VCG/Getty Images News

Tencent (OTCPK:TCEHY) is a fantastic tech company with a dominant market position in China. The company has a diversified revenue stream across many growing trends.

The stock is currently undervalued and riding the technology trends of Social Media, Gaming and even Cloud technology.

If you had invested $10,000 into Tencent stock back in 2004 at its IPO, you would have $7.9 million today. Despite these prior gains, I believe this company still has room to grow.

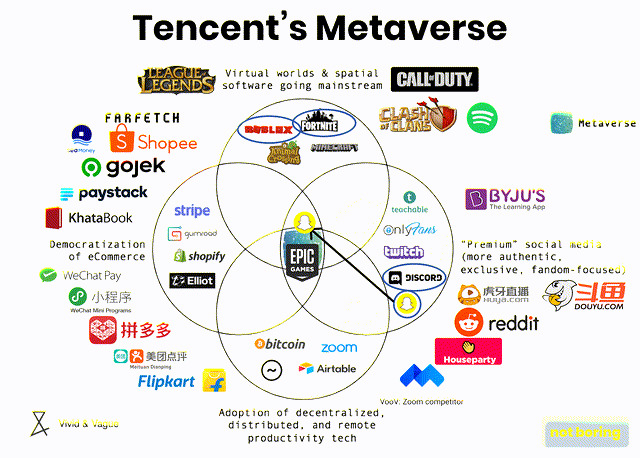

Tencent Metaverse Investments (Seeking Alpha Post (The Great Patrick McCormick Not Boring))

Tencent is in a Prime Position

Tencent Holdings Ltd is a tech investment holding company, which you could call the Google (NASDAQ:GOOG)/Facebook (NASDAQ:FB) of China or even a technology-focused Berkshire Hathaway (NYSE:BRK.B).

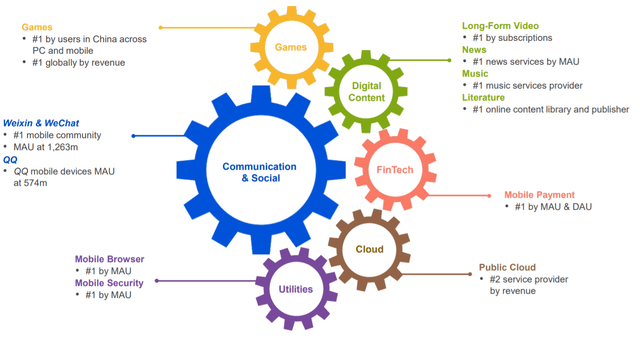

The company is a market leader in social media & gaming. They have the number one mobile chat company (WeChat) and the most popular Mobile Browser and are the number one in China for both PC and mobile gaming.

Tencent Services Overview (Tencent Q3 Presentation)

Thus, Tencent is poised to ride the growth of many macro trends in the technology industry. For example, China has one of the highest rates of mobile penetration in the world at over 88%, with 1.22 billion people subscribed to mobile services in China.

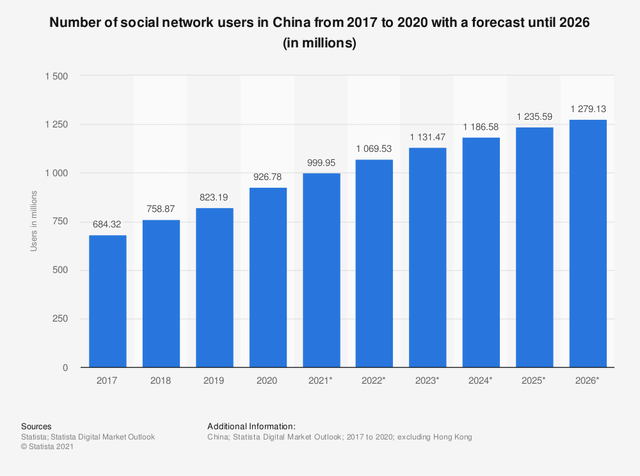

China is also seeing tremendous growth in social media users, they are expected to grow from 926 million social media users in 2020 to an astonishing 1.2 billion users by 2026, according to data from Statista.

Growth in Social Media China (Statista)

China is also the world’s largest and most rapidly growing online gaming market. According to data from Statista, the Chinese gaming market is worth 337 billion Yuan and is expected to reach 469 billion Yuan by 2023, which is an incredible 39% increase!

Mobile games have also overtaken PC-online games as the largest sector in the Chinese online gaming market. These tailwinds mean Tencent (as the market leader) is in prime position to benefit from this huge, expected growth.

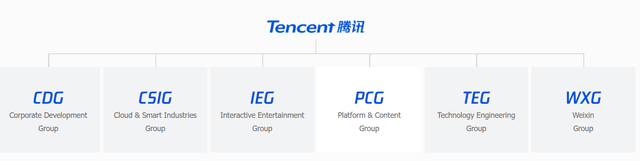

Business Model

Tencent has a large and complex business, using their financial statements as a guide, I have broken the company into four business segments:

1. Value Added Services (V A S)

This part of the company is mainly involved in the development of mobile games & Social platforms. The company boasts one of the largest mobile chat communities in the world (WeChat), which has over 1.2 Billion users.

Tencent WeChat (Screenshot of Phone)

WeChat is what is called a Chinese “Super App” it’s basically like WhatsApp, but on steroids in terms of functionality. On WeChat customers can pay for items via WeChat pay, play video games, do video conferencing and even book a Taxi.

In addition to WeChat, the company owns QQ. Which is a web based portal very similar to WeChat, as it includes instant messaging, games, music, shopping and even Micro Blogging. However, QQ has a desktop version which makes it more popular with business professionals.

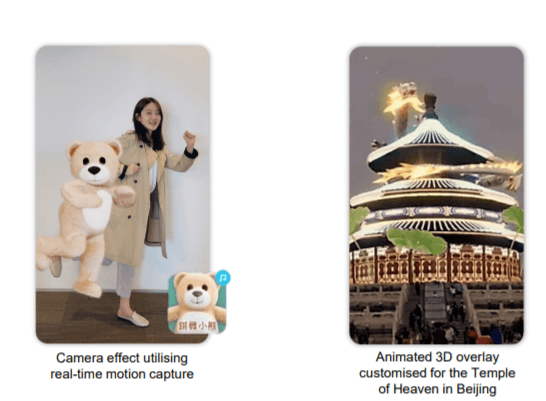

The company has recently introduced AI powered social games and even the ability to watch Tencent Video together in Video Calls. The platform is widely popular in China and has approximately 600 million users.

These vast social platforms give Tencent vast network effects and offer competitive moat for the company. They are also riding the growth in Social Media usage in China.

QQ Artificial Intelligence. (Tencent Investor Relations Report)

According to Tencent’s Investor relations report, the company also is a 51% shareholder of Tencent Music. Tencent Music has over 660 million users across its music steaming apps. These include KuGou Music, which is aimed at the younger generation, while QQ Music targets the older demographic. Tencent Music also owns 10% of the global music giant, Universal Music Group.

Tencent Music 2022 (S1 Filing )

Gaming

Tencent owns a ubiquitous majority of the Chinese gaming market across multiple genres and styles. For example, the company owns major gaming brands such as League of Legends China, FIFA China and even Call of Duty.

In addition to Honour of Kings which was the top-grossing mobile game worldwide and the most popular mobile game in China by Monthly active users. Then there are more obscure titles such as Moonlight Blade Mobile which ranked as the top grossing MMORPG on iOS in China, during Q4 of 2020.

International games Tencent (International games. Source: Tencent Q3 Investor Presentation)

Tencent even scored a partnership with Nintendo which extended offering substantially. Tencent has so far distributed over 1 million Switch consoles and published many popular Switch titles in China.

2. Tencent Cloud & Fintech

Tencent’s “Other” segment of the business is dedicated to fintech and cloud. This section includes WeChat Pay, the number one payment platform in China and Tencent Cloud.

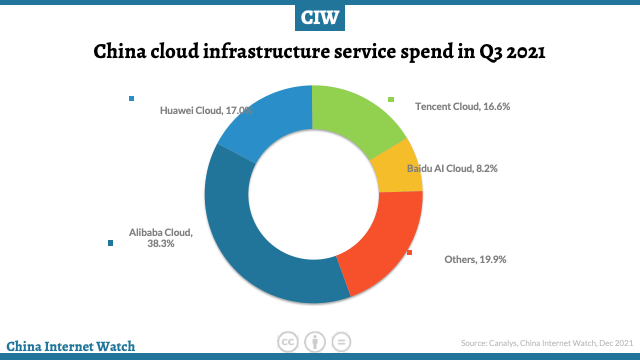

Tencent Cloud (China Internet Watch)

Tencent Cloud

Tencent is the 2nd largest cloud services provider in China. Behind Alibaba Cloud and close to Huawei Cloud in terms of market share.

This rivalry draws parallels to Amazon Web Services and the 2nd Player (Microsoft Azure) in the U.S. and rest-of-world cloud industry.

The Zoom of China

Tencent operates the Tencent Meeting which has become the largest app for cloud conferencing in China. The company released an enterprise version of the platform recently which has gained major traction in the healthcare & education sector.

Then there is the enterprise version of Weixin (Similar to WeChat) which now serves over 5.5 million enterprise customers and connects them internally to over 400 million Weixin users.

3. Advertising

Similar to Alphabet in the US, Tencent has a strong online advertising business. The companies leverages WeChat to allow brands to market direct to the 1.2 billion users of the app in China.

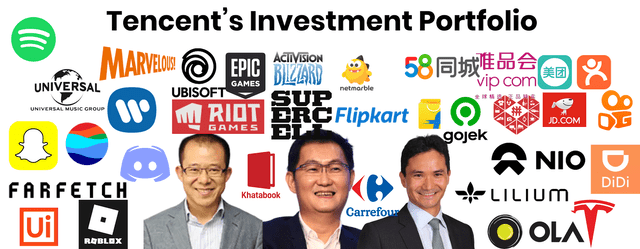

4. Investments (Venture Capital)

Tencent has one the world’s most lucrative Tech investment portfolios, with an incredible track record of success. The company holds 83 companies worth over $1 billion in its portfolio. The even more impressive thing is 52 of these companies are unicorns (private companies worth over $1 billion).

Tencent Investments (Patrick McCormick Seeking Alpha/Not Boring Post )

According to Tencent’s Investor Relations report, referring to the merger and acquisition strategy, the company looks for four things:

- Disruptive companies.

- Great management.

- Synergies with their existing services.

- Innovative products.

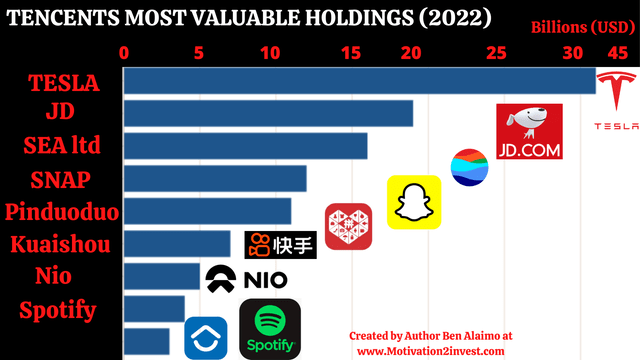

Tencent Investments (Created by author)

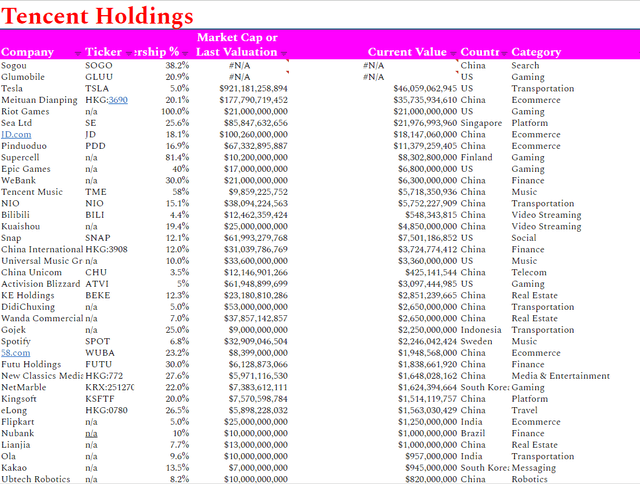

The below spreadsheet shows just some of the holdings Tencent has invested into. This include major companies such as Tesla (NASDAQ:TSLA) (5%) which is close to a $1 trillion valuation, in addition to NIO (NYSE:NIO) (15.1%) , Spotify (NYSE:SPOT) (6.8%) and many more.

Tencent Holdings (Tencent Holdings part 1. Source Valuation Model)

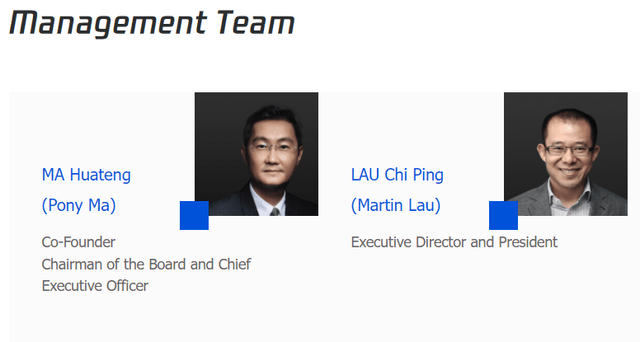

Exceptional Management

Tencent is still run by the incredible founder and CEO Ma Huateng, who is also known as Pony Ma. Investing in great companies which are founder-led is a solid strategy I and many great hedge funds utilise. In addition, Tencent has large insider ownership, with the founder holding 7.46% of shares. This means the founder has “Skin in the Game” and thus I expect his decisions to be more aligned with shareholders.

Management of Tencent (Tencent Investor presentation)

Financial Analysis

Revenue Breakdown

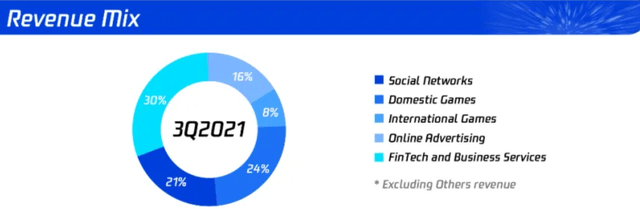

According to Tencent’s Q3,2021 Earnings report, the company has a diversified revenue stream and makes the majority of its revenue from Fintech & Business services. This diversification is positive and makes the company more attractive than other large tech companies such as Alphabet (Google) which make over 90% of their revenue from advertising alone.

Tencent Revenue Mix (Tencent Q3 2021 report)

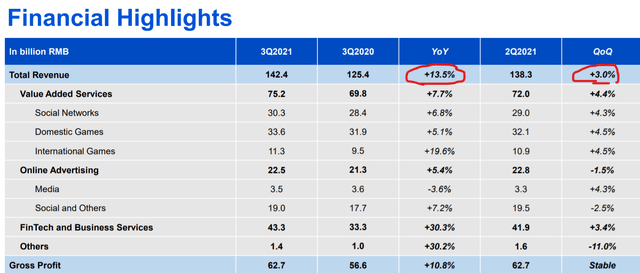

Revenue has grown year over year at +13.5%, which is great for such a large business, but quarter over quarter growth is only 3% thanks to slowing in advertising growth -1.5%.

Tencent Financials Q3, 2021 (Tencent Q3 Earnings Report)

Margins

The companies margins are fantastic & stable, which is characteristic of a software based tech company. 44.1% Gross Margins and 28.7% net operating margin.

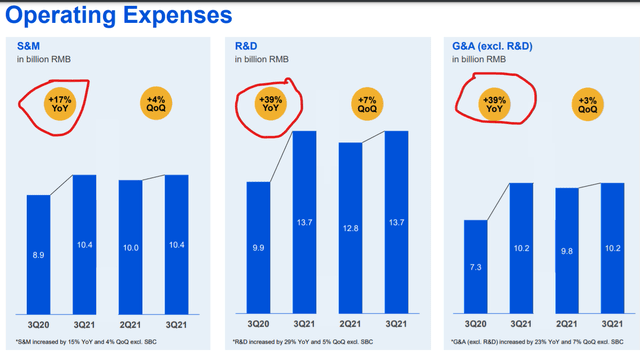

Operating Expenses

The companies increased their investment massively in R&D, up 39% YoY. I see this as a positive sign as most studies show companies which invest tend to create more shareholder value long term. However, the large increases in G&A expense +39% is slightly worrying. This shows the company may not be operating as lean as they could be, which is characteristic of such a large mature company.

Tencent Operating Expenses (Tencent Investor relations)

Balance Sheet

The company has a strong balance sheet with approximately $40 Billion in cash and a current ratio of 1.28. In addition, the company repurchased approximately 5.6 million shares at a cost of a massive RMB2.2 billion (USD334 million) during 3Q21.

Is the Stock Undervalued?

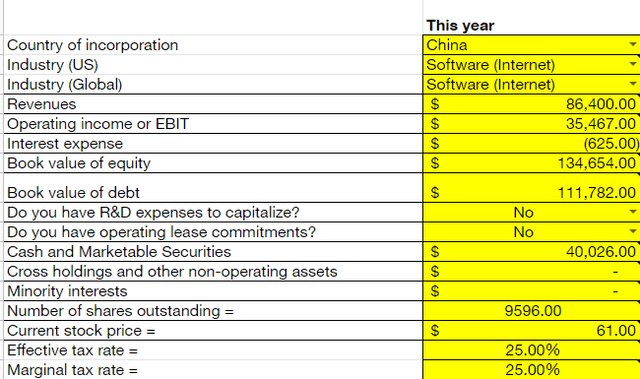

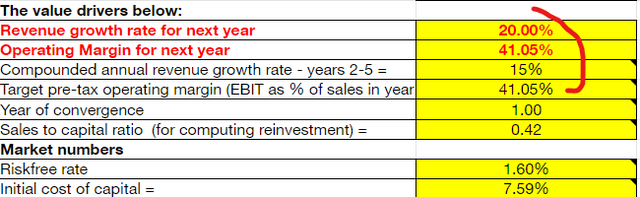

Tencent is an extremely large and complicated company, which makes it challenging to value. However, my advanced Investment Valuation Model, gives a very good approximation of the companies intrinsic value. I utilised the discounted cash flow method of valuation. For easy reading, I have converted the financials over from Chinese Yuan into USD.

Tencent Valuation Model 2022 (Created by author at Motivation 2 Invest) Tencent Stock Valuation Model 2 (Created by author)

Below I have been optimistic with the revenue growth plugging in a 20% growth rate on the revenue for next year, which drops to 15% for the next two to five years. My assumptions were driven by prior revenue growth rates (27% in 2019/2020) and 13.5% growth in the year 2020/2021.

Tencent Stock Valuation Model (Created by author)

From this valuation, I get a fair value of $71 per share. Thus the stock is undervalued by approximately 15%, with optimistic growth baked in.

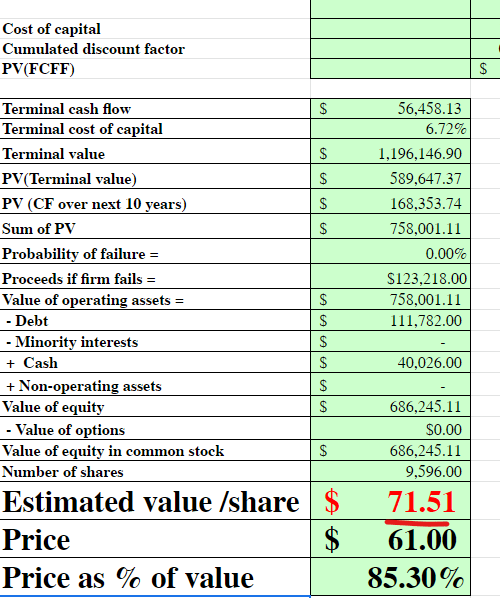

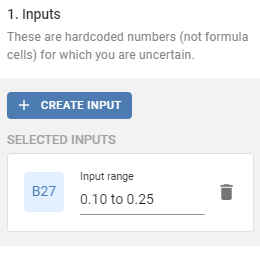

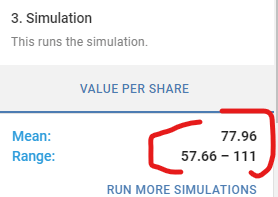

Monte Carlo Simulation

To analyse a range of outcomes and scenarios, I have completed a Monte Carlo simulation, estimating the revenue growth from anywhere between 10% and 25% for the next five years.

Tencent Stock Valuation (Created by author )

Tencent Valuation Model (Created by author )

From this analysis I get a mean valuation of $77 per share and a range of outcomes between $57 and $111. The stock is currently trading at $61, so close to the bottom of this range. The market may also be discounting the “China risk,” which is embedded into the stock.

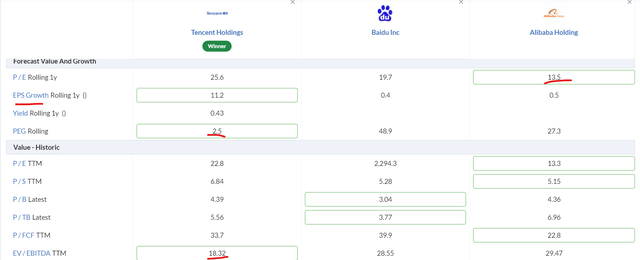

Competitive Analysis

Tencent’s competition includes the other major tech giants in China such as Alibaba (competes in Cloud), Baidu (“The Google of China”) and even Huawei.

Tencent Competitor analysis (Alibaba Baidu) (Created by Author Ben Alaimo with Stockopedia Software)

As far as relative valuation, Alibaba is cheaper on a P/E ratio basis which may be down to the extra scrutiny Alibaba has gotten from the Chinese government. However, on an EV/EBITDA & PEG ratio Tencent is better value overall.

Risks

China’s big tech regulation

A major risk to all large Chinese tech companies is government regulation. An example of this is Alibaba, in April 2021, the Chinese communist party whacked Alibaba with a huge $2.8 billion fine, in an anti-monopoly probe. Ironically, this was a much lighter penalty then they were fearing.

Jack Ma (Alibaba Founder), even went missing for close three months after a controversial speech criticizing the Chinese financial system. Then there was the cancellation of Ant Financials IPO in 2020, a subsidiary of Alibaba.

Jack Ma Alibaba China Tech Crackdown (India News)

The good news is Tencent seems to be keeping themselves slightly more lowkey than Alibaba and thus may be able to learn from their missteps.

According to the CEO in their Q3,2021 Report:

We are proactively embracing the new regulatory environment which we believe should contribute to a more sustainable development path for the industry.

In addition, Tencent’s vast number of external investments into companies such as Tesla and Spotify help to diversify the company’s operations,

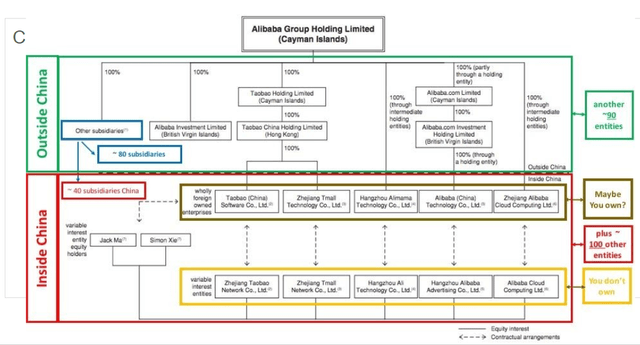

Complex Structure

Tencent is an extremely large company with a vastly complex setup of multiple subsidiaries and units. This means corporate governance is a nightmare & investors will have little rights should something crazy occur.

Tencent Business Structure (Tencent Investor Relations)

Now although I couldn’t find a more detailed outline of the setup, you can expect it to be a similar setup to Alibaba as both are officially based in the Cayman islands.

Alibaba Company Setup Similar to Tencent (Alibaba SEC Filing)

An investment into Tencent, is an investment into an ADR (American depositary receipt). This is a certificate issued by a U.S. bank that represents shares in foreign stock. Thus as an investor your contract is with the Cayman Islands (Tencent) and then that company has a contract with the mainland China business (which is where all the revenue is generated).

How to Invest into Tencent (Safely)?

Crazily, Tencent is trading on the OTC (Over the counter) exchange that is usually reserved for penny stocks & means limited disclosure for investors. You can also via the Hong Kong Exchange, with the ticker HKG: 0700. This will offer slightly more protection, as you won’t have to worry about US delisting as much, which is set to happen with DIDI stock very soon.

Another option (and my favorite) is to invest via Prosus. This is a Dutch multinational conglomerate company which is a division of Naspers. Naspers is the South African investment firm which were one of the original investors in Tencent.

In 2001, Naspers invested in Tencent by buying close to 45% of its shares for just $35 million. The company now owns 30% of Tencent and it’s last reported that the net asset value (NAV) of this is worth $164 billion. Thus an investment into Prosus is an investment into Tencent. Many successful Value Investors such as Mohnish Pabrai and Guy Spier have invested via this method.

Final Thoughts

Tencent is a fantastic company with a dominant market position in China. The company has a diversified revenue stream across many growing trends including Social Media, Communications, Fintech, Gaming and even the Cloud. Tencent’s investment portfolio provides one of the most incredible selection of Tech & growth heavyweight’s from Tesla to NIO.

The company is founder led by a very smart operator with a proven track record. The only major risk to the company I can see are the macro political issues in China and the complex nature of Chinese Stocks. The stock is currently undervalued and thus in my eyes is a great long-term investment if you want some exposure to China. However, some investors may demand a greater discount to account for future volatility expected.

Be the first to comment