bloodua/iStock via Getty Images

Opportunity Overview

This is one of several articles I have written that describes how frontier and emerging market telecommunications stocks are safer ways to gain exposure to these markets. Many markets, such as Brazil and Indonesia, have lower penetration rates for some of these services, which has resulted in strong demand growth while other industries declined. Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (NYSE:TLK), also known as Telkom Indonesia, is a solid pick for many reasons:

-

Indonesia is one of the world’s largest telecommunications markets, and it still has ample room for growth. This growth is mainly due to the potential growth in the number of users, but could also be driven by increased revenue per user as incomes in the country rise.

-

Indonesia is an extremely significant emerging market, yet it is often overlooked among emerging market investors. Despite being a significant economy, it is not even a top 5 constituent among iShares MSCI Emerging Markets ETF (EEM).

-

Telkom Indonesia has a circa 60% market share and has been performing very well during the past few years.

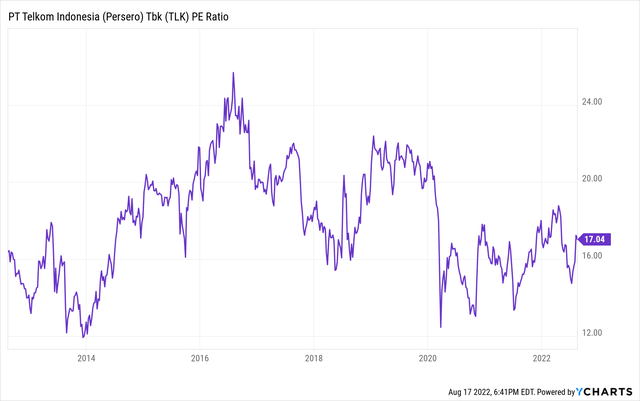

Telkom Indonesia is a decent value stock to consider, but the clearer narrative comes at a price (higher valuation). Now is probably not the most ideal time for entry if you are concerned about performance in the next 1-3 years. However, it is still a solid long-term hold, given that the market is not saturated and there is room for increased revenue per user.

The Case for Indonesian Equities

Indonesia is the world’s 4th populous economy, the 10th largest country in the world in terms of purchasing power parity, and the world’s 14th largest economy. Indonesia’s GDP per capita has increased substantially, from $2,980 in 2012 to its current amount of $3,855. The country’s average income is also low by regional and emerging market standards. Indonesia’s economy has been expanding rapidly during the past decade, and even recent performance has been stellar, with a GDP growth of 5.4%. It will be hard to ignore Indonesian capital markets this decade if these growth trends continue.

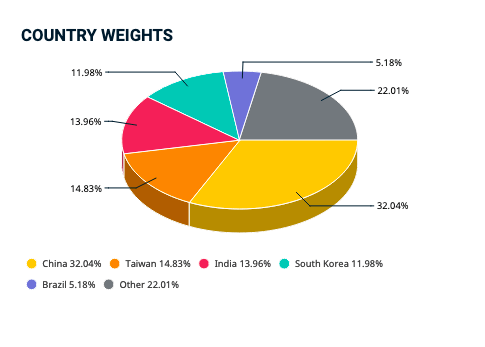

MSCI

However, Indonesia is a mere blip with MSCI Emerging Markets. Its weighting in MSCI is lower than that of South Korea and Brazil, despite its economic significance.

Investors focusing on Asia have focused more on larger countries such as China, South Korea, and Japan.

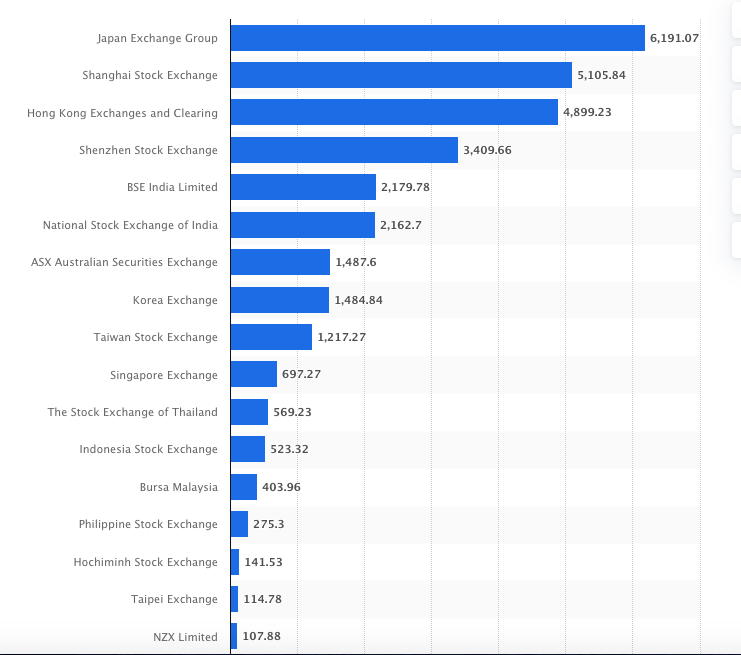

Statista

There is room for growth in the Indonesian stock market if macro trends accelerate. Among all of the U.S. ADRs, Telkom Indonesia is the only one that is listed on the NYSE, so it may be the first choice among investors who are passively interested in the market and not committed to investing directly in the stock exchange. Telecommunications is also one of the highest growing industries in Indonesia and has been a safe bet even during Covid-19. Telkom Indonesia is essentially a play on Indonesia’s macro. These factors make it worthwhile to consider a long-term (5-10 years) investment in Telkom Indonesia.

Indonesia Telecom Industry

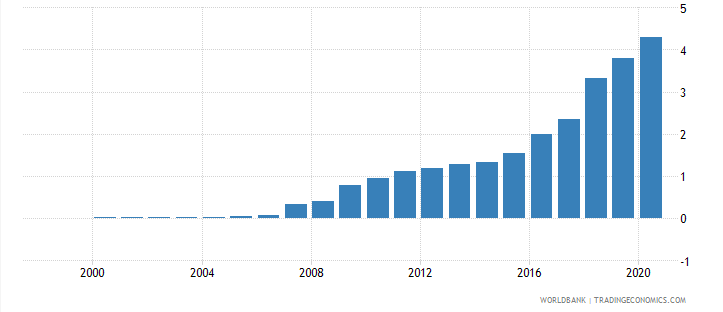

Indonesia’s telecommunications industry is also significant on a global scale, and it will likely attract a large number of investments this decade. Indonesia currently has 355 million mobile cellular subscriptions, which makes it the world’s 3rd largest market. Penetration rates in other areas are still relatively low. As of 2020, there were only 11.7 million fixed broadband subscribers in Indonesia, out of 273.5 million. There is still ample room for growth in this area.

Fixed broadband subscribers per 100 People

Trading Economics

The three largest telecom countries in the country collectively control 80% of the market. Telkom Indonesia is the largest company in the industry, with a market share of around 60% as of 2021. The rising public demand and government support should help boost the construction of towers in the country. Recent laws have helped to liberalize foreign investment in telecom and technology, which should help boost the industry’s growth. Furthermore, local players are very active in this space. Mitratel, a subsidiary of Telkom Indonesia that recently had an IPO, owns 28,000 towers in Indonesia.

Covid had a Minimal Impact: The telecommunications industry in Indonesia did not experience a significant setback in growth like other industries, due to the increased digitization and increased demand for the internet in Indonesia. The total number of internet users in Q1 2021 actually increased by 15.5% compared to Q1 2020.

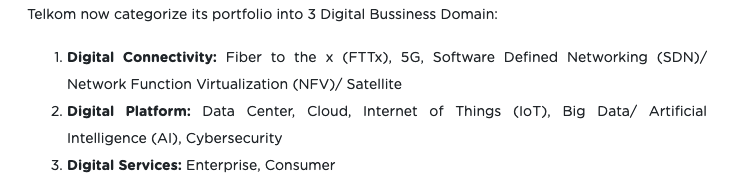

Telkom Indonesia

Telkom Indonesia is a leading telecommunications company in Indonesia, which has a dominant standing in many business segments.

TLK

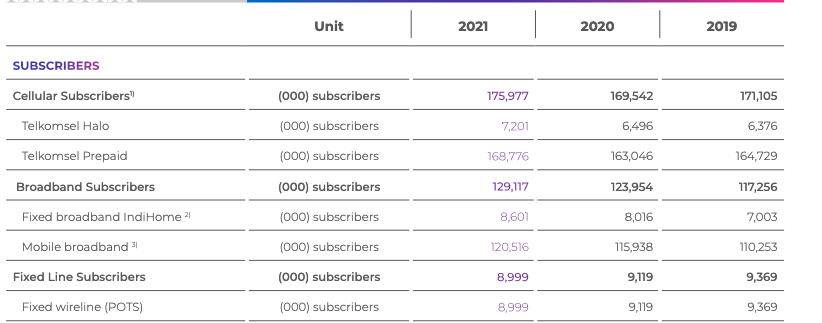

Mobile Segment: Telkom Indonesia has maintained a 59.3% market share in this segment, and serves over 170 million customers in Indonesia. However, this segment is relatively saturated, and Telkom Indonesia only experienced 0.4% growth in this segment in 2021.

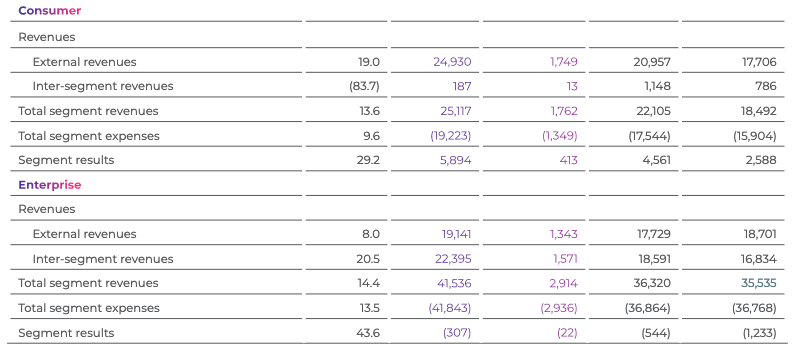

The consumer segment will be one of the key drivers of growth, as revenue from this segment expanded by 13.6% in 2021 and by 19.5% in 2020.

TLK Annual Report

The company’s enterprise segment will also be a key driver of growth moving forward, as it grew by 14.4% last year. However, one key factor to note is that its mobile segment (84.2 bn) is larger than all of its other four segments combined (58.5 bn).

TLK Annual Report

It appears that the greatest driver of growth moving forward will have to be increased revenue per user, although there is still ample room for growth in subscribers in its enterprise/consumer segments. Furthermore, while most people in Indonesia have access to a cell phone, the % of the population with internet access is relatively low at around 73%.

Outlook

Emerging market equities will likely be under fire during the next year, due to heightened political risks, rising commodity prices, and rising issues such as inflation/sovereign debt defaults/etc. Indonesia in particular is negatively impacted by commodity price increases in some ways, as it is a net importer of oil and a major buyer of wheat and soybeans. Inflation has remained under control, at 4.9% recently.

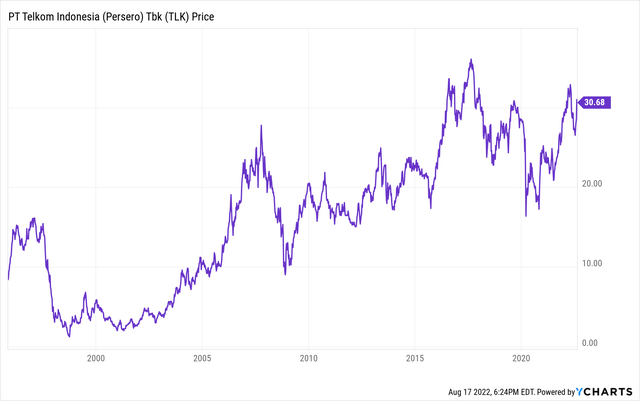

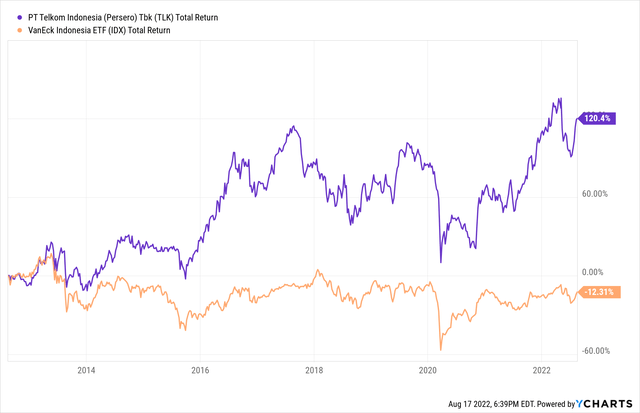

However, these factors are unlikely to impact Indonesia’s telecommunications industry. In the long run, Telkom Indonesia has drastically outperformed Indonesian ETFs.

12-16x earnings is a very attractive entry point for a stock like this (EM telecom company with a large market share). I plan to add a position and accumulate during any pullbacks. One appeal of this stock is that you can purchase it with no fees from some brokerages. Other Indonesian stocks trade on the OTC market, and you usually have to pay a $7+ fee per trade. This allows one to strategically accumulate over time.

Be the first to comment