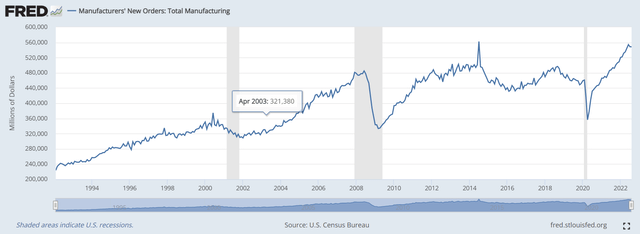

The general increase in manufacturing activity shows up in the numbers. New orders are near an all-time high.

FRED

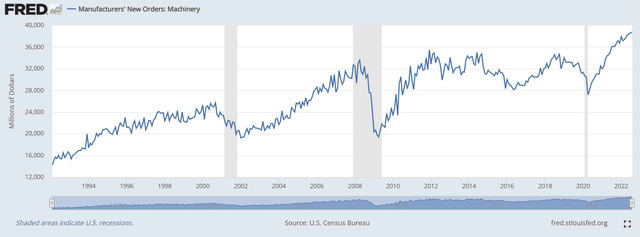

I view machinery orders as a forward looking indicator because it represents capex that will facilitate future increases to domestic production. This metric has ramped up quite nicely in recent months.

FRED

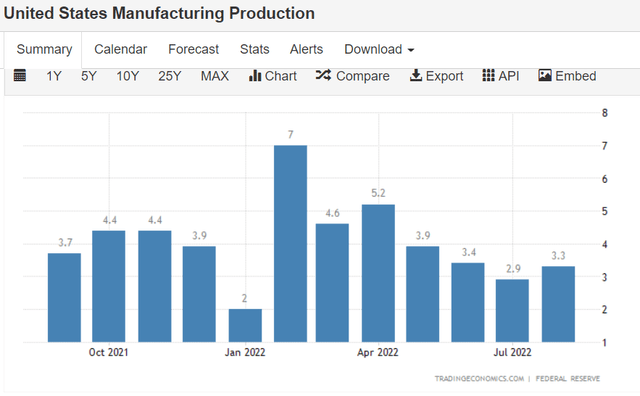

Overall, U.S. manufacturing has been increasing at a good clip with steady increases in each of the past 12 months.

Tradingeconomics

How does this affect the REITs?

There are both direct and indirect benefits. While logistic properties are where the hype has been, quite a few REITs like Gladstone Commercial (GOOD), PLYM, STAG, WPC and others have significant exposure to manufacturing facilities.

As domestic manufacturing ramps up, demand for facilities already set up for manufacturing rises as well.

There is also an indirect benefit to logistics warehouses. Warehouses will be utilized to store and supply inputs and again utilized to distribute the outputs of manufacturing.

E-commerce’s impact on demand for industrial real estate has been thoroughly studied and quantified. I am not yet aware of any white papers quantifying the ratio with which manufacturing activity stimulates demand. At a qualitative level it is a clear positive.

Substitution of real estate for workers

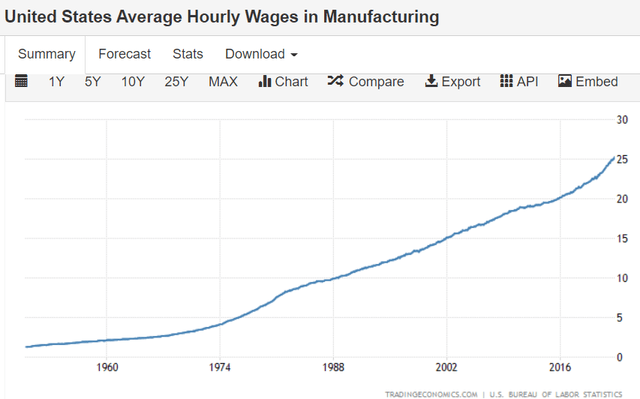

This one is a bit sad because it is never enjoyable to see human jobs being replaced by machines, but that is the unfortunate side effect of wages spiking. The average hourly wage in manufacturing has now crossed $25.

Tradingeconomics

The higher wages go, the more economically viable it becomes to invest in infrastructure that reduces worker hours needed.

In real estate this has largely meant three things:

- Wider aisles for machine picking and/or use of heavy equipment like forklifts.

- Higher clear heights. Class A warehouses now have ceilings approaching 30 feet.

- A greater real estate emphasis on loading docks and rail access

The better a building is designed, the more productive each work hour. Tenants are increasingly willing to pay more rent for a better building so as to avoid the inefficient wage expense of an inefficient building.

This is leading to significant redevelopment and expansion opportunities for the REITs. Those with land available adjacent to existing properties are particularly benefitting. First Industrial (FR) arguably has the best land bank on which to capitalize.

Undersupply of industrial real estate

Despite industrial real estate being a hot sector for much of the past five years, developers still have not built enough to keep up with demand. We can measure this in two ways.

- Directly measurable via vacancy. Occupancy rates across REITs are reaching historic highs. Terreno had 98.9% same store occupancy in 3Q22. Note that frictional vacancy is a few percentage points so this represents a truly unusual level of occupancy.

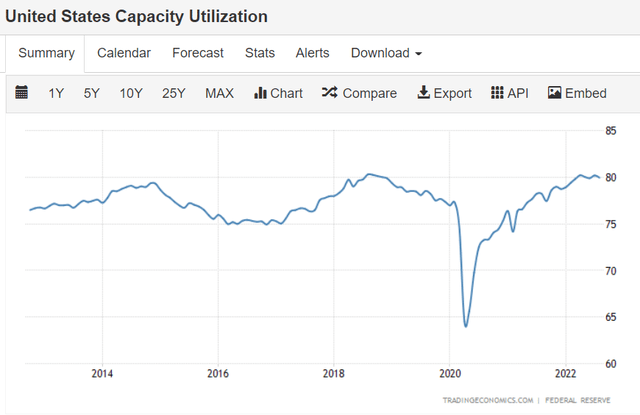

- Capacity utilization

As is being observed in office right now, the properties might be leased but they are not being used due to work-from-home.

Industrial real estate is not just leased, but heavily utilized with capacity utilization nearing highs.

Tradingeconomics

Nominal GDP to drive future rent growth

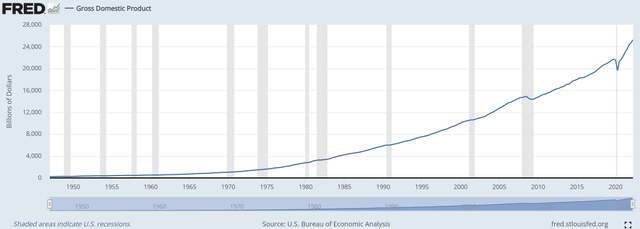

While the U.S. has had two negative quarters of real GDP, nominal GDP growth remains very strong.

FRED

While it makes sense to think of the economy in real (inflation adjusted) terms, rental rates are priced in nominal dollars.

Thus, rental rates tend to be related to nominal GDP, not real GDP. It takes a few years to fully kick in, but inflation direction contributes to industrial real estate rent growth. Due to this lag time, the inflation portion of rent growth is not yet in the mark-to-market numbers and represents another leg of potential growth going forward.

Putting it together

While there are legitimate headwinds for industrial there are also a myriad of tailwinds. Overall, the tailwinds seem bigger to me and I anticipate moderate to strong growth for the sector going forward.

Given the cheap valuation at which it now trades, I think industrial will outperform both REITs and the S&P over the next five years. Terreno is a great company but remains at a somewhat high FFO multiple relative to peers. I prefer the more reasonably priced names in the sector.

Be the first to comment