Pgiam/iStock via Getty Images

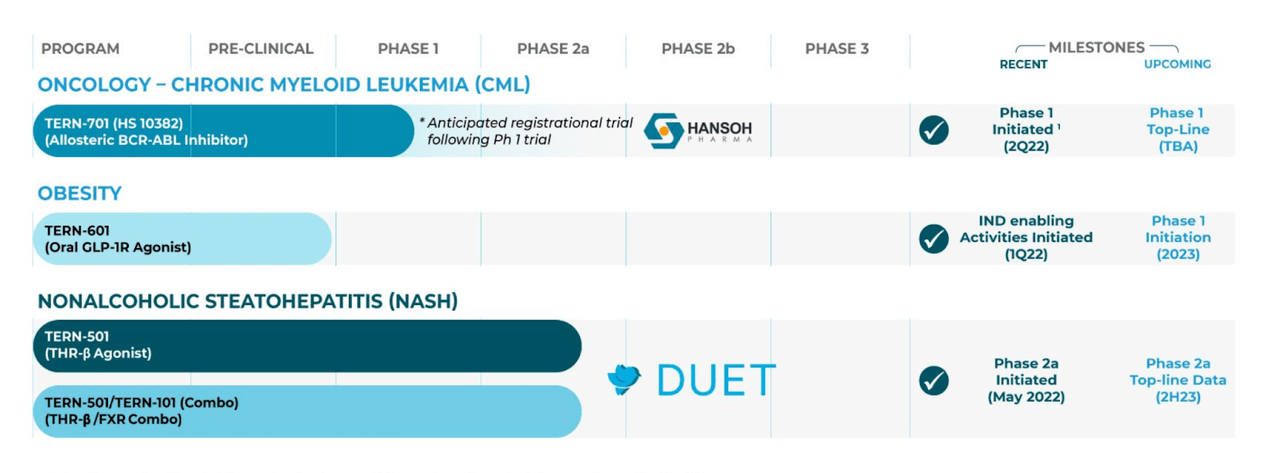

Terns Pharmaceuticals (NASDAQ:TERN) is a small company targeting NASH, obesity and cancer. It has a pipeline of four molecules, and the pipeline looks like this:

Pipeline (TERN website)

TERN-501 is a THR-β agonist and the lead candidate, which is in a phase 2a trial in NASH. There’s also a combo therapy, TERN-501 and TERN-101, an FXR agonist. TERN-501 is a THR-β agonist like Madrigal’s resmetirom. About that, the company tells us that tern-501 has “high metabolic stability, enhanced liver distribution and greater selectivity for THR-β compared to other THR-β agonists in development.” It is also “23-fold more selective for THR-β than for THR-α activation thereby minimizing the risk of cardiotoxicity and other off-target effects associated with non-selective THR stimulation.”

Topline data from a phase 1 study in healthy volunteers was reported in November 2021 for TERN-501.

The pharmacodynamics results from the 4 MAD cohorts are:

|

TERN-501 MAD (QD) Mean % Change from Baseline to Day 15 |

|||||||

|

Placebo (N=6) |

3 mg (N=6) |

6 mg (N=6) |

10 mg (N=6) |

||||

|

Sex Hormone Binding Globulin (%) |

-12% |

55% |

134%* |

166%* |

|||

|

Low Density Lipoprotein – cholesterol (%) |

-4% |

-17% |

-19% |

-21%* |

|||

|

Triglycerides (%) |

-16% |

-22% |

-21% |

-36% |

|||

|

Apolipoprotein-B (%) |

-6% |

-18%* |

-23%* |

-28%* |

|||

There is disease activity. However definitive data is years away. Terns’ NASH assets are originally from Eli Lilly (LLY). Terns began as a “transpacific” biopharma with roots in both China and the US. The problem, as I see it, is that these are early stages and Terns keeps changing its lead NASH assets. There used to be three assets in NASH, 101, 201 and 501. Now 201 is gone, and 101 lives on only in combo with 501. In all these assets, Terns is playing a late entrant game; 101 is an FXR agonist, and there are other such, like the well-known but not so well-regarded obeticholic acid; 201 is a VAP-1 inhibitor, and Boehringer Ingelheim had one that failed; and 501 is a THR-B agonist, like Madrigal’s resmetirom. The company began as an effort to bring US drugs to Chinese consumers. Instead, they are now bringing US drugs to US consumers, without much differentiation. That might have worked if the consumers were in China. In the US, there’s no real reason for such a business strategy.

Just this year, in March, another candidate also announced trial data in NASH. However, the data wasn’t solid, and the candidate, TERN-201, is not visible in their pipeline any longer.

Among other molecules is TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor (TKI) for chronic myeloid leukemia. Novartis’ Asciminib, sold under the brand name Scemblix, is an allosteric BCR-ABL TKI, the first such TKI approved by the FDA, to treat Philadelphia chromosome-positive chronic myeloid leukemia. TERN-701 is out-licensed to Hansoh Pharmaceutical of China.

Financials

TERN has a market cap of $208mn and a cash balance of $187mn as of the September quarter. That gives it an enterprise value for its pipeline of just about $22mn. This seems just about right to me. Their R&D spend was $12.2 million for the quarter ended September 30, 2022, while G&A expenses were $5.1 million. At that rate, they have cash for 10 quarters, but that is not the rate that is going to be once they begin later stage trials. Anyhow, the company isn’t poorly funded right now. We have seen worse.

Terns began life as a discovery team in California with a development team in China, and they planned to take advantage of China’s improving drug approval bureaucracy to develop drugs for the Chinese market. However, they seem to have pivoted towards the US more, and all the trial locations for the TERN-501 trial are now located in the US. I see no real reasons to be hopeful about this molecule. If THR-B works, then Madrigal is the leader; if it doesn’t work, Terns is nowhere. And of Terns’ claim to be better than other THR-βs, well, proof of that pudding is years away.

Terns is mostly funded by PE/VC firms, especially due to Lilly’s original backing. Very little retail involvement seems to be there. The company is very thinly traded, which adds to the risk – there’s an average trading volume of just ~10,000 shares.

Bottomline

There’s nothing here, at least as of now. Like I said, Terns is developing copycat molecules which it says have all shown superior differentiation in the lab. Two of them have moved into the clinic, and one has been an abject disappointment, the other one not much better. Now we have a third NASH molecule with healthy volunteer data, which tells us nothing much. Currently, I see no reason for its existence; however, I have no data to say whether I will be mistaken two, three years down the line.

Be the first to comment