David Ramos/Getty Images News

This article was coproduced with Wolf Report.

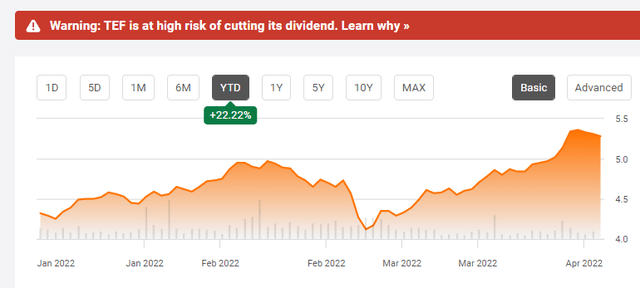

Despite some of the gloomy Seeking Alpha warnings on the stock page, such as the high supposed “warning” for a dividend cut, Telefónica, S.A. (NYSE:TEF) is a company we consider to be absolutely solid – as Wolf Report wrote about in his recent article (on February 10th, 2022).

Since the time and the timing of his buys (close to $4/share), the company has outperformed 7-12% in very short order.

It’s been a bit of a theme that we’ve been able to show that, thanks to undervaluation, it’s easy to pick up this company to cause outperformance in the longer term.

In this article, we’ll look at what Telefonica can do for you, and why we continue to like the company here.

Telefonica – Set up for solid performance

Telefonica’s multi-country focus on Spain, Germany, UK, and Brazil is 80% of the business. In many of these markets, the company is either a leader or close to it.

The company’s relatively recent asset monetization/spin-off of all Non-Brazil Hispanoamérican assets was a very well-timed overall sale. The merger between O2 and Virgin, which brought together TV and Mobile UK, was another excellent example of the company’s superior capital allocation and M&A skills.

Telefonica also continues to offer one of the highest yields in the entire telco space, especially with AT&T (T) now normalizing its dividend. The only telco in my entire portfolio that offers close to or above this yield is the 2022E yield of Tele2 (OTCPK:TLTZF) due to the massive, extraordinary NL asset sale. This pushes Tele2’s annual yield to over 15% – but this is, of course, just a one-time thing.

The bottom line is that Telefonica is a real high-yielder. Telefonica is a good example of strong assets being discounted to an unfair degree by the market. Nothing in the company’s recent performance allows for a relative discount to the level we’ve been seeing, and it seems that the market is catching on.

If you follow me, you know this well, because Orange (ORAN) is in the same position. So is Deutsche Telekom (OTCQX:DTEGY), to some degree. Wolf Report owns stock in all of them – as he does in Telefonica. And he plans to keep investing in them as long as they’re cheap.

Telefonica is no longer cheap, given that it’s been coming up to our price target and is currently, as of this writing, trading at €4.94/share.

The company’s core market focus has been paying off, and the company’s operations are humming. There’s excellent momentum to the share here. Around a year ago, and even months ago, we could talk about ridiculous-level sort of discounts for undervalued Telefonica assets, despite their formidable and solid nature when it comes to fundamentals.

Trough valuations were around €2.5 for the share back in 2020. The company has been on a recovery streak since 2019 – and the recovery has been solid/impressive. Telefonica’s market position with semi-leadership in Spain, Germany, the UK, and absolute leadership in Brazil gives us a solid foundation for this telco.

We can’t really expect the company dividend to pick up quickly – but there’s definite room to pay the currently planned dividend. The 2022E planned dividend is forecasted at €0.3/share, but it’s forecasted to €0.33 in 2023E and to grow from there.

The company’s downsides or risks haven’t changed either – the company’s market competition in Spain is one of the major factors against Telefonica here. The way that debt is accounted for, with most of the company’s debt consolidated at the Spanish HoldCo level, is also a somewhat different construction – and the company needs to consolidate and communicate regarding its fixed and TV strategy.

In the end, and how we consider Telefonica, the company is a play on its operational segments in the various nations – and this is where the strength is showing.

You can look at Spain individually – where the company is one of two leaders – Germany, where the company is delivering solid results, and the UK, where TEF is one of two market leaders.

In addition, we have the company’s operations in Brazil, where Telefonica is, once again, the absolute market leader and is posting continual amounts of service revenue growth due to the acceleration of mobile services. Vivo’s fiber footprint continued to expand, with 1.3m new premises passed during Q4 to a total of 19.6M to become the largest fiber asset in the region (the group continuing to progress towards its ambitious target of 29m premises passed by FTTH by 2024).

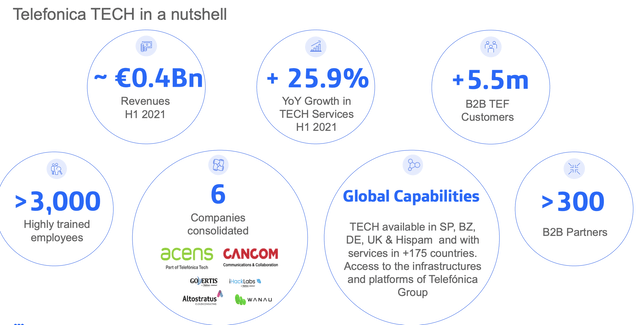

In addition, we have Telefonica Tech, which is growing as well.

Telefonica IR

This segment has solid upside with superb growth prospects. There’s a huge cybersecurity market, a huge cloud market, and a massive IoT (Internet of Things) market where Telefonica already as a solid footprint thanks to its huge client base. The services that the segment offers in all Telefonica markets are services that clients are going to be interested in.

All in all, not much of the fundamental upside for the company has really changed since my last article. What has changed is that the market has seemingly gotten an understanding for the upside that is in the company.

TEF Stock Valuation

Telefonica’s valuation has largely remained a somewhat fluid consideration due to the degree of undervaluation in the company. We’re always hesitant to apply full valuation multiples to companies suffering from multi-year undervaluation.

However, once an undervaluation trend is broken, that snap-up can be quite sudden and volatile. That’s what’s started happening with Telefonica as it left behind the trough valuations and is now moving to €5/share.

Wolf Report mentioned in his last article that the market can discount a Telco incumbent for a long time based on transitory headwinds. There is plenty of global evidence of this.

However, eventually, things will normalize, even if the company does as major a restructuring as we’ve seen here. Even during Wolf’s last article, he said that Telefonica has recovered from what he sees as its most unfairly valued depths – which is coincidentally where he bought most of his position.

But if we assume that the company’s plans for its legacy areas, including Brazil, work out, and Tech/Infra work at least somewhat acceptably, then the company at this time is massively undervalued still – more than 20%, even with a 20% discount applied prior to this.

This fundamental stance remains.

While we can make some quarterly adjustments for some recent numbers and changes, even applying conservative DCF estimates of essentially zero or even negative sales/EBITDA growth, the company is still worth more than what it’s being traded at.

Neutral/negative numbers give us a DCF Estimate of over €8.2 – but this, and the related uncertainty, is why we don’t weigh DCF as heavily for this company, or discount it even further.

NAV multiples give us better estimates with regard to fair value. At a listed valuation for the various listed businesses, and low 5x-5.5x EBITDA multiples, the net asset value on a per-share basis still come to over €6.3/share.

On a peer basis, Telefonica also still trades below where we believe that it should based on its business. Averaging out the entire EU telco market, we get average valuation ratios of 11-13x P/E, with Telefonica ranging from 9-10.5x, and significantly lower EV/EBITDA and book multiples.

Basically, the undervaluation opportunity Wolf Report spoke of in his last article is still very much there – and it’s only a question of when the market normalizes with regards to this company.

Wolf has already made substantial RoR from his Telefonica investment. We also have clients who now have made over 100% including dividends in a relatively short amount of time (less than 3 years). This isn’t surprising to me, though it might be surprising to some.

Wolf’s €5 PT for Telefonica remains a bare-bone minimum level of normalization. The market seems to be counting on this at this time – but the company is still undervalued to most of its peers. It becomes a question of how we discount risk and chronic undervaluation when we consider the company’s historical volatility, and how likely this is to once again be the case in the future.

It’s one of those cases where we clearly want to make a case to you, dear reader, that Telefonica is worth more than €5/share.

But at the same time, the company has been in the doldrums for several years. It’s unclear when it will push past that “barrier” and go up into the €5.5-€7/share, which to me would signal more of a “full” valuation on part of the company.

The fact is, you should have bought Telefonica far earlier. If you’re just starting to look at it now, as it approaches €5, your upside is going to be limited. We could raise our PT here, say that you could buy below €5.25 and €5.5, and indeed you could. There’s an upside to be had even here.

But Telefonica’s base case hasn’t changed. This is a southern EU/South American telco with something of inherent volatility, but a high, solid yield and fundamentally solid assets.

If that didn’t sell you when the stock was less than €3-€4, it honestly shouldn’t sell you now that the company is climbing toward €5. It was always worth this much, even if the market didn’t see it.

This is how value investing works.

We find the mispriced opportunities in the market, we buy them, and we wait for them to normalize. Depending on the base case and depending on what’s available, we may choose to rotate part or the entire position at this time and repeat the process once again.

This is how we grow our portfolio and our dividend income.

So, we will slightly reduce the discount that we apply to Telefonica in our average-weighted valuation models and give the company a €5.25 PT. But we will state clearly to you that it could go higher – or drop back down. There are plenty of catalysts for this company to stabilize and drive higher earnings going forward. We believe in the bull case here.

But these are things we already went through, more comprehensively, in this piece right here.

So read that – We’re bumping the target slightly, and there we have the upside at this time. Realize also that despite bumping my PT, it still takes a higher consideration than peer targets such as over €6 from European analyst colleagues, or almost €6.5 from S&P global high target ranges (though closer to €5.1 average).

Thesis

This isn’t a complicated thesis – it has never been.

- Telefonica is an undervalued telco asset play. The company has been chronically undervalued for years on end, but is finally normalizing. That means the upside is now less than 20%.

- Like some other Southern-EU/South American companies, investing in Telefonica requires you to handle perhaps unfamiliar amounts of volatility for a Telco – but you’re being rewarded by a yield of more than 6%, even after the dividend cut compared to 2019-2020. Wolf’s own YoC is more than 9% at this time.

- We’re bumping the PT to €5.25, but this shouldn’t “make” the decision for you. If you didn’t buy Telefonica dirt-cheap, the upside is now less than what we might consider being worth a strong “BUY” recommendation.

- The company is a “BUY” here. No more.

Remember, we’re all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, we harvest gains and rotate the position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, we buy more as time allows.

- We reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Telefonica is a “BUY” at the current price with an upside to a native share price target of €5.25.

Thank you for reading.

Be the first to comment