VioletaStoimenova

Thesis

We cautioned investors in our post-earnings article that investors needed to be wary about adding Teladoc Health, Inc. (NYSE:TDOC) stock then as it was likely to underperform. Accordingly, TDOC has fallen nearly 20% since our previous article, underperforming the broad market significantly.

Notwithstanding, we postulate that TDOC’s valuations are looking interesting again, even as Amazon (AMZN) has strengthened its ambitions in the healthcare space further with the purchase of One Medical (ONEM). CVS (CVS) followed up with its acquisition of Signify Health (SGFY), solidifying its push into primary care after losing out on the ONEM bid to Amazon earlier. Therefore, we believe the long-term outlook for the healthcare space is looking increasingly exciting if Teladoc can compete effectively against these behemoths.

We still believe that there’s a tremendous level of execution risk moving ahead, as a looming recession impacts the recovery of its fee growth cadence. Also, it’s uncertain how Amazon intends to reshape the space. However, CEO Andy Jassy appears to be committed to the healthcare segment as its next critical growth driver as it consolidates its clout in the consumer space.

Notwithstanding, we noted that TDOC’s valuations had pulled back to levels that we believe should find robust support and, therefore, limited downside volatility. Given our conviction that speculative growth stocks have bottomed out in May, we are confident that TDOC should hold its May/June lows resiliently.

Accordingly, we revise our rating on TDOC from Hold to Speculative Buy, with a medium-term price target (PT) of $40 (an implied upside of 33%).

Teladoc’s Growth Slowdown Has Stabilized

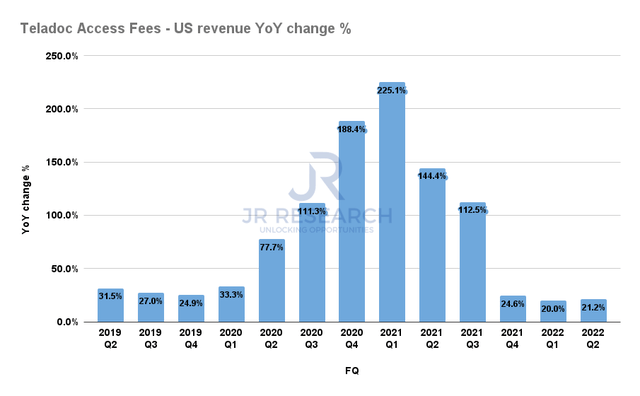

Teladoc access fee (US) revenue YoY change % (Company filings)

Investors familiar with price action should recognize the similarities between the trend seen in Teladoc’s US access fees’ growth and its price chart. Therefore, the market has gotten TDOC’s peak growth spot on, as it anticipated that its COVID-driven growth cadence was most likely a one-off.

Consequently, Teladoc posted a 21.2% YoY growth in its access fees for the US segment, hobbled by challenging comps and worsening macros. As a result, investors are justifiably concerned whether Teladoc’s growth and operating leverage could deteriorate further.

However, we believe the worst is over.

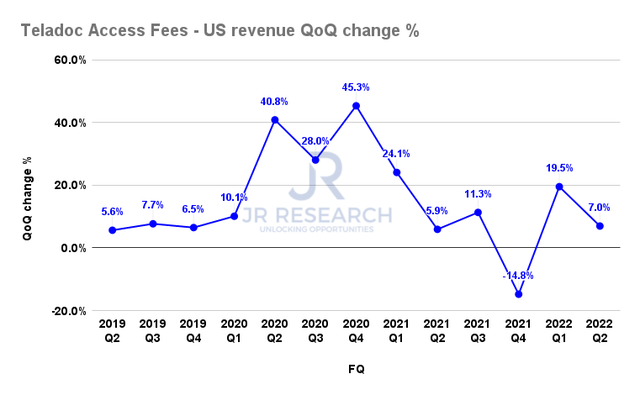

Teladoc access fees (US) revenue QoQ change % (Company filings)

As seen above, Teladoc’s growth in access fees appears to have bottomed out in Q4 before it reaccelerated in Q1. However, macro headwinds intensified, causing the company to revise its outlook, and led to a moderation in its QoQ growth in Q2, down to 7%.

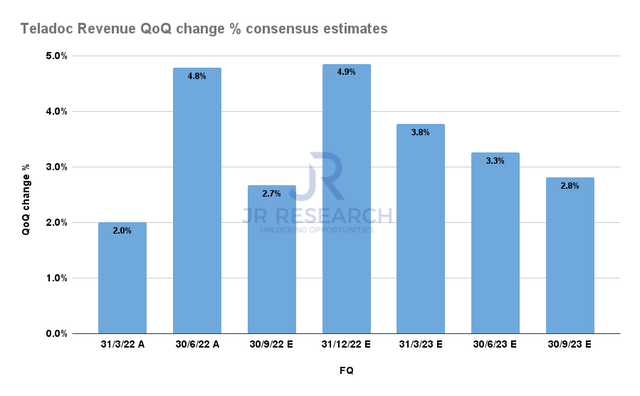

Teladoc Revenue QoQ change % consensus estimates (S&P Cap IQ)

However, management’s Q3 guidance of $610M (midpoint) in revenue indicates that it’s unlikely for its QoQ revenue growth to fall back into negative zones. Moreover, the consensus estimates also suggest its QoQ growth could accelerate through H1’23. Therefore, we believe management has likely learned its lessons by telegraphing “achievable” guidance, given the worsening macros.

Hence, we are confident that the worst is likely over for Teladoc.

Is TDOC Stock A Buy, Sell, Or Hold?

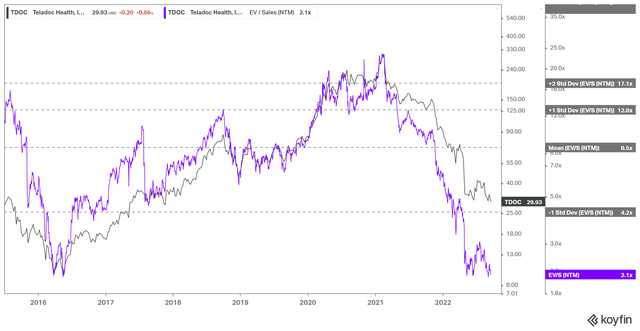

TDOC NTM Revenue multiples valuation trend (koyfin)

The pullback after its summer rally saw TDOC fall more than 33% to its current levels. Also, its NTM revenue multiple of 2.1x has pulled back to lows last seen at its May bottom.

Coupled with our conviction of a bottom in its operating metrics, we are confident that its current valuation should be supported robustly. Despite the potential for further downside volatility, we deduce that the reward-to-risk profile at the current levels for a speculative position appears attractive.

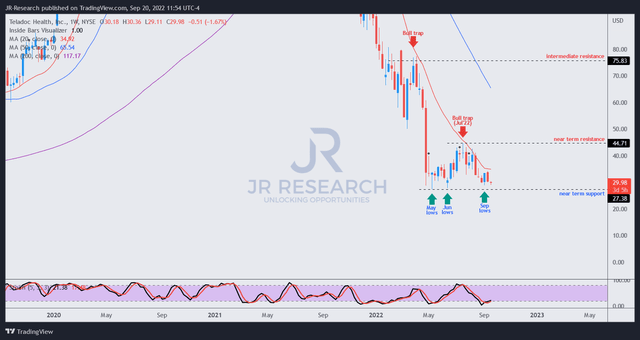

TDOC price chart (weekly) (TradingView)

A closer glance at TDOC’s medium-term chart corroborated our conviction that its bottoming process along its May lows is constructive. Selling pressure has consistently fizzled out at its near-term support over the past four months.

Therefore, unless something “sinister” appears to push TDOC down further, we believe the consolidation seems resilient. We are confident that speculative stocks have already bottomed in May.

Therefore, we are also confident that TDOC’s price action supports our thesis of revising our rating from Hold to Speculative Buy, with a medium-term PT of $40.

Be the first to comment