SDI Productions

What is the Goal of This Article

As my readers know, I always like to start by sharing what my goals are for any article. The goal for this article is to get both value and growth investors with diversified portfolios to ask themselves, “Should I add Teladoc (NYSE:TDOC) in my portfolio?” The trends for this stock are now trending in the right direction and the stock has been de-risked.

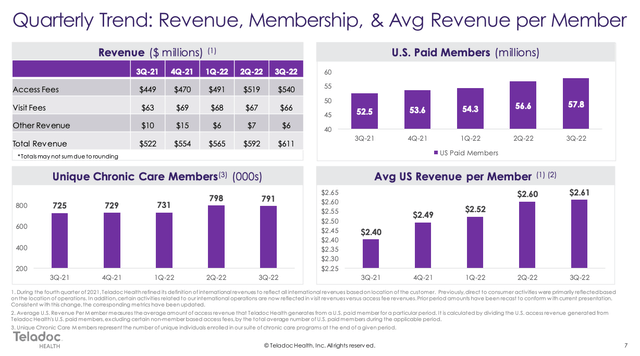

TDOC Revenue Trends (Teladoc Q3 Earnings Presentation)

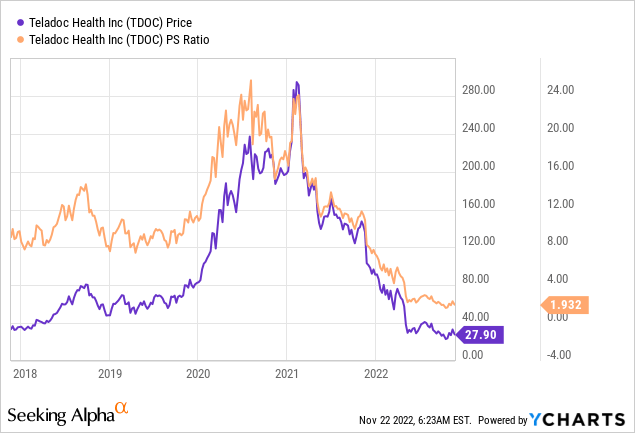

I believe the risk and overvaluation of Teladoc stock has been demolished by the massive 90% sell off from all-time highs in February 2021. In my opinion, healthcare is an industry that all investors should want to have exposure to as part of their diversified portfolio. We will review what skeptics fear in the stock, but also will dive into why a capitulation to a strong foundational bottom has formed for Teladoc. Let’s jump into this once loved digital healthcare stock.

Competition Has Been Factored in This Punishment

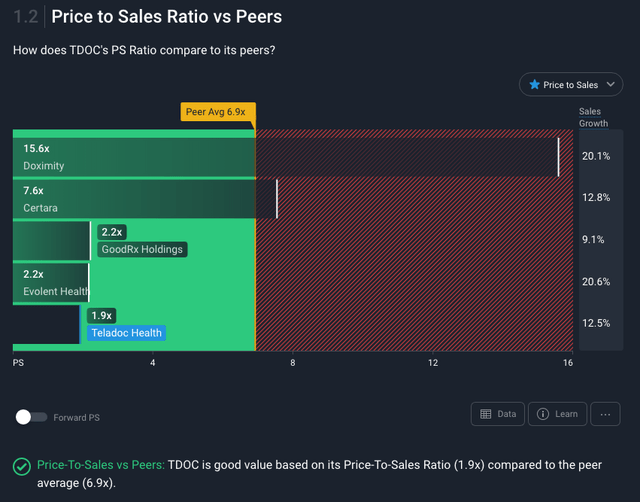

When you read what bears and critics say about Teladoc as a stock, you will come across concerns around telemedicine being a competitive space, arguments that there is no moat as anyone can deliver telemedicine to patients, or that the company is overvalued. These are arguments you could have maybe argued on why not to own the stock back when it had a P/S ratio over 25 back in 2020, but now this stock trades at a P/S ratio of 1.9.

Yes, the telemedicine sector is competitive and Amazon (AMZN) is trying to enter the telemedicine space, again. However, it is going to take a lot for Amazon to establish the relationships and partnerships that Teladoc has with insurance companies, clinics, hospitals, and the medical community overall. Teladoc is not a fly by night company as many investors forget this is a company with the clear first mover advantage and has been operating over a 20-year history.

Teladoc has grown its reach and scale to now having 1 out of 4 Americans having access to its services through their employer or health plan. Teladoc has transformed over this time from being solely focused on delivering the best telemedicine experience to whole-person virtual care. This company has put in the time, experience, and efforts to establish a first mover advantage in whole-person virtual care that will not be easily be disrupted. How many times have different companies announced their desire to deliver telemedicine capabilities to customers and investors writing off Teladoc?

I am not saying Teladoc hasn’t made mistakes in the past like over-paying in the acquisition of Livongo Health. Which many investors may have not gotten over yet, but I believe it is time to turn over a new leaf in this investor story. Teladoc is not overvalued against it competitors anymore as you can see below, after being taken out to the woodshed these past two years.

Price to Sales Ratio vs Peers (Simply Wall St. App)

The Undeniable Health Trends

Teladoc is participating and leading in a global market that is projected to reach $636 billion by 2028 at a CAGR of 32.1% according to Fortune Business Insights. The effects of COVID-19 demonstrated the need for all countries to have a Telehealth plan and active government initiatives for this have propelled the market further. Gartner Research believes technology will continue to further connect consumers, payers, and providers. I believe this report from Omada Health and Digital Medicine Society highlights the trends in this marketplace and the value of virtual care vs. just telemedicine. Teladoc understands these points very well and is why they have taken on the platform approach for whole-person virtual care. This article in Forbes “Virtual Care is Transforming the Future of Healthcare” supports Teladoc’s strategy significantly.

This commentary of author Tony Bradley in the article clarifies the importance of virtual care, what it is, and how it is different than telemedicine.

For starters, virtual care is not telemedicine. They are two different things.

Telemedicine replaces a visit to a doctor’s office, while virtual care delivers ongoing care and communication. According to the report, there has been a 38x increase in use of telemedicine during the Covid pandemic as many people did appointments over Zoom or other video platforms rather than traveling to the doctor’s office in person.

Whether that initial visit is in-person or conducted via telemedicine, virtual care is a broader scope of services delivered online or via apps to manage and maintain care. Virtual care provides education, coaching, engagement, and patient support to improve patient outcomes. It is also useful for delivering specialized care for various chronic conditions.

Megan Zweig, Chief Operating Officer at Rock Health explained in the Omada press release, “Telemedicine simply digitizes in-person care-conversely, impactful virtual care redesigns how care is delivered, putting the patient at the center and leveraging technology to enable proactive, continuous management. This transition is essential to make significant strides in patient care.”

Some of the key findings in this report showed the following:

- 90% of survey respondents see virtual care as a high priority

- Majority believe virtual care is the principal means to improve patient care and outcomes

- Nearly 50% believe it will become the primary model of care – but few have a clear understanding of the model

- More than 95% who already offer virtual care are looking to expand but need a roadmap

- Only 15% of respondents identify as having experience across all areas of virtual care

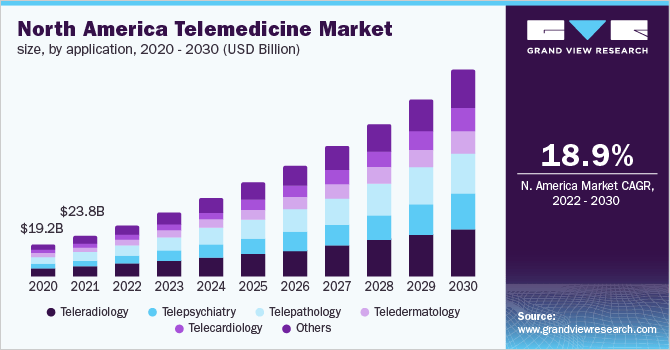

Teladoc’s acquisition of Livongo Health, InTouch Health ,and Best Doctors over the years has supported a platform approach to virtual care. The integrations into the Teladoc ecosystem continue to get better and drive scale with their customer reach. As the telemedicine market continues to accelerate at a staggering CAGR of 18.9% in North America, it is the ability to offer a consolidated wholistic healthcare offering that I believe will continue to allow Teladoc to gain new customers and capture market share against the competition.

North America Telemedicine Market Growth (Grandview Research)

Why This Value Stock is For All Diversified Portfolios

So we have established this is a massive growing market both in North America and globally. We have discussed how Teladoc has first mover advantage and how it is cheaper than its peers from a price-to-sales ratio. Now, let me share why I believe Teladoc is a value stock, with low risk in a well diversified portfolio, and is positioned to deliver returns shareholders will be pleased with moving forward.

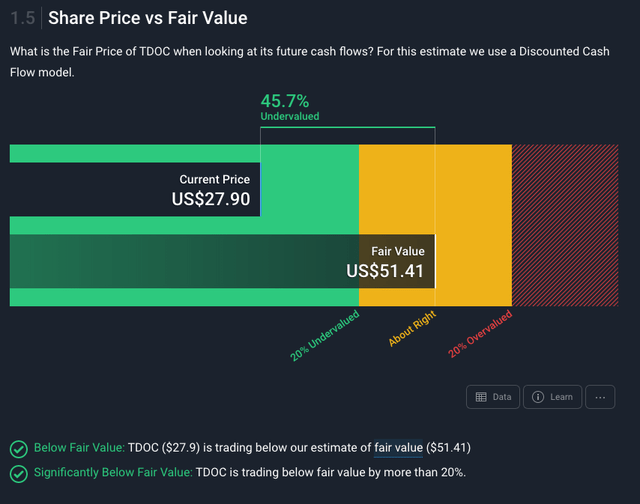

Teladoc is an undervalued stock to what it is trading at by over 45% according to the DCF from analysts. The revenue growth is still growing at 17% y/y at $611 million and I believe with the expansion of its Primary 360 Care will continue to grow at higher rates.

Valuation via DCF (Simply Wall St App)

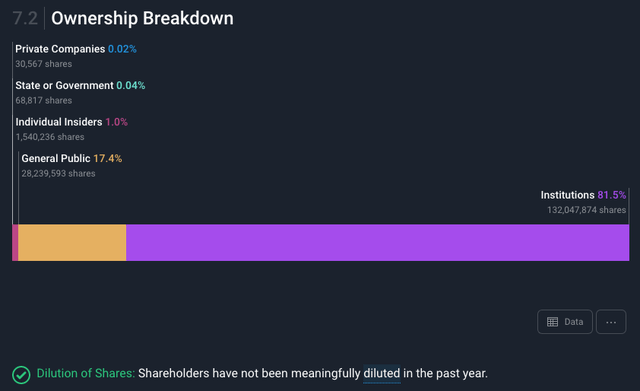

Teladoc’s success in its investment to scale and gain market adoption I believe is under-appreciated in the retail investor community. However, this I do not believe is lost on the institutional investor population as over 81% of shares are held by institutions to a small 17% for the retail community.

Teladoc Ownership Breakdown (Simply Wall St. App)

So why is Cathie Wood’s ARK Investment (ARKK) so bullish on Teladoc? and I know this is where everyone goes haywire when they see I am referencing Cathie owns 12% of the stock, as the ARK portfolio of investments has performed so poorly the last two years. I am not a big Cathie Wood fan and how she operates her portfolios either, but she isn’t the only believer in Teladoc. Look at who else owns positions in the stock, The Vanguard Group (8.4%), BlackRock Inc. (7.2%), Nikko Asset Management (5%), Baillie Gifford & Co (3.2%), State Street Global Advisors (3%), and D.E. Shaw & Co (2%). These are some of the best investment firms around in technology and growth stocks.

I believe all of these investment firms are holding shares of this company because of the undeniable long tailwinds they will ride long-term. In the past three months DA Davison, Truist Securities, and Keybanc have initiated ratings on the stock. The last 19 out of 20 price targets from analysts on the stock show upside from where the share price is today. Just another stat supporting a potential bottom or more likelihood of positive upside in the stock.

It is the foundation and reach that Teladoc has created that I believe has institutions holding onto this stock. Teladoc reached their first one million visits in 2015 and just seven years later they have reached 50 million visits. That is a near 75% CAGR for visits on the platform! Teladoc is capturing market share and activity on their platform at a fast pace. Roughly one third of those 50 million visits occurred just last year. Not all of those customers are going to be one offs due to COVID but they will use the platform again.

Here are some of the new data points from Teladoc Health, that show demand for a unified whole-person care platform.

- Individuals are now increasingly counting on Teladoc Health to support a range of health needs, including primary care (4x growth in visits YTD) and nutrition (+30% growth in visits YTD).

- 1 in 3 Primary360 members are now using at least one additional Teladoc Health service, like mental health care or chronic care management.

- The percentage of individuals enrolled in chronic condition management solutions using two or more programs continues to grow, from 13% in 2020, to 24% in 2021, to 34% in 2022.

- Over the past three years, Teladoc Health’s clinicians have seen a 15x jump in anxiety and depressive disorders diagnoses, and a 10x jump in diagnoses for acute stress.

Investors can feel confident on the company culture of Teladoc and talent wanting to stay there, as over 82% of employees give an approval rating to CEO Jason Gorevic on GlassDoor. In 2022 Teladoc was listed in Newsweek America’s Most Trusted Companies, Great Places to Work, and LinkedIn’s Top Companies in Healthcare.

Summary

I believe at the price points Teladoc is at, with the experience it has for the last 20 years, first mover advantage, leadership, and expansion of its user base, it has arrived at a safe place to be a part of any portfolio. The only risk I could see is a larger company acquiring Teladoc but shareholders would also be rewarded in that scenario. So in my opinion true risk has been taken off the table for any long-term investors that are willing to hold this stock for the next three to five years.

Hopefully this article has been insightful and helped you look at Teladoc differently, especially at where the company is headed. Thank you for reading this article.

Please leave a comment below about your thoughts on Teladoc, the article, or just the virtual care industry in general. The more dialogue we generate on an investment idea the more we learn and different perspectives we gain.

Be the first to comment