Wirestock/iStock via Getty Images

Investment Thesis

While I still see the possibility of long-term growth potential, I take the view that the next quarter will need to show more meaningful earnings growth and a reduction in churn rates before we see meaningful upside in the stock.

In a previous article back in October, I made the argument that TELUS Corporation (NYSE:TU) could have potential to see upside from here on the basis of an attractive valuation from an earnings standpoint as well as growth in ARPU and overall mobile network revenue.

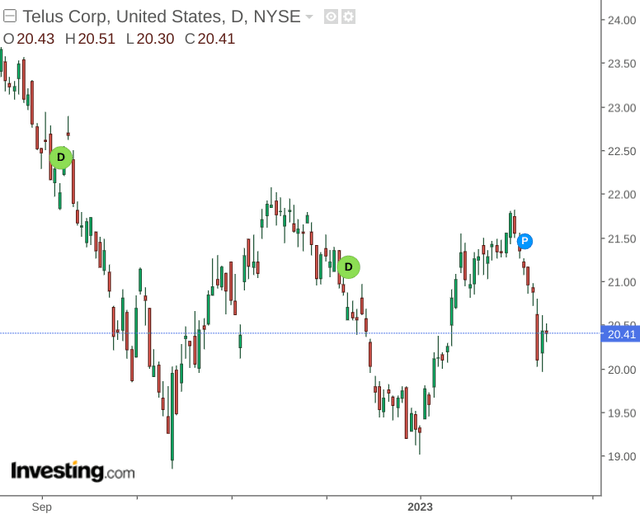

Over this period, we have seen the stock trade in a largely stationary manner:

The purpose of this article is to assess whether a long-term bullish outlook for TELUS Corporation still holds, taking recent quarterly performance into consideration.

Performance

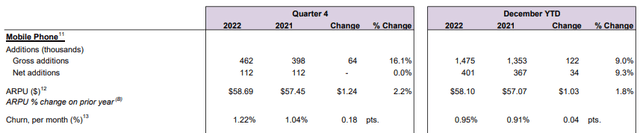

When looking at Q4 2022 results, we can see that both ARPU (average revenue per user) has increased on both a quarterly and year-to-date basis for the mobile phone segment. That said, churn was also up slightly during this period:

Telus Corporation: Fourth Quarter 2022

Adjusted basic earnings for 2022 came in at $1.17, which is up from that of $1.07 for the previous year.

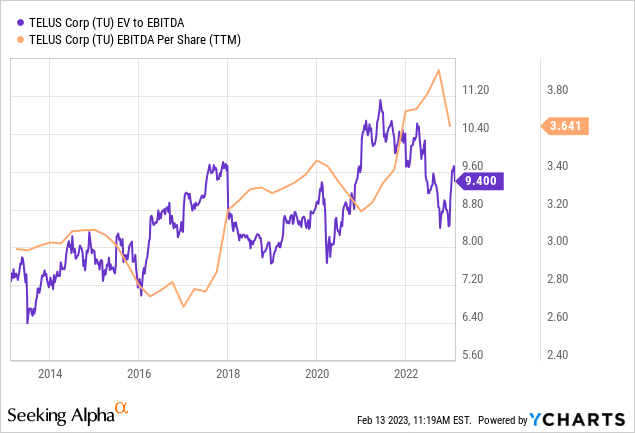

In terms of the company’s EV to EBITDA ratio, we can see that on a 10-year basis – EBITDA per share has continued to see a long-term increase even though the EV to EBITDA ratio has been rising.

ycharts.com

From this standpoint, I continue to take the view that TELUS Corporation provides good value from an earnings standpoint.

The company’s balance sheet shows that long-term debt remains substantial as compared to total assets (over 40% of total assets for 2020 and 2022).

| 2020 | 2021 | 2022 | |

| Long-term debt | 18,856 | 17,925 | 22,496 |

| Total assets | 43,273 | 47,983 | 54,046 |

| Long-term debt to total assets ratio | 43.57% | 37.36% | 41.62% |

Source: Figures sourced from TELUS Corporation: Management’s Discussion and Analysis, 2022. Figures (except ratio) provided in $ millions (Canadian dollars). Long-term debt to total assets ratio calculated by author.

While we have been seeing earnings growth continuing along with growth in ARPU – it would be encouraging to see a reduction in long-term debt relative to total assets going forward. With that being said – a higher long-term debt load is more typical for a company in a capital-intensive industry such as telecommunications, and the long-term debt to total assets ratio has remained quite consistent over the past few years (slightly higher at 45% in 2019). In this regard, I take the view that if we do not see a significant increase in this ratio, then the stock can continue to see upside from here.

Looking Forward

I had previously remarked that inflation and broader macroeconomic considerations are likely to play a part in the trajectory of this stock going forward. The slight increase in churn per month that we have seen over the past year could be down to inflationary pressures – there is the possibility that price competition has led to users switching to the services of a competitor in the current market.

Additionally, while earnings has continued to see growth overall during the past year, one hindrance in this regard has been higher financing costs – which were up to $322 million in 2022 from $192 million in the previous year.

In this regard, there is the risk that higher inflation could place further upward pressure on both churn and the company’s cost base – which in turn could place pressure on earnings growth.

Conclusion

My overall view on TELUS Corporation is that while the company has continued to show resilient growth in ARPU, higher costs have placed pressure on the company with respect to churn rates and earnings growth. While I still see the possibility of long-term growth potential, I take the view that the next quarter will need to show more meaningful earnings growth and a reduction in churn rates before we see meaningful upside in the stock.

Be the first to comment