BryanLever

Teladoc (NYSE:TDOC) stock has been absolutely crushed. There is panic and fear here, and it has been going on for a while. When we say crushed, it really has been an implosion. We have never seen anything like this collapse. It is one of many innovative tech stocks that has fallen from grace. And when we say fall, it was a steep fall. A huge drop off a cliff. Folks, this stock is down 90% from all-time highs. 90%. There are metaphorical graveyards of investors who bought this thing in the $200s that have held on. That is unacceptable. While we like long-term investing and holding good stocks, even stocks you want to own long-term, you can never allow yourself to be down 70-80-90%. It is inexcusable. There are experts who may disagree, but we work with winners. Down 90%, you are losing. Sorry. Fast forward to now, we have a $30 stock again, following some fresh downgrade action. We are going against the grain here, taking the contrarian view against the panic and fear crowd, and think the stock is a speculative buy here for a relief bounce out of the $20 range again and/or off the $30 level. Let it fall again to this area, then do some buying for a quick trade. Winners win.

The play

Target entry 1: $31-$32.00 (20% of position)

Target entry 2: $28-$29.00 (35% of position)

Target entry 3: $27-$27.50 (45% of position)

Stop loss: $23

Target exit: $36

Selling $30 puts 2-3 months out is a valid options entry strategy here.

Let us discuss further.

Recent performance is highly mixed

For most of 2022 the market has been horrible, though tech rebounded hard in the last month. Yet now, TDOC stock has given it almost all back with another wave of panic and fear. It is speculative, but we see this stock as looking to bottom along with operations. Operational wildfire like growth has stalled. The landscape is challenging. But we think the company has a solid base to now build off of, even if there is ongoing uncertainty in the macroeconomic backdrop. In this market, high revenue growth, little to no earnings type companies are seeing their stocks largely collapse under the weight of a higher rate environment and recessionary pressures. Now that said, Teladoc recently reported another quarter that left the Street unimpressed. However, we believe telemedicine is here to stay, and this company is a leader in the space.

Pressure mounts

There was some panic selling after this report. Second, waves of downgrades have now flown in from those very brave analysts with immense foresight. They have reacted to the kitchen-sink type quarter of poor news, lowering targets and ratings. That weighs.

Another major concern is that telemedicine is not something that other companies cannot replicate. There are other players out there. This leads to concern over the company having any kind of moat.

In the actual results, the company beat consensus estimates on both the top and bottom lines. The company is still showing growth, but the rapid growth has slowed. Revenue beat by $5 million. That is not terrible in the grand scheme of things, but was not all that strong either. Still nice to see. Then there was just a terrible goodwill charge of $3.0 billion that was recorded; it led to a net loss of a laughable $19.22 per share, vs. a loss of $0.86 last year.

There also continues to be dilution and costs associated with stock based compensation. This seems to be a common problem for many of these high revenue growth tech companies to keep talent. That said, those charges were $51 million in the quarter, hurting earnings by $0.32. On the conference call, we learned:

The goodwill impairment was triggered by the decline in Teladoc Health share price with the valuation and size of the impairment charge, primarily driven by an increased discount rate and decreased market multiples for a relevant peer group of high-growth digital health care companies.

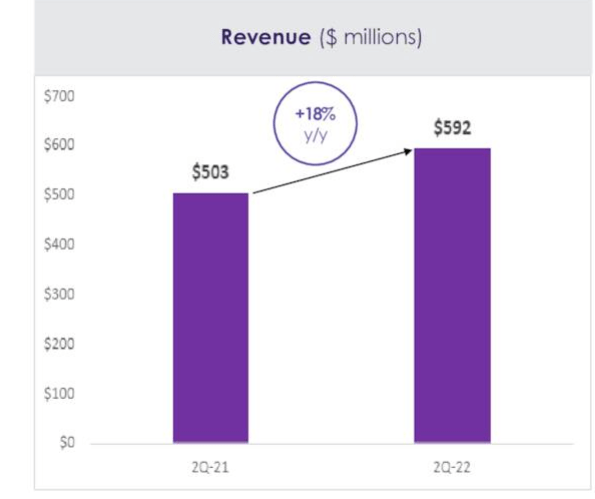

So, there’s that context. While revenues grew, the rate of growth has continued to slow. That is a problem. Revenue increased just 18% to $592.4 million, from $503.1 million a year ago.

TDOC Q2 slides

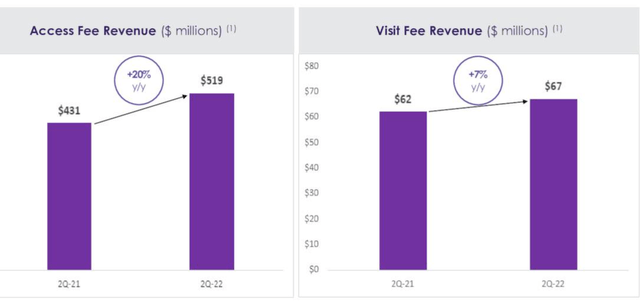

Look, it is still good growth but nowhere near where it was. Most of this growth came from access fee revenue growing 20% to $518.7 million and visit fee revenue growth of just 7% to $66.7 million.

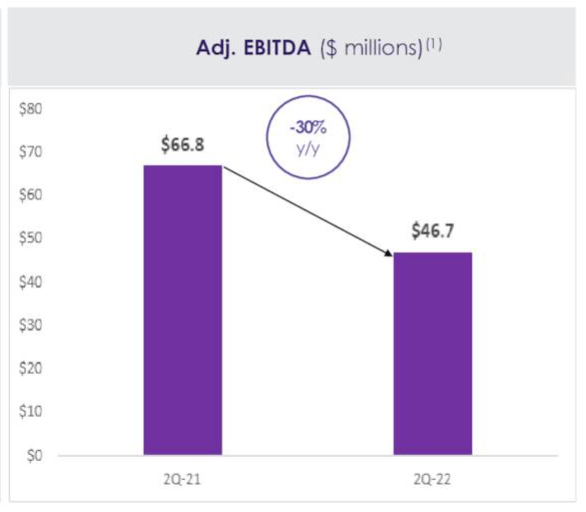

While the revenue growth, although slowing, is good to see, the larger issue is that even making adjustments, EBITDA declined. That is just not good at all. Big problem in our opinion. Adjusted EBITDA fell a monster 30% to $46.7 million, compared to $66.8 million last year.

TDOC Q2 slides

This comes even as margins expanded some which was good news. Margins expanded to 68.2% on a GAAP basis vs. 67.9% a year ago. Making adjustments, there was still expansion to 69.2% from 68.1%. That is a hidden positive internal metric out of this quarter.

Another major problem is competition is truly heating up, as noted by management on the call again:

We still see smaller private competitors pursuing what we believe are low or no return customer acquisition strategies to establish market share. Although we do not see this as sustainable, it’s difficult to predict how long this dynamic may continue. We also believe that the weakening economic environment and declining consumer sentiment is likely having an effect on [us]…. we are also continuing to see some of the competitive dynamics in the chronic care space.

We continue to believe that this is pretty problematic if they cannot protect their moat. It is hard as telemedicine is not protected, any company with the permits can do it.

Guidance poor

Then there is the guidance, which, the market did not love, and frankly does not trust because guidance changes and failure to meet them has resulted in a lack of confidence from the Street. Several times this year there has been revised guidance.

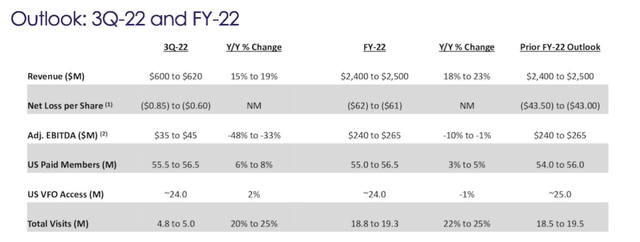

But after Q2, the company reiterated its previously issued revenue and adjusted EBITDA outlook for the fiscal year but said that “based on current trends in the market, management now expects results to be toward the lower end of those ranges.” That is not good. Further Q3 guidance was poor. Management expected revenue to range between $600 and $620 million compared to the consensus expectation of $618.36 million. Further we will see a loss on EBITDA of $29 to $46 million but should be a positive adjusted EBITDA of $35 to $45 million. So why get speculative here?

Time to take a chance

Look, a lot of bad news is priced in here. We are taking a contrarian view here and think you can buy the stock over the next few weeks for an easy trade. The fact is that revenue growth is stalling. Yet, the stock is now approaching $30 here again and has been revalued back to near yearly lows. Yet, revenue is still growing. Further, average revenue per U.S. paid member increased to $2.60 in the quarter from $2.31 last year and was up from Q1 2022 as well.

The company also should experience growth, even though the growth rate has come to a crawl vs. a few years ago. The company sees revenue to be in the range of $2.4 billion to $2.5 billion, which would be growth of 18% to 23% over the prior year, even if it comes in toward the lower end. While it is growth, it’s way less than the possible $2.65 billion guided to start the year. But it is growth. Membership continues to grow about as expected which is good. And the company is expecting total visits in 2022 to be between 18.5 million and 19.5 million visits.

The total addressable market is growing as well. It is likely that this market is expanding. More and more people are connected to the internet, getting into the metaverse, and opening up more and more to using technology to communicate and to embrace not leaving their homes if they do not need to in order to receive services. This is a lasting impact of the pandemic. The global population is growing, which means the potential market is larger each year.

Finally, it appears that EBITDA margins will increase as we move into the second half of 2022. That expansion is welcomed with a rising cost environment.

Overall, in the $27-$31 a share range, we think it’s now a speculative buy that will offer returns, especially if internal metrics bottom out and start to improve. A lot of negativity is priced in.

Take home

The panic and fear has driven the stock back down, and we are getting contrarian. The company is still growing revenues. They are winning some competitive areas. They are seeing revenue per user rising. They are getting into other health care areas. And, the total addressable market is expanding. While a lot of headwinds and execution issues have combined to weigh on the company, we think the risk will be to the upside over the next few months. Scale in for a trade.

Be the first to comment